In the modern business landscape, you can’t avoid dealing with a mountain of data.

This is especially true for businesses dealing with subscriptions and recurring billing. Just think about all your customers—from their names and contact details to their subscription type, billing frequency, payment methods, and payment history.

Although, at times, it may seem like you are drowning in all these figures and statistics around you, it is precisely this sea of information that holds the key to improving your business—if you use it right.

That’s why we are here to help.

In the next few chapters, we’ll show you five ways to make the most of your recurring billing data to boost your business. And trust us, it’s a smart move for your company.

So, let’s get going.

Identify Sales Trends

Sales trends are like roadmaps for your business, showing where you’ve been and helping you predict where you’re headed.

In other words, your past sales help you forecast what’s ahead, thanks to the data you can analyze and compare.

But why does this matter? Let’s dissect it.

Firstly, sales trends offer valuable insights into customer behavior and the evolving dynamics of the market.

For instance, by analyzing these trends, you can understand which subscription plans, features, or content resonate with customers and which ones are on the decline.

So, when you see there is an increased demand for a specific product or service during a particular season, you can adjust your pricing strategies for that product.

Additionally, sales trends shed light on subscriber retention and churn. For example, if you detect a growing trend of customer churn, it’s a clear signal that you should focus on improving customer retention efforts.

In a nutshell, identifying sales trends not only highlights your strengths but also pinpoints areas for improvement in your business strategy.

This empowers you to provide better products and services to customers while ensuring financial stability and growth for your business.

So, how can you go about identifying these trends?

It would be best to begin by selecting the data you’ll analyze, including the information on customer subscriptions, purchase history, billing cycles, and payment methods—depending on what you will focus on in your sales trend analysis.

Some key recurring billing data elements you can analyze to identify sales trends include:

- Subscription growth

- Churn rate

- Billing frequency

- Product adoption

Next, it would be wise to divide your customer data based on various attributes, such as demographics, subscription plans, region, or even individual sales trends by a customer.

The latter is particularly valuable when monitoring larger customers.

For example, suppose you follow figures for a certain large customer and start noticing a gradual decline in sales for this customer. In that case, you can immediately address the issue, see why there is a decline in sales, and find a way to meet customer demands.

Another thing to consider is analyzing data in different periods—day, week, month, quarter, or year—to track how your customers’ behavior and sales have changed over time.

Then, once you’ve determined the sales trends you want to track, selected your customer data, and chosen the periods, you can dive into the data and look for patterns, fluctuations, and trends in sales figures over time.

By analyzing these recurring billing data points, you can gain a clear insight into where you should focus your efforts for improvement.

Keep an Eye on Your Churn

In subscription-based businesses, keeping customers is a top priority.

Churn, which represents the rate at which your subscribers unsubscribe from your service and leave, can be a stumbling block if you don’t manage it effectively.

It’s like a leak in a bucket—if you don’t patch it up, you’ll lose valuable customers over time.

So, to address this issue, you need to track it and, more importantly, understand why it’s happening. Only with this knowledge can you fix what it is that makes your subscribers leave.

But keep in mind that your subscribers don’t always want to cancel the service. Sometimes, churn happens because of some external factors.

That’s why we must make a difference between voluntary and involuntary churn:

| Voluntary Churn | When customers cancel their subscriptions or stop doing business with a company on their own accord. |

| Involuntary Churn | When customers can’t continue their subscriptions due to payment issues, expired credit cards, insufficient funds, or changes in billing information. It’s not their choice to leave. |

Moreover, your data could be showing you are losing subscribers, while your sales remain stable. That would mean even though you’ve lost some subscribers, the ones that remain are opting for more expensive plans, for instance.

Even though it is excellent that subscribers choose more expensive plans, you should still inspect why you are losing subscribers—it may be involuntary, so you have to find ways to prevent it.

