You’ve worked countless hours to create the perfect SaaS product, and it’s zero hour: your software, your website, and your online store are all perfect. You have a solid business plan and marketing strategy in line.

The last step? Getting paid by your first client.

That’s where SaaS billing software comes in.

You need a solution that not only provides the basic processes necessary for billing, but the customer-facing features expected in a modern SaaS experience.

You’ll want some behind-the-scenes features, too—not to mention the ability to grow with your business when the time comes.

We’re here to help.

Below, we’ll explain the basics you should know about Saas billing software, including the components and features it should boast. By the end of this article, you’ll know what to look for when searching out the right solution for your own business.

Jump to section:

3rd Party vs. In-House Billing Systems

What Elements Does a SaaS Billing Software Have?

Features to Look for in a SaaS Billing Software

Additional Concerns for Your SaaS Billing Software

3rd Party vs. In-House Billing Systems

When setting up your billing solution, you have the option to choose between an in-house system—one that is built and maintained within your own organization—or third-party billing software.

There are pros and cons to each solution.

In-House Billing

An on-premises billing system is more customizable, since it’s built uniquely by and for you.

However, building a billing solution has higher upfront and ongoing maintenance costs. Per-transaction costs do tend to be lower once the system is up and running, though.

An in-house system is also more time-consuming to build, as you’ll need talented engineers to handle the complex logic involved in payment transactions.

Your in-house billing solution must also comply with regulations in each country where you do business.

Furthermore, since billing is always at risk for security breaches, any in-house system needs to stay up to date with the latest security technology.

Finally, no in-house billing system is completely self-containing; it must involve third-party vendors for processing card payments, at the very least.

Third-Party Billing

A third-party billing system is less customizable, but it comes largely pre-packaged and ready to use out of the gate.

As a result, this option is great for smaller businesses or those that are on a deadline and lack the resources to construct and maintain a billing system.

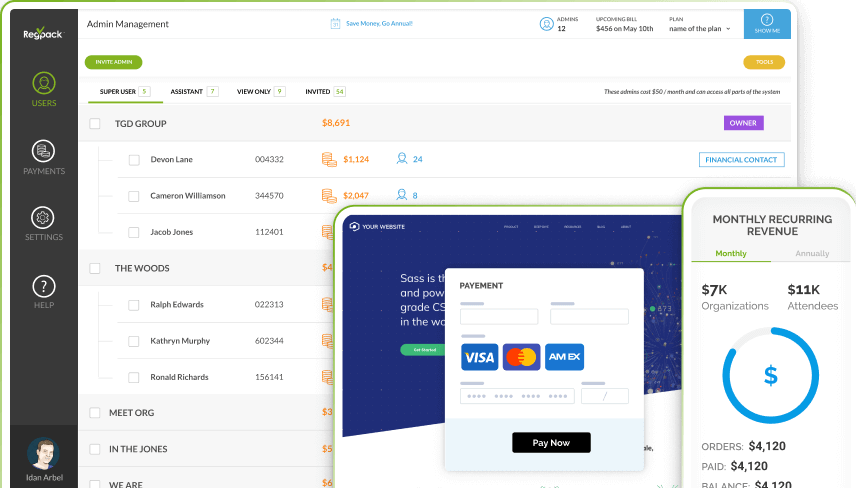

Some third-party solutions, like Regpack, embed all forms and payment processes on your own website, which gives the appearance of an in-house system without all the behind-the-scenes upkeep.

Per-transaction fees for third-party solutions are more costly than an in-house billing system, although you won’t need to worry over ongoing maintenance or upgrade costs like you would with an in-house option.

