For most businesses, late payments are an unwanted but unavoidable reality.

No matter how much you pay attention to sending your invoices on time, nurturing the relationships with your customers, and doing everything in your power to get paid, sometimes the customers are simply late with keeping their part of the bargain.

That’s why you should know how to write a payment request email that will make dealing with late payments easier.

Curious? Let’s dive in!

- First, Check That the Customer Received the Invoice

- Know When to Send the Payment Request Email

- Write a Clear Subject Line

- Remain Professional in Your Writing

- Detail Your Payment Options

- Include the Unpaid Invoice as an Attachment

- Create a Payment Request Email Template

- Conclusion

First, Check That the Customer Received the Invoice

So, you emailed an invoice to your customer, the due date came and went, and—nothing happened. There’s no response or money on your account.

And while it seems like it’s time to spring into action and send the customer a payment request email, you should first ensure that they received your invoice.

You don’t want to send them a reminder to pay you and later find out that they didn’t receive the original invoice in the first place, for one reason or another.

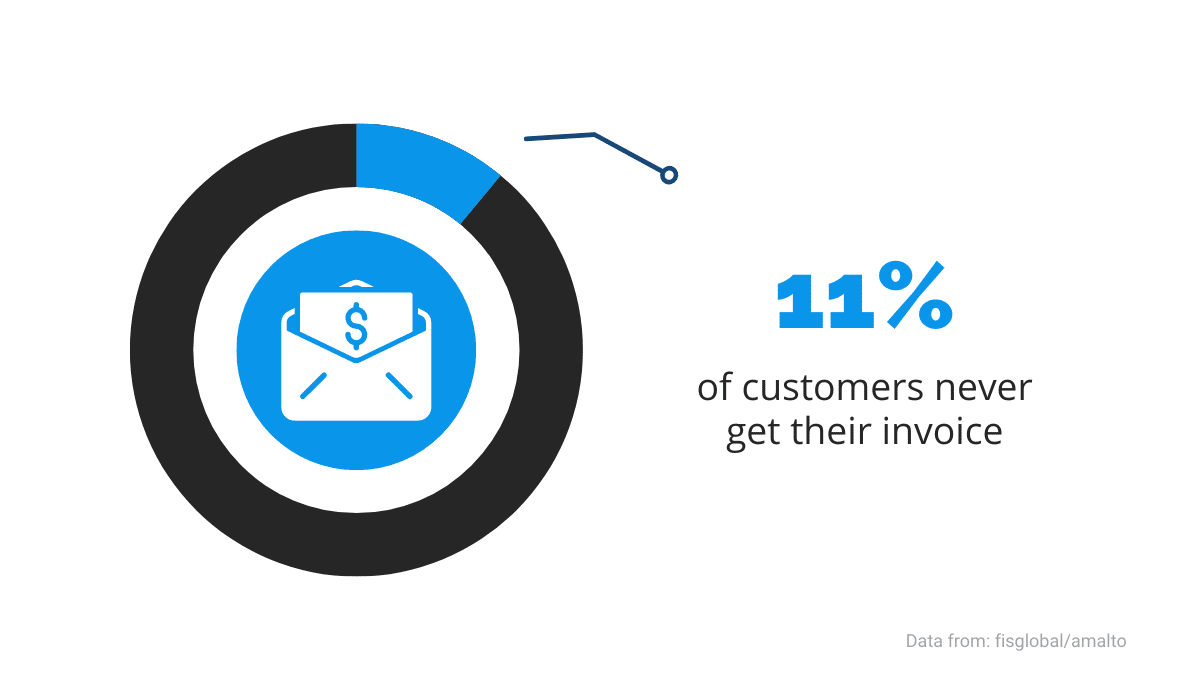

Customers not receiving an invoice isn’t that rare of an occurrence. The data from FIS and Amalto indicates that 11% of customers never receive their invoice.

Source: Regpack

To put it another way, that’s about one in every ten customers, which is certainly a number that you shouldn’t dismiss.

So, before you remind them that they’re late with the payment, check that you did everything right.

There can be various reasons why the customer might not receive an invoice:

- You forgot to send the invoice

- You sent it to the wrong department or person

- You sent it to the incorrect email address

- The customer’s inbox is full

- The email went to the spam folder

This list could be longer, but you get the gist. Technology is sometimes unpredictable, and on top of that, errors and miscommunication can happen to anyone, including you.

