Are you considering purchasing recurring billing software for your business?

If so, you likely have a lot of questions about how the system works and whether it’s even the right choice for you.

In this article, we’ll answer some of the common questions about recurring billing technology, and by the end of it, you’ll be able to make an informed decision and choose the solution that’s right for you.

So, let’s dive in and get started!

What Is Recurring Billing Software?

First, it’s essential to clarify what recurring billing is.

As the name itself implies, it entails charging customers on a recurring basis for a product or service.

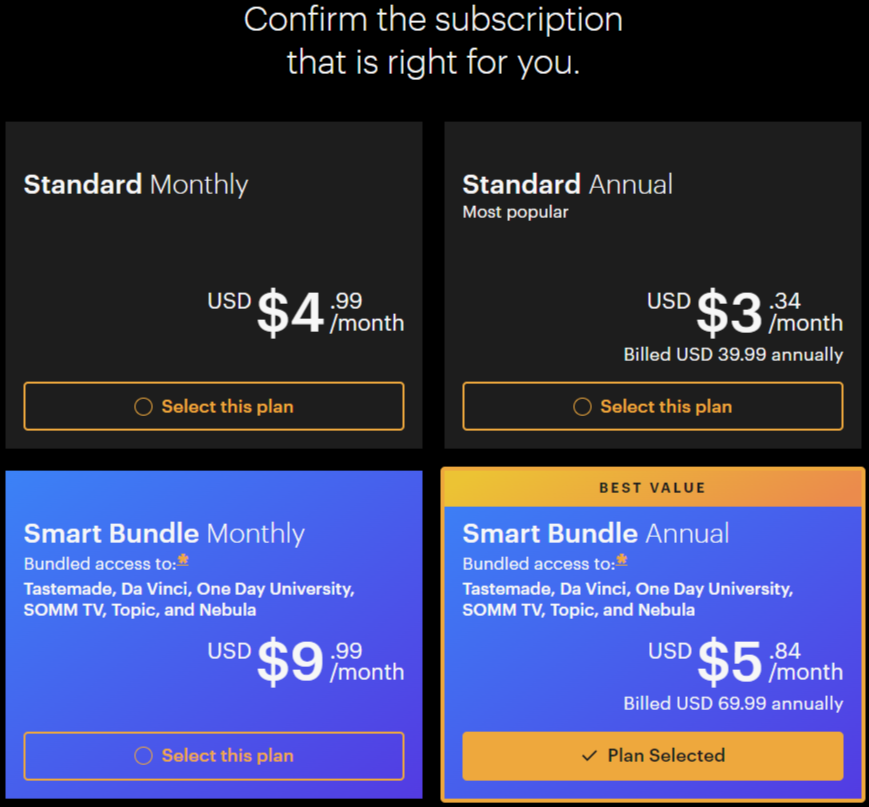

The frequency of these charges can vary, with options including monthly, quarterly, semi-annual, or annual plans. Customers or clients continue to be charged until they decide to cancel their subscription or membership.

As an example, take a look at the pricing plans offered by Curiosity Stream, a popular documentary streaming platform.

Chances are, though, that a screen similar to this one is already familiar to you.