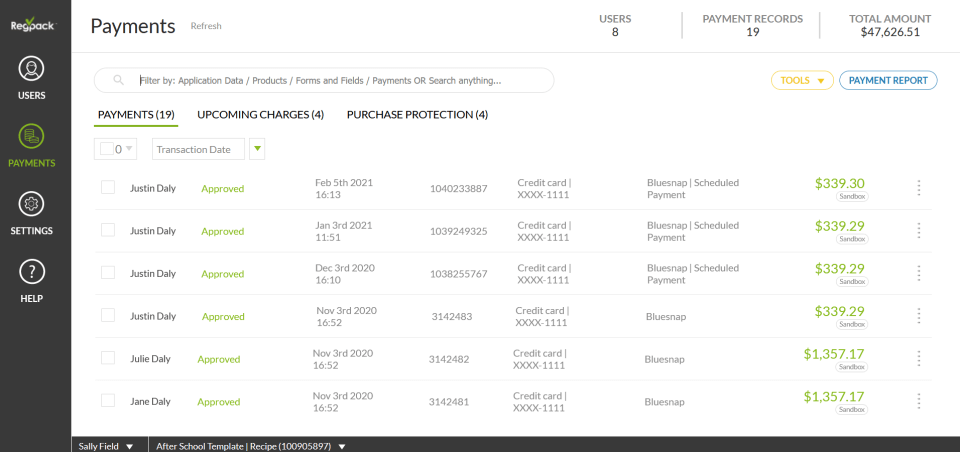

What Elements Does a SaaS Billing Software Have?

When searching for the right SaaS billing software, you’ll need to know what to look for.

Below, we’ll go over the major components of any worthwhile billing solution.

Payment Processing

You’ve probably used Amazon Pay, Stripe, PayPal, or Square to pay for that latest online shopping spree or coffee at the local shop.

All of those platforms are examples of payment processing software.

As you might expect, the ability to process payments is a crucial component of any SaaS billing system.

Payment processing software enables businesses to track, accept, and process several types of payments, such as:

- Credit/debit card

- ACH

- Wire transfer

Our automated billing software, Regpack, for instance, integrates with BlueSnap, a global payment processing platform. BlueSnap is mobile-friendly, supports over 100 currencies, and is PSD2 and GDPR compliant.

The best SaaS billing software not only integrates with payment processing software, but lets you create a custom payment form directly on your website.

This integration helps customers feel at ease, since they won’t be directed to a different website for the payment portion of the signup process.

Merchant Accounts

A merchant account lets merchants (i.e., businesses like yours) process customer payments made with cards.

It is an agreement between the payment processor, the retailer, and your bank to settle card transactions.

Say the customer completes a purchase at the retailer. Those funds are deposited into the merchant account, which functions as a holding place for customer deposits. The funds are eventually transferred to your business bank account.

Merchant accounts serve a few purposes.

First, they reduce the number of deposits being made into your business bank account.

Your payment gateway likely accepts payments from several different sources, especially if you make a high volume of sales.

The merchant account gathers those payments and makes a single deposit into your bank account on a regular basis, usually daily, weekly, or monthly.

This process helps make reconciling your accounts easier.

Also, merchandise can be returned, or transactions can be canceled.

If that happens, the customer will expect a refund—which will be deducted from your merchant account before the day’s, week’s, or month’s net revenue is transferred to you.

Recurring Billing and Subscription Management

If you’re a software as a service company, recurring billing and subscriptions are an essential component of your business model.

Therefore, your billing software must be able to handle charging a customer for your product on an ongoing and reliable basis.

Recurring billing is the process of charging customers for a regular product or service. These charges are commonly automatically deducted monthly, quarterly, or annually.

This type of billing ensures that subscriptions are billed both on time and correctly, even accounting for payment failures and global taxes.

Subscription management is a complex issue, too.

Unless you have a very simple subscription model, it’s likely that your customers will expect to be able to choose from a variety of membership tiers and payment frequencies.

