Recurring payment has a lot of potential advantages for service-based businesses—greater business efficiency, predictable cash flow, happier customers, the list goes on.

The keyword, however, is “potential”. Businesses that implement recurring payments incorrectly might actually see a net loss.

To ensure recurring billing is a value-add to your business and not a source of chargebacks, headaches, and lost customers, you must learn the dos and don’ts of the system.

In this article, we’ll teach you three best practices and three common mistakes related to recurring payments, and show you how to get the most out of your billing process change.

The Dos

There are three things you should be doing if you want recurring billing to deliver its promised benefits.

Read on to learn what these three best practices are, and how to do them effectively.

Researching Before Choosing a Recurring Payment Solution

Do your due diligence before selecting your recurring billing software. Otherwise, you risk choosing one that doesn’t meet your company’s payment needs.

All recurring payment software will make recurring payments possible, but not all of them will have the same set of features and functions.

For example, a solution that is meant for service-based businesses, like Regpack, will have a different feature set than one designed for e-commerce stores.

When researching a recurring payment software, a good place to start is by googling “recurring payment solution for {business type}” and then investigating what shows up.

Some factors to consider include:

- Which payment methods (credit card, ACH, etc.) will the tool accept from my customers?

- What languages does it support? Does it offer the languages my customers speak?

- Which currencies does it support? Will my customers be able to pay with their currency?

- Does it come with a secure payment processor that’s PCI DSS compliant?

- Are there reporting capabilities for monitoring payments and analyzing my billing process?

Regpack, for example, is a PCI DSS-compliant recurring payment solution that offers various payment options, languages, and currencies, and can generate detailed payment reports.

It’s also mobile-friendly.

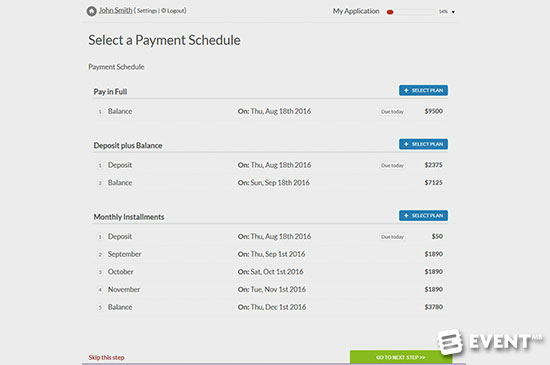

Further, it offers you the ability to create payment plans and offer them to your customers, making it great for service-based businesses who want to improve the customer billing experience they provide:

Source: Regpack

When evaluating recurring billing software, consider how customers will interact with the online forms, user portal, and other customer-facing elements, and pick a tool that will make their payment process as convenient as possible.

Providing Customers With a Detailed Order Summary

When using recurring billing, it’s important to make customers very aware of the agreement they’re entering into with your business, or else they might be frustrated later on.

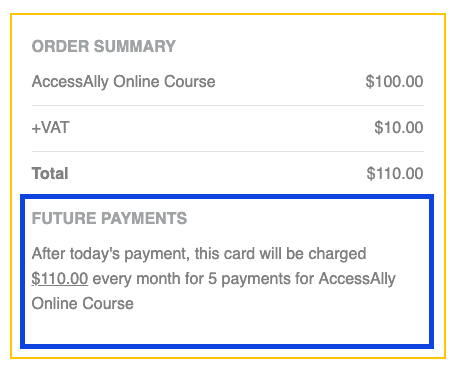

An order summary gives the customer an opportunity to review and confirm their agreement with the terms of the subscription before finalizing their purchase.

You should tell them exactly how much they’ll pay, how frequently they’ll pay it, and when the subscription will end or be automatically renewed.

Source: Accessally

The ordered items, the quantity, the cancellation terms, refund terms, recipient contact information, and the date paid should also be included.

