While most small business owners would rather focus on acquiring and retaining new customers or creating new products, they also agree that budgeting is a necessary part of owning a company.

Nevertheless, budgeting doesn’t come naturally to everyone, and there are many mistakes you could be making in the process. It’s even more challenging if you have to handle everything by yourself.

To help you on your journey to control your finances, we’ve created a list of the most common budgeting mistakes small business owners make, so that you can avoid them.

Let’s start!

Jump to section:

Failing to Create a Budget

Not Aligning Your Budget With Your Business Strategy

Poorly Managing Expenses

Neglecting to Budget for Taxes

Leaving Too Little Wiggle Room

Not Keeping Your Budget Up to Date

Failing to Create a Budget

First, many companies don’t create a budget at all —and that is the single worst mistake you can make!

Neglecting to create a budget is like driving a car through a thick fog at full speed and praying you don’t hit anything.

Or in other words, without a budget, you have a very limited overview of your finances. Instead, you’re addressing all of your expenses as they come, without the ability to make long-term plans.

Without a budget, you can’t adequately ensure you’re not spending more than you earn, either.

The sad reality is that you’re probably not alone.

According to recent research by Clutch, almost 50% of small businesses failed to create a budget in 2020, and it was the smallest businesses (those with less than ten employees) that were most likely to skip budgeting in the first place.

Source: Regpack

But why are so many small businesses reluctant to create budgets?

Rhett Molitor (co-founder of Basis 365 Accounting) believes that budgeting can feel like a restriction, which is what people want to avoid once they start their own business.

This is a false assumption: budgets can actually provide small businesses with more freedom and improve their ability to scale.

As mentioned before, with a properly devised budget, you’ll have a clear picture of how your business is performing. You’ll know exactly how much money you earn and spend.

Additionally, if you break the budget for one area, it will be easier to reallocate resources on time.

Once you start managing your money more effectively, it’ll be easier to plan for future projects and make better financial decisions. It’s easier to solve future problems if you plan for them ahead of time.

Here’s an example.

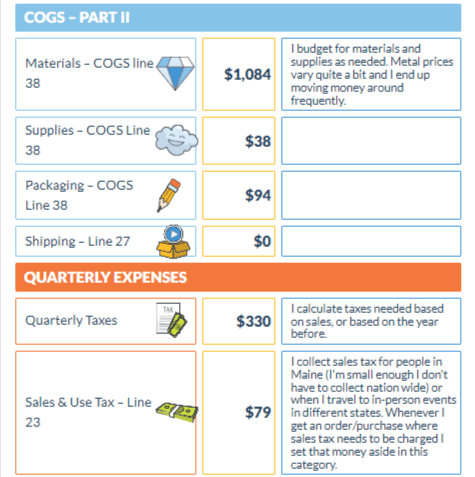

Izzy, a designer from Maine, is proof that no business is too small to have a good budget. Her small company produces fine jewelry, and she’s been in the business for five years, handling everything from production to shipping herself.

This also means she’s the only one responsible for keeping track of her expenses.

Source: YNAB

The challenges she faces are even more remarkable since her work is seasonal. As a result, in her busiest months, she can garner up to $20 000, while in her slowest months, she earns around $3000.

Since she can’t depend on a regular income, she’s invested in software that will help her create a realistic budget and keep track of her expenses.

This provides her with more clarity and assurance that she’s running a sustainable business that can grow in the future.

In the end, bills will still come in, with or without a budget. But having a budget will ensure you’re operating with more predictability and handling your ongoing expenses more successfully.

Not Aligning Your Budget With Your Business Strategy

How does your budget correlate to your long-term business goals and strategy?

Donna Conte, service area leader for accounting services at Warren Averett, says that budgeting keeps you accountable and helps you stick to your business goals.

It also enables you to evaluate if you’re hitting the right performance metrics and gives you insight into how you can change your action plan accordingly.

Creating a budget essentially means forging a game plan to outline your priorities and allocate resources most effectively.