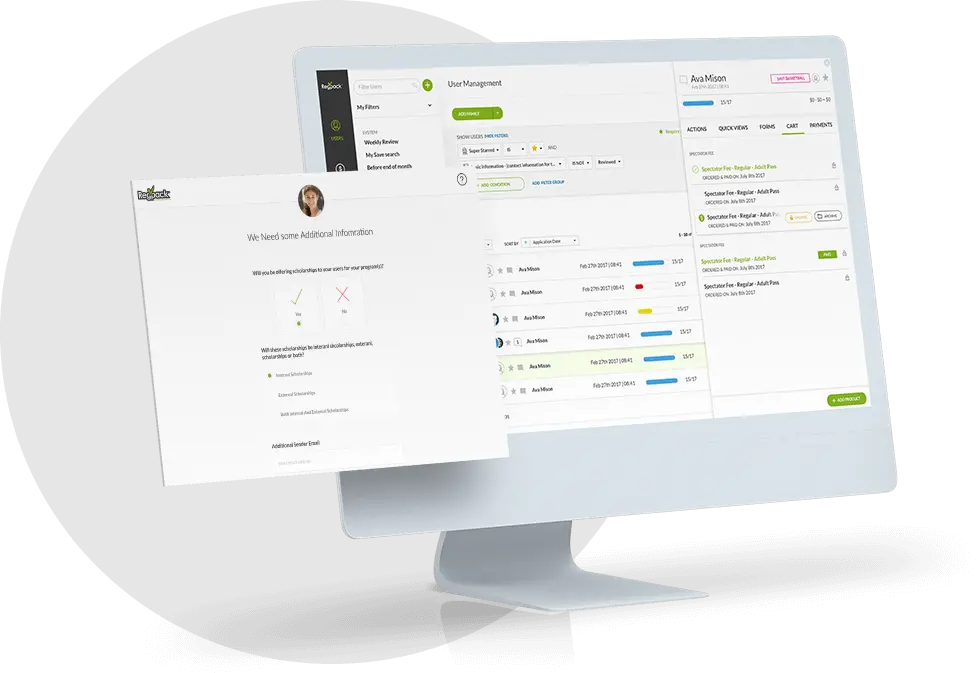

An automated billing platform helps eliminate manual errors and handle complex scenarios such as taxes, upgrades and downgrades, and add-ons.

Features to Look for in a SaaS Billing Software

While there are many options out there, not all SaaS billing software is created equal. A billing system should include a few key features at baseline, including:

- Subscription tiers

- Discounts

- Multiple currencies

- Integrations

- Payment failure procedures

- Taxes and invoicing

- Analytics

- Mobile support

We’ll take a look at each essential feature below.

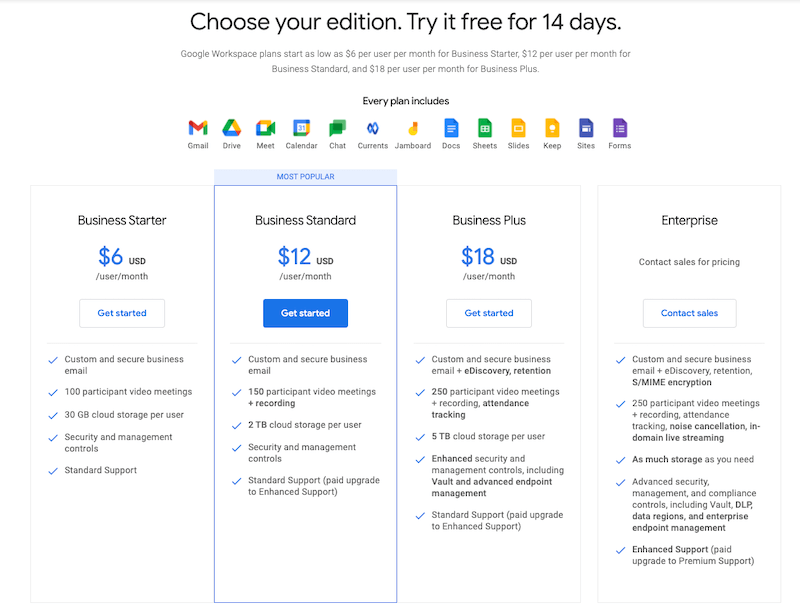

Different Subscription Tiers

A tiered pricing strategy is the most common billing structure in SaaS, and for good reason.

The tier system allows companies to offer a variety of service or product packages at different price points, in order to appeal to the most customers.

It’s most common for SaaS companies to offer between three and four tiers.

These packages are generally geared toward low, medium, and high (or “premium”) price points, and each tier is structured to fit the needs of various customer personas.

For instance, Google’s Workspace (formerly G Suite) uses a four-tiered pricing system with straightforward packages created for different user levels: Business Starter, Business Standard, Business Plus, and Enterprise.

One benefit of the tier system is that, as users outgrow their current package, there is an easy avenue to upsell customers to the next price package.

