A payment processing platform is an essential tool for small businesses that want to allow their customers to pay with debit and credit cards—a policy decision that will surely increase customer loyalty in an age where cash and check payments have fallen out of fashion.

Saving your billing team time, payment processors handle the behind-the-scenes logistics of the card transaction, transferring the money from the customer’s account to yours in a secure, seamless, and scalable manner.

In this article, we’ll show you why it’s important for small businesses to work with a payment processor by listing the main benefits you’ll receive.

- Accepting Credit and Debit Card

- Possibility to Integrate Payments With Your Own Systems

- Scalability

- Security

- Available Analytics

- Conclusion

Accepting Credit and Debit Card

A 2021 study done by the Federal Reserve Bank of San Francisco found that credit and debit card purchases accounted for 55% of all purchases made by those surveyed.

As time progresses, there is increasing customer demand for this payment option and companies that want to stay relevant need to satisfy it.

Payment processors represent an easy way for businesses to start accepting this form of payment without the usual hassle that comes with an internal process change.

Furthermore, some solutions can even facilitate other payment methods, from ACH to digital wallets.

Providing convenient payment enhances the customer experience and increases customer loyalty, as well as how much you can charge your customers, according to a Walker study:

Source: Super Office

The positive correlation between customer experience and multiple payment options all comes down to the fact that customers value personalization.

They want to pay for your service in the way that is most convenient for them.

If you can give customers that personalized experience throughout the customer journey, including the step where they give you their hard-earned money, you’ll find fewer customers leaving you for the competition.

You will have made it, in a sense, comfortable for them to work with you.

To further increase the personalization of your purchasing process, find a payment processor that offers even more payment options for customers, such as digital wallet payments, which are rising in popularity.

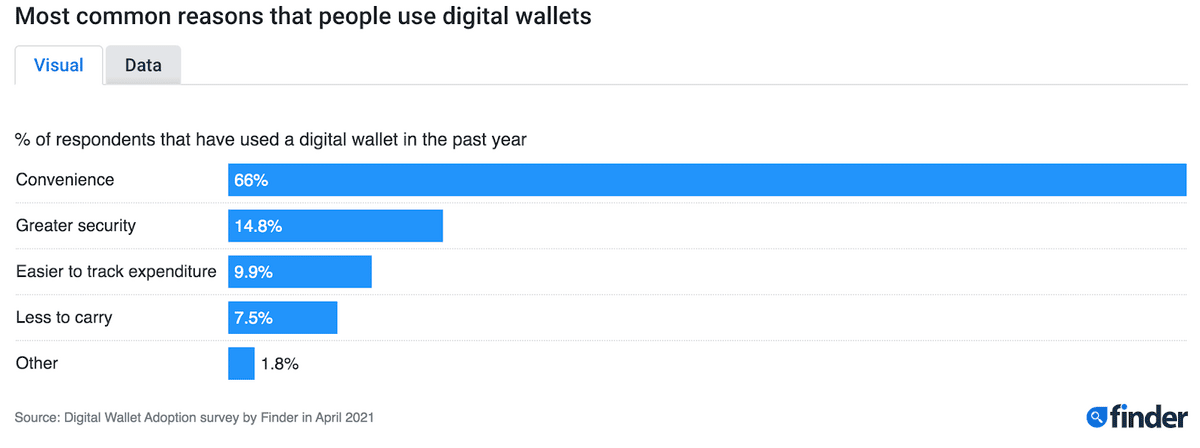

According to a recent Finder study, around 150 million Americans have chosen to pay with a digital wallet over cash or card at least once in their lives.

The reasons given by customers for this swap are that e-wallet transactions are more convenient, more secure, and easier to track.

A small percentage also noted that they’re easier to carry:

Source: Finder

As the number of payment options your customers expect increases, it’s important to have on your side payment processing technology that is consistently updated to facilitate such payment methods.

This allows you to focus on providing top-notch service rather than learning and teaching the minutiae of processing unfamiliar payment methods.

