Managing customer registrations and payments online is crucial for service-based companies, particularly those offering after-school activities, educational programs, and trips.

To charge these services periodically, you will need a reliable payment gateway for recurring billing that will be secure for your customers to enter their payment details.

Getting lost in various payment gateway options is easy, so we have compiled a comprehensive list of the top 10 payment gateways for recurring billing.

We will delve into each gateway’s key features, pros and cons, and pricing with the hope of helping you make an informed decision when choosing the one for you.

So, let’s get started!

Adyen

We will start with Adyen, a payment platform from the Netherlands.

With Adyen, businesses can accept various payment methods across multiple channels, including credit and debit cards as well as local payment methods.

Source: Adyen

Moreover, Adyen offers robust infrastructure and advanced technology, including machine learning tools for fraud detection and revenue optimization, and accepts recurring payments.

With the latter, Adyen has gained popularity among global businesses, with clients such as Spotify, Upwork, and Etsy, who rely on recurring billing for their customers.

However, it is important to note that Adyen requires a minimum monthly invoice, making it less convenient for low-volume transactions.

Here’s a brief overview of its key features.

Key features

- Local payment methods for global customers

- Recurring billing

- Fraud prevention with a risk-management tool RevenueProtect

- Revenue optimization with RevenueAccelerate

- Extensive payment method support

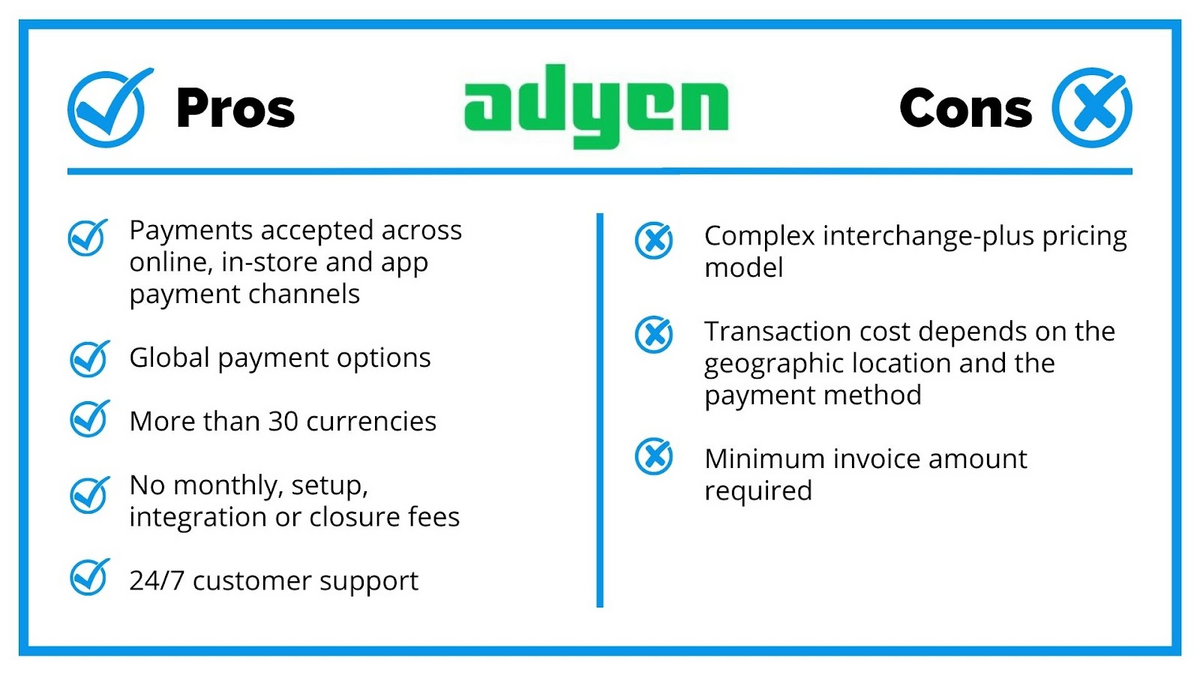

The table below shows some of Adyen’s advantages and disadvantages:

Illustration: Regpack / Data: Adyen

In terms of pricing, Adyen does not charge monthly, setup, integration, or closure fees.

Instead, they have a fixed processing fee (€0.11) per transaction, along with fees determined by the specific payment method.

Overall, Adyen is a favored choice for businesses worldwide due to its comprehensive service, but its suitability may depend on meeting the minimum monthly invoice requirement.

Amazon Pay

The next on the list is Amazon Pay, a payment service offered by Amazon that allows customers to use their existing Amazon accounts to make purchases and pay for goods and services on third-party websites.

This gateway offers a secure and convenient payment experience because customers can use their payment methods and shipping addresses stored in their Amazon accounts without re-entering the information on other websites.

But it does require customers to have Amazon accounts.

Source: Amazon Pay

Amazon Pay supports recurring billing for subscription-based services and products, making it suitable for businesses with recurring payment models.

However, one limitation of Amazon Pay is that it doesn’t support other payment methods except for credit and debit cards. Additionally, it doesn’t offer discounts for high-volume merchants.