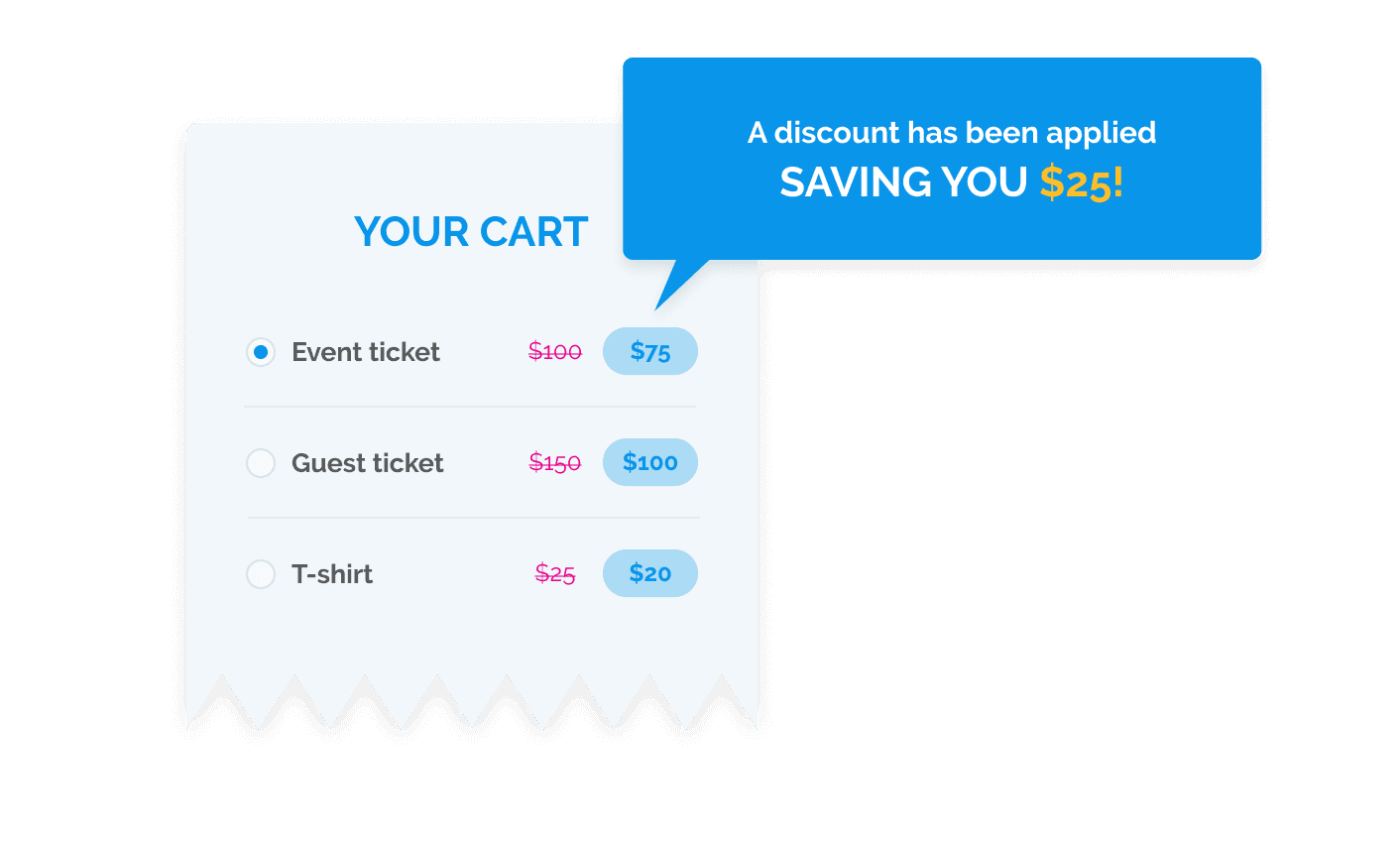

Discounts and Coupons

Coupon and discount codes are a great way to track which marketing campaigns are working.

By choosing a billing software that automatically applies a variety of discount codes, you’ll be able to discern which ad campaigns and marketing channels are most effective.

You’ll be able to discern this based on which discount codes customers are applying most at checkout.

While offering a discount shouldn’t be your go-to response anytime someone raises an objection to your full price, a discount that is used sparingly and strategically can actually help grow your business.

For example, you may offer a free trial period that shows customers the value of your product.

It’s tied to a pre-selected pricing tier (say, the $25 basic plan), but the customer has unlimited access to all of your features.

At the end of the trial period, the customer receives a one-time offer to purchase the next tier up—usually priced at $60—for only $40 per month.

The customer has already seen firsthand the value of your product during the free trial, and now they are being offered a discount on the premium tier.

This one-time offer communicates a sense of scarcity that the customer is tempted to take advantage of, while placing limits on the discount so that it doesn’t look like your business is just desperate to make a sale.