Possibility to Integrate Payments With Your Own Systems

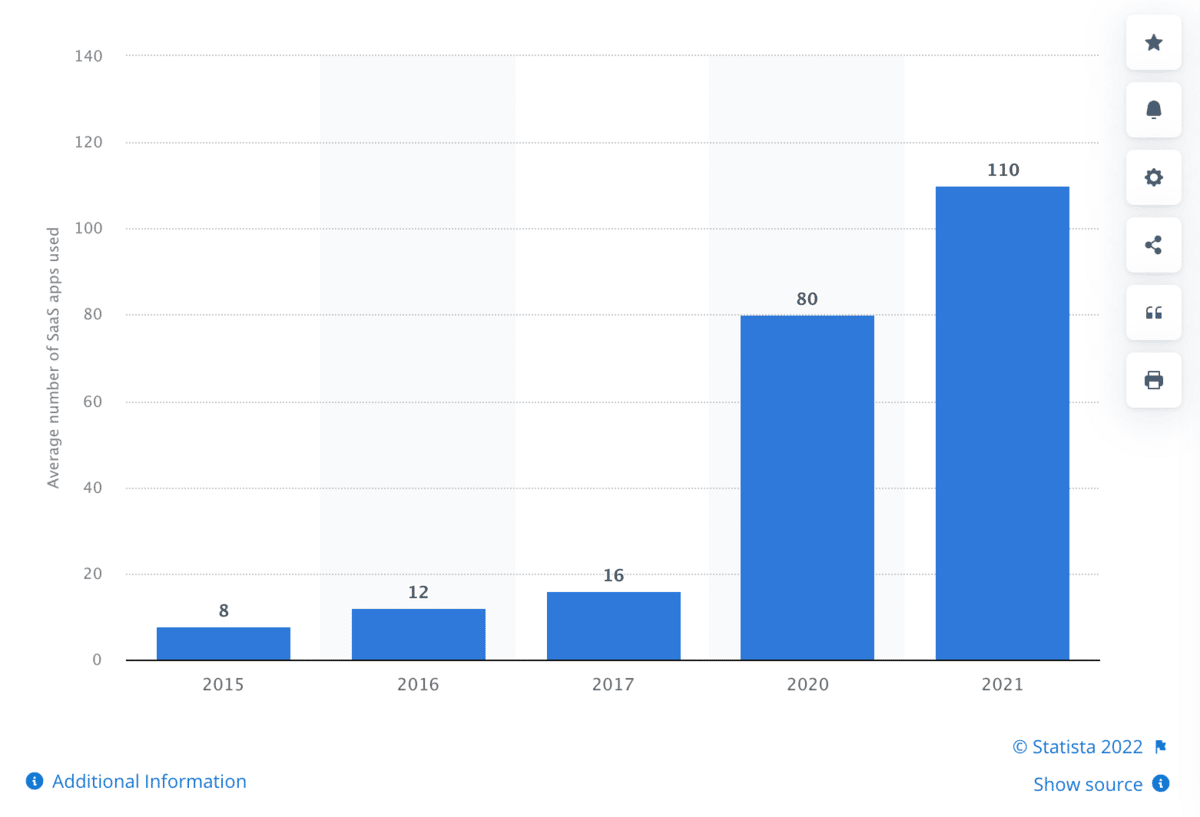

Businesses these days rely on numerous software systems to manage their operations.

In fact, the average business uses about 110 software systems to run their organization, according to this Statista study:

Source: Statista

And, on average, an employee uses eight software systems.

Without integration of their systems, employees have to do things like re-enter data points that are already available in another software system. That’s a lot of wasted time.

So, your billing department will operate most efficiently if its technology and systems communicate with each other.

And quality payment processing platforms allow for such integrations.

They typically connect your payments with your other software systems, from billing and accounting tools to customer relationship management software and your general ledger.

This creates synergy and smooth information flow.

For example, pretend a customer’s credit card was declined by your online payment processing system.

If you integrated payments with your CRM, the event would show up on the contact’s history.

Or, if your payments are connected to a billing tool with automation functionality, you could even configure the billing tool to send out an automated email reminder to customers whenever their cards are declined.