Here is what you can expect from Amazon Pay.

Key features

- Fast and convenient payment for customers with Amazon accounts

- Recurring payments

- Trust and security associated with the Amazon brand

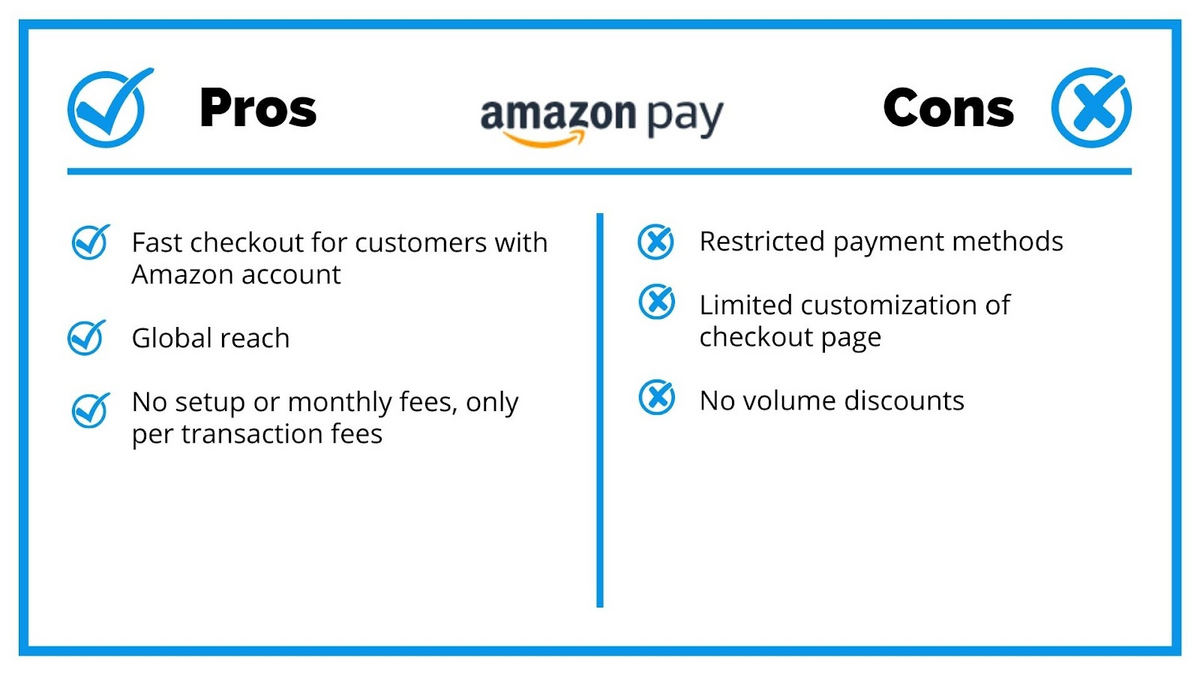

The summary of Amazon’s pros and cons is shown below:

Illustration: Regpack / Data: Amazon Pay

When it comes to prices, they are transaction-based.

For web and mobile transactions, the fee is 2.9% plus 30 cents. Alexa transactions cost a 4% fee plus 30 cents, while cross-border transactions require an additional 1% fee.

Overall, customers appreciate the sense of security provided by Amazon Pay.

Still, it may not be the most suitable option for businesses that require support for a wide range of payment methods or high-volume discounts.

Authorize.net

Authorize.net, a payment solution owned by Visa, offers both an all-in-one solution with a merchant account and a payment gateway or a standalone payment gateway option.

However, it’s important to note that the merchant account is facilitated through a third party.

Source: Authorize.net

Authorize.net supports various payment methods, including major credit cards, PayPal, Apple Pay, and E-checks.

It also offers a recurring billing feature, allowing businesses to easily manage subscription-based payments.

Another helpful feature is the customer information manager, which lets customers save their billing, payment, and shipping information for future orders.