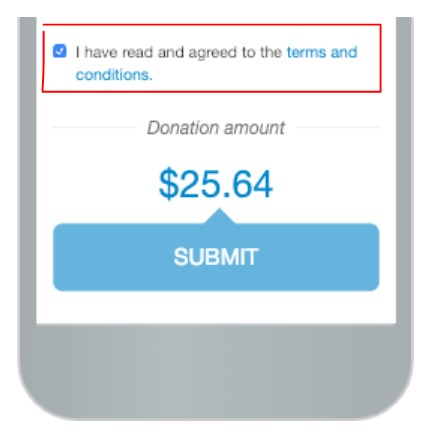

Further, it’s best practice to have a separate checkbox that the customer needs to check to indicate their agreement with the business’ terms and conditions before finalizing their purchase.

Source: Stack Overflow

A detailed order summary makes it less likely that customers will file a chargeback out of ignorance, and protects the business if an illegitimate chargeback is filed.

Chargebacks occur when a customer reaches out to their credit card provider to dispute a charge to their card.

Too many of them is bad for business, and they cost retailers 0.47% of their total revenue annually.

This is because the bank will charge the business and return the money to the customer. It’s on you to prove the charge was valid if you want to recoup the funds.

In sum, creating a detailed order summary that the customer reviews before initiating the recurring payment is important for both the customer experience and your revenue numbers.

Having a Recognizable Billing Descriptor

Your billing descriptor is the name that appears on the customer’s bank or credit card statement after they make a purchase at your business.

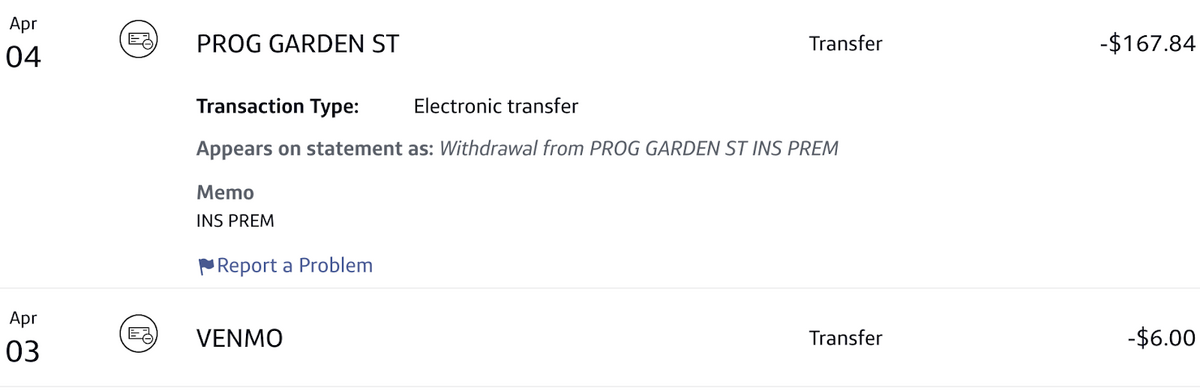

For example, here’s Progressive Garden St Insurance CO’s descriptor in a bank statement:

Source: Capital One

Customers sometimes review their statements to check for any unrecognizable payments that might indicate payment fraud or stolen card information.

When they do this, you don’t want them to fail to remember who you are, then dispute the charge with their bank via a chargeback.

Therefore, it’s important that you use a clear and obvious billing descriptor that your customers will immediately recognize as your business.

Use the name that your customers use when referring to your business.

