If you aren’t a financial expert, the process after a customer swipes their card and before the funds land in your business bank account can be a mystery.

The essential, often overlooked players in that in-between time are known as payment processors—and they’re instrumental in getting you paid.

The right payment processor lets you accept your customers’ preferred payment types (and not charge you an arm and a leg to do it).

That’s why understanding a payment processing platform’s role in your payment acceptance process and choosing the right one is crucial.

- What is a Payment Processor?

- Who Is Involved in Payment Processing?

- What Types of Payment Methods Do Payment Processors Accept?

- What Types of Fees Can Payment Processors Incur?

- How to Choose a Payment Processor

- Choose the Right Payment Processor to Maximize Your Profit

What is a Payment Processor?

A payment processor is a third party that facilitates a financial transaction. Essentially, it’s the middleman between the customer and the business or merchant.

Payment processors are also referred to as:

- Acquirers

- Card Processors

- Payment service providers

When you make a non-cash payment for that new pair of shoes (or, in a less-fun example, your utility bill), you give the merchant your card or bank information.

Behind the scenes, the payment processor acts as a mediator, communicating that information to both your bank and the merchant’s bank.

The funds are then moved from your bank to the merchants.

There are many tools available on the market that businesses use to process their payments. All of them have some fees associated with their services.

Some are dedicated payment processors, while some – like Regpack, have integrated payment processing along with many other features.

Who Is Involved in Payment Processing?

There are several players involved in every digital payment, from the customer and the merchant to their respective financial institutions—and the “middlemen” helping facilitate the transaction.

Let’s look at the major players below.

Payor and Payee

Every transaction needs a customer or payor. This person initiates the transaction by making a payment to the payee (or the person who receives the money).

Source: Your Dictionary

The payee might be an individual, but in the context of payment processors, the payee is more likely to be a business or merchant.

To begin the online payment process, the customer enters their payment information into a form on the merchant’s website.

They might input their credit/debit card number or, if they want to make an ACH payment instead, their bank information.

And, if they’re paying in person, they’ll swipe their card at the register.