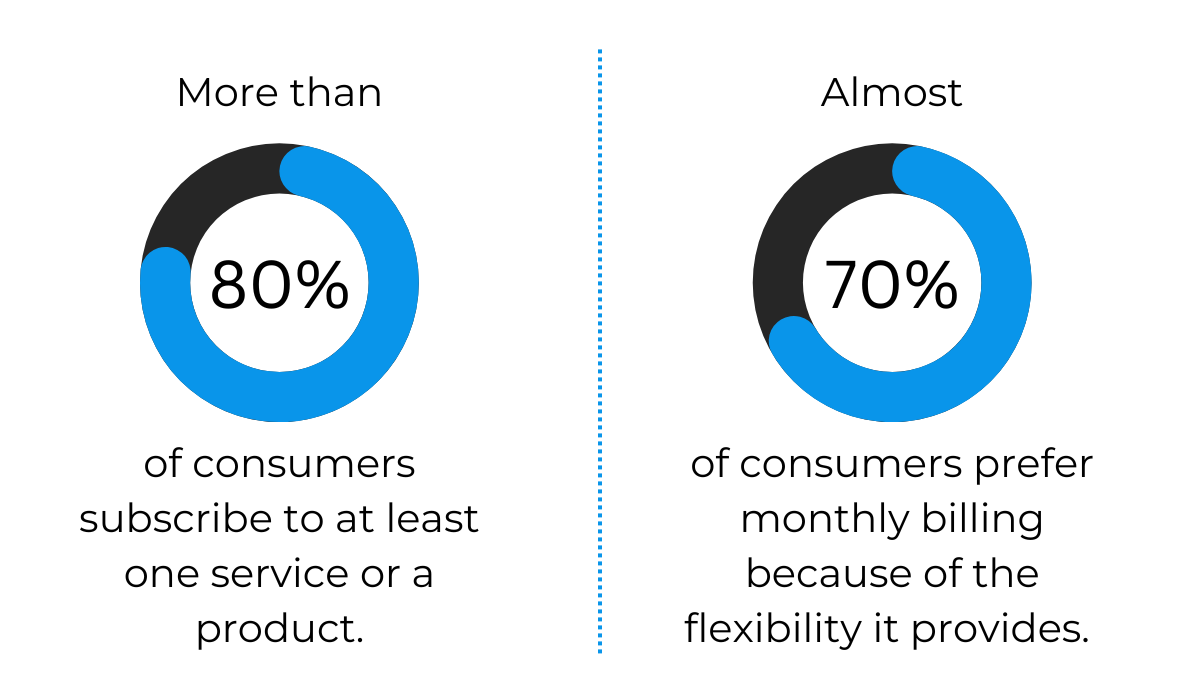

According to a recent survey by Forrester, the popularity of subscription-based services is booming. From streaming platforms to meal kits—consumers subscribe to a diverse range of products.

The survey also reveals why these services are in such high demand.

A subscription, especially a monthly one, can be canceled at any time, meaning they provide clients with flexibility. They don’t have to commit to anything permanently, and the transaction occurs on their own terms.

Recurring billing, therefore, involves charging customers according to a set schedule, automatically. This is where recurring billing software comes into play.

If you offer subscription-based services or products, this is certainly a tool for you.

The software makes the invoicing process smooth and hassle-free, taking it to a whole new level of efficiency, and eliminating the need for manual invoicing.

Along with automatically charging clients, these tools commonly offer an array of features that can further enhance your payment management. For instance, some systems will also collect and store payment details, create and manage payment plans and schedules, generate various financial reports, and much more.

Essentially, with a recurring payment solution, what you get is a more predictable cash flow and less administrative work. Talk about a win-win situation.

We’ll get into the benefits of this technology in more detail later, though.

Before that, let’s explore what makes this system different from other invoicing solutions.

What Makes Recurring Billing Software Different?

This question can, in fact, be answered with one word only: flexibility.

Don’t worry, though, we’re going to elaborate.

As we already concluded, recurring billing systems manage and track subscription-based payments. Other payment management tools are not equipped to handle such transactions.

However, this is not all they can do.

Recurring payment processing solutions offer the flexibility to accommodate various pricing models, such as tiered or usage-based pricing, which enhances customer retention by tailoring services to their needs.

Take a look, for example, at Unbounce’s pricing tiers.

By offering multiple options, they’re able to attract companies of different sizes and budgetary requirements. Having only one tier, on the other hand, would automatically limit their potential customer base.

Another thing your clientele will appreciate is the recurring billing software’s ability to set up discounts and coupons.

Want to set up a discount code as a part of a marketing campaign?

No problem. The system does it for you in just a couple of clicks.

To recap, recurring billing software is set apart from other invoicing solutions by the sheer amount of features it provides.

It allows you to offer customers a payment plan that suits their needs perfectly. As a result, they are more likely to opt for or keep using your product, feeling like it was designed precisely for them.

Which Businesses Require Recurring Billing Software?

From Netflix and Hulu, through Dropbox and Slack, to The New York Times—more and more enterprises are opting for recurring revenue business models, to the point it’s hard to find a company that doesn’t offer some kind of subscription-based service.

In other words, the tools for recurring payments find their use across multiple industries, such as:

- SaaS

- eCommerce

- Entertainment

- Health/fitness

- Education/eLearning

- Publications

Essentially, If there’s a recurring need for something, there’s room for recurring billing and, therefore, for the technology that makes recurring billing possible, too.

For instance, the successful Dollar Shave Club relies on the fact that razors and grooming products are always (and probably always will be) in demand. What they offer are subscriptions to various shaving kits, which they then deliver to their customers.

Simple and effective.

And the forecast for subscription e-commerce is great, as well.

The Business Research Company predicts its market size will reach a whopping $1,482.11 billion in 2027.

Numerous companies that don’t necessarily fit into this system have also found ways to utilize it.

For example, a marketing consultancy may initiate a subscription-based newsletter that offers advice from experts to its subscribers, guaranteeing an additional continuous revenue stream.

In general, subscriptions are surely here to stay.

However, to ensure smooth and hassle-free processing of recurring payments, an effective tool is necessary. This is why businesses offering monthly or annual services, products, or memberships choose automated solutions instead of manual invoicing.

What Are the Benefits of Using Recurring Billing Software?

Although we’ve hinted at some of the benefits of the recurring billing systems throughout the text, now it’s time to really get into the nitty-gritty of why this is a solution of choice for so many businesses out there.

Of course, at the top of the advantages list, we must put the automation of recurring payment processing. In essence, the software makes for easier, faster, and error-free payment management.

When invoicing is done manually, even the most skilled members of the billing team are bound to make a mistake from time to time.

In contrast, automated payment processing minimizes such mistakes, allowing you to concentrate on more critical tasks.

What’s more, the system provides a consistent and reliable cash flow. You will have the knowledge of how much money to expect every month, allowing you to manage any market instability and allocate resources more effectively.

Finally, using recurring billing technology proves advantageous for customers, too. And let’s face it. What’s good for them is good for you.

