Invoicing is one of the most critical processes for businesses. After all, you usually can’t get paid unless you issue invoices.

Most businesses have a method of invoicing customers, but not all of them are effective, timely, or optimal. If you use manual billing, you probably know what that feels like.

So, if you’re looking to streamline your invoicing process and make it easier for your customers to pay you, this article is for you.

We’ll walk you through the steps of simplifying and optimizing your invoicing experience, allowing you to make changes to the process.

Let’s get started!

- Standardize Your Invoice Outline

- Use an Invoicing Software Tool

- Create an Invoicing Schedule

- Allow Multiple Payment Options

- Create a Customer Portal

- Maintain Detailed Invoice Records

- Conclusion

Standardize Your Invoice Outline

Standardization can help you issue and process invoices more quickly.

If all of your invoices look the same, you can be certain they contain all the data you need to charge the customer and get paid quickly.

Furthermore, knowing where to expect each piece of information will make it easier to process the invoice and payment.

However, if your invoices aren’t consistent, you could run into numerous issues. Customers may be confused if each bill they receive from you differs significantly.

If you start each new invoice from scratch, some will undoubtedly miss critical information, complicating the process further.

Finally, if the information on the invoice is never in the same place, it will take your team longer to process it.

You can solve all these problems by creating or using a premade invoice template. If you’re unsure where to start, a quick internet search will yield plenty of results.

Office, for example, provides a variety of editable templates you can use to bill your clients.

Source: Office

If you’re creating one of your own, be careful to include everything you need to charge your customers and process their payments.

Missing information will lead to questions and late payments, which you want to avoid.

In most cases, an invoice contains information that helps the customer identify the purchase and aids your team in payment processing.

This data includes things like your company’s logo and contact information, as well as a product and service description.

Then, don’t forget to include information such as the invoice number and date, customer details, the price with any discounts and taxes, and payment data.

Moreover, list the terms and conditions to ensure that you and the customer are on the same page and that everyone understands their commitments.

This data is necessary for the customer to make a payment—and your team to process it.

However, you can add more fields relating to your products and services depending on your company’s requirements.

After all, the invoice should contain everything necessary for you to charge the customer, for them to pay, and for your team to process the payment.

Creating, processing, and paying invoices will be easier if you use an invoice template.

Use an Invoicing Software Tool

Using invoicing software is a convenient way to streamline your invoicing process.

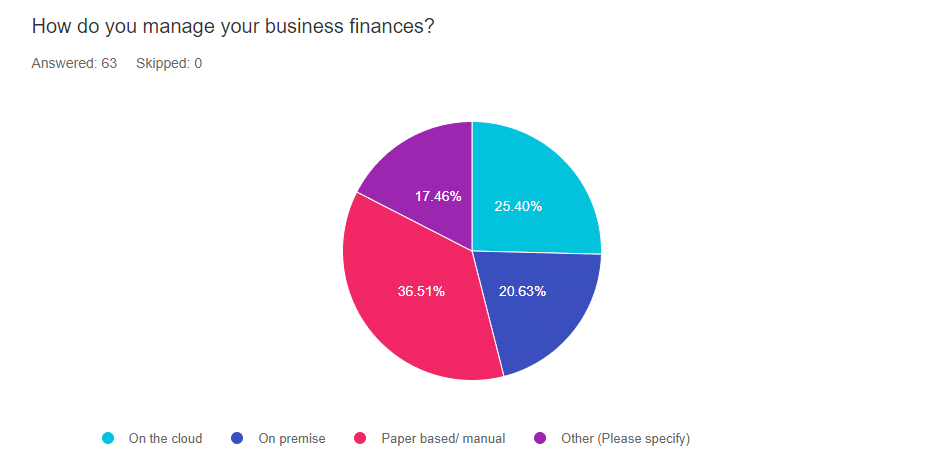

Even though more than a third of businesses still manually handle their finances, including invoices, automation is the better choice.

Source: Zoho Public

You save time and reduce errors when you stop creating, sending, and processing invoices manually.

Let’s face it: good invoicing software does all of this work for you and consistently produces reliable results.

Because of this uniformity, you can trust the software to do its job while concentrating on tasks you cannot automate.

Once you create an invoice template, upload it to your preferred software. You won’t have to do any manual work for invoice sending until you decide to change the template.