Payment Gateway

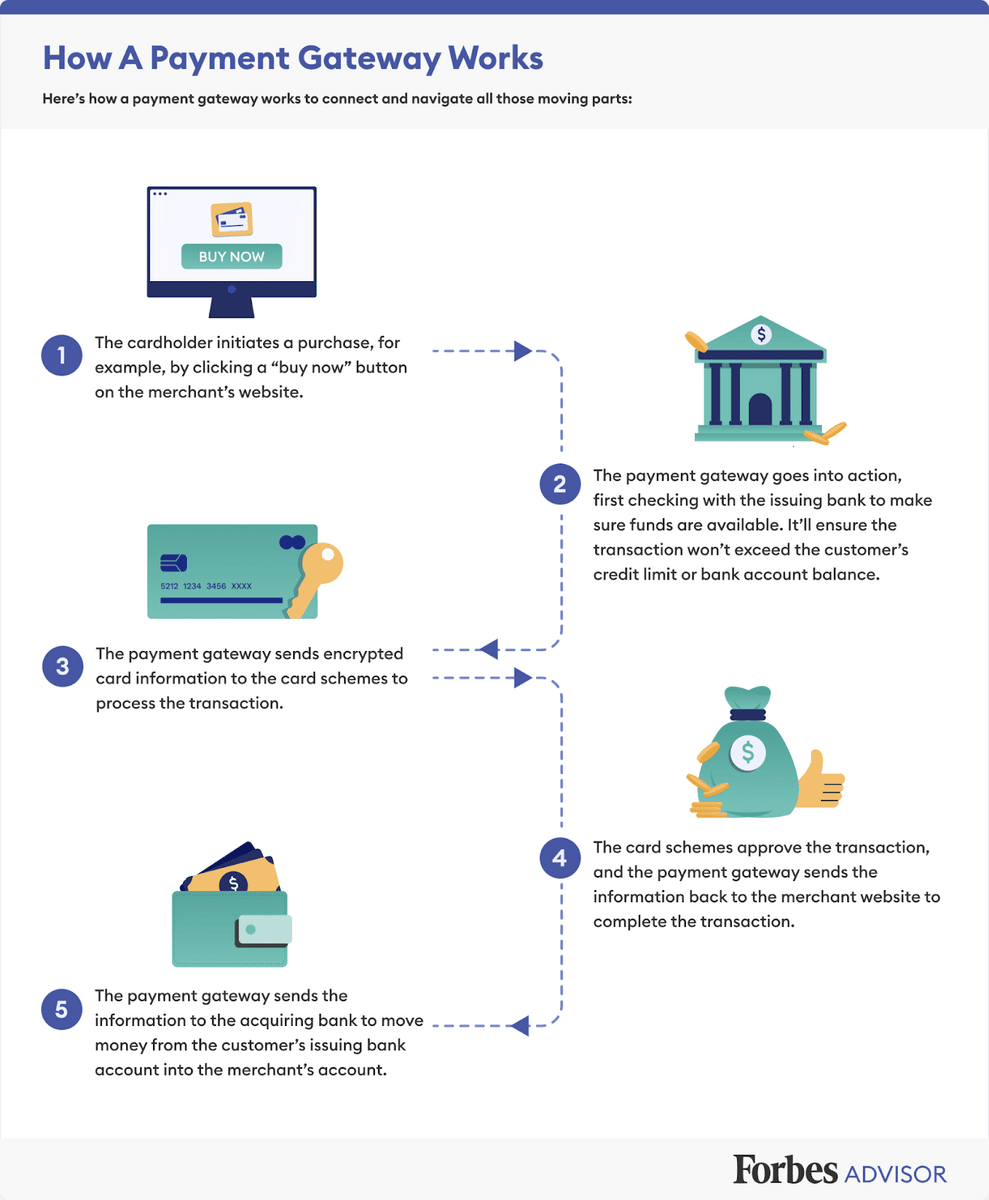

If the customer is paying by card, the merchant’s website transfers the cardholder’s information to the payment gateway.

While the terms “payment processor” and “payment gateway” are often used interchangeably, they don’t do the same thing.

If payment processors are the middlemen between customers and merchants, payment gateways are mediators between the merchant’s bank account and the credit card company.

Confusing? Maybe.

A payment gateway reads the card payment information and communicates it to the cardholder’s financial institution to ensure there are enough available funds to complete the transaction.

It can be used in-person as part of the merchant’s point-of-sale (POS) system or card reader, or it can be used online as cloud-based software.

Common payment gateways include PayPal, Stripe, and Square.

Source: Forbes

Essentially, payment gateways handle the technical aspects of verifying cardholder information, while the payment processor handles communication between parties.

Payment Processor

Once the payment gateway verifies the information, the payment processor passes it along to the card network (such as Visa or Mastercard).

The card network communicates with the customer’s bank to approve or decline the transaction.

The payment processor transmits its response to the payment gateway, which informs the merchant and the customer.

If you’d swiped your card, it’s at this point that you’d see an approval message on the point-of-sale card reader and know that the payment “went through.”

Sending Bank and Receiving Bank

Once the transaction has been processed, the funds still need to be sent from the customer’s financial institution to the merchant’s bank.

In the world of online payments, these entities are referred to as the sending bank (the customer’s bank) and the receiving bank (the business’s bank).

In most cases, the funds won’t be available for immediate use by the business.

They’ll need to sit for a certain period of time in the business’s merchant account before being transferred to its business checking account.

What’s a merchant account, you ask? As Steve Walker writes for Chron:

“Merchant accounts can only receive money electronically. They are not deposit accounts that accumulate a balance like a checking or savings account or evidence of debt, as in the case of a loan balance. They are a pass-through account since the money is en route to its final location.”

Once the waiting period is over, the funds are automatically transferred into the merchant’s business checking account, where they’re freely available for use.