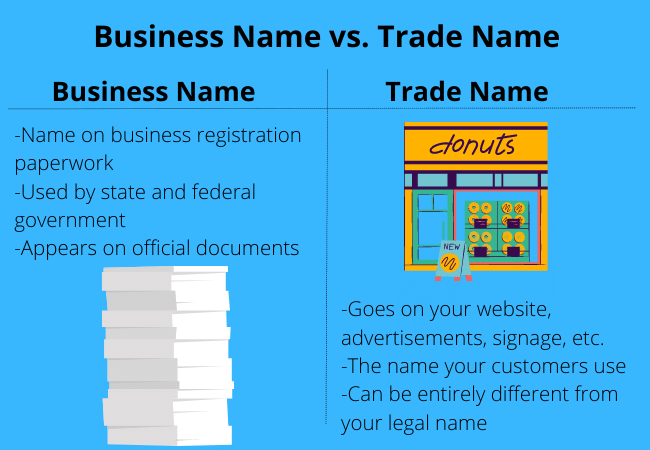

If your business currently uses its registered name (the legal name) as the billing descriptor (this is typically the default), but your customers know you by your trade name (the name on the sign above your door or website), change the descriptor accordingly.

Source: Skip

The exact steps to change your billing descriptor depend on the recurring billing tool you’re using.

A quick Google search of “how to change my billing descriptor in {Software Name}” should pull up a tutorial. You can also message the software’s support team for guidance.

To make your identity on the statement extra clear to customers, it’s advisable to also include your contact information (phone number, email address, or website) in the second part of the billing descriptor.

That way, the customer can contact support if they are confused about the charge.

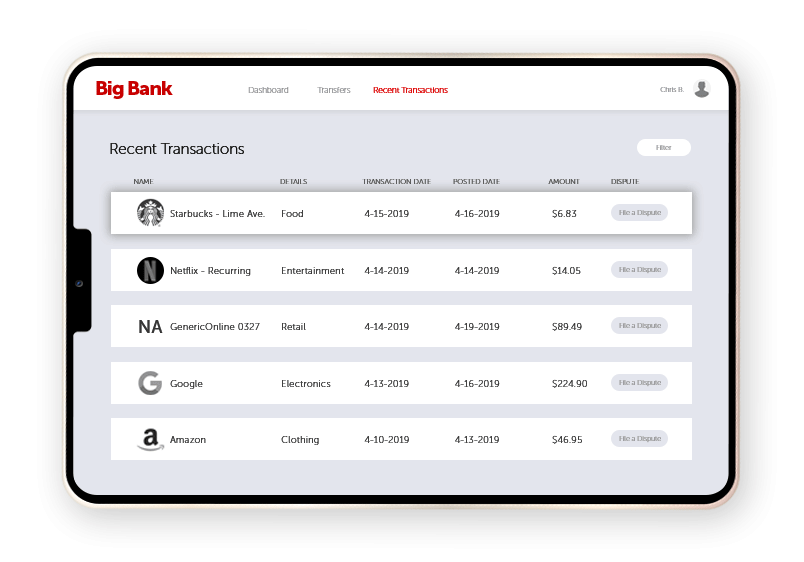

Also, if you have multiple physical locations, consider putting the address of your store on the descriptor next to the business name, as Starbucks does below:

Source: Chargebacks911

Taking precautions to ensure customers immediately recognize you on their statement will help you reduce chargebacks and their associated costs, while also improving the customer experience by removing stressful financial confusion.

The Don’ts

Among the many recurring billing mistakes businesses make, there are three that pose the greatest threat to your business.

Let’s take a look at them and explore what to do instead.

Not Notifying Customers Prior to Each Recurring Payment

To avoid customers forgetting about the subscription altogether and filing a chargeback after noticing the unexpected charge to their account, notify your customers via email before billing them for the next period.

This gives them the opportunity to cancel the subscription should they no longer want to pay for the service. It also provides the courtesy of a heads-up about an upcoming charge.