Key features

- Accepts various payment methods

- Fraud protection

- Recurring payments

- Customer information manager

- Digital invoicing

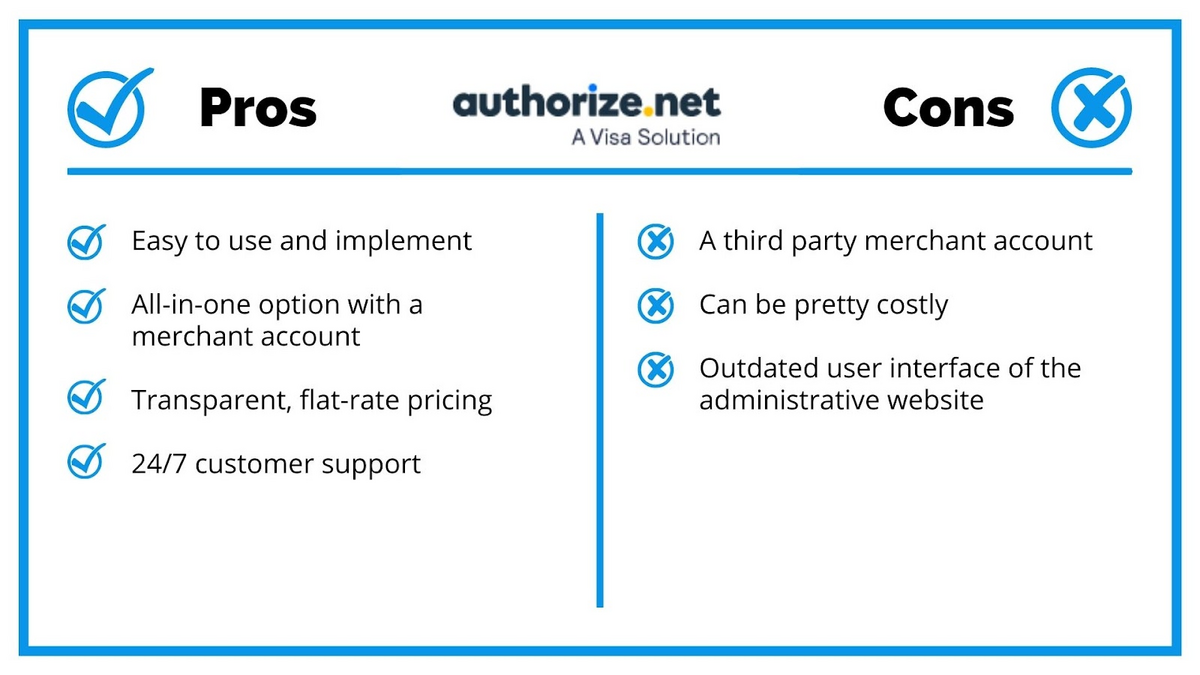

The table below summarizes the main pros and cons of Authorize.net:

Illustration: Regpack / Data: Authorize.net

The pricing for Authorize.net depends on whether you opt for the all-in-one solution or just the payment gateway.

For the all-in-one option, the pricing is 2.9% plus 30 cents per transaction, along with a monthly fee of $25.

If you choose only the payment gateway, the pricing is 10 cents per transaction, a daily batch fee of 10 cents, and a monthly fee of $25.

Electronic checks are billed separately at a rate of 0.75% per transaction.

In summary, Authorize.net provides a range of features for businesses requiring recurring payments.

Nevertheless, it’s important to consider the pricing structure and the potentially outdated backend interface when evaluating its suitability for your specific needs.

Bambora

Bambora, recently acquired by Worldline, is another global payment solution provider that empowers businesses to securely accept and process various payment methods.

Their services include online payments, in-store payments, mobile payments, and recurring billing.

Source: Worldline

Bambora’s payment gateway supports major credit and debit cards, digital wallets, and ACH payments.

Much of their service is oriented toward the sports industry, where recurring billing plays a significant role in managing club memberships and periodic payments.

Additionally, Bambora serves non-profit organizations that require the capability to accept recurring donations.

Here’s an overview of its main features.

Key features

- Accepts various payment methods

- Offers currency conversion to customers

- Tokenization for payment data protection

- Option to create payment profiles for customers

- Automated recurring billing

- Robust tracking and reporting tools

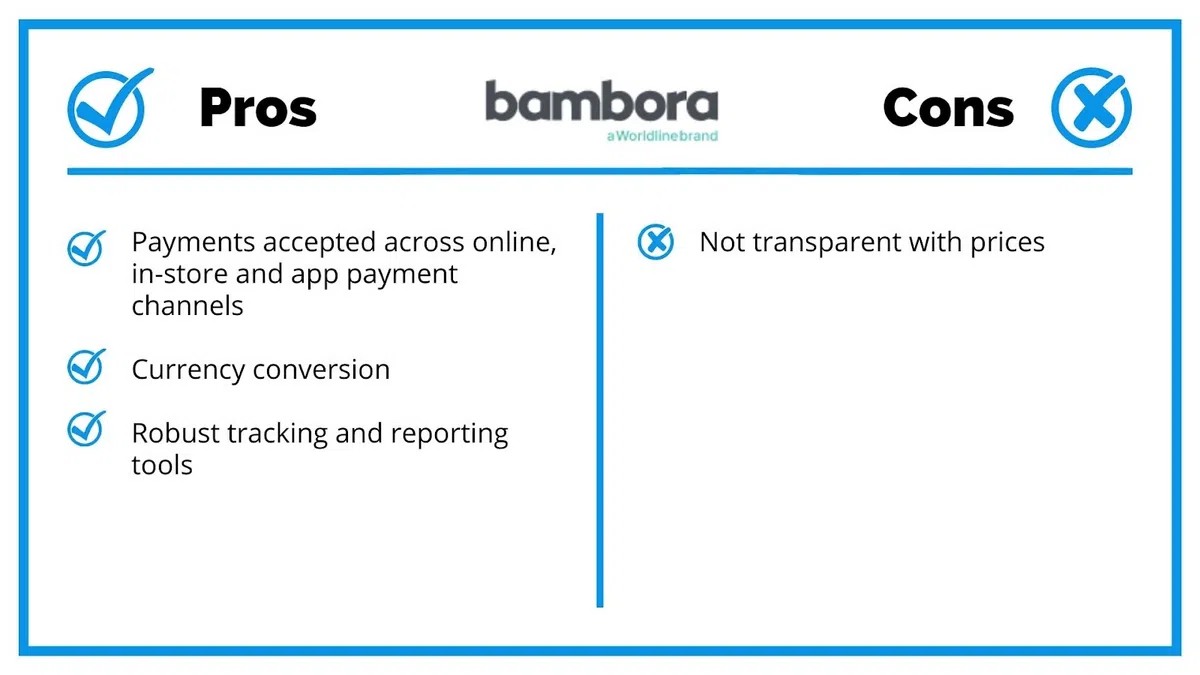

You can see Bambora’s main advantages and disadvantages in the table below:

Illustration: Regpack / Data: Worldline

While Bambora offers some valuable features, one notable drawback is the lack of transparent pricing information.

They offer three pricing plans: standard, tailored, and omni-solution. However, detailed pricing is not readily available on their website.

So, to obtain an estimate, you must reach out to Bambora directly for a customized offer.

BlueSnap

Next in line is BlueSnap, an all-in-one payment service that simplifies payments by supporting over 100 payment methods in more than 100 currencies.

With BlueSnap, businesses can accept payments from digital wallets like Apple Pay and PayPal, credit cards, ACH, wire transfers, and more.

Source: BlueSnap

One of the standout features of BlueSnap is its robust recurring billing capabilities.

It offers easy customization for tiered plans and automatically updates customer payment information to ensure uninterrupted sales even when a card expires or changes.

For example, our automated billing software, Regpack, utilizes BlueSnap as a payment gateway for recurring billing, harnessing these powerful features and global payment capabilities.

This integration allows us to provide businesses with a comprehensive solution for managing and processing their recurring payments.

Key features

- Supports over 100 payment methods and over 100 currencies

- 3D Secure payment protection

- Flexible recurring payment plans

- Subscription management

- Automated retries when subscription charges fail

- Automatically updates customer payment information

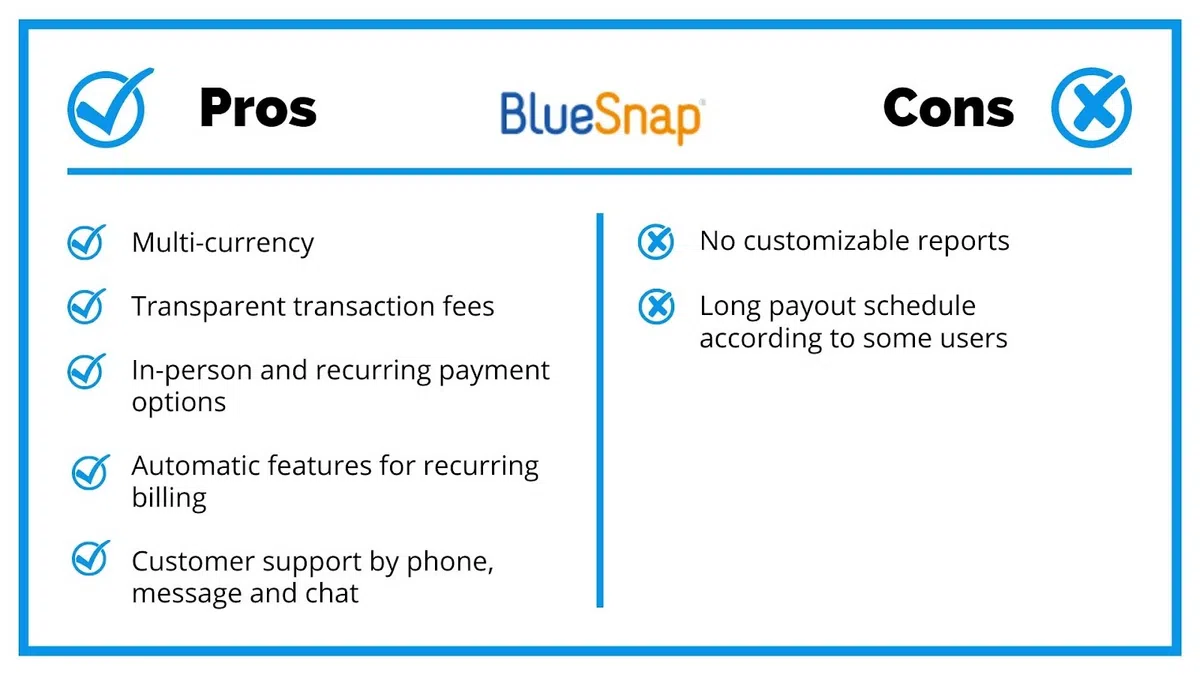

Check out the main pros and cons of BlueSnap in the table below:

Illustration: Regpack / Data: GetApp

In terms of pricing, BlueSnap employs a percentage-based fee for each transaction.

The standard plan starts at 2.90% (+$0.30). Custom pricing options are also available for businesses with high sales volumes and non-profit organizations.

In summary, due to its array of automated features, BlueSnap is an excellent choice for businesses that offer subscriptions and memberships and require recurring payments.

