The subscription model is exploding in popularity these days. Whether it’s your Netflix account, your gym membership, or your weekly meal delivery kit, odds are that if you can be charged a recurring payment, you will be.

But despite the prevalence of recurring billing models across nearly every industry, businesses still face many challenges in billing, collecting, and even processing recurring payments.

That’s why in this post, we’ll walk you through eight of the toughest recurring billing challenges businesses face—and how to overcome them.

Adjusting to Real-Time Changes in Billing Plans

Is your billing system set up to adapt to the changes in your customers’ plans? These changes are a normal part of the subscription business model and can include activities such as:

- Upgrades

- Downgrades

- Adding new users to an account

- Subscription cancellations

- Subscription renewals

To keep up with the demands of your customers, you’ll need to be flexible and adapt to all of these changes and more.

And what about legacy plans that no longer exist? Do you have a method for transitioning these plans into current plans?

Many businesses focus on the initial sale of their product or service, then struggle to keep up with their customers’ accounts and ongoing needs.

But if you’re a subscription-based company, you rely much more on customer loyalty and ongoing payments to keep your business afloat.

That’s why providing a superior customer experience—including adjusting to their preference changes in real-time—is crucial.

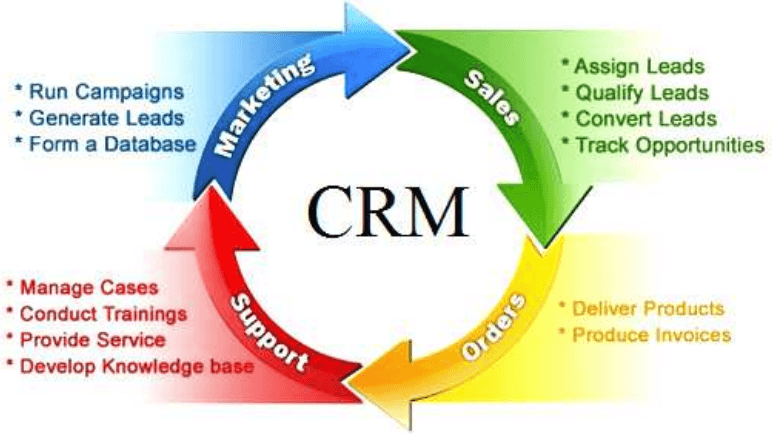

One way to solve this issue is to use a customer relationship manager (CRM) tool that integrates with your billing system.

Source: Researchgate

Much like the name suggests, a CRM helps you manage your ongoing relationship with your customer. As researchers Mijat Jocovic, Boban Melovic, Nikolai Vatin, and Vera Murgul wrote in their study published in Applied Mechanics and Materials:

“Customer Relationship Management becomes the key of all marketing processes of a modern company. CRM emerges from a new basic philosophy which does not admit sale as the end of [the] marketing process, but sees the richness of the company in the customer.”

The right customer relationship management tool will let you store important customer information in one place, generate actionable reports for your team, and give you the right level of effective communication with your customers.

You’ll know when they’re ready to upgrade or when they might benefit from another service you offer.

You’ll also be able to seamlessly meet their needs like adding or subtracting users, changing billing methods, and more.

Automating Invoices

Most subscription-based businesses have to keep track of various tiers, packages, and billing cycles.

Different customers sign up at different times for different service packages, and each one expects you to manage their payment details and account data promptly and precisely.

With that in mind, let’s be clear: if you’re still writing your invoices manually, you’re wasting hours—if not days—of precious time.

Manually handling these invoices is messy and time-consuming, not to mention unsustainable as your subscriber count grows.

Source: Payments Canada

As you can see from the diagram above, paper invoicing requires multiple steps to be completed by several agents—including the postal service.

And it can be costly; in fact, businesses that process paper invoices spend an average of $171,000 a year, according to The CFO’s Guide To Digitizing B2B Payments.

On the other hand, electronic invoicing cuts down on not only the steps, but the wait time between the sender generating an invoice and the receiver completing the payment.

Source: Payments Canada

There are many tools out there that let you bill customers automatically, with automated systems that pull data, fill invoice templates, and send invoices at automated intervals.

For example, Regpack’s auto-billing system lets you:

- Choose between percentage-based payment plans and specific payment amounts

- Design plans for selected products and services, or plans that pay off the entire order at once

- Control payoff timelines and automatically generate installment payment dates based on your settings

- Add deposits into any plan, with those deposits automatically factored into installment payment calculations

- Create private plans that are accessible only by your team

Regpack clients using our auto-billing system have seen a 25% improvement in cash flow and a 35% payment rate increase. Automated invoicing lets you save time, money, and manpower—and scale your business easily.

Establishing Flexible Recurring Billing Frequencies

Some businesses use simple billing structures, such as flat-rate charges and payments made only on the first of the month. But if you (and your customers) prefer more flexibility, you’ll need a recurring payments system that can handle something a little more complex.

And you’ll probably want to offer more flexible billing frequency options.

The best billing frequency for most recurring billing services is monthly or annually. More often than that, and your customer may experience too much friction.

After all, every new bill gives them another opportunity to consider the value they’re getting for their money—and the more frequently that occurs, the more likely they are to decide to end their subscription.

If your customer receives invoices too frequently, that may increase the risk of customer churn.

The solution? Use a reliable automated billing system that can handle varied subscription tiers and payment plans. Here’s how to set up a billing frequency in Regpack, for example:

Source: RegPack

When deciding which billing frequency options to offer, make sure to consider the choices that best match both your customers’ preferences and your business growth goals.

Managing Failed Payments

Managing complex customer payment settings and account preferences is one thing, and so is staying on top of invoicing.