Multiple Currencies

Because you likely sell to a wide variety of customers across the globe, your SaaS billing system should also cover multiple currencies.

Even if your business conducts most of its transactions using USD, it’s a good idea to support local currencies as well.

The customer may not be willing to do business outside of their local currency, or they may need that familiar frame of reference to decide which tier fits within their budget.

Whatever their reason, giving the customer the ability to pay in multiple currencies is worth the additional overhead cost on your end.

There are typically two methods of offering multiple currencies (otherwise known as price localization):

- Cosmetic localization: The price is automatically adjusted to the viewer’s local market based on the latest exchange rates in the major regions where you do business (e.g., the EU, UK, US, and Canada).

- True localization: The price is targeted based on price sensitivity studies in each pinpointed market. So the product may be priced differently in different locations, not just converted to the local currency.

If your business is still in the early stages, it may be wisest to start with cosmetic localization and then progress to true localization as the situation calls for it.

Integrations

Your billing system should also be able to integrate with other solutions that are essential to your business operations. Let’s take a look at a few below.

Email Communication

If your billing system is integrated with email, you’ll be able to send invoices with a single click.

Regpack, for instance, comes with a built-in email communication tool that lets you filter users based on any data criteria and send customized messages from within the platform itself.

Customer Portal

Customers should be able to log on and see their payment history, invoice records, and bills easily.

This integration also helps save you money on sending invoices.

Customers can simply log on to update their information rather than submitting a service request that your team will need to spend time completing for them.

Customer Relationship Management (CRM) System

Automatic integration with your CRM enables your customer service team to enter account changes once and have them reflected across all of your records.

This avoids awkward mistakes such as using outdated contact or billing information.

A CRM integration also lets your sales and marketing teams create personalized offers for upselling and cross-selling.

Accounting and Tax Software

Your billing solution should integrate with your accounting platform to give your management access to up-to-date financial information at a glance.

Regpack offers easy uploads into Quickbooks and other online billing services to ensure all revenue is automatically tracked, tagged, and reconciled—making end-period reconciliation that much simpler and more reliable.

Handling Payment Failures

Payment processing failures come with the territory, and any good SaaS billing software incorporates a payments infrastructure to prevent failures, and deal with them when they occur.

During an interrupted network connection, for instance, a page load error might lead to uncertainty about where the charge in-process left off.

Was the money successfully transferred into the merchant account?

Or, the money may be transferred correctly, but it may be incorrectly recorded in the system (or not recorded at all).

This problem should be resolved by first detecting the unresolved charge request, then determining whether the charge actually went through.

With Regpack, an error code appears as soon as a payment failure happens so that corrective action can be taken.

Some of the most common payment errors include:

- The user’s card being declined by their bank. They’ll need to contact their financial institution to find out why their card is being declined, then try making the payment again. They can also try using another form of payment.

- Payment method not being supported. This is a straightforward reason for failure; the user is attempting to pay using a method that isn’t allowed. They should try paying with a supported method.

- Invalid input. These errors can occur because the customer incorrectly typed some portion of their information, whether it be an incorrect phone number format, invalid card number, or past expiration date.

These error messages inform the customer why the payment failed, enabling them to correct the error and try again.

Taxes and Invoicing

A billing system should tackle the more administrative components of billing as well, including taxes and invoicing.

Invoices should be sent securely and seamlessly, and they should be integrated with your payment processor to ensure easy payment.