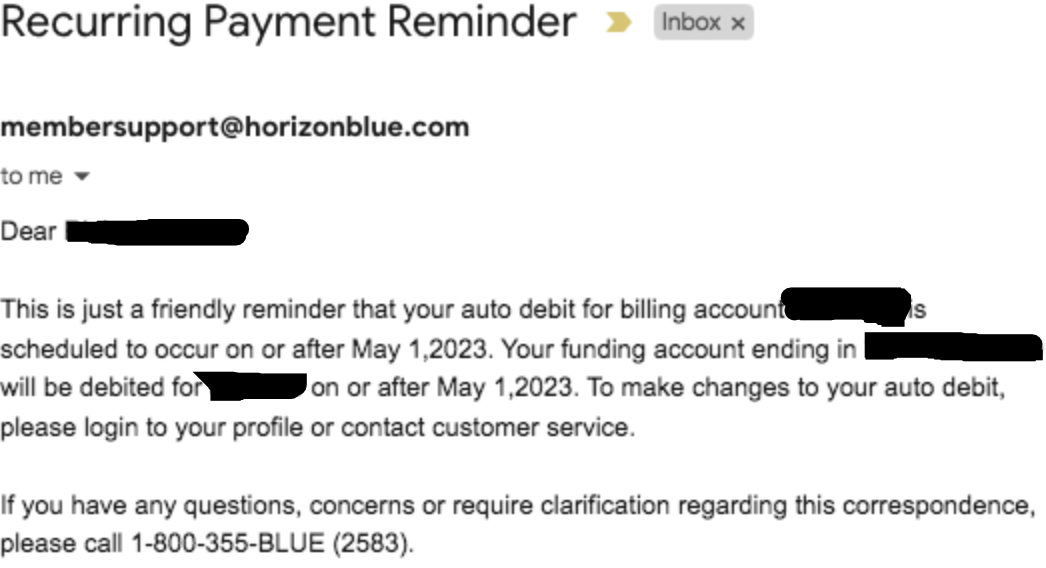

Below is an example of an effective recurring payment reminder email:

Source: Horizon

Note how it tells the recipient how much they’ll be billed, what they’re being billed for, which payment method will be charged, and when the charge will take place.

The email also gives them a phone number to call for clarification on the upcoming payment in case they have any questions or concerns.

As for when to send your recurring payment reminders, a rule of thumb is to send one about a week prior to each payment.

An early reminder becomes especially important if you’re charging the customer a higher amount than the last billing period or the originally agreed-upon amount.

Without early notice, they might lack sufficient funds in their account and could feel caught off guard when the charge occurs.

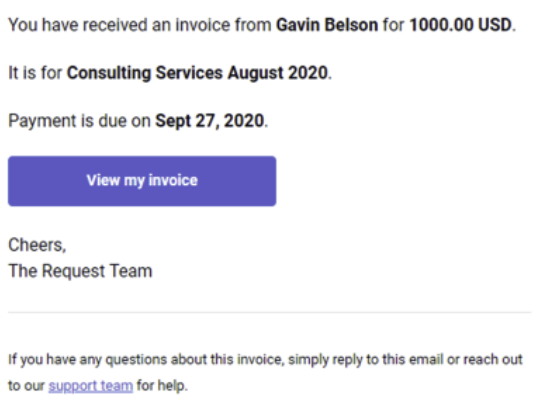

As an extra measure, consider also sending automatic payment confirmation emails after the customer has been charged.

Source: Request

This tactic further reduces the chances of them initiating chargebacks because they’ll be aware of your charge to their account before they review their billing statement.

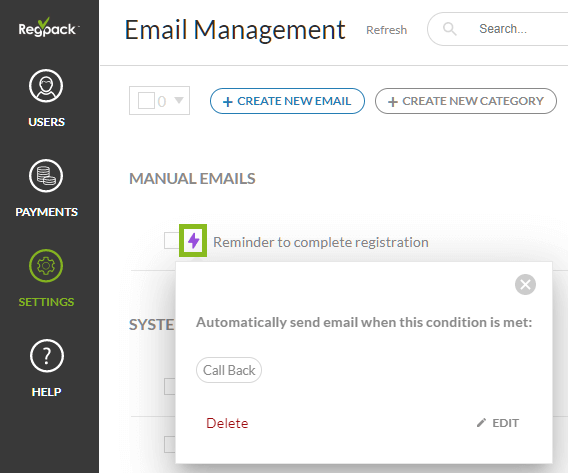

It’s easy to automate these notifications using a tool like Regpack, which can be configured to automatically send payment confirmation emails to customers after they’ve been charged.