Braintree

Braintree is a payment processor and gateway that offers various payment acceptance options, including credit and debit cards, digital wallets, prepaid cards, and alternative payment methods like ACH, Venmo, and PayPal.

Braintree was acquired by PayPal in 2013.

Source: Braintree

This gateway allows businesses to set up recurring billing, allowing for custom pricing plans, discounts, and add-ons.

Moreover, Braintree offers prorated subscriptions that allow customers to upgrade or downgrade their subscriptions anytime.

Key features

- Accepts a wide range of payment methods

- Fraud detection tools

- Creates flexible pricing plans for subscriptions

- Secure payment vault for storing customer information

- Automatically updates users’ credit card details

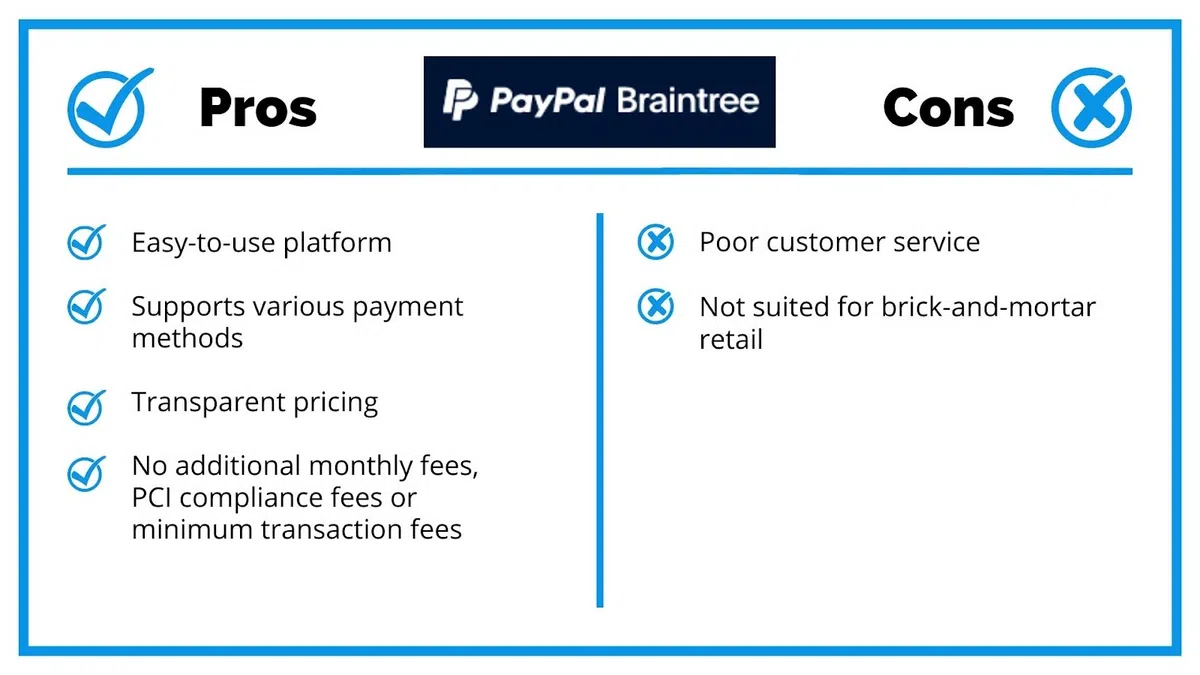

Let’s check Braintree’s main advantages and disadvantages:

Illustration: Regpack / Data: Nerdwallet

In terms of pricing, Braintree charges a flat rate per transaction, depending on the payment type.

For credit cards, debit cards, and digital wallets, the fee is 2.59% plus 49 cents per transaction.

There are additional costs for the Braintree gateway ($49 per month plus 10 cents per transaction), third-party merchant accounts ($10 per month), and potential fees from the merchant account provider.

Chargebacks incur a flat $15 fee.

While Braintree offers some excellent recurring billing features, it’s worth noting that users have reported subpar customer service experiences.

So, you should consider this aspect when evaluating Braintree as your payment gateway.

GoCardless

GoCardless is a versatile payment gateway that enables businesses to collect payments in over 30 countries, including the UK, Eurozone countries, the US, Canada, New Zealand, and Australia, supporting transactions in eight currencies.

Much of its focus is on automated recurring payments, making it an ideal choice for subscription-based services and membership payments.

Source: GoCardless

With flexible recurring payment plans, businesses can easily manage subscriptions, invoicing, and installments.

GoCardless offers additional features like Success+ for minimizing payment failures through payment intelligence and Protect+ for advanced fraud protection in recurring payments.