Now, let’s take a look at some other benefits of payment processor integration:

| Improve cash flow management | When your payment processor is integrated with your general ledger or ERP software, you’ll have up-to-date snapshots of your cash flow status. |

| Reduce labor costs | When payments immediately and automatically go into your general ledger, you won’t need to pay staff or accountants to reconcile accounts. Plus, training employees on how to use the tools takes very little effort. |

| Nearly eliminate human error | Say goodbye to instances of duplicated data or data entered into the wrong account, along with the time it takes to find that error and to handle unhappy and overcharged customers. |

Enjoying these advantages of an integrated payment processor, you can spend your time coming up with strategies to overcome your current payment processing challenges and focusing on your more impactful work.

Scalability

Small businesses often experience stagnation at certain growth points because their processes cannot manage the new increases in customers, data, transactions, and resources they have to deal with.

If you want to handle these changes efficiently and seize opportunities to grow, without sacrificing service or product quality, you need to create and start using processes and systems that allow your business to quickly adapt to new demands.

In the billing and payment space, that means using a payment processor that can handle large increases in the number of transactions, as well as changes in the types of payments you’re accepting.

Fortunately, most payment processing platforms are designed to work effectively even as your business transforms, thereby making payments just one less thing you have to worry about during business expansion.

When you implement such a system, you won’t have to hire and pay for new billing staff when the business grows, and you won’t have to worry about stunts to your growth because functionality slows down during times of business hardship.

Business will continue as usual.

As you shop around for payment processors, look for ones that offer the following scalability features:

| Features should remain functional during growth. | Look for a platform that gives you access to all its features no matter how many payments you have to process in a given period. |

| The vendor should be continuously updating the software. | As new payment processing trends pop up, the platform should add new features that allow you to seize these opportunities to improve your payment process. |

| The platform should accommodate growing payment numbers. | Before purchasing, ensure that the platform will be able to handle your expected growth in transactions. Switching systems in the middle of growth can be a costly pain. |

If you find a tool with these features, not only will you experience fewer growing pains, but you will also do a better job of keeping your business up to speed with the rapidly changing payments landscape.

And that means you’ll likely be ahead of many competitors, seizing more market share.

Security

Because online payments involve the transfer of highly sensitive data, like a customer’s credit card or routing number, payment processors provide the necessary security to businesses to prevent data breaches that can hurt a company’s reputation and their customer’s wallet.

This high level of security is also a necessity because it alerts customers that it’s safe to give you their payment information.

Otherwise, they might run off to another vendor with safer payment practices.

It makes sense then that payment processing companies pour a lot of dollars into ensuring they are using the best technology and encryption methods to protect their clients’ businesses that use their software.

Below are four key security features that you’ll find in a high-quality payment processor:

| EMV-chip readers | If you collect payments in-store, use a payment processor that is EMV-chip equipped, as this protects against counterfeit cards using dynamic cryptogram technology. If you don’t have EMV tech, you’re liable to pay the costs associated with a breach. |

| Tokenization | This is the encryption method of turning sensitive data (card information) into randomly generated characters before it enters the server database. This way, if a server breach does occur, the thief won’t be able to find your customers’ card information. |

| Smartphone processing | With methods like Apple Pay going in popularity, your payment processor should handle smart wallet payments, which are not just convenient, but also more secure than card payments. |

| SSL Certificate | Secure socket layer is an encryption method that ensures the safety of data transferred from a customer to the company’s website, for example when they’re typing in a credit card number. |

You should also look for payment processors that are also PCI-compliant, meaning they meet the Payment Card Industry Data Security Standard.

In other words, they’ve passed an annual security audit done by a third-party specialist trained to look for any issues with the processor that may jeopardize someone’s data.

In sum, you can use payment processors to protect your customers from cybercriminals looking to steal sensitive information.

Having one also enables you to advertise this safety and security to customers so more of them trust your website, stay on your checkout page, and buy your product or service.

For example, check out how Yellowstone Forever lets its customers know at checkout that they’re using a PCI-compliant and Starfield Technologies-certified payment processor called Regpack:

Source: Yellowstone Forever

All of the certificates are prominently displayed, which immediately signals trustworthiness.

Available Analytics

Many payment-processing platforms come with advanced analytics capabilities that you can use to uncover insights that will help you improve your small business’s financial situation, increase efficiency, and boost revenue and sales.

