The occasional disputed transaction—also known as a chargeback—is nothing to fret over. It happens to pretty much every business.

Serious problems only occur when you start receiving a high number of them over a longer period of time.

The first step to protect your business from chargebacks getting out of hand and substantially hurting your reputation is to fully understand them.

In this guide, we’ll tell you what a chargeback is, the reasons why they occur, the short- and long-term consequences of them, the chargeback process, and how to handle them.

This knowledge should help you prevent chargebacks from happening and successfully challenge ones that will no doubt occur despite your efforts.

- What Is a Chargeback

- Why Do Chargebacks Happen

- What Are the Consequences of Chargebacks

- How Does the Chargeback Process Work

- How to Handle Chargebacks as a Merchant

- Conclusion

What Is a Chargeback

A chargeback, also referred to as a payment dispute, is when a customer reverses a credit or debit charge through their issuing bank, thereby drawing funds from the merchant’s bank account and returning it back into the customer’s.

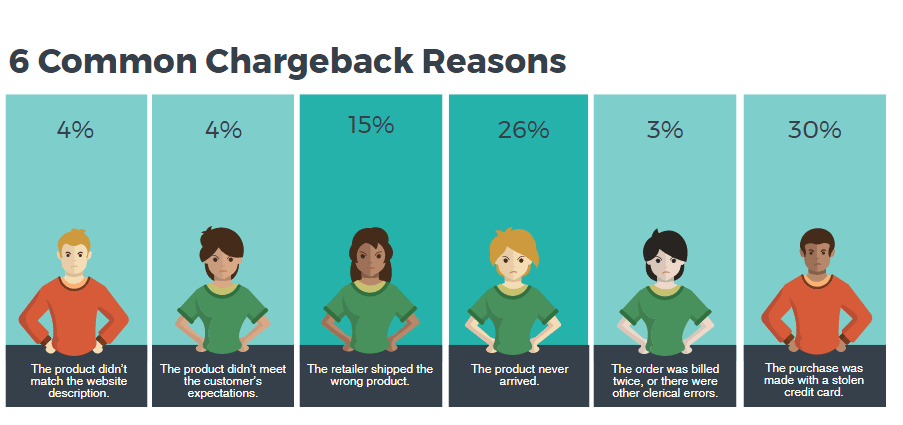

Chargebacks have many causes:

Source: ClearSale

For example, a customer who sees an unfamiliar charge on their bank statement could dispute the payment through their bank to get their money back.

Another customer might request a chargeback because they felt that the product did not live up to their expectations.

Unless the merchant can provide convincing evidence to the issuing bank that the transaction was fair, the funds are removed from their account and returned to the customer.

Chargebacks were originally designed to protect customers from losing their money to credit card fraud.

Unfortunately, customers may at times use this power irresponsibly, filing payment disputes against good businesses simply to recoup their funds.

Compared to a refund, where the customer deals directly with the merchant and returns the goods to get their money back, a chargeback requires no such cooperation and is therefore easier to initiate and pull off.

Why Do Chargebacks Happen

There are many reasons why chargebacks occur, and they can be grouped into three overarching categories, or chargeback types: criminal fraud, friendly fraud, and merchant error.

According to Kount’s 2021 research report, here are some of the main reasons why chargebacks occur:

Source: Kount

As you can see above, 45% of the surveyed business owners listed delivery delays as the top reason for their increase in chargebacks.

43% have cited trouble scaling, and another 43% blamed customer service delays.

These happen to all fall under the category of merchant error and are therefore controllable.

Only 26% and 11% cited the other two types—criminal fraud and friendly fraud—as the top causes for the rise.

Now that we’ve introduced them, let’s now go more in-depth into these three overarching categories of chargeback causes.

Criminal Fraud

Chargebacks that fall under the category of criminal fraud occur when a third party uses someone else’s card information to make unauthorized purchases from a merchant.

Often, a customer initiates this chargeback after reviewing their account and finding that someone has been making purchases from businesses they’ve never heard of.

According to Kount’s research, criminal fraud is a less common reason for chargebacks than merchant error.

However, it still happens from time to time. There were 389,845 reported cases of credit card fraud in 2021, making it the second most common type of identity fraud:

Source: Motley Fool

Unfortunately, unlike merchant error, which is in your control, it’s harder to prevent criminal fraud and the chargebacks that result from it.

Friendly Fraud

Chargebacks from friendly fraud happen when a customer buys a product or service from the merchant, receives it, and then inappropriately initiates a chargeback.

This type of chargeback might happen if the customer didn’t recognize your business’s name on their statement, if they forgot about the transaction, or if they just felt like getting their money back.

You should refute these chargebacks by submitting a rebuttal letter that includes supporting evidence like shipping information, receipts, and order invoices.

Merchant Error

Chargebacks as a result of merchant error happen because of mistakes on the merchant’s end. This is the one chargeback type where the merchant directly caused the chargeback.

Here are some common errors merchants make that cause customers to file a dispute:

| The product or service doesn’t reflect what you advertised and promised. |

| The goods are defective, damaged, or something other than what the customer ordered. |

| The product or service arrived late or past the promised deadline. |

| The merchant accidentally charged the customer for stuff they didn’t buy. |

| The merchant overcharged the customer for the goods. |

Because these chargebacks are the only ones directly caused by merchants, they’re also the most easily preventable.

Businesses can improve their operational processes and customer service to reduce them.

What Are the Consequences of Chargebacks

Chargebacks come with consequences that can damage your business’s bottom line, reputation, and ability to conduct business.

Immediately after a chargeback is initiated and processed, you lose the revenue from the transaction and recover none of the administrative, shipping, or other operational costs that you had to pay to deliver the product or service to the customer.