Key features

- Automated recurring payments

- International payments

- Success+ feature to reduce payment failures

- Protect+ feature to protect from fraud

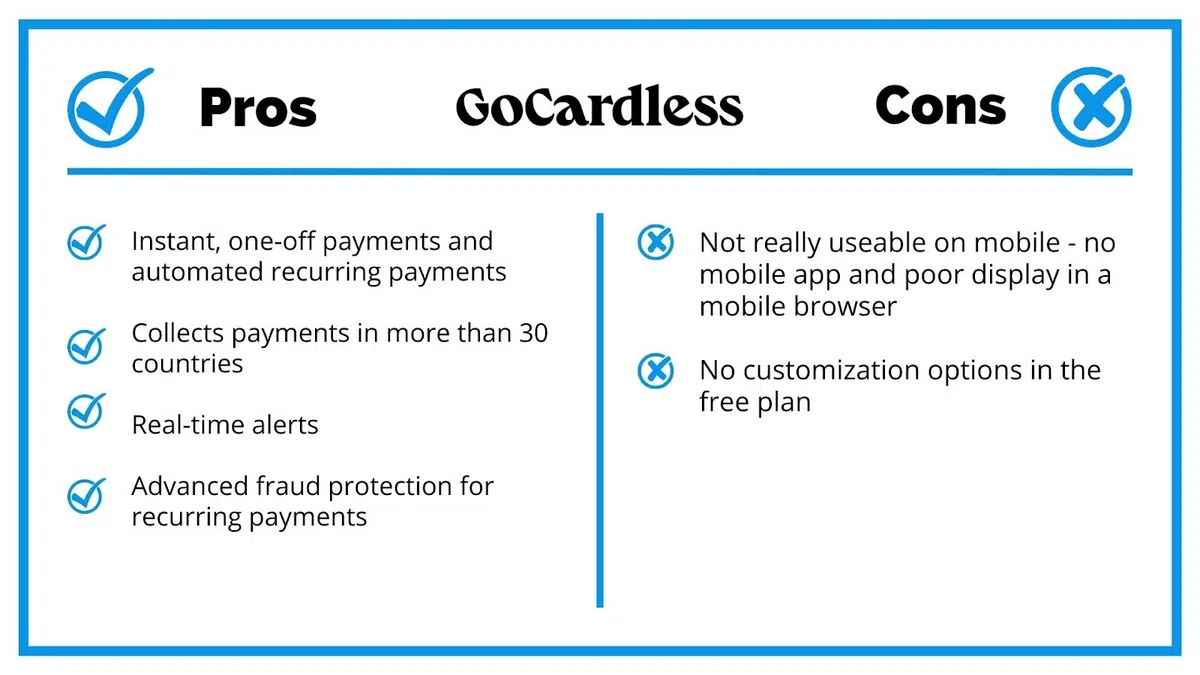

In the table below, you will find the main pros and cons of this payment gateway:

Illustration: Regpack / Data: GoCardless

The pricing options include a standard plan with no monthly fee (2% + £0.20 per international payment), a Plus plan with a £50 monthly fee, a Pro plan with a £200 monthly fee, and custom volume-based pricing.

GoCardless remains a reliable solution for businesses seeking seamless automated payment collection.

But when choosing one for yourself, keep in mind that the standard plan may lack some advanced features that are helpful for recurring payments.

NMI

NMI, short for Network Merchants Inc., is another payment gateway and technology provider on our list that enables businesses to accept electronic payments securely.

It offers a range of payment solutions, including credit card processing, e-commerce integration, mobile payments, and recurring billing.

Source: NMI

One of NMI’s standout features is its robust support for recurring payments.

By utilizing tokenization to store and reuse customer data, NMI simplifies the process of handling recurring billing.

It also updates card information automatically, ensuring uninterrupted payments for businesses.