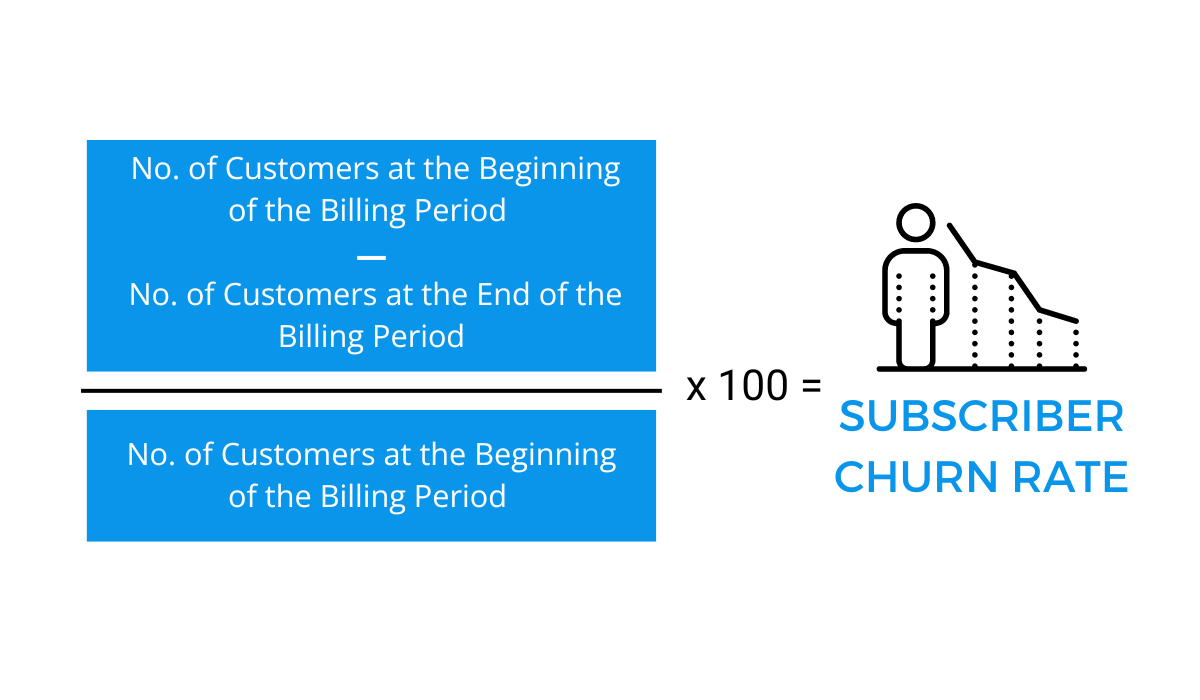

Once you know what the reasons behind the churn are, you can calculate it, by following this formula:

But to obtain precise data on the number of subscribers who left during a specific period and the reasons behind their departure, you need a reliable tool—recurring billing software, such as our Regpack.

Regpack’s reporting and analytic tools can help you understand your subscriber base—precisely what you need to keep tabs on your churn.

Apart from the ability to easily create reports, as software for recurring billing, Regpack has features that can help you prevent churn.

For example, this software will automatically retry failed payments. And if that doesn’t work, it will notify your customers about it. This will allow them to check their payments, edit card details, and learn why this happened.

If this were not the case, your customers would be logged out of their accounts, your service would stop working for them, and this would negatively affect your customer relationship.

In fact, Regpack’s clients have experienced an impressive 25% reduction in churn—they’ve retained more subscribers and ensured long-term growth and success for your business.

In summary, monitoring churn closely and understanding when and why it occurs is a wise step if you want to improve your recurring billing service.

By keeping an eye on churn, you’re better equipped to patch up those bucket leaks.

Optimize Your Product Offering

We’ve already mentioned that when you analyze your sales trends, you gain insights into which of your products are popular with your customers, and which leave them cold.

This information can improve your business in two key ways:

- You can level up your service.

- You can set reasonable pricing for your products.

Let’s explain.

First, when you have a thorough understanding of what your customers want (or don’t want), you can make sure to improve your offerings in accordance with their preferences.

If your data reveals that some products go unnoticed by your customers, you have options.

You can transform them into customer favorites by incorporating them into other subscription plans and additional advertising, or, conversely, redirect your efforts toward products that resonate with your subscribers.

Second, knowing precisely what your customers are buying, how often, and how much they value your service can guide you in setting the perfect price points.

In other words, you can find that sweet spot where customers feel they’re getting exceptional value from your service while improving your cash flow.

We’ve crafted a few actionable tips to help you use your data to optimize product offerings:

| Look for patterns in your subscribers’ behavior. | Are there trends or habits that you can identify? This information can help refine your product offering and optimize your pricing. |

| Pay attention to features that aren’t getting much attention. | Try to understand why they’re being overlooked. It might be worth investing in educating your subscribers on how to use these features effectively if they offer value. |

| Check if your subscribers know how to use your products. | Do you have an effective onboarding process for new subscribers? Ensuring a smooth start for your customers can enhance their experience and retention. |

In conclusion, optimizing your product offering goes beyond identifying popular and less-favored products.

It’s about applying this knowledge to improve your services, set up appropriate prices, and create tailored experiences for your subscribers.

Recurring billing data can provide these insights when you ask the right questions.

Improve Your Marketing

Effective marketing goes beyond catchy slogans and visuals. It is also determined by your audience—what they want and how they behave.

To grasp this, you must make your customers the center of your marketing strategy. When you do, you can create campaigns that truly resonate.

But where can you find the goldmine of customer insights? The answer lies in your recurring billing data.