Additionally, these analytics enable you to monitor payment transaction performance and spot issues, fraud, or anomalies.

Here are some of the best ways to use payment analytics to better your business:

| Study your customers’ preferred payment methods | Learn which payment methods your customers are using most often and analyze the usage rate of new methods you choose to offer. |

| Find out which services are doing the best | Get real-time feedback about how your services are selling by analyzing transaction data for that service. And uncover reasons why certain ones might be suffering. |

| Locate your business’s most viable periods | Using historical data, figure out when in the year your company deals with the highest influx of payments, so that you can adjust your plans appropriately. |

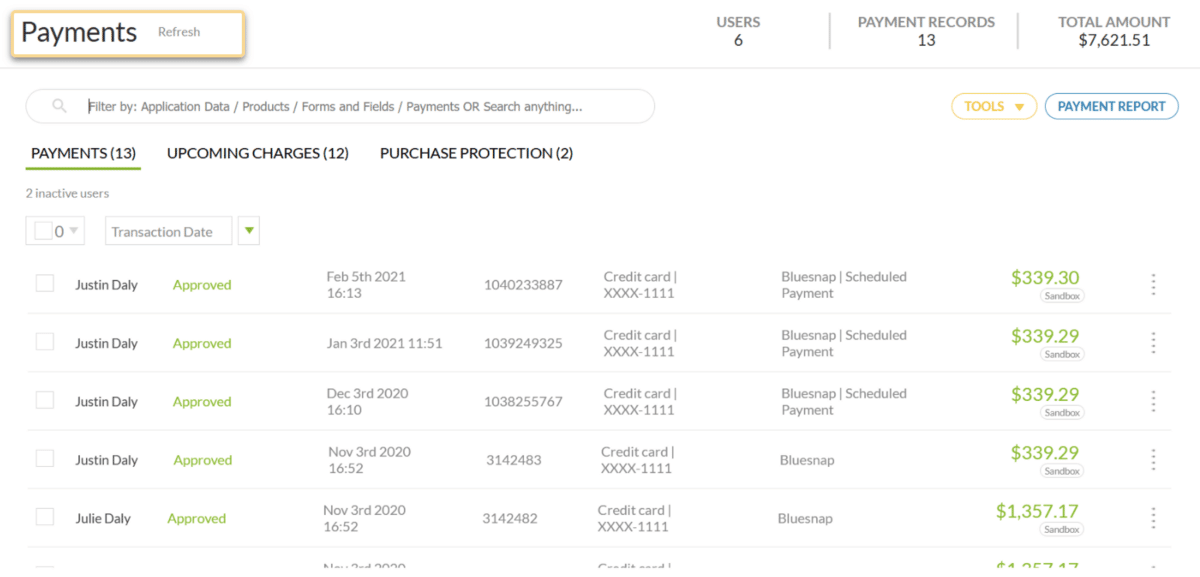

An example of a payment platform that allows you to collect and use your payment data easily is Regpack.

Users on the platform can run payment processing reports to gain insight into how payments are allocated so they can more effectively manage sales.

For example, here’s a simple summary report of recent payments:

Source: Regpack

Users can also run custom payment reports and use filters like program type, date, and others to find data about a certain set of transactions.

For example, if they wanted to know which type of service was bringing in the most money over the last year, they could easily find this out.

Answers to questions like the above allow businesses to allocate resources to the services that have the most potential to positively impact revenue.

Not to mention, payment platforms often make it easy for anyone on your team to understand the analytical findings by giving users the ability to display the information in a variety of visualizations, like graphs, tables, and pie charts.

In conclusion, when you work with a quality payment processing platform, you will have wider and easier access to business analytics that will help you make better decisions and improve your payments and billing processes.

Conclusion

Switching from manual payment management to the use of payment processing software can do wonders for your small business.

It can save you time via payment processing integration and scalability and help you gain and retain customers by enabling credit and debit card payments and ensuring data security.

Most importantly, through analytics, you can monitor and improve the performance of your payments and billing processes, which increases cash flow and financial stability.

If your payment process is something you want to work on, consider reading our article on payment processing tips and implementing some as soon as possible.