Service-based businesses have a lot of options when it comes to payment processing software.

You should engage in thoughtful research to find a tool that caters to your specific needs and avoid hassles down the line.

In this article, we’ll cover the top seven online payment processing tools for service businesses, illuminating their core features, pricing, ideal users, and reasons you may want to avoid them.

By becoming informed on the top players in the market, you’ll be better equipped to make a smart investment.

Regpack

Regpack is a payment processing software designed for professional services businesses, like camps and educational programs, that want to automate customer onboarding and accept online and recurring payments from them.

Source: Regpack

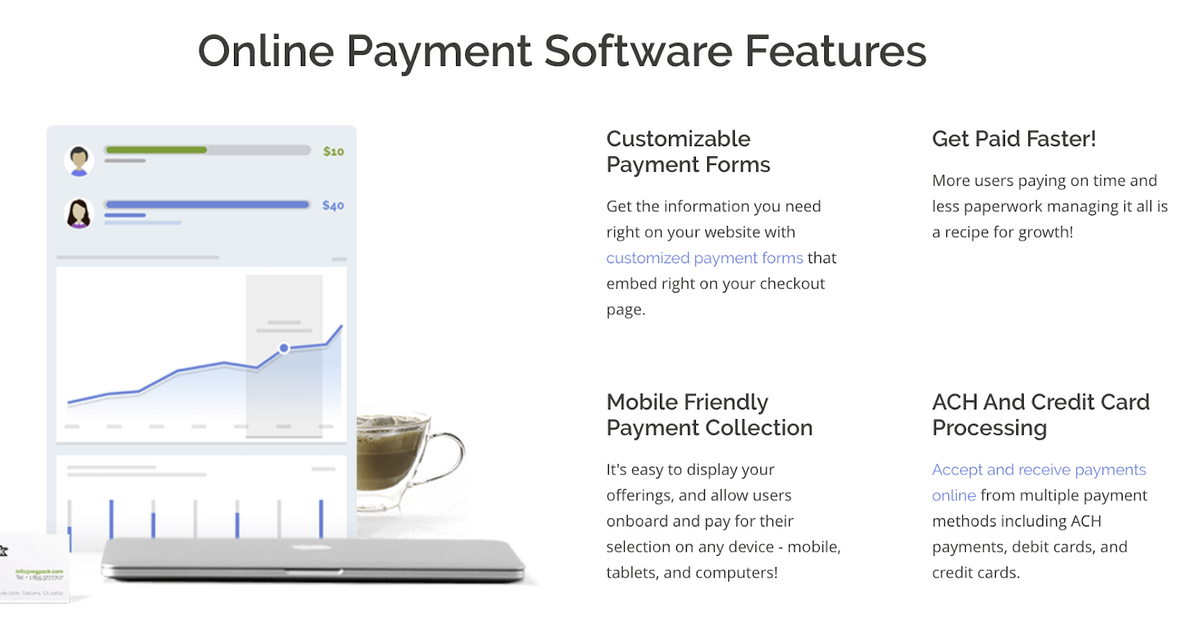

The tool supports multiple languages, currencies, and payment methods, including ACH transfer, credit card, and e-wallet payments.