The tool enables you to offer clients different payment plans, payment methods, and billing frequency options that they can alter or cancel at any time they like.

By providing these options, you can ensure that the customers have better control over their payments and are more likely to continue doing business with you.

How Does Recurring Billing Software Work?

If you’ve ever signed up for a subscription, you already know what the process looks like from the customer’s perspective.

It’s simple enough.

All you have to do is provide payment information, select a plan that you like, click the Purchase button, and that’s all there is to it.

After that, you’re automatically charged each month or year, depending on the chosen plan. Besides, you’re free to change it (either downgrade or upgrade it), pause it, or cancel it.

All of this requires little to no effort from a service provider, too. It’s the software that does all the heavy lifting.

Once a client clicks that Purchase button on your website, their credit card details are sent to a billing platform, which stores the data and sends an online payment request to a gateway.

From there, the request continues its journey from the gateway to the payment processor and then to payment service providers or card associations, such as MasterCard, Visa, or American Express.

This is where the request is handed off to the customer’s issuing bank, which then either approves or denies the transaction.

Finally, if everything is in order with the card details and there are sufficient funds, the client is billed.

Believe it or not, the software does all of this in just a couple of seconds, being able to handle multiple transactions simultaneously. Manual invoicing is simply no match.

Is It Possible to Integrate Recurring Billing Software?

Imagine buying an amazing, new, and expensive recurring billing software, only to find out it isn’t compatible with your current accounting or project management software.

What a waste of money!

A billing solution should be able to integrate with the existing software solutions, meaning that when it records specific data, the other systems should be automatically updated without the need for manual data input.

After all, as we already concluded, manual data entry is something to avoid.

Therefore, look for software that integrates with your customer relationship management (CRM), project management (PM), marketing automation, and, probably most importantly, accounting software.

If a payment processing solution doesn’t natively integrate with the existing technology, you can use an open API (application programming interface) to facilitate communication between different software systems.

With API, your IT team can easily integrate the recurring billing software with other solutions based on the request one system makes to another.

All in all, it’s both possible and necessary for recurring billing software to be compatible with your current technology. So, when selecting a system, don’t neglect data-sharing requirements and search for a solution that has various integration options.

It’ll make all the difference for your business and its efficiency.

How to Choose the Right Recurring Billing Software?

Different integration options, however, are just one feature of an ideal recurring billing software.

With so many solutions available on the market, it can be overwhelming to choose the right one for your business. So how do you do it?

Of course, you want to consider your own specific needs, but there are some key features to keep an eye out for, including:

- Merchant account setup option

- Multiple payment methods

- Multi-currency support

- Ability to pause and resume payments

- Discount application

- Automated invoice management

- Reporting feature

These features will ensure you can easily process payments, track transactions, and manage the company efficiently while providing a seamless experience to the clients.

At Regpack, we pride ourselves on creating robust automated billing software that has all the necessary features and takes care of your payment processing needs without sacrificing its user-friendliness.

With Regpack’s system, every sale is completed safely, easily, and quickly with either credit cards, debit cards, or mobile payments.

Moreover, the software allows consumers to select a pricing model that suits them. This includes recurring, as well as subscription, retainer, or prorated billing. It’s up to you to choose which options you want to provide.

Stay up-to-date with everything happening in your company by utilizing our analytics and reporting features. These tools generate reports on revenue recognition, subscriptions, revenue leakage, and more, allowing you to keep track of it all.

Whether you prefer daily, weekly, or monthly updates, we’ve got you covered.

To find out more about Regpack’s many useful features, click here.

To sum everything up, software efficiency hinges on the features it provides. So make sure the solution you choose meets all your specific business requirements.

How Much Does Recurring Billing Software Cost?

Now, let’s address the question that’s on everyone’s mind by now: How much does this system cost?

The short answer is it depends.

It depends on a wide variety of factors.

For instance, some software vendors charge a flat monthly fee along with a certain percentage of the total transaction volume, while some will also charge extra for each user.

As is the case with a lot of SaaS companies, there will be multiple pricing tiers to choose from, determined by the number of users, projects, reports, or forms you want or need.

The fact is, there are a lot of software options out there for all the budgetary requirements.

However, be careful not to get swayed by a lower price if it means sacrificing essential features or buying software that’s going to be too complicated for your team to use. That way, you’re not getting your money’s worth.

Before making a purchase, it’s a good idea to search for software that provides a free trial and test it out for yourself.

This will give you the opportunity to determine whether it’s suitable for your needs or if you should continue the search.

After all, nothing beats first-hand experience.

Conclusion

Hopefully, this article has provided helpful answers to your questions regarding automated payment processing solutions.

To recap, these systems are highly beneficial for businesses that need to charge customers automatically on a regular basis. Remember, manual invoicing simply isn’t efficient enough and is highly prone to human error.

Recurring billing software has a wide range of features that can enhance the financial operations of any business, including multiple currency support, the ability to accept various payment methods, and discount application.

To make the most of these benefits, though, it’s important to choose software that meets your specific needs rather than opting for the cheapest option.

Investing in the right solution can save you money in the long run.