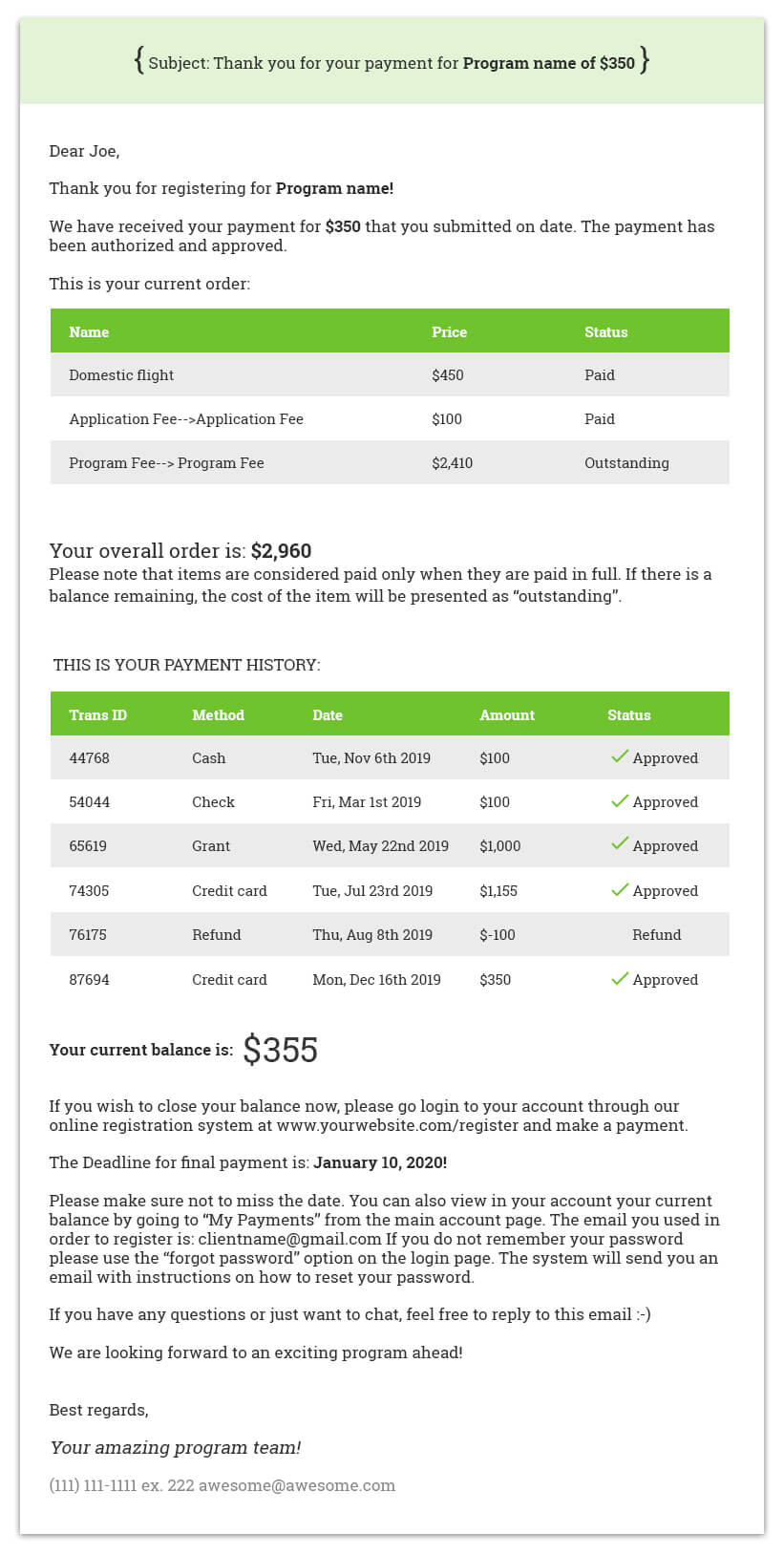

Regpack lets you send personalized invoice emails complete with payment instructions.

Therefore, when a customer makes a payment, an email is automatically triggered that lists the transaction details, current balance, and other useful information.

Your billing solution should also be able to calculate and assign the appropriate sales tax for each transaction and account for any exemptions that apply.

Sales tax rules for software vary depending on the local region where the sale is being made.

Therefore, manually calculating and adding tax could quickly become overwhelming and impractical.

Taxes might vary even further based on whether the service is delivered physically or digitally, or whether the software is custom-built.

Regpack enables businesses to set up taxing transactions based on their county, state, or country requirements.