The tool uses trigger-based email automation, which allows you to pick the condition that must be met for the email to send, as well as what information the email will include:

Source: Regpack

When you notify customers about their recurring payment before and after the charge, you come across as a courteous and transparent business, and you reduce the likelihood of complaints and chargebacks.

Thinking That Customers Will Not Need to Contact You

Even though customers are automatically billed and the payment process is almost entirely hands-off, you still need to anticipate that some of your customers will have questions, complaints, and concerns about billing.

And you need to provide them with an easy way to address those concerns with customer support.

If, on the other hand, customers struggle to reach customer support with questions about billing, they’re more likely to file a chargeback or cancel their subscription out of frustration.

In fact, according to Zendesk, 50% of consumers will switch to a competitor after just one negative experience with customer service.

To help customers get their questions answered quickly, start by prominently displaying the customer support’s contact information on your website.

State which methods customers can use to reach customer support clearly, whether that’s through phone, live chat, email, or some combination.

Tell them when customer support is available, and how soon they should hear a response for each contact method.

For example, if the average response time for a question to support’s email is under two hours, write that next to the support email address.

If you offer an app and really want to wow your customers with your service, consider adding in-app support for the customers’ convenience.

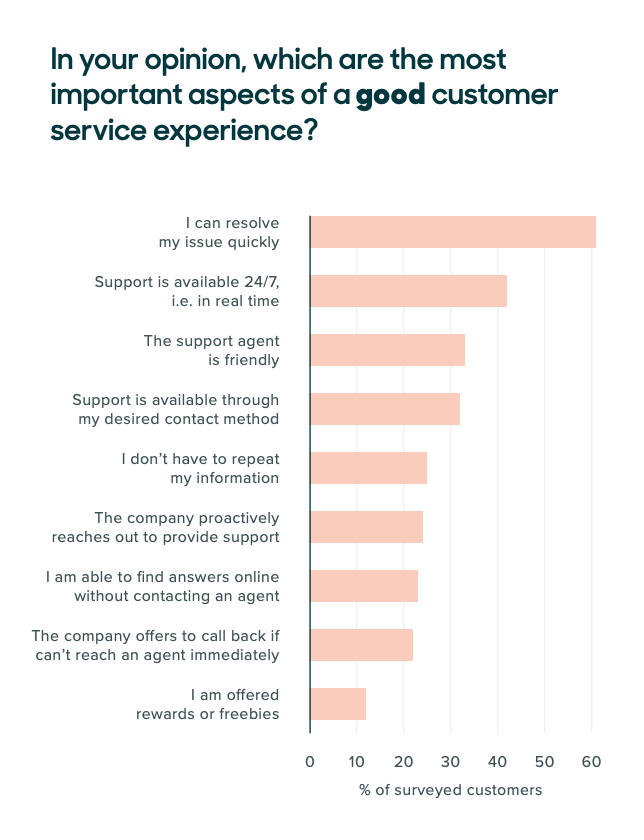

Here are some other things customers want from their customer service experience:

Source: Zendesk

Recurring billing is partly about making your customers’ payment experience easier and less frustrating, so don’t let poor customer service practices offset its many benefits.

Making It Difficult for Customers to Cancel the Subscription

Making it difficult for customers to cancel the subscription won’t discourage them from canceling. Instead, it will only increase their motivation to do so.

They might feel so passionately about canceling that they’ll encourage friends and peers and random people on the internet to do so as well.

To add insult to injury, before canceling, they’ll also probably conclude that requesting a chargeback is an easier method for getting their money back.

And a high number of chargebacks can mean penalties for your business from credit card networks—penalties such as high fees or account termination.