That way, you’ll know how much money you need for supplies, improving your website design, or marketing, among other things.

Remember, a budget does not limit your business, but it helps you make better decisions that will support your business plans and goals.

So, let’s go back to Izzy and see how she uses her budget to achieve her business goals. Currently, her business brings in annual revenue ranging from $50 000 to $90 000, and she mainly distributes her products through her website and wholesale to stores.

Some of her goals for the future are breaking the $100 000 revenue mark and focusing on online-centered sales so she can travel less. Her way of achieving those goals is relatively simple but effective: investing in the right tools and equipment.

Source: YNAB

To get more customers and repeat orders, she has to create great products. Since she makes physical products, one-third of her budget goes into acquiring materials, supplies, and packaging.

Then, to boost her online sales, she makes a fair bit of investment into online marketing and maintaining an e-commerce platform.

She also has recurring monthly subscriptions to several SaaS products that enable her a better online presence and showcase her products in the best way possible. These include scheduled social media posts, email newsletters, and even Photoshop.

Your main takeaway from this should be that your budget is a tool that will help you establish priorities and achieve goals.

Ask yourself where you want to take your business and how strategic funding can help you accomplish realistic objectives.

Poorly Managing Expenses

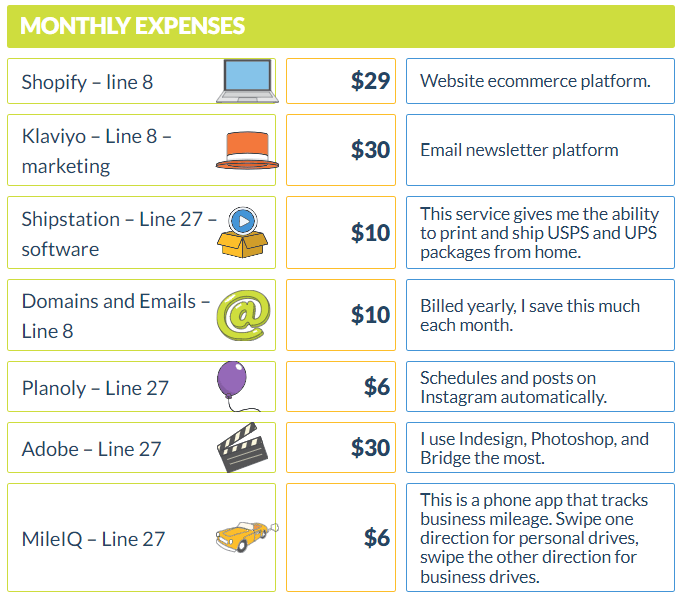

Once money starts coming in, spending it excessively, even if it’s on your business, is very easy.

Of course, when you start earning, you want to build on this momentum and provide your customers with more value, but it’s easy to rack up costs if you haven’t budgeted properly.

For example, ordering more inventory than needed, hiring more employees, or spending too much on marketing before you find the best method to give you a good ROI.

You may call it reinvesting, but poor organization and expense management will inevitably lead to business failure.

Once you have more money going out than coming in, it’s time to reassess your spending.

First of all, start small. Take one average month and track your expenses to get a picture of what you’re spending on the most.

Accounting software or an expense tracking app can be of additional help, allowing you to examine how money is spent for your business needs. You can compare different months and scrutinize every expense to make better decisions for the future.

Source: QuickBooks

Small businesses need to be smart with their revenue and control their expenses as much as possible. Otherwise, improper expense management can lead to non-compliance.

If that happens, you’re going to have to pay heavy fines, interest, and other penalties, but you can also suffer from a bad reputation or terminate your business.

In the end, carefully tracking your ingoing and outgoing funds is the best way to maintain a sustainable business and set yourself on the right track to scale in the future.

Neglecting to Budget for Taxes

One typical consequence of poor expense management is not having enough money to pay taxes when the time comes. Every business has to do it, so it’s important to have a good amount saved.