Key features

- Accepts all major payment types in many international currencies

- Offers robust reporting

- Supports tokenization of cardholder data for subscription payments

- Ensures uninterrupted payments by updating card information

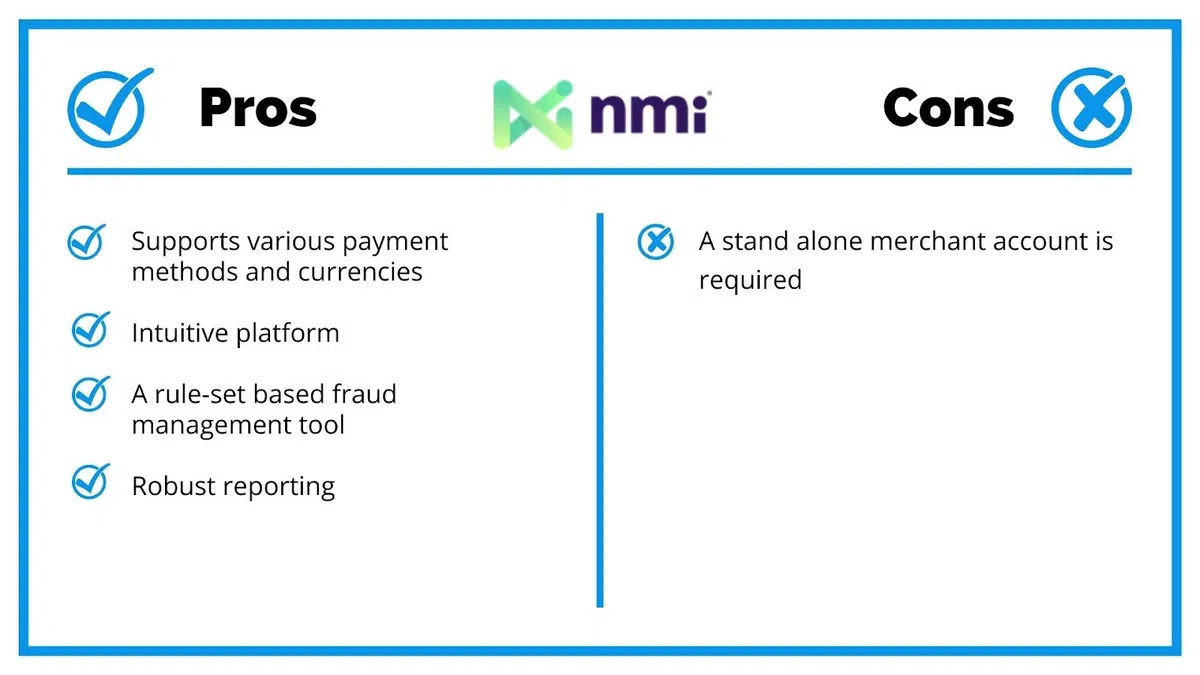

Below is the summary of NMI’s pros and cons:

Illustration: Regpack / Data: NMI

While pricing details are not readily available on NMI’s website, according to Payment Cloud,

NMI charges approximately $0.13 per transaction, along with a monthly fee of $19.95 and credit card processing fees.

Overall, NMI is a reliable payment gateway with recurring billing functionality and supports various payment types.

However, their website doesn’t list prices, so you should reach out directly for specific pricing information tailored to your needs.

PayPal

PayPal, a widely recognized payment processing platform, has gained immense popularity for its convenience and versatility.

It proves beneficial for small to medium-sized businesses, as it supports a comprehensive range of payment methods like PayPal, Venmo, debit and credit cards, and even cryptocurrency.

Moreover, it also allows transactions in 25 different currencies.

Source: PayPal

Notably, PayPal enables businesses to accept in-person and online payments, and for recurring payments, you will have to pay an additional $10 per month.

With recurring billing features, companies can set up tailored payment plans with customizable subscriptions and interval payments, offering added incentives like free trials and discounts.

Moreover, PayPal provides a free invoicing app with customizable templates, which simplifies the billing process and facilitates link sharing.

Key features

- Accepts various payment methods in 25 currencies

- 24/7 monitoring for fraud prevention + Seller Protection Program

- Recurring billing option

- Customized subscription and interval payments

- Free invoicing app

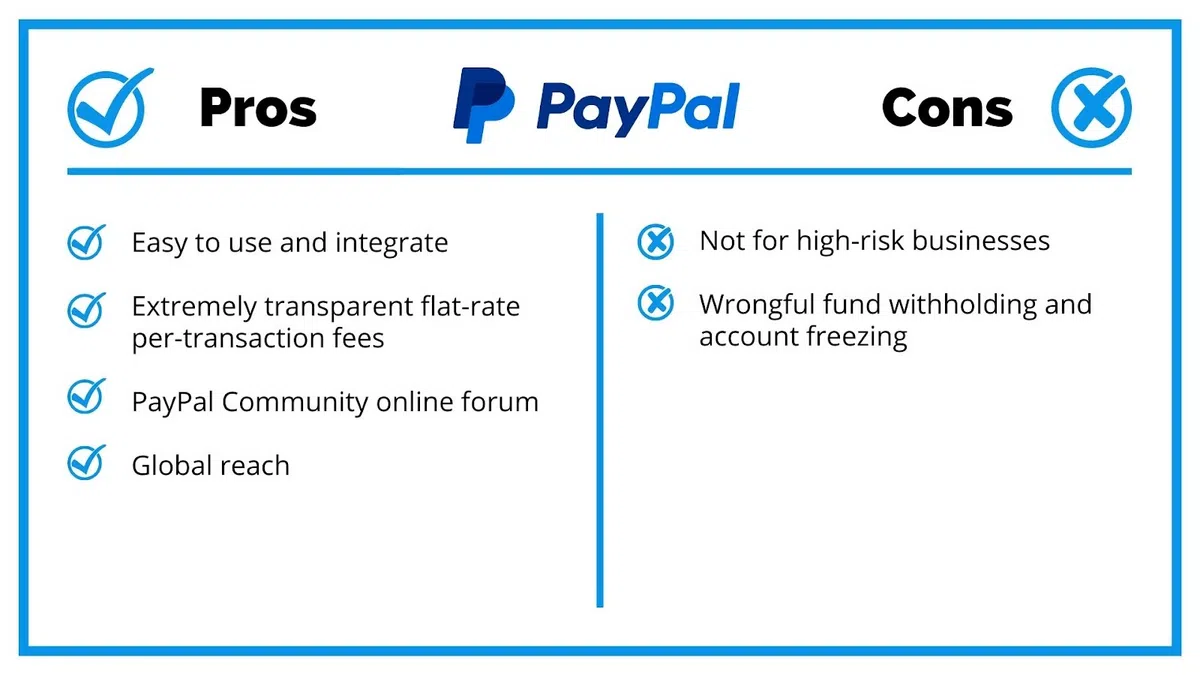

In the table below, we have summarized the pros and cons of PayPal:

Illustration: Regpack / Data: Nerdwallet

Regarding pricing, PayPal offers three monthly payment plans for payment gateways: standard (free), advanced ($5 per month), and pro ($30 per month).