Plus, you have to pay a chargeback fee to your acquiring bank, which typically falls anywhere between $20 and $100 per transaction.

High-risk businesses will have fees on the higher end of the spectrum.

Chargeback consequences in the short term are monetary and usually not that damaging to a healthy business.

It’s when your business gets a high number of chargebacks over the long term, increasing your monthly chargeback rate, that things start to get dicey.

The chargeback rate is calculated with the formula displayed below:

Source: Chargeback Gurus

For example, if your business made 300 transactions in February and received 10 chargebacks, your chargeback rate would be 3% (10/300).

If your chargeback-to-transaction ratio exceeds the acceptable threshold determined by your acquiring bank, your business could receive heavy penalties, first in the form of fines and then, if the rate remains above the threshold month after month, in the form of account termination by your acquiring bank.

That’s because acquiring banks use chargebacks as an indicator of your business’s credibility as a reputable establishment.

Unfortunately, the business may also be blacklisted and incapable of securing anything other than a high-risk merchant account, which has processing fees between 2% and 20% of the transaction.

And it’s not only the acquiring bank you have to worry about keeping happy.

Card networks like Visa and Discover also have chargeback rate thresholds and penalties for those who exceed them.

For example, Visa has a chargeback rate threshold of .75%, or 75 chargebacks per month, even if the rate is below .75%.

If a business’s chargeback rate exceeds one of these thresholds, Visa flags their account, and if the business exceeds a .9% chargeback ratio, Visa places them on a list for full-scale monitoring.

If the business can’t get its act together and lower its rate in a certain amount of time (typically around 3 months), Visa can boot them from the Visa network, thereby making it impossible to accept that type of card from customers.

In sum, the short and long-term costs of excessive chargebacks are high enough to warrant the implementation of a strong chargeback mitigation plan.

How Does the Chargeback Process Work

The chargeback process involves various parties, including the merchant, the customer, the issuing bank (the customer’s bank), and the acquiring bank (the merchant’s bank).

Let’s go through the sequential stages of the process and review each party’s role:

| Chargeback Stages | Party | Event |

| One | Customer | The cardholder requests a chargeback through their issuing bank, typically on an online portal or over email. |

| Two | Issuing Bank | The customer’s bank receives the chargeback request and evaluates its validity. If they side with the customer, they’ll inform the acquiring bank and remove the disputed funds from the merchant’s account. |

| Three | Acquiring Bank | The merchant’s bank is notified of the chargeback and has the opportunity to counter the chargeback if they have evidence against it. If not, the bank sends the chargeback to the merchant. |

| Four | Merchant | The business can now review the chargeback and determine whether the claim is fair or something they want to fight. If they accept it, the customer is awarded the funds. |

If the merchant, feeling they have significant evidence, decides to dispute the legitimacy of the chargeback, then the issuing bank will act as the arbiter and make a decision.

In most cases, the issuing bank sides with the customer unless the merchant provides extremely compelling evidence that the chargeback was unfounded.

Because of this high burden of proof on the merchant, some business owners decide to just accept chargebacks even if they seem illegitimate in order to avoid the time sink of refuting it, but that’s not always the best option.

How to Handle Chargebacks as a Merchant

When you receive a chargeback, you have two options. You can either let it be or dispute it. Different companies have different protocols when it comes to handling chargebacks.

The Digital Payment Report by Kount we referenced earlier found that 60% of businesses dispute at least some chargebacks, 33% dispute all chargebacks, and 5% never dispute chargebacks:

Source: Kount

When a merchant decides to dispute a chargeback, they must create and send a letter to the issuing bank arguing their position for why the chargeback is illegitimate.

The letter should be succinct and straightforward, focusing on the evidence. No bank administrator wants to read through a long rant emanating with indignation.

They just want the facts, so try to keep your letter to between 100 and 200 words, highlighting the main pieces of evidence.

Here’s an example of a great chargeback rebuttal letter template:

Source: Sherianajamii

The letter begins with information about the recipient, and then briefly explains the purpose of the letter and the reason why they’re disputing the chargeback and its reasoning.

Next, they provide the supporting documents, and then politely let the recipient know that they’re happy to provide further information if necessary. This structure works well.

While politeness works, the most important part is definitely the evidence. For the letter to be convincing, it must support the claim, usually in the form of documentation.

The burden of proof lies on the merchant here, not the customer.

The evidence that you include will vary on a case by case basis, but the most common documents that companies include in their letters are receipts, order invoices, website terms and conditions, the website’s checkout page, emails with the customer, and shipping records.

Different situations call for different evidence. For instance, a merchant who’s fighting a delayed arrival chargeback might include the shipping delivery confirmation to show the goods arrived on time.

Here’s one from UPS:

Source: Refund Retriever

Meanwhile, another merchant disputing a chargeback declaring that the product didn’t reflect the merchant’s promise might send the terms and conditions along with proof that the customer agreed to their terms and conditions, such as a picture of the checked box.

In sum, refuting a chargeback is sort of like going to court, where the customer’s bank is the judge, and you’re the defendant.

As when facing a real judge, logic and evidence will be your best weapons; emotional appeal probably won’t do the trick.

Conclusion

A chargeback is a payment dispute where the customer reverses a payment they’ve made to your business, without contacting you.

Common causes of chargebacks can be lumped into three categories: friendly fraud, criminal fraud, and merchant error, such as late deliveries or deficient products.

Short-term consequences include chargeback fees and loss of revenue, while long-term costs can include damages to your reputation with card networks and even the termination of your bank account.

Issuing a chargeback rebuttal letter is the main way to fix chargebacks that have already happened, but you’re better off creating a chargeback prevention strategy that keeps them from happening in the first place.