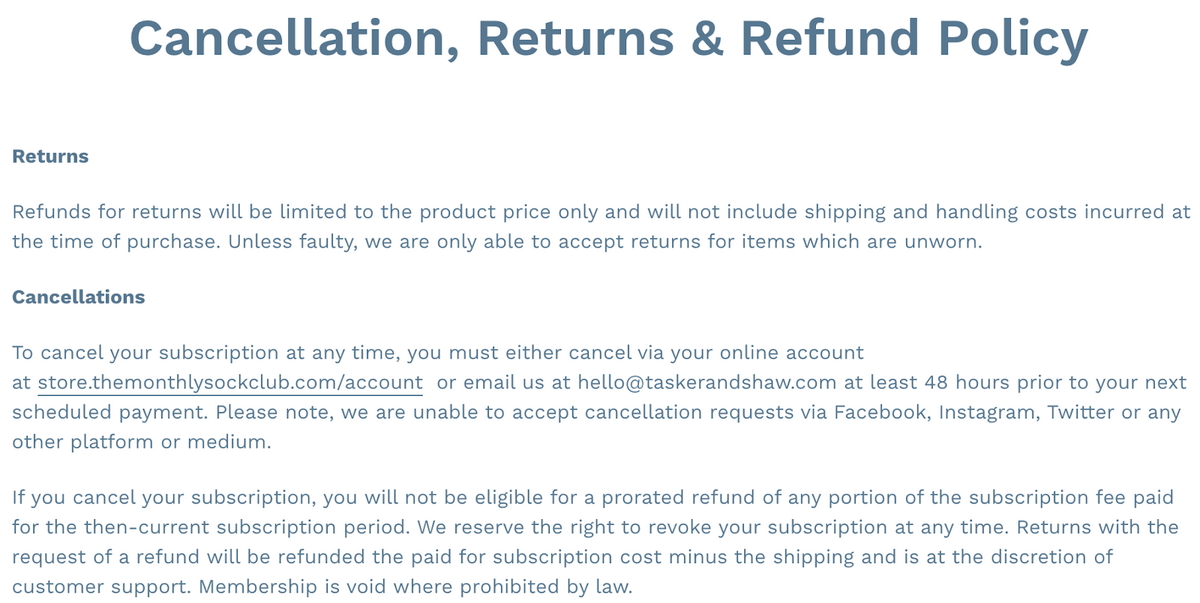

Therefore, it’s critical that you make it simple for your customers to cancel their subscription with your business.

Your cancellation policy should be clear, easy to understand, and included in the terms and conditions of the subscription.

Here’s a solid one from The Monthly Sock Club:

Source: The Monthly Sock Club

The policy should also be prominently displayed on your website. A best practice is to give it its own page, or, if it’s short and simple, to have it share a page with your refund policy.

You should also put the policy on your customer’s account page.

Highlight the cancellation policy with bold or title lettering.

Customers shouldn’t have to search far and wide for the steps they need to cancel, their temper heating up with every webpage they explore.