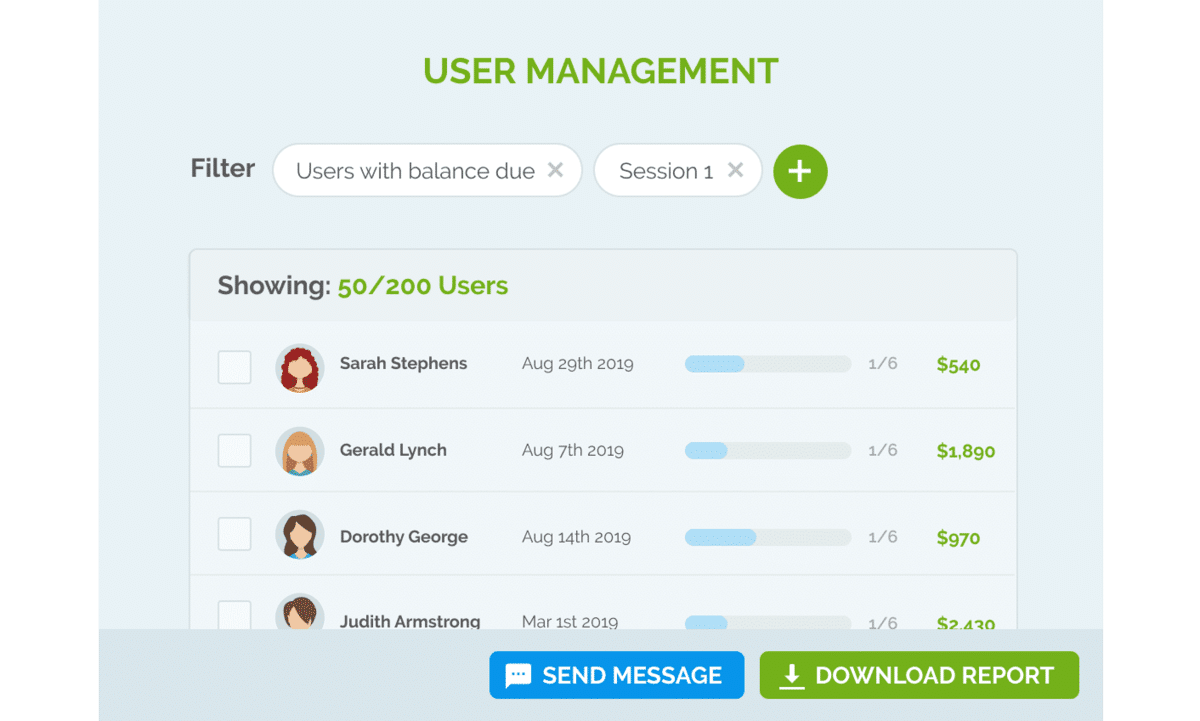

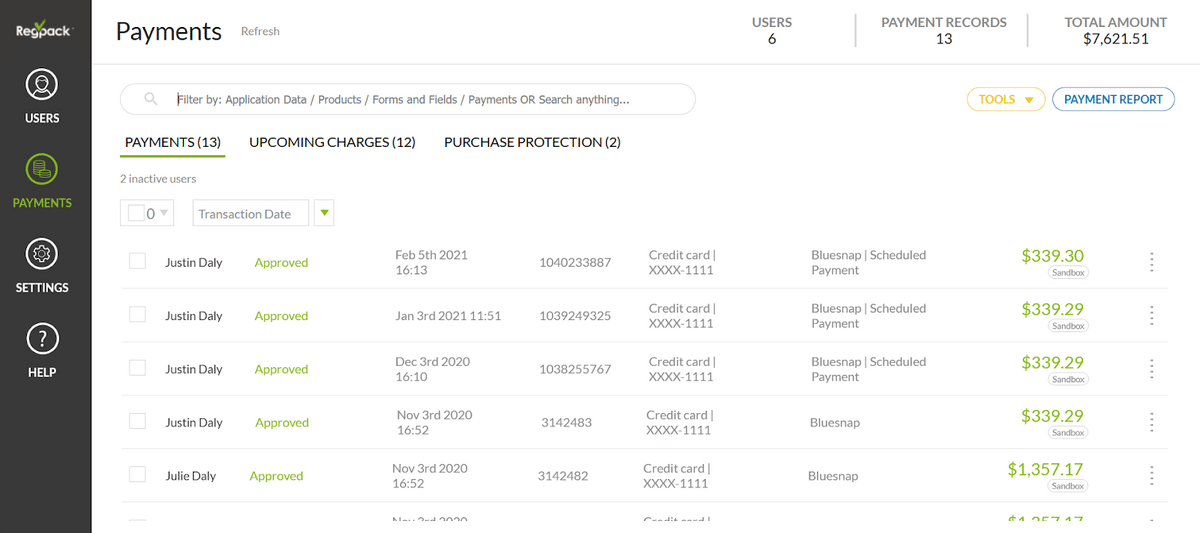

Aside from basic invoicing features, your software should have good reporting options that show you an overview of your payments, upcoming charges, and late payers.

Source: Regpack

Invoicing software like Regpack lets you filter payments and check details for each paying user.

These options allow you to quickly identify which customers do or don’t consistently pay on time. However, you don’t need to pursue late-paying customers on your own.

The software can also send automated reminders to customers before and after the due date, informing them of their unpaid balance.

You have to set these reminders and let technology do the rest.

An invoicing software tool will let you automate most invoicing activities, simplifying the process.

Create an Invoicing Schedule

An invoicing schedule will help you keep up with customer billing.

First, you have to decide when to invoice customers.

Will you send the invoice the same day someone places an order, or will you invoice them on the first of every month if you provide monthly service?

Invoicing all customers at the same time seems like the fairest option.