© towfiqu barbhuiya via Canva.com

There are several types of taxes you’ll need to pay, and they all depend on the type of business you have.

First are the federal taxes, which include:

- Self-employment tax

- Income tax

- Employment tax (if you have employees)

These taxes are paid quarterly to the IRS. But you’ll also need to cover various state and local taxes, such as:

- Sales tax

- Franchise tax

- Property tax

- Excise taxes

Exactly how much you’ll have to pay depends on numerous factors, so consulting a tax accountant will give you the best idea of what you owe and important due dates.

Now, how much do you have to budget to pay your taxes on time?

Experts like John Hewitt, founder of Liberty Tax Service, advise that you should set aside 30-40% of your revenue for taxes. But just to be on the safe side, always talk to a tax professional about what percentage is best in your individual case.

Source: Regpack

Here is how much Izzy has to pay in taxes and how she approaches saving for tax season.

Every quarter, she calculates her profit to pay for her quarterly taxes and Sales & Use tax in Maine. She estimates her self-employment taxes based on her current sales or looking at the previous year.

One way she saves for sales tax is by setting aside money on each order that requires sales tax.

In the past, she’s worked with an accountant, but she’s been educating herself to do her own taxes since she has a keen interest in it. She files her taxes as a sole proprietor (Schedule C for taxes), and her average quarterly taxes amount to $409.

If you want to be diligent and pay your taxes on time, too, follow Izzy’s example and set money aside monthly. Put it into a separate savings account, so you’re not tempted to use it for other business expenses.

Remember, paying taxes is unavoidable, so your best strategy is to have a budget to stay compliant and file taxes on time.

Leaving Too Little Wiggle Room

In business, unexpected things happen all the time. From equipment breaking down to necessary materials being delivered late, these inconveniences always come when you least expect them.

According to Jeff Zhou, CEO of Fig Loans, unexpected expenses, and emergencies are some of the main reasons businesses break their budgets. It’s a reminder that business owners need to be more flexible.

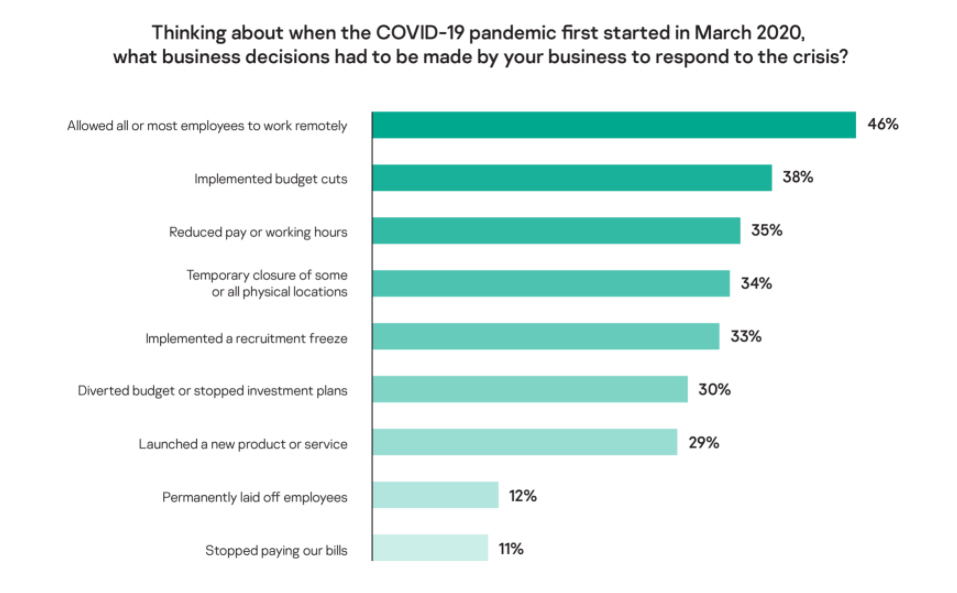

If you don’t, you could fall into the same trap 66% of businesses found themselves in during the pandemic, when their finances rapidly declined.