However, there are software tools that can help you with those problems.

Software solutions like Mailtrack show you if the customer opened your email and how long ago, and you can even set up real-time notifications that let you know when they opened your email.

Source: chrome.google

Of course, that can’t prevent every issue we mentioned earlier, but at least you know if the customer received your email and opened it.

Once you’re sure of that, you can assess when to send a payment request email. Let’s explore that in the next section.

Know When to Send the Payment Request Email

After you’ve made sure that the customer received your invoice and didn’t pay it on time, you should send them a payment request email.

The key thing to know is when to send it.

First, you should send it after the due date on the invoice has passed.

If you send your email while the customer still has time to pay you, that might come across as pushy and impatient, and you certainly don’t want your customers to think of you that way.

Second, you should set up a schedule for reminding your customers of late payments because you might need to send them more than one email.

For instance, the stats from MYOB indicate that 21% of invoices are paid after the first follow-up, 20% after the second and 32% after the third.

Source: Regpack

The number of payment request emails you decide to send is up to you, but there are some general rules that most companies follow.

For example, your sending schedule can look like this:

- One week after the due date

- Two weeks after the due date

- A month after the due date

After that, if the customer still hasn’t made the payment, you can plan more reminder emails or involve collection agencies—there are various strategies to deal with that.

Regardless, you should plan at least the three emails we listed above.

Below is an example of a payment reminder email sent a week after the due date.

Source: Regpack

As you can see, it’s written as a friendly and polite reminder. Still, it contains everything a customer needs if he or she has missed their payment deadline.

But we’ll discuss the content of those emails more in one of the following sections.

Now, let’s ensure that you draw your customer’s attention with a great subject line.

Write a Clear Subject Line

When you send a payment request email, the first element your customer sees is the subject line. That’s why it’s essential to create a great one.

How important is it? According to research from Superoffice, a third of email recipients open the messages based solely on the subject line.

Source: Regpack

That means that a significant portion of your customers might not even open your payment request email if you don’t put effort into creating a clear subject line.

And clarity is precisely what you should aim for when you want to remind customers to pay.

The subject line of your payment request email has two important tasks: to inform the customer about the content of the email and encourage them to open it.

They don’t need to be witty and intriguing because that could produce an unwanted result, like the one that copywriter Benjamin Watkins described on Twitter.

Source: Twitter

Instead, you should aim to be direct so that the customer knows right away what the email is about when they see the subject line.

You can use phrases like:

- Your invoice #3532 is overdue

- IMPORTANT—Payment reminder for invoice #4325

- Your invoice #4324 for Morning Coffee is overdue

The subject line is clear as long as it informs the customer why you’re sending them the email and what they should pay.

Below, you can see another example:

Source: invoiceowl

As you can see, that particular example is for an invoice already a month overdue.

Although that’s a significant amount of time, you should still remain polite and professional to maximize your chances of collecting the payment.

And the importance of being professional in your writing goes beyond just the subject line. We’ll dive more into that in the next section.

Remain Professional in Your Writing

Your business needs a healthy cash flow to survive and prosper. Late payments can jeopardize that, so reminding your customers to pay is necessary.

Of course, late payments are nobody’s favorite thing to deal with. However, it’s best to remain professional when writing payment request emails and not let emotions or frustrations take over.

As Anja Simić, Director of Content Marketing at Deel, points out, that can accomplish two important goals—you increase the chances of collecting payment, and you remain on good terms with the customer.

Source: Regpack

In other words, if you’re professional in your email communication, even on uncomfortable subjects such as late payments, you project the image of a serious business, and customers are drawn to that.

Luckily, adopting a professional tone in your payment request emails requires that you follow only a few guidelines.

As we’ve mentioned, it’s important to be polite and straightforward, and avoid blaming or threatening your customers.

Take a look at the example below:

Source: Regpack

As you can see, the email starts with a friendly greeting, followed by information about the payment.

There’s also a warning about the possible additional fees that the customer might face, but it’s written in a non-threatening and purely informational way.

In short, the email is concise, informative, and, above all else, professional.