However, some businesses have different billing criteria, with some allowing customers to choose the billing date themselves.

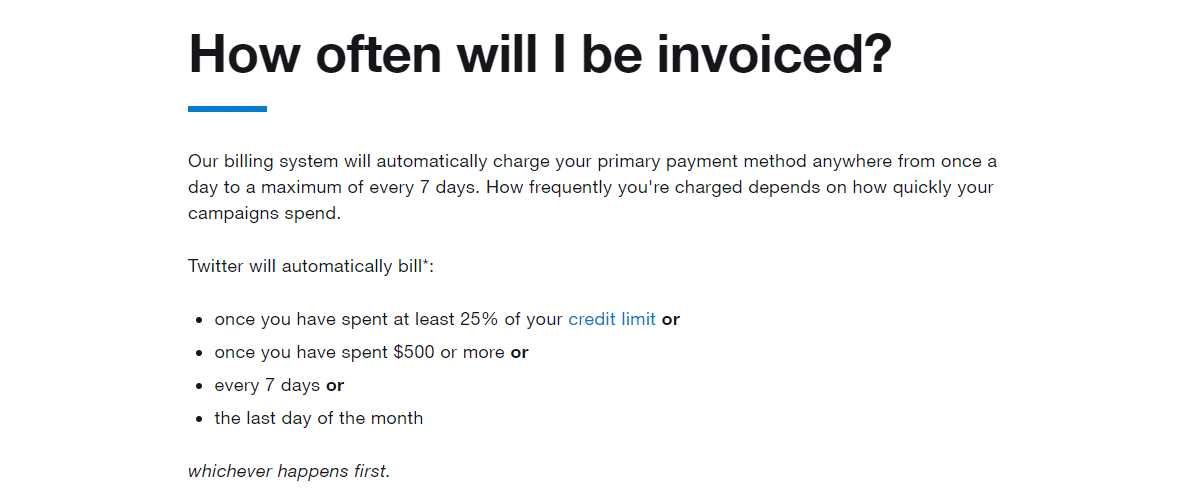

Others, like Twitter Business, charge customers based on whichever condition is met first.

Source: Twitter

Twitter charges users when they’ve spent a quarter of their credit limit, once they’ve spent at least $500, every week, or at the end of the month—depending on what happens first.

If you charge similarly, maybe their system would make sense to you and your customers.

However, billing everyone at the same time allows you to keep your cash flow steady.

If you send out invoices on the first of the month and give everyone a 2-week payment window, you should have the money by the middle of the month, supposing everyone pays on time.

Create a timetable that you will follow, regardless of the invoicing option you use.

Don’t promise consumers you will send out bills on the first of the month just to be a few days late because you can’t handle the manual work. Invoicing software is an excellent answer to this problem.

You’ll have to set up a schedule, and the app will automatically invoice your clients.

