Online shopping isn’t new by any means, but as more customers turn to online retailers for their purchasing needs, it is essential to stand out from the competition and cater to their preferences.

In fact, just in the Netherlands, there was an 80% cart abandonment rate in the third quarter of 2021. The reasons are numerous, but the result is the same: all of these incomplete orders meant huge amounts of unsold products.

The good news is that you can combat this problem, and one area you can focus on improving is payment processing.

It is often the last hurdle between the customers and the company making a profit.

By offering seamless payment processing, you’re showing you value your customers, which is likely to lead to more repeat and high-value purchases for your business.

Now, we’ll give you five important tips to optimize your payment process and increase sales.

Jump to section:

Offer the Payment Methods Your Consumers Prefer

Instill a Sense of Security in Your Customers

Make All Fees Visible

Allow Different Payment Plans

Provide Stellar Customer Support

Offer the Payment Methods Your Consumers Prefer

Here is a simple truth: people want flexibility and options. What this means is that you should provide all the payment methods your customers prefer.

Keep in mind that not every payment method will be equally popular in all markets.

In fact, what your customers in Germany expect may be completely different from what your American customers are used to.

For instance, card payments, especially credit cards, are the most prevalent payment method in the US.

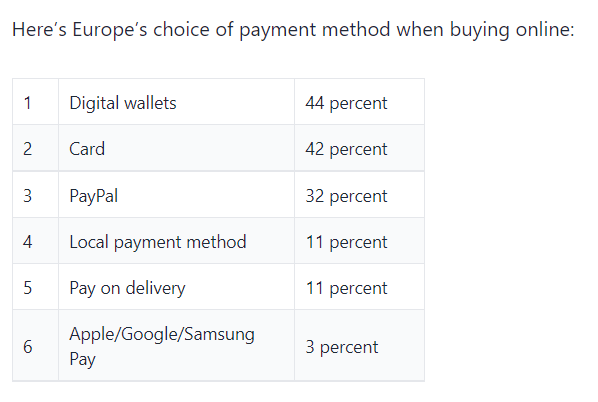

On the other hand, Europeans exhibit a higher preference for money being debited directly from their bank accounts, and tend to use digital wallets when online shopping.

However, although it’s a cutting-edge payment method, neither market seems to be too partial to PayPal yet, with the exception of Germany.

Source: ECommerceNews

But that’s not all. Some countries, like the Netherlands, have their own system like iDEAL, that’s used by 83% of consumers in the country for all their online transactions. So, if you want to penetrate the Dutch market, you have to offer iDEAL as a form of payment.

What do you gain from this?

First, there’s the ability to increase conversion. By catering to each country or region’s payment preferences, you can reach more customers globally and increase your sales.

Payment preferences also differ between generations, so according to a recent study by GoCardless, Millennials and younger generations opt for debit cards more frequently than credit cards.

This is because they earn less, so they want to have less debt and are more budget-conscious.

Younger generations are also more tech-savvy and increasingly use digital payment options such as digital wallets.

Actually, in the span of a year (from 2019 to 2020), Apple Pay grew by 67 million users and reached 507 million users.

In the end, there will likely never be a universally accepted payment method, so it’s wise to make several options available, to cater to the widest range of customers.

The right mix will include credit and debit cards and several digital wallets (Apple Pay, Google Pay, Alipay), or even bank transfers like ACH.

Source: Super Website Builders

Basically, to maximize your sales efforts and reach more customers, it makes sense to allow them to pay with their preferred payment method.

Instill a Sense of Security in Your Customers

Experts project that e-commerce sales worldwide will grow to $5.4 trillion, with real-time payments annually growing by 23% from 2019 to 2024.

Unfortunately, as e-commerce sales increase, there is also a higher risk of online scams and fraud.

Source: Regpack

In fact, according to the Federal Trade Commission, victims of online shopping fraud lost $246 million in 2020.

Here are some of the most common scams:

| Identity theft | Criminals steal customers’ personal and payment information by impersonating a website or online shop. |

| Business email compromise | Scammers use social engineering and impersonate a supplier to convince customers to settle fake invoices on the scammer’s bank account. |

| Payment interception | Scammers take over transactions in the middle of the sales process. They often send links to customers to an unauthorized payment page. |

| Password or code hacking | Scammers use different strategies to access customers’ personal information. |

| Website takeover | Fraudsters hack into an online store through a plugin that they later use to change bank details and redirect online payments to a different account. |

As a result, customers are more careful to spend their money at online stores that don’t provide an adequate level of security.

So what can you do to improve your security and impact your bottom line?

It goes without saying that you should ensure your e-commerce platform is equipped with all the latest security standards and solutions to prevent fraud.

This means you need compliance with the 12 standards posed by PCI Security Standards Council (PCI SSC) and a Secure Sockets Layer (SSL) certificate.