Here’s another example from Robert Allen, a publisher and copywriter:

Source: kingsofconversion

That email is more informal than the previous example, but it’s still polite and professional while reminding a customer of their responsibilities.

It’s not always easy to remain professional when dealing with clients. However, when it comes to writing payment request emails, that’s vital for your business and future prospects.

Detail Your Payment Options

There are many possible reasons why your customer is late with a payment, and you can’t control all of them.

However, what you can do is make it as convenient as possible for them to pay you.

When it comes to money transactions, there are a lot of options that you can offer to your customers.

The times when customers had to sit down, write a check, and mail it to a company are slowly but surely becoming history.

That’s especially true for online purchases. For instance, below, you can see the data from the Consumer payer trends 2022 report from Paysafe.

Source: Paysafe

As you can see, debit cards, credit cards, and digital wallets are the most popular ways to pay for online products and services in the US and the UK.

Therefore, you should offer your customers at least those payment options and make sure to remind them of those possibilities in your payment request email.

Let’s take a look at one example:

Source: squareup

There are two elements worth noting here.

First, the customer is reminded of their payment options in the text of the email. Simply detailing payment options like that can nudge them to choose one and settle their debt.

Second, the email has a Pay Invoice CTA button. Essentially, it’s a link that leads the customer directly to the payment page.

Making sure that your payment options are clear and convenient for the customers will increase your chances of receiving payment.

It’s simple—the easier you make it for your customers to pay you, the more likely it is that they will actually do it.

Include the Unpaid Invoice as an Attachment

As mentioned earlier, the best payment request emails contain everything the customers need to settle their debt. That should also include a copy of the original invoice they didn’t pay.

Similarly to detailing your payment options, the purpose of attaching the unpaid invoice to your email is to make the payment as convenient as possible.

That way, you save your customers time.

Sometimes, emails get lost, unnoticed, or simply forgotten, and by attaching the invoice to a reminder email, you spare them from digging through their inbox.

Of course, this practice can also benefit you. A customer will be more likely to pay what they owe if you take the effort of finding the unpaid invoice out of the equation.

Also, don’t forget to inform them of the attachment in the email itself, like in the example below.

Source: Clockify

There’s another benefit of including an unpaid invoice in your payment request email—you can be certain that the customer has the invoice now.

Remember in the first section when we pointed out how important it was to check that the customer received the invoice? Well, attaching it to every payment request email you send makes sure that they do.

Or, as Marija Kojić from Clockify puts it:

You’re still giving your client the benefit of the doubt.

Including an attachment in every payment request email doesn’t require much effort on your part, but it can be important for the success rate of those emails.

There’s no reason to skip it.

Create a Payment Request Email Template

It’s highly unlikely that you’ll need to send just one payment request email to one customer.

Late payments happen from time to time, and you could find yourself in a situation where you often send the same email.

You can save yourself a lot of time and effort by creating a template for payment request emails.

And in addition to eliminating time-wasting and tedious work, you can also ensure that your emails are consistent and accurate.

With a template, every customer gets the same relevant information.

That way, you reduce the chance of errors, and you are far less likely to forget crucial data or to make it difficult for your customers to pay the invoice.

Luckily, software tools like Regpack can help you with all of that.

With Regpack, you can create email templates and set up a schedule to send them automatically.

Source: help.regpack

Regpack also allows you to set triggers for sending out emails.

For example, if a customer is two weeks late with their payment, Regpack can automatically send a ready-made email to them.

That way, you minimize the chances of errors like sending payment request emails to the wrong customers, typing the incorrect email address, or any other mistakes that can set you back in your efforts to collect payments.

Source: Regpack

There’s no need to reinvent the wheel when composing payment request emails.

As we discussed earlier, it’s important that they’re clear, on time, professional, and informative.

Creating a template with all those qualities is a great way to give your customers the same treatment and minimize the chances of any issues.

Conclusion

Although you know you have the right to your hard-earned money, it’s never pleasant to chase someone for payment.

However, your business depends on a steady revenue stream, so you should have a way to communicate with your customers when they’re behind on payments.

We hope this article inspired you to start writing the best payment request emails you can.

If you follow our guidelines, you’ll see the results very soon, both in your account and your relationship with customers.