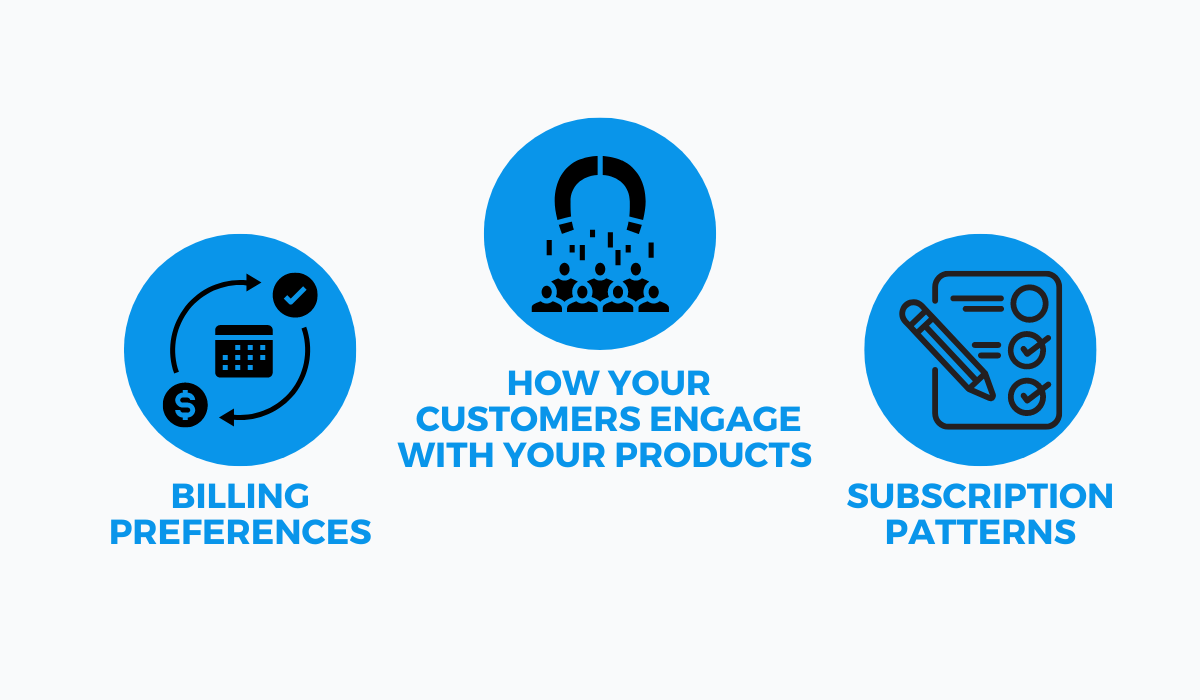

Recurring billing data isn’t just about invoices. On the contrary, it can show you the following:

This data is the key to improving your marketing and creating campaigns that hit the mark.

Let’s explore one hypothetical example to illustrate this.

Imagine a virtual fitness platform facing a common challenge—keeping subscribers. To address this, they turn to their recurring billing data.

By analyzing it, they discover that customers who choose annual billing tend to stay loyal. So, they launch a targeted marketing campaign promoting the benefits of yearly subscriptions, like savings and exclusive content.

The result? A significant increase in annual sign-ups.

Their data also reveals that many of their users prefer short, high-intensity workouts. Since they lack a monthly subscription plan with such videos, they create a new one featuring 20-minute workouts and promote it to this specific audience.

The result? Nearly all of these subscribers switch to this plan that fully aligns with their preferences.

This simple example illustrates how using your recurring billing data can improve your marketing and your offerings.

This leads to happier subscribers who stay loyal to your business because it meets their needs, ultimately improving your overall business.

Monitor Your Customer Base Diversity

You know that old saying, “Don’t put all your eggs in one basket?”

Well, it holds weight—especially regarding your customer base.

While it’s important to identify your strongest customers—those who bring in the most profit—it’s equally important not to rely only on them.

The key to long-term stability and growth lies in the diversity of your customer base.

Consider what could happen if your only two major customers suddenly switch to a basic plan, run out of their business, or opt for a different service provider. In such scenarios, you could potentially lose all your profits.

Moreover, by nature, subscription-based businesses see some customers come and go.

According to a study by Recurly (they surveyed more than 1,500 global subscription businesses), they lose around 5.6% of customers every month.

Now, 5.6% may not sound like a lot, but it’s a weighty figure for smaller businesses.

That’s why keeping an eye on customer diversity is vital.

One way to do this is by looking at your billing data.

This data shows you how different groups of customers behave. For example, you can see which groups are loyal and profitable and which shrink their subscription plans.

The latter might show signs of canceling your services in the future.

But with this information, you can take action to keep customers around, like offering special deals or even improving your service.

In short, billing data is helpful for monitoring your customer diversity. It helps you make smart choices to protect your business and ensure it keeps growing.

Conclusion

In this article, we have pointed out five ways to use recurring billing data to improve your business.

This data doesn’t only give you information about your customers’ invoices.

On the contrary, you can use it to optimize your offerings, identify sales trends, and reduce churn.

More than that, recurring billing data gives you insights into customer diversity and can help you improve your marketing efforts.

As you can see, recurring billing data is extremely valuable, and leveraging it would be wise.