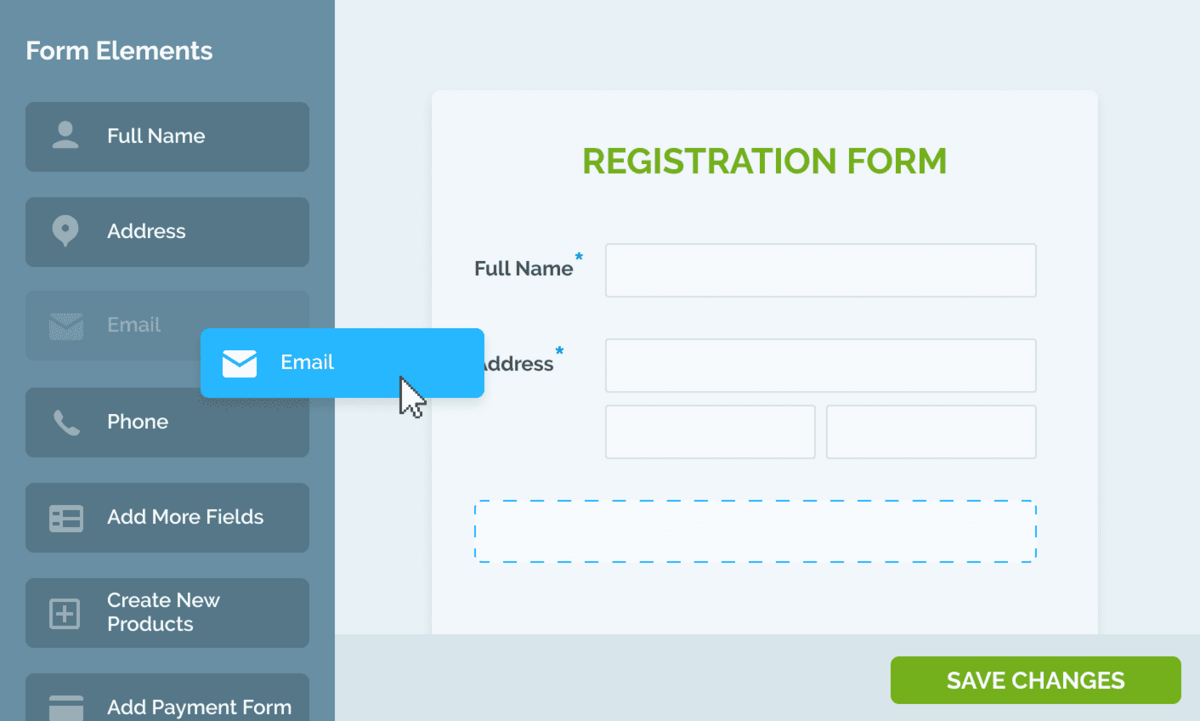

With the drag-and-drop editor, you can quickly build custom payment forms that collect the data and payment information you need to run your business.

Source: Regpack

And, with no knowledge of coding required, you can easily embed these forms onto your website’s checkout page and registration workflows.

Another benefit of Regpack is that it streamlines payment collection and the customer experience thanks to its recurring billing feature.

Regpack will automatically charge auto-pay customers at recurring intervals that you set, or according to a predefined payment schedule that you create in the payment software:

Source: Regpack

You can even configure the software to automatically send personalized invoices to your customers after the recurring charge.

Further, Regpack offers email automation that helps you keep in touch with your customers, as well as reporting and analytics tools that help you understand and improve your processes.

Regpack’s pricing is an affordable $125 per admin per month with a 2.1% processing fee per transaction.

Source: Regpack

Overall, Regpack is a solid software provider if you’re a service business that prioritizes automated onboarding and other time-saving features, wants to avoid hidden fees, and values quick and competent customer support.

2Checkout

2Checkout is an online payment system designed for subscription-based companies selling digital goods and services online to a domestic and international customer base.

A globally-minded option, 2Checkout supports over 30 languages, 200 countries, and 100 billing currencies.

The platform also offers a wide range of advanced subscription features that help with everything from managing subscription renewals and upgrades to analyzing subscription data to spot opportunities for improvement.

Pricing for 2Checkout depends on which of the three plans you choose:

Source: 2Checkout

The most popular option is the 2subscribe plan, which comes with advanced subscription management tools.

This costs 4.5% + $0.45 per successful sale, and there is no monthly fee.

In addition to not having any features to help you accept in-person payment, another potential con is that the platform’s user interface might seem less than intuitive.

GoCardless

GoCardless is a direct debit software that focuses on helping subscription-based, global companies accept and process recurring online payments through ACH payments.

Source: GoCardless

Users can easily customize payment pages in real time like the one above to reflect their brand.

They can then embed these forms on their website, or send them to customers through a secure link, which is important for payment processing security and fraud protection.

GoCardless also offers robust reporting, an all-in-one dashboard to easily manage and track payments, and seamless integration with over 200 popular software tools.

GoCardless uses a pay-per-transaction model, where you pay 1% + $0.25 per US transaction and 2% + $0.25 per international transaction.

Source: GoCardless

While GoCardless is a solid choice for service companies wanting to use recurring or one-off billing to accept direct deposits, it’s a bad choice if your payment option involves credit or debit card payments.

The name, GoCardless, hints at why that is. Basically, you can’t use GoCardless to accept credit or debit card payments from your customers.

PaySimple

PaySimple is a payment processing software that empowers service businesses to accept a range of online transactions and in-person payment methods, from ACH transfers and electronic checks to card payments.