The transaction fees typically fall between 2.29% to 3.49%, accompanied by an additional charge of 9 to 49 cents per transaction.

While PayPal offers numerous benefits for businesses, it has certain drawbacks too.

Strict rules sometimes result in wrongful fund withholds, and account freezes.

Moreover, it may not be suitable for high-risk or high-volume businesses due to the lack of interchange-plus fees or volume discounts.

Stripe

Lastly, we will explore Stripe, a popular payment service that caters to smaller businesses, providing them with a wide range of payment methods.

With Stripe, businesses can accept credit cards, digital wallets, and ACH payments in over 135 currencies, offering flexibility to customers worldwide.

Source: Stripe

One of Stripe’s standout features is its ability to offer highly customizable checkouts and robust data reporting, empowering businesses to tailor their payment processes to their needs.

Additionally, Stripe offers a valuable service called Stripe Billing, which enables businesses to set up recurring invoices and subscriptions, simplifying the management of ongoing payments.

Key features

- Accepts various payment methods in more than 135 currencies

- Offers Stripe Billing feature for recurring payments

- Highly customizable

- Offers robust reporting

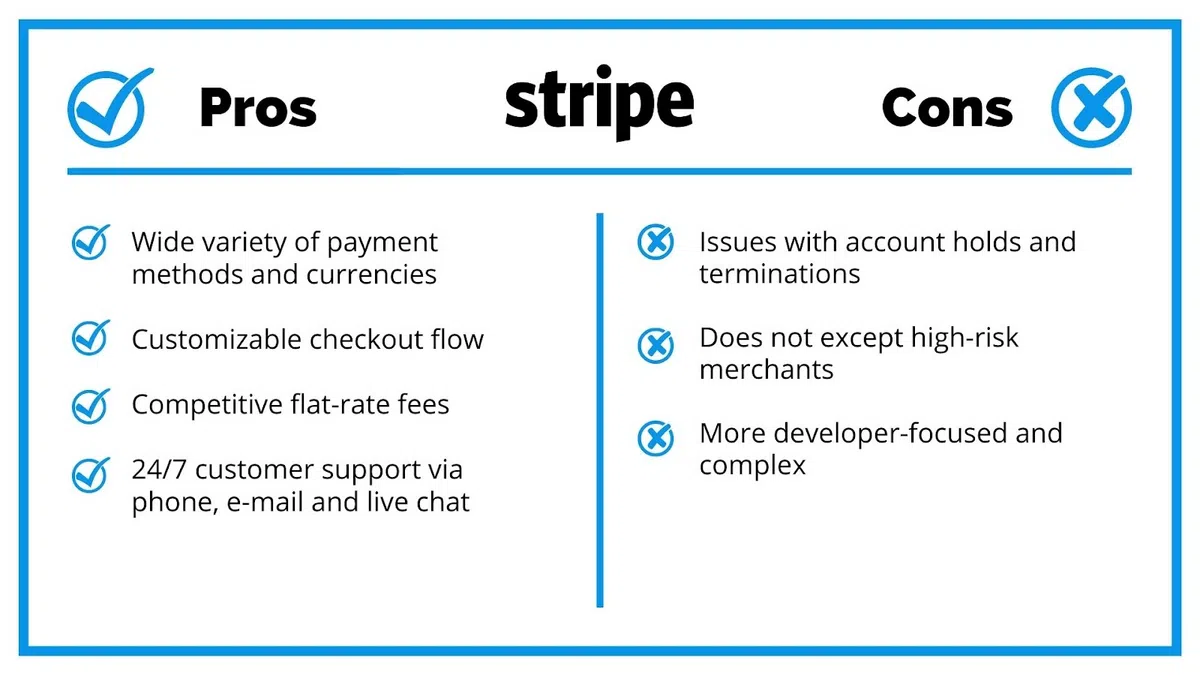

And our last table today showcases Stripe’s main advantages and disadvantages:

Illustration: Regpack / Data: Nerdwallet

Stripe maintains transparent pricing, readily available on their website.

While monthly fees are based on the chosen plans and features, the payment structure generally involves flat-rate fees per transaction.

For instance, online transactions typically cost 2.9% plus 30 cents.

In summary, Stripe offers notable advantages such as customization options and competitive flat-rate fees.

However, similar to PayPal, it may not be suitable for high-risk merchants, and some users have reported issues with account holds and terminations.

Conclusion

Hopefully, we provided some valuable insights into the top payment gateways for recurring billing. We highlighted their key features, pros and cons, and pricing structures.

So, when selecting a payment gateway for managing customer registrations and recurring payments online, keep these in mind.

Look for a reliable gateway that offers automated periodical payments, customizable subscription plans, and seamless cardholder data updates to get the most for your business.

Good luck!