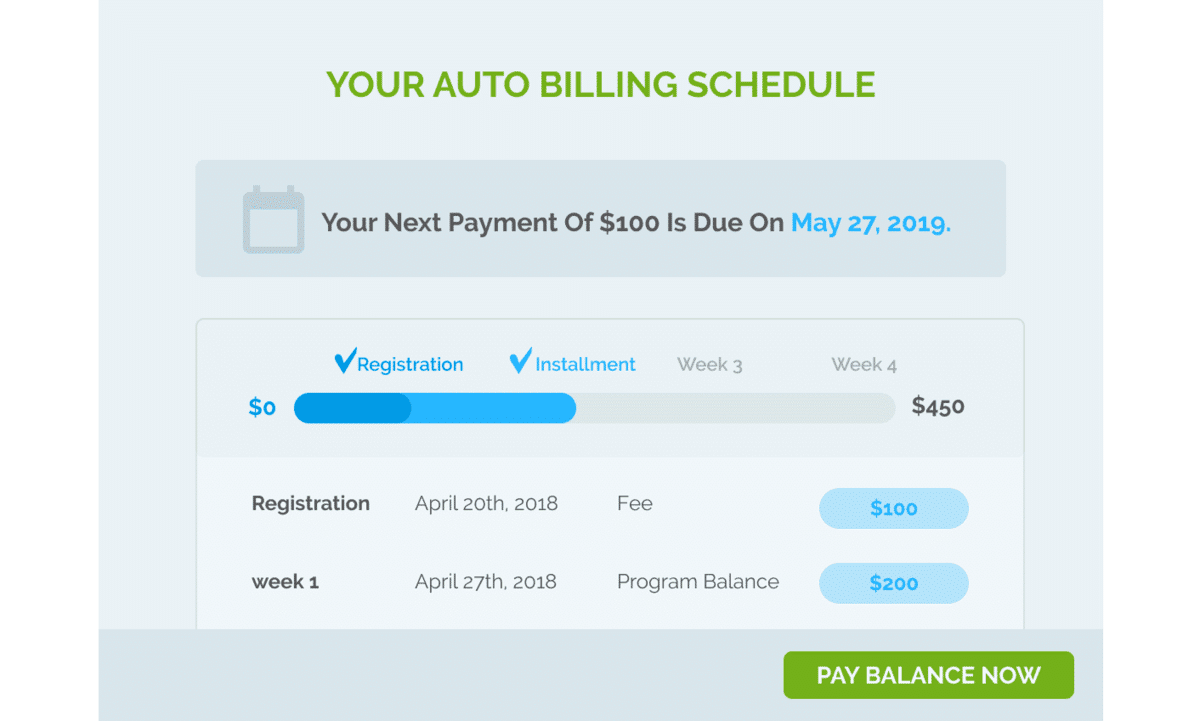

Advanced software like Regpack will let you give your clients the option of choosing whether the bills should be recurring.

In other words, the customer will decide whether they’ll get charged automatically at the end of every billing period or manually pay you every time.

Source: Regpack

You or your administrators can specify how frequently the customer should receive bills, enable auto-renewals, and upgrade or downgrade.

To put it another way, you’ll be able to automate many aspects of invoicing while allowing consumers to make their own choices.

Good invoicing software will assist you in sticking to your billing schedule and maintaining a reliable cash flow.

Allow Multiple Payment Options

This advice is self-explanatory: the more payment options you provide, the faster you’ll be paid.

Customers’ preferences for cash payments have shifted to more modern methods.

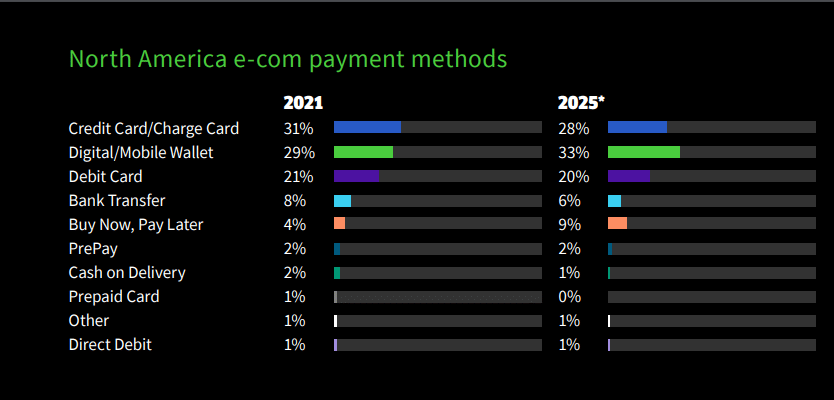

According to the most recent FIS Global Payments Report, customers typically pay with a credit or charge card when they shop online.