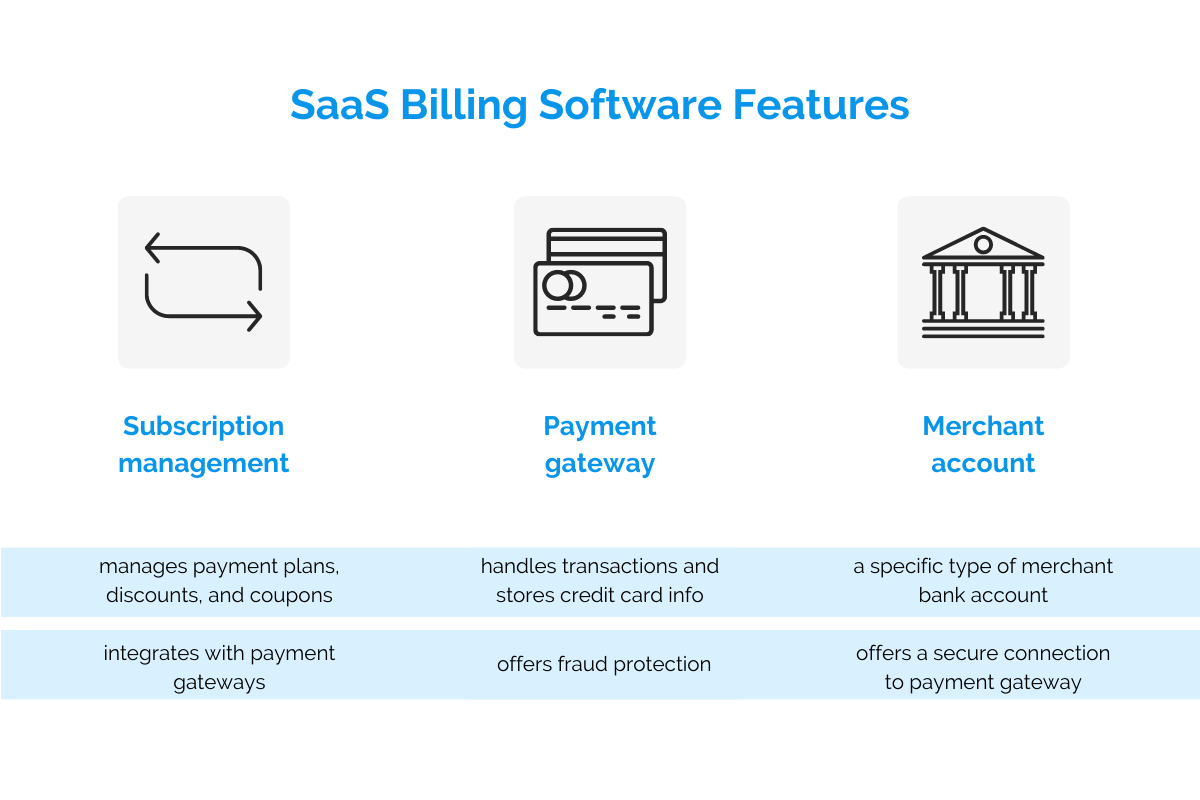

Analytics

Analytics are an essential component of any business strategy. They allow you to predict trends and future outcomes using historical data and machine learning.

With insight into your customers’ needs and expectations, you’ll be able to segment customers and optimize your audience’s user experience.

Tailoring the customer experience using analytics helps you boost revenue and reduce churn rates.

Incorporating analytics into your SaaS billing system comes with many specific benefits, as well.

You can create custom sales and payment reports with precise or filtered information, letting you understand the generated revenue and real-time income generated by your services.

Knowing how your payments are allocated lets you manage your sales in the most cost-effective manner.

Other reports to look for in your billing system include:

- balance due

- auto billing

- emails sent

- fees paid to processors

- monthly payments

The more you can measure, the better you can manage your business and plan.

Mobile Support

In an increasingly mobile world, it’s essential to offer mobile payments as an option for your users.

In fact, mobile purchases are expected to make up more than half of all retail and eCommerce payments in 2021.

If your customers cannot complete a purchase on their mobile device, they likely won’t even bother doing business with you.

Mobile payments let users not only discover your SaaS product on their phone, but make a purchase then and there—rather than needing to visit a store later or navigate to your website on their desktop computer.

Your billing solution should include a variety of mobile payment options and be a mobile-friendly solution overall.

To keep your checkout experience mobile-friendly, your platform should provide a clear, easy-to-read mobile checkout screen with fast load times across the entire shopping and registration experience.

Additional Concerns for Your SaaS Billing Software

At this point, you should have a good idea of the kinds of features to look for in a billing platform.

Still, don’t forget that the software you choose should be a match not only for your current needs and budget, but also a good fit long-term.

Below, we’ll go into some additional concerns decision-makers should keep in mind when choosing a billing system for their SaaS.

How Scalable It Is

As your business grows and brings on more customers, your billing needs will become more complex to match.

A billing system for a scaling enterprise should be able to keep up with SaaS growth.