From start to finish, the entire card payment process generally takes one to three business days.

What Types of Payment Methods Do Payment Processors Accept?

Payment processors most commonly process credit card transactions, but that doesn’t mean they’re limited to that payment type.

Depending on the processor you choose, it may be able to accept the following types of payments:

- Debit cards

- Credit cards

- eChecks

- ACH payments

- Digital payment apps like Apple Pay, etc.

Note that some credit card types are less commonly accepted. Visa and Mastercard are the most widely accepted cards, while Discover and American Express are less common.

Also, different payment types likely come with different sets of fees and risks (more on that below), which can impact the cost transferred to the merchant.

If you’re looking for a payment processor for your business, be sure to research which payment methods it accepts and how much it will cost you to process them.

For example, Regpack accepts debit and credit cards, eChecks, and ACH payments.

You’ll want to consider your customer base’s most commonly used payments and choose a processor that makes it easy and affordable to accept those.

What Types of Fees Can Payment Processors Incur?

Digital payments require complex systems and network maintenance, so it makes sense that it costs money to process payments.

Each stopping point along the payment process incurs a cost, including the networks, credit card companies, and the processors themselves.

Every entity along the transaction’s path needs to cover its costs—and earn a profit.

This cost is usually passed along to the merchant.

The payment processor collects a fee from the merchant, takes its cut, and then pays the remainder back to the various intermediaries involved in the transaction.

The total fee paid by the merchant is usually between 2% and 3% of the entire purchase.

The types of fees involved in an online payment include:

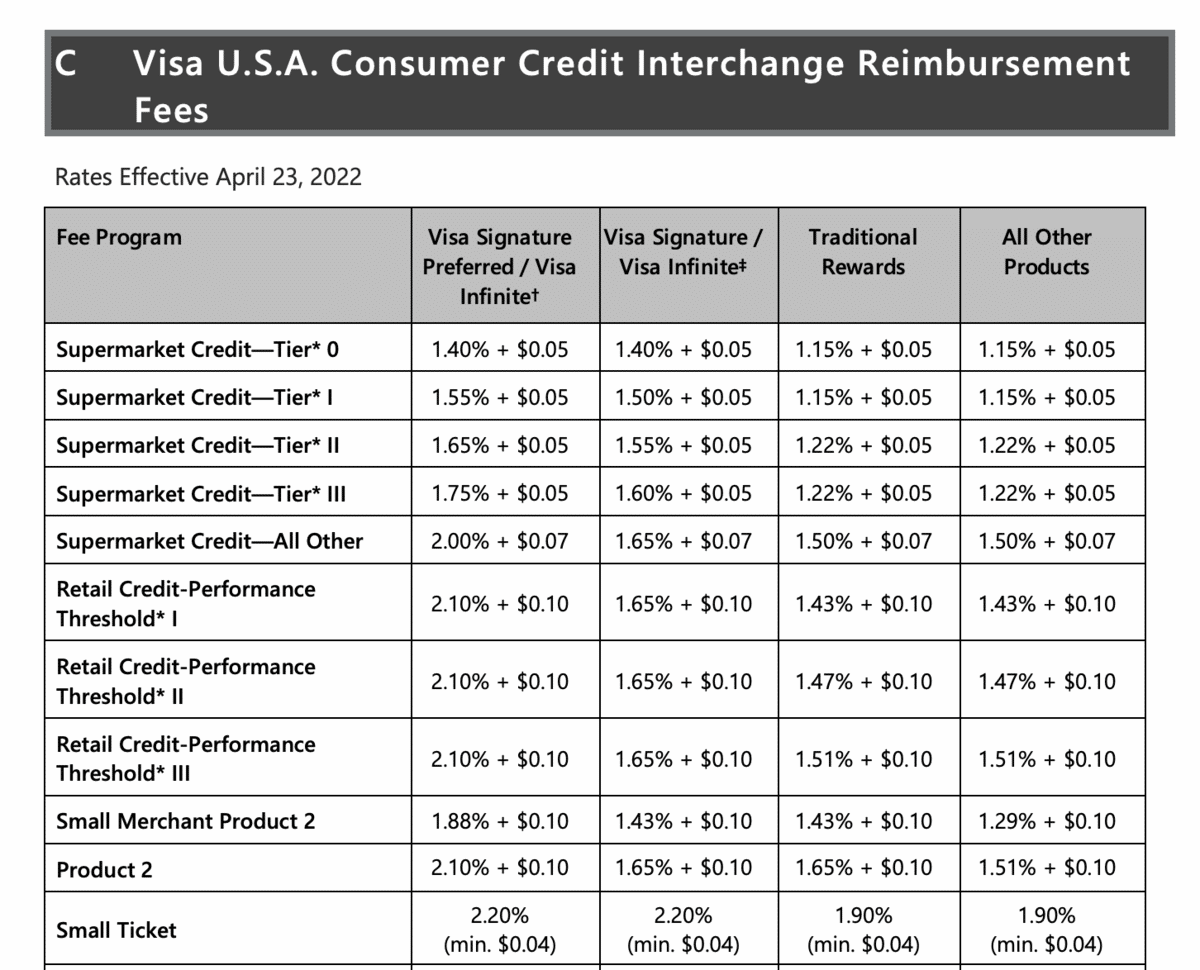

Interchange Fees

Interchange fees go to the issuing bank, and card networks set the rates.

So if the customer uses a Chase Visa card to make their payment, the interchange fee would be set by Visa (the credit card network), and the payment would go to Chase (the issuing bank).

Some credit networks publish their interchange fee tables, which include a long list of categories. For example, here’s an excerpt of Visa’s interchange fee table:

Source: Visa USA Interchange Reimbursement Fees

These fees make up most of the total processing fee the merchant pays.

The fee itself can vary based on whether the card was used in person or online or in the merchant’s industry, but they generally range from 1% to 3% of the total payment amount.

Assessment Fees

An assessment fee is much smaller than an interchange fee, and it goes directly to the credit card network.

But like an interchange fee, the amount can vary based on a variety of factors. As personal finance expert Rita Williams writes for Value Penguin:

”Some networks will charge higher rates for credit card versus debit card usage, while others may charge higher rates when the transaction volume is greater. Other incidental fees may arise from specific transactions being unique, such as foreign transaction fees.”

Assessment fees typically range from 0.13% to 0.15% of the total payment amount.

Processor Fees

As you might expect from the name, processor fees go directly to the payment processor.

These charge types vary in both amount and structure.

Some processors charge a flat rate, while others charge based on a percentage or a tiered system.

To make things simple for our clients, Regpack charges a flat processing fee of 1.5% of the total transaction.

How to Choose a Payment Processor

If you’re on the hunt for a good payment processor, the sheer number of options can quickly become overwhelming.

The trick is to understand your business’s needs, budget, and the most common payment methods your customers use. Then, choose a processor that fits your requirements.

We recommend keeping the following considerations in mind:

PCI Compliance

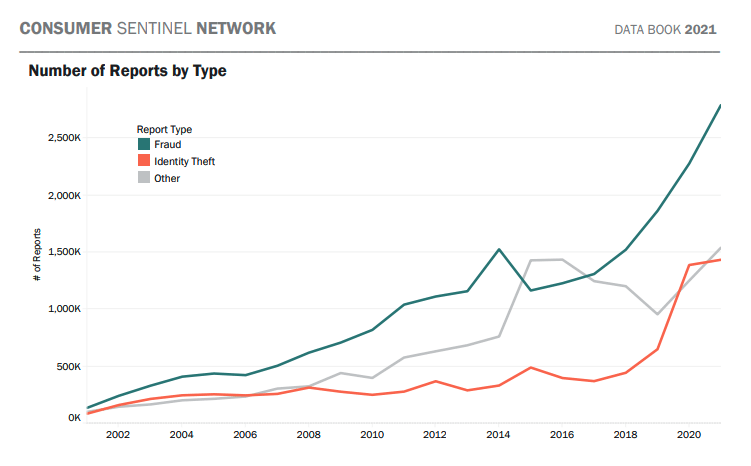

If it’s not already, credit card fraud should be a major concern for both you and your customers.