Digital and mobile payments are a close second, followed by debit cards and bank transfers.

Source: World Pay Global

Surprisingly, only 2% of online orders were paid in cash at the time of delivery. As a result, you should not rely solely on cash as a form of payment.

Your clients might be paying you late because the option you provide isn’t convenient for them.

For example, maybe a client pays online using PayPal and settles the rest of their bills in the bank.

This customer will go to the bank occasionally to settle debts. Why wait if you could offer them PayPal payments and get paid instantly?

Nowadays, most businesses offer a plethora of options in the hopes of providing their customers with exactly what they require.

Instead of depending exclusively on cash and credit cards, incorporate payment methods popular in your market.

Source: Regpack

GooglePay, Amazon Pay, and PayPal are the most popular alternative payment methods in the United States, according to FIS.

Why not conduct a quick survey to find out which methods your customers prefer? Getting their feedback will assist you in providing clients with exactly what they need.

Offering more than one or two payment options ensures that you satisfy your customers and get paid on time.

Create a Customer Portal

Customer portals provide your customers with access to their invoices and active subscriptions.

These portals are typically online gateways that allow users to view the details of their previous purchases and subscriptions with your company.

Clients can also access their invoices and pay them online. Customer payment portals provide more information than traditional invoice delivery methods such as email.

Source: Regpack

Moreover, an email invoice may end up in the wrong folder or be accidentally deleted, resulting in a missing invoice and late payment.

That is not possible in a customer portal, allowing easier invoice access.

After a simple login, the user has access to all available data and can download their invoice as many times as they want.

Additionally, customer portals are an excellent way to provide extra support through FAQs, chatbots, and contacting customer service.

These options can be included in your customer portal, allowing clients to complete all of their tasks from the same application or website.

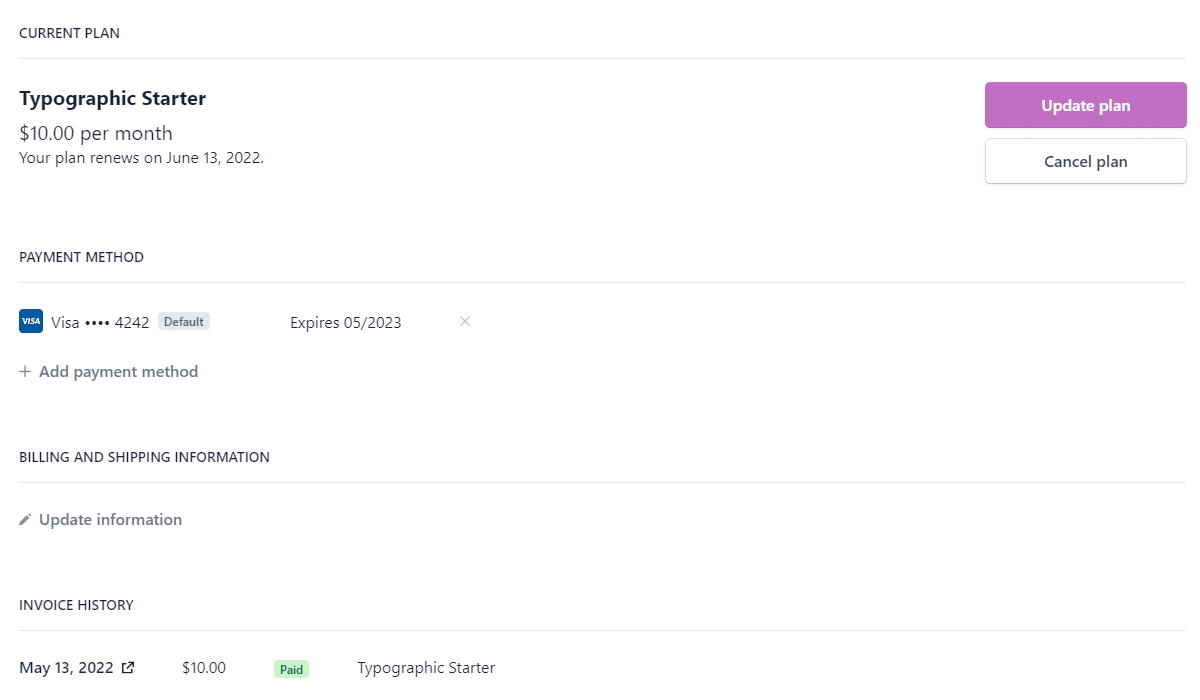

This system may appear complicated, so let’s put it in context with a screenshot of Stripe’s customer portal.