Source: Kaspersky

Basically, 38% admitted to budget cuts while others resorted to reduced pay, staff layoffs, or even stopping their investment plans.

A single event has rapidly forced companies to reallocate their spending, and as many as 52% of them believe the negative consequences will likely be permanent.

Is there a solution?

One way to deal with unexpected expenses is to have an emergency fund.

How much that is solely depends on your income, the type of business you run, and your motivation.

Most of the time, you will not need that money. But knowing that you have a large safety net in case anything happens will give you peace of mind.

Not Keeping Your Budget Up to Date

A budget isn’t a set it and forget it affair. Once you create an annual budget, many things can happen that will affect your initial estimates and force you to adjust your budget.

Reusing last year’s budget can be a good starting point, but your business certainly will not be in the same place as it was a year ago. Your business will change for better or worse, and your budget has to reflect your current situation.

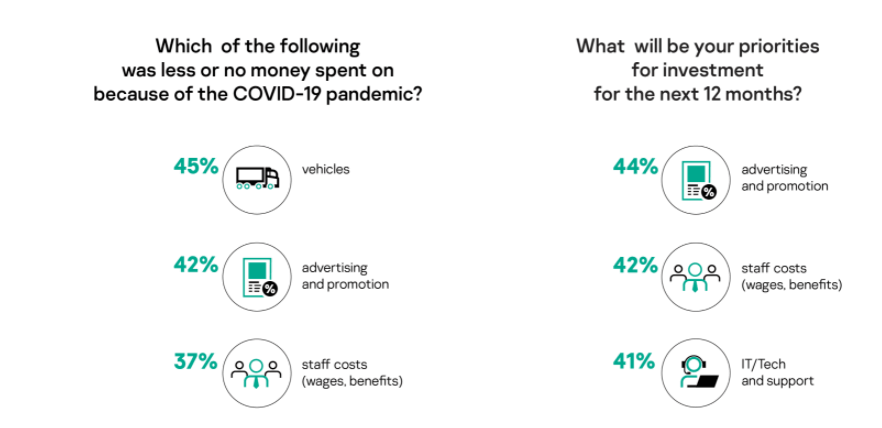

In the same previously mentioned research commissioned by Kaspersky, most companies were forced to readjust their budgets to the reality and challenges of the pandemic in 2020.

As more people worked from home, 45% of companies stopped spending on vehicles. Moreover, companies that had to reduce their staff at the beginning of the pandemic expect to spend more on recruiting in the upcoming months.

Source: Kaspersky

To put it simply, it’s necessary to compare actual numbers to the ones you planned in your budget each month.

First of all, it’s easy to spot trends such as rising income or higher rent costs, and that way, you’ll reallocate resources to solve large issues beforehand.

We’ll come back to Izzy one last time to see how often she keeps her budget up to date.

As mentioned before, Izzy’s business is seasonal, and she can control her finances better if she manages her budget on a month-by-month basis.

So, if she receives money in March, she looks up her April’s set expenses and starts filling in different categories to keep up with her budget.

Izzy revisits her budget several times a week, but the bulk of her money reviews falls on Fridays. She compares amounts in her accounting software with her business bank account to ensure the numbers are correct.

What can you learn from this?

First, updating your budget allows you to be more flexible and respond faster to micro and macro business events. Second, frequently re-evaluating your budget will keep your business on track and even help you meet your goals.

Changes are inevitable, and one of the best ways to run a successful business is to have an accurate and updated budget that accounts for them.

Conclusion

Budgeting mistakes can create numerous problems for your company. Failing to create a budget or poorly managing your expenses can force you to close your business forever.

Controlling your finances can be challenging, but having an effective budgeting strategy and being aware of the most common mistakes is a good starting point.

Improve your chances of success by implementing some of our tips so you’re avoiding mistakes that could jeopardize your business growth.