It’s an incredibly prevalent problem, with the U.S. Federal Trade Commission (FTC) reporting that there were 2.8 million fraud reports in 2021 alone, with consumers losing more than $5.8 billion.

And even worse, that number is up 70% from the reported fraud-related losses in 2020.

Source: FTC

It is up to businesses to ensure secure payment processing for their customers—and once you’ve experienced a data breach, it can be difficult to regain your customers’ trust.

So when choosing a payment processor, you should take security concerns seriously. Check into the processor’s fraud protection services and make sure it:

- Flags and/or denies suspicious transactions

- Encrypts transaction data

- Encrypts stored customer data

- Is PCI compliant, meaning it is in line with the Payment Card Industry Data Security Standard

For instance, Regpack is PCI compliant Level 2 and has passed all audits on the first scan since 2010. We scan our entire system weekly using a PCI checking mechanism, and we also have a PCI compliance approval entity scan our system monthly to ensure maximum security for our users.

Pricing Structure

You’ll also want to consider what pricing structure works best for your budget, sales volume, and priorities. Most payment processors use one of the following pricing types:

- Flat-rate pricing – A single rate for all types of transactions. This structure is straightforward, but it can add up for businesses with high sales volumes.

- Interchange-plus pricing – The interchange rate plus a pre-defined markup, which is usually a percentage and/or a fixed amount. This structure can be less expensive than other options, but costs can fluctuate quite a bit based on the hundreds of interchange rates out there.

- Tiered pricing – A mix of interchange-plus and flat-rate pricing. Different interchange rates fall into different tiers, where each has its own fixed markup costs. With this system, fees are more predictable, but costs can be higher than interchange-plus pricing.

We recommend checking the payment processor’s website for information on how its fees are assessed.

Some platforms offer several different rate packages based on your industry type or subscription level.

And keep in mind that most payment processors charge a higher fee for online payments since those typically come with a higher degree of risk.

Payment Types

Will you be accepting in-person payments?

If so, keep in mind that some payment processors are designed especially for e-commerce, while others easily integrate with point-of-sale terminals for a multi-channel business.

If you plan to accept payments in person, it’s a good idea to find out if the payment processor will let you use your own payment terminal or if you’ll need to buy or lease a terminal from the processor themselves.

The right payment processor for you should let you choose the payment types that fit your needs and the current trends in payment processing, such as:

- Credit/debit cards

- ACH

- eChecks

- Digital wallets

Even for those that pay online, many customers aren’t comfortable paying with a credit card.

Not offering a variety of digital payment options means potentially losing out on significant business.

Your Industry

The industry your business is in can also be a deciding factor in which payment processor you choose.

Due to the high risk of credit card fraud and chargebacks, some platforms don’t cater to certain industries.

And other industries are so highly regulated by federal and state law that it can be hard for them to find payment processors willing to work with them.

Such high-risk industries include:

- Firearms

- Gambling

- Pawn Shops

- Tobacco

- Marijuana

- Travel

If your business is in one of these high-risk industries, you may have fewer possible payment processing solutions to choose from.

Choose the Right Payment Processor to Maximize Your Profit

Accepting customer payments has become much more complicated since the advent of credit cards and digital payments.

Now, you need a payment processor to act as a middleman and ensure the proper financial data is transmitted to all the right parties.

Processing payments includes collecting cardholder (or bank) information, communicating with your payment gateway, and sending the right information to the customer’s bank and yours.

Without a reliable and secure payment processor, getting paid can be a huge headache.

That’s why you should choose one that’s PCI-compliant, offers a pricing structure that works with your budget and sales volume, and accepts all the payment types your customers prefer.