Because of its focus on recurring billing through e-checks and bank transfers, the software is widely used by businesses that form ongoing relationships with their customers and need to collect payments at regular intervals.

To further aid in your customer retention and nurturing, the tool comes with a built-in customer relationship management system (CRM).

From here, you can track and report on important data about your buyers.

Pricing packages start at $79.95 per month, and processing fees begin at 2.54% for credit cards, and $0.69 + 0.25% for ACH and electronic check processing.

Source: PaySimple

The Achilles’ heel of PaySimple is its lack of support for cross-border payments and international currencies.

The platform only works for US-based businesses that process payments in US dollars.

That might not matter for a local gym or Cotsco that only serves customers in the area, but If you have an international clientele, find another payment technology.

Square

Square is a popular payment processor that allows you to process online and in-person payments, set up an online store, accept card payments, and organize invoice processing.

Through its builder, Square empowers you to create custom online payment pages that help your customers make their online payments using a variety of methods, like the ones shown below:

Source: Square

One unique feature is Afterpay, which enables customers to pay in interest-free installments over a period of months, while you’re paid in full immediately after purchase.

Signing up for Square is painless. You don’t need to sign up for merchant services or go through a background check.

As for pricing, you can create an account for free, but you’ll be charged a flat rate for every transaction.

Square’s standard rate for processing payments via an online store, online checkout page, or online API is 2.9% + 30 cents per transaction.

No monthly fee, as well as the 2 business day deposits, makes it an affordable product for new businesses with limited sales numbers and a need for steady cash flow.

However, once you exceed $10,000 in monthly sales, you’ll probably be better off with a different payment process that offers a variable rate that decreases as your sales increase.

Stax

Stax is a payment processing software offering ACH and card processing, digital invoicing, automatic card updates, recurring invoices, web-hosted payment links, and other features that help you efficiently accept payments from your customers.

Users can use the tool to accept payments in-person at their store, online, and through mobile devices.

Stax’s dashboard is intuitive, and from it, you can handle all of your payment requests and track and analyze key payment data:

Source: Stax Payments

Unlike some other electronic payment processors, Stax requires no contract and charges no markup on interchange rates, which makes its processing fees some of the lowest in the industry.

Stax’s pricing is also subscription-based. Their most affordable plan costs a flat fee of $99 per month and is meant for businesses processing up to $250,000 per year.

Companies with $250,000 to $500,000 of processing per year pay $199 per month. Any amount above that receives custom pricing.

With its low processing fees, Stax is great for large businesses with a lot of sales volume.

But, because of its flat monthly fee, Stax is a suboptimal choice for businesses with a low transaction volume—any amount under $5,000 per month.

Though the transaction rate is low compared to other tools, this perk won’t provide small businesses enough savings per transaction to offset the costs of the $99 monthly subscription fee.

Stripe

Stripe is an all-in-one payment platform that lets you accept online payments and purchase orders globally.

They process all major debit and credit cards, as well as bank transfers, digital wallets, and other popular payment methods.

Highly customizable to your needs, Stripe also enables you to build custom online web pages where customers can pay for your service.

You can then easily send these payment page links to customers or host them on your website or mobile app:

Source: Stripe

You can also create custom flexible invoice payments to charge customers for one-off payments and use the mobile SDKs to accept payments through your business’s IOS or Android mobile app.

Stripe is remarkably develop-centric. Through its developer platform, you can create custom integrations with your other tools.

Source: Stripe

One thing to note is that Stripe specializes in helping you accept card and contactless payments. Most of their features revolve around this functionality.

If you prioritize another form of payment, like an ACH bank transfer, you might want to look for a different tool that will help you in that regard.

As for pricing, Stripe’s starting price is 2.9% + 30 cents per successful transaction.

There are no hidden or monthly fees, and Stripe extends volume discounts to businesses with large payment volumes.

How to Choose the Best Payment Processing Software

As a business owner, when you’re selecting payment processing software for your service business, you must do proper research to fully understand the nuanced differences between different options.

One tool might specialize in card payments, while another only allows direct debit.

One might charge a flat monthly fee with low transaction rates, while another has no monthly fee but steep transaction rates.

By learning the differences between tools, either through online research or phone calls with their reps, you’ll be able to pick a tool that makes your job easier, not harder.

Due diligence also keeps you from making any of these costly common mistakes people make when buying a payment solution.