Source: Stripe

The portal displays the customer’s current subscription plan and pricing, as well as the renewal date, which means that the customer has set up recurring payments.

The software will automatically charge the customer at the end of the subscription period.

The user can either update or cancel their subscription plan. They can also see which payment method they’ve chosen for automatic renewals and add another one, if necessary.

On top of that, the client can see and access their invoice history and check the status of the payments.

Therefore, creating a customer portal will enable you to deliver invoices and collect payments more quickly.

Maintain Detailed Invoice Records

The invoicing process ends when you process the billing and save the payment statement, not when you get paid.

Invoices, after all, serve as proof that you sold something to the customer and sent them the bill stating the payment terms.

The payment statement proves that the customer paid you for that product or service. Keeping these files will be helpful in the event of a dispute and for tax filing purposes.

However, if you rely on manual processes, these documents may be lost, deleted, or misplaced.

Furthermore, you might run out of space to save them, and finding the specific invoice you’re looking for will be difficult if they’re simply saved in some folder.

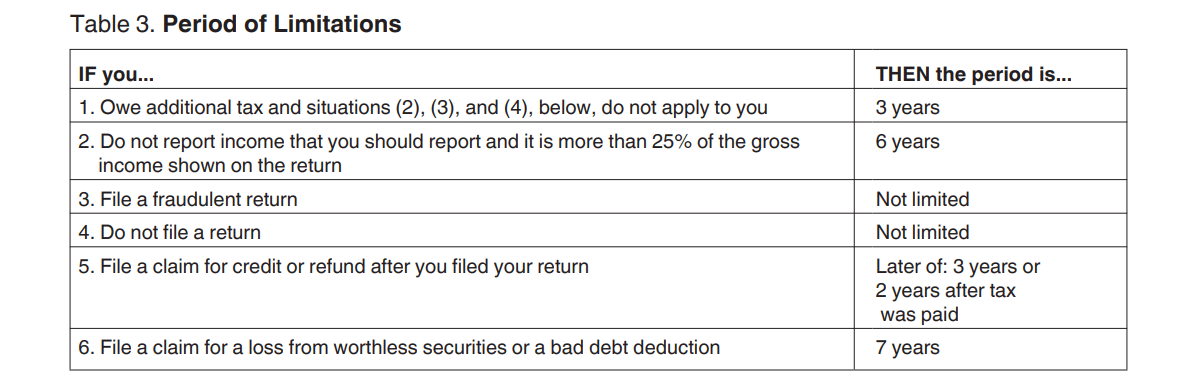

Take into account that the IRS requires you to keep invoices for at least three years, and you’ll soon realize just how much documentation you have to keep.

Here are some more details on IRS’s rules on recordkeeping.

Source: IRS

If the documents in question don’t have a period of limitations, you will have to hold onto them forever.

As mentioned, for invoices, the limitation period is three years, which means you’ll have to keep them for a while.

Small Business Chron recommends you scan the invoice and hold on to the digital copy until it is safe to delete it.

While this is excellent advice for those who still deal with paper invoices, it’s not the way of the future.

Source: Regpack

If you use invoicing software, you will avoid manual scanning and saving and simply let the tool create and store bills.

When choosing the right invoicing software, go for one that allows you insight into past invoices, like Regpack.

With the option of filtering by user, amount, payment date, and similar features, you’ll locate the needed bill in no time.

Invoicing software will help you keep track of your past invoices, which you legally have to have for several years.

Conclusion

Streamlining your invoice process will make it faster and easier for everyone involved.

You can save time while creating invoices by using an invoicing template. Allowing several payment alternatives and a robust customer portal will help you get paid faster.

Maintaining consistency is easier with an invoicing schedule.

You won’t have to worry about any of this if you use reliable invoicing software like Regpack.

You’ll upload your invoice template to the app and let it fill in the details and send bills according to your schedule.

The same tool will act as your customer portal, allowing customers to access their invoices.