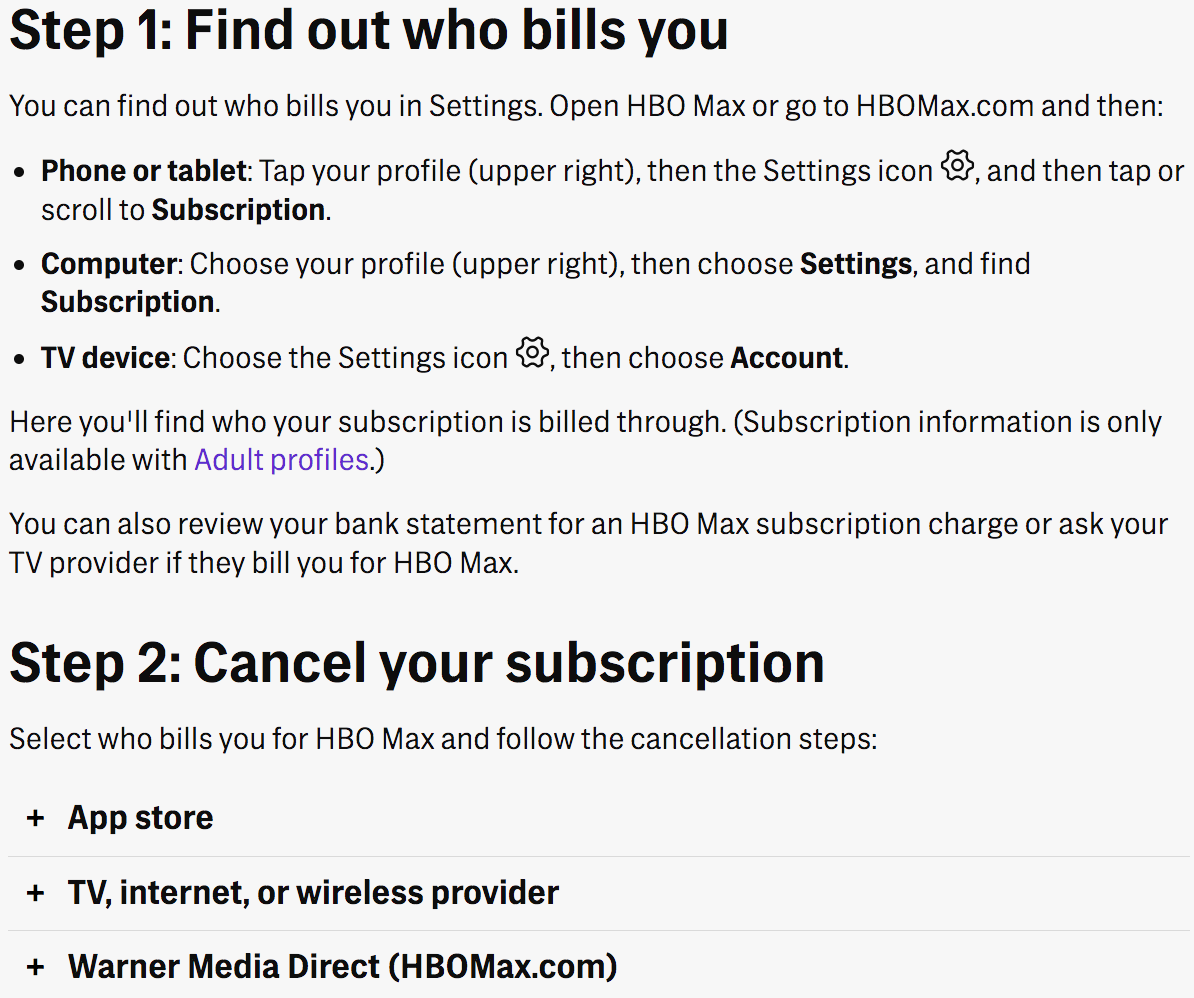

If you have a help center or knowledge base online, include an article explaining how to cancel the subscription, as HBO Max does below:

Source: HBO Max

Also, consider providing your customers with the option to speak to someone from customer support when canceling their subscription.

Near your cancellation instructions, provide a phone number and ask them to reach out to you. Let them know that you want to hear what’s bothering them to see if you can fix it.

Some customers might take you up on the offer, and you might be able to save some of them from canceling.

Many will call and cancel anyway, but at least you will have acquired some intel about why they’re leaving your brand.

If a few reasons for cancellation are common enough, you can then take action to address them, thereby preventing future cancellations.

Conclusion

As a recap, you should always do your research before selecting a recurring payment tool, give customers detailed order summaries before they purchase, and use a recognizable descriptor.

And you should never forget to remind customers about upcoming payments, neglect customer support, or make it hard for customers to cancel their subscriptions.

If you follow these guidelines, you should have a successful experience when you switch to a recurring payment model.