Everything within your SaaS billing software should be scalable, including accounting for:

- The number of transactions made on a regular basis

- Different payment options

- Integrations

- Coupon and discount options

- Credits and prorated payment plans

- New subscription models

- Metrics and data analytics options

- Global currencies and tax requirements

Many SaaS startups are founded by coders who start with a simple billing system that only needs to accept payments on a recurring schedule.

However, with a growing business comes a variety of challenges and customization requests from customers and internal teams alike.

Tweaking your billing system’s code is one thing, but major changes, including some of the items listed above, require a great deal of research and development to implement correctly from scratch.

That’s why growing businesses should choose SaaS billing software that has built-in features that are meant to grow with you.

What Are the Fees?

Finally, make sure to consider the fees for payment processing in your SaaS billing software of choice.

Most billing systems charge subscription fees on a monthly basis for using the software itself.

They also may charge setup fees to complete one-off tasks, like opening a merchant account for you.

Finally, each transaction generates a small fee as well, usually a percentage of the transaction amount plus a fixed rate (for instance, 2.9% + 30¢) per transaction.

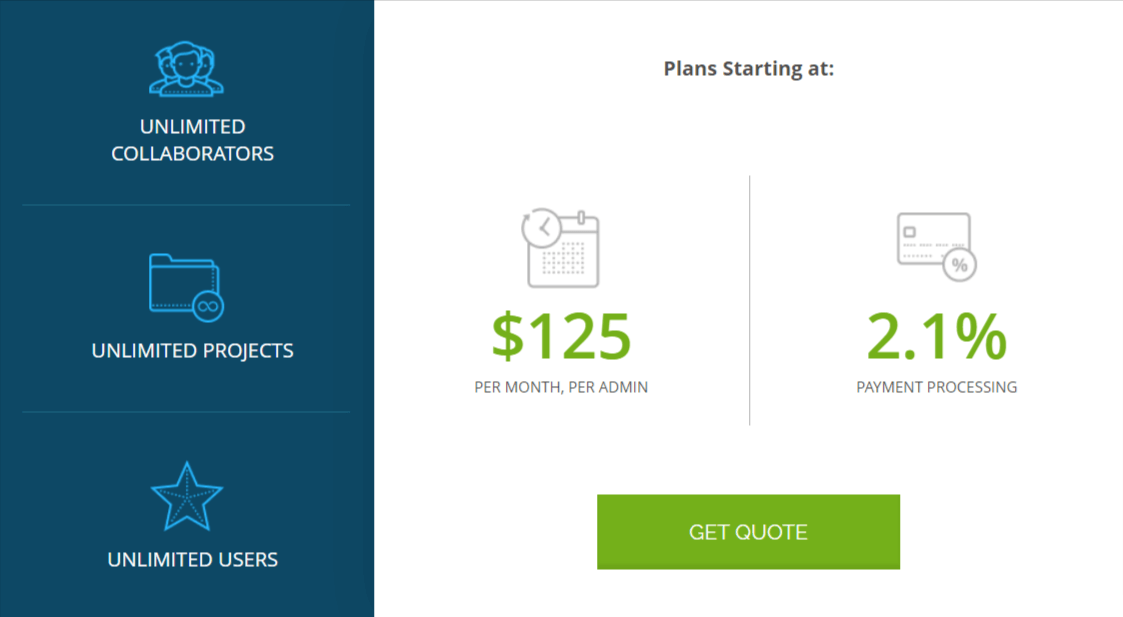

Regpack keeps things simple.

The software comes with a monthly charge for the number of full-access admins, starting at $125 per month, for unlimited forms, billing plans, reports, and email communications.

Processing fees vary according to the amount being processed, but the per-transaction rates begin at 2.1%.

Regpack also offers fixed and blended processing rates—so that you can get the best deal that works for your business’s processing needs.

SaaS Billing Software: The Right Tool Makes Life Easier

Finding the right SaaS billing software can help you overcome the complexity involved in running a SaaS business.

Your customers want easy, streamlined, and efficient payment options that are tailored to them.

Therefore, you want to be able to customize the services you offer, from different subscription tiers to automated communications to integrated tax and analytics functions.

Without SaaS billing software to match your needs, you’ll find yourself spending a lot of time trying to juggle and manually handle basic accounting tasks, leaving customer service issues and essential billing information falling through the cracks.