But there’s nothing more frustrating than when a customer finally sends you the money they owe—only for that payment to fail in the middle of processing. And of course, there are those pesky customers who never manage to pay their invoices on time at all.

Finding a way to manage failed or missing payments is crucial if you don’t want to deal with cash flow interruptions and revenue loss.

That’s not even mentioning customer churn. Failed payments without follow-ups can result in customers deciding to look elsewhere for the services you offer.

And since most experts agree that customer retention has a much higher ROI than acquiring a new customer, it’s well worth your while to make sure you mitigate all of the potential obstacles to providing a smooth billing cycle for your customers.

In fact, it’s estimated that increasing your customer retention rates by only 10% yields a 30% rise in your company’s value overall.

Source: Retention Science

A good recurring billing system can help keep customers happy and payments flowing smoothly.

Choose a solution that automates tasks like sending payment reminders and failed payment notices—otherwise known as dunning emails—to your customers while providing detailed payment analytics for your team to monitor.

Maintaining Strong Data Security

In a recurring billing system, most transactions happen online. While this solution is more convenient than traditional payment methods, it does open the door for many more security risks.

And identity theft is on the rise. In fact, last year was a record year for data breaches. According to Eric Griffith of PC Mag:

“The number of data compromises for 2021 overall—1,862—is… the highest recorded. It’s 68% higher than the 1,108 in 2020 and 23% higher than 2017’s record 1,506.”

As a company, it’s your responsibility to protect your customer’s personal information and credit card details once they hand them over to you.

If that sensitive data is hacked or lost, that security breach will damage your brand’s reputation. Other customers won’t want to shop with you.

Source: PC Mag

Storing card data is a huge risk. So in your business, you’ll need to implement a secure recurring billing system with a reputable and secure payment processor.

Make sure to follow proper procedures to storing and handling your customers’ sensitive information, such as:

- Avoid storing a card’s track data. This data is the information stored on the card’s magnetic strip—and while it’s a prime target for hackers, it’s not necessary for your online payment processing. Only save the information you actually need.

- Use encryption for the data you do save. According to Security Metrics, 74% of companies still save unencrypted card data. Invest in software that encrypts sensitive data to protect it from hackers.

- Stay up-to-date on PCI standards. The payment card industry (PCI) has implemented regulations to protect customer data, such as using a secure network and protecting the cardholder’s personal information. If a company violates those standards, it may be hit with anywhere from $5,000 to $100,000 in monthly fines until it achieves compliance.

And of course, choose a reputable payment processor that prioritizes security and is compliant with all the latest regulations.

Managing Discounts

Discounts are one of the most effective techniques to encourage new customers to try your product and existing customers to experiment with additional products or services.

But if your billing system can’t manage those discounts, you’ll end up with a lot of unhappy customers who are expecting their bill to reflect those reduced prices.

You want your customers to be able to redeem offers or coupons or receive recurring discounts for promotional offers; otherwise, they may become frustrated enough to look elsewhere.

Trying to manage these discounts manually can quickly become a full-time job, especially as your customer base grows.

You may decide to offer promotions based on the time of year or to entice users to try new product roll-outs. As your business scales, you’ll want the ability to juggle multiple discount types and coupon codes.

Look for a recurring billing solution that can create, track, and manage discounts. For instance, Regpack lets you create discounts that apply to specific products or categories or to the user’s entire cart.

Source: Regpack

The discounts can be a percentage of the price or a specific dollar amount. You can also decide whether the discount will be automatically added to the user’s card and if the discount can be used more than once.

Accepting Payments in Different Currencies

Once you expand a business internationally, accepting different currencies and handling fees becomes a challenge. Fluctuating exchange rates often mean some expenses will cost much more than expected, which will, in turn, impact your profit.

Offering your services or selling your products in another country means you need a recurring billing solution that accepts payments in multiple currencies and allows you to troubleshoot payment issues with your international customers.

Source: RegPack

Taking on the complications on your end will help prevent your clients from having to deal with heavy foreign transaction fees on theirs.

Supporting Customer Payment Preferences

In today’s digital world, cash is no longer king. Modern customers want access to a variety of payment options.

To make it as easy and painless for your customers as possible, you’ll want to enable a wide range of payment channels.

But you’ll want to pay special attention to the kinds of payments your specific customers prefer. Knowing your target audience helps narrow down what methods they use the most.

Source: Score

For B2C customers, credit and debit cards are by far the most popular—while for B2B customers, ACH payments and checks rule the day.

Every payment method—from credit cards, to e-Checks, to PayPal—comes with a different associated fee.

Whether it’s a percentage of the charge, a fixed transaction fee, or a mix of both, you’ll need to stay on top of the costs in order to accurately track and manage your net revenue.

“Regpack simplifies everything for you. We lay out the cost of each method in advance with integrated payment method fees and automatic payment processor changes according to updates and policy changes that banks and credit card companies frequently make.” —Regpack

Choose a billing solution that offers a wide range of payment options and can meet your needs regardless of the integrations, APIs, online payment gateways, e-wallets, or digital currencies in question.

Conclusion

Recurring billing is nothing new—and it’s quickly becoming the mainstream billing structure adopted by many scaling businesses.

But despite its omnipresence in our lives, many companies still struggle to deal with common challenges in implementing recurring billing.

Whether it’s adjusting to the constant changes in customer payment preferences, sending invoices, or maintaining flexibility while establishing strong information security, navigating the challenges of recurring billing can easily feel like a minefield.

Follow the tips above to avoid many of the stumbling blocks that affect many businesses of all sizes. And don’t forget to choose a payment solution that’s equipped to meet any challenges you face.