Cassandra Nuamah, Chief Marketing Officer at Kukuwa Fitness and Director of Travel at Africa With Us, was looking for a better online payment solution for her trips to Africa.

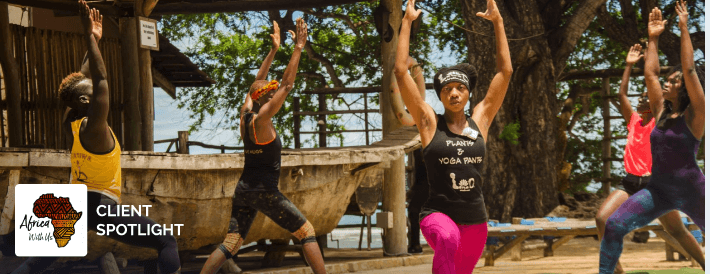

Africa With Us provides an experience of Kukuwa Fitness through an experience of African Dance, Fitness, Cultural Exploration, and Community Service. Local guides provide the opportunity for participants to immerse themselves in the local culture through dance, music, fitness, and food.

Before Regpack, Cassandra used both Stripe and Square to collect payments for her trips. While it solved the basic problem of collecting payments online, it didn’t offer the automation and flexibility that she was looking for, especially for payment plans to allow for trip participants to pay for their big-ticket items on a schedule.

Cassandra shares below how Africa with Us and Kukuwa Fitness is using Regpack to manage clients and payments.

What were you doing before Regpack to manage registrations and payments?

We used Square and Stripe to process all of our payments.

We had participants making monthly payments using these two platforms. We were looking for a more seamless solution that didn’t require us to be so hands-on. We wanted a solution that allowed our customers to manage their own payments and payment plans, login to view their information, and see their balance.

One of our team members who work directly with our technology came across Regpack and thought it would be a great solution for what we were looking for.

We do events as well, so once we were on a demo with Regpack, we understood we could use Regpack for events here in the United States as well as our international trips.

So what ultimately sold you on Regpack?

The independence of the customer managing their own account and us being able to collect all the information we need for our trips and workshops.

We used forms on our website to collect the information and then had to link that up with payments that came in through Stripe and Square. It was extremely manual and it was a big pain creating spreadsheets and connecting the information together.

Now we can pull a report from Regpack on any criteria we need, like everyone who has paid, without the need to transfer the form to the spreadsheet, and marking that they paid manually.

What do you do with the time you’ve saved on manual data entry?

It definitely has helped us refocus our efforts on bigger picture tasks and not so much on the small things.

A customer the other day called to say she had a new credit card, and I was able to let her know she could log in to Regpack and update that herself, which was nice!

How has Autobill and payment plans helped your cash flow?

I love that I can give my customers options when it comes to how they want to pay and we don’t have to manage it manually.

They can select between the amount they want to pay, and then in installments. With Square and Stripe, we had to set up payment plans individually for each person, which took a lot of time.

With Regpack, we can create a handful of Autobill plans, and customers can select which one they want when checking out, including paying in full, and the system handles the rest.

Our cash flow hasn’t really changed, but from an administrative perspective, it’s been so much easier!

How is the support you receive from Regpack?

It’s been great! Your team always answers my questions when they come up in a timely manner and finding solutions for any challenges I’m having.

Would you recommend Regpack to another organization similar to yours?

Yeah, I would for the simple fact that Regpack is a one-stop shop for different functionalities that a business similar to ours might need in terms of client independence with their payments, and event management, and tech support.