That will signal to your customers that you’re a legitimate and safe business. Trust signals should make your customers feel confident that they are making a safe purchase.

Some of them include:

- The use of phrases like ‘’best price guarantee’’ or ‘’money-back guarantee’’

- Trust by association with a major partner or well-known endorser

- Membership trust

- Social proof (reviews, etc.)

- Policy information

For example, one way to instill trust is by inserting a badge with a security logo on your website, so customers know you’re taking their safety seriously. Here’s how Asos does it:

Source: ASOS

Finally, to actually ensure your customers will be protected against fraud, pick a payment processor that will have features like two-factor authentication, IP address verification, card verification code requirement, or EMV chips.

As scams and frauds become more widespread, it’s wise to show your customers that you have their safety in mind.

Once they know they can trust you with their personal information, they’ll be confident enough to complete transactions.

Make All Fees Visible

Additional fees are an important consideration for customers’ online purchases.

Most consumers look at advertised prices and get excited about a product, but once you list your delivery charges and other unexpected costs, they might end their checkout process prematurely.

Almost 85% of Americans reported encountering unexpected fees from services they used as a negative experience that resulted in businesses losing sales.

For example, one customer was shocked after he tried to book concert tickets which, instead of the promised $99.95, cost him $123 after additional fees.

Source: Regpack

The most obvious solution to this problem is to be completely transparent with your customers. If you have to add charges to the base price of the product or service you offer, clearly communicate the amount.

This is especially important if you have unusually high or varying shipping rates for international sales.

A good practice is to disclose this along with the product description, so customers can make an informed decision before they begin the payment process.

For example, when a customer clicks on a product, Amazon provides more information about shipping in two different places before adding the item to their cart.

Source: Amazon

Another great idea is to copy what the Australian sleepwear company Peter Alexander did on their online store. They have a dedicated section on their website to address different shipping prices and delivery dates.

Source: HelpScout

In both examples, the customer can see what and how much they’ll pay for their product to be delivered to their location. Since there are no surprises, if the customer decides to begin a purchase, he or she will be more likely to finish their transaction.

It boils down to this: customers will be drawn to your competitive prices and quality products, so don’t sabotage your payment process with hidden fees.

If you do, they might feel tricked and decide to terminate a transaction early.

Allow Different Payment Plans

Younger generations nowadays have less money to spend than previous generations.

Generally, individuals aged from 65 to 74 have an average bank balance of $8000, while individuals under 35 typically have $3200. In a nutshell, this significantly impacts customers’ ability to make purchases.

According to recent research by Sezzle, almost 55% of carts were abandoned because the final price of the goods was deemed too high. So, if your target customer falls in the ‘’under 35’’ category, this could be a significant issue.

But there’s a solution!

Because the customers are more aware of debt and high credit card interest, they’re increasingly looking for companies that allow more flexible payment plans.

This is where the Buy Now, Pay Later (BNPL) service becomes useful.

Source: Regpack

Basically, in this model, customers can make payments in several installments. They’ll pay the first one during the initial payment process and the others after three, four, six, or twelve months until the product is paid in full.

BNPL is increasingly popular because customers don’t have to pay interest or pass a credit check.

What does this mean for your business?

Let’s look at some research.

First, you can expect conversion rates of up to 30%. Allowing the customers to stretch out the payment for a product over several months increases the likelihood of them actually paying even if they’re in a tight spot.

Additionally, the average price of the purchased products also increases. Researchers have found that offering BNPL increased sales from 30-50%, on average.

Or, to put it differently, BNPL service makes expensive purchases affordable to more people, including those with smaller budgets. Ultimately, this also means you can reach a wider customer base.

Let’s take Rue21, an apparel retailer, as an example. Their key demographic consists of female customers aged 18-25, who don’t use credit cards.

When the company closed their stores during the pandemic, they needed to increase their online sales for shoppers without credit.

So, they added Klarna as a payment option and their average order volume has increased by 73%. Also, more than a quarter of purchases have been made through Klarna since May 2021.

To sum up, they sold more products after they allowed customers the option to pay in installments.

Source: Rue21

What you can take from this is that paying in installments gives the customer more purchasing power, options, and convenience regarding budget management. So if you want to increase your sales, adding a BNPL service is a great solution.

Our payment processing software, Regpack, also empowers you to manage payments through installments, so read more to take advantage of this feature in your onboarding and payment solution.

Provide Stellar Customer Support

What if your customers encounter problems during the payment process?

Some of the most common issues they can experience are:

- Declined credit cards

- Stolen cards

- Over-limit issues

- Large deposit issues

If these and similar problems are not dealt with quickly, you can face another surge of cart abandonment and loss of sales.

In fact, 60% of customers stopped doing business with a company if they had a bad experience with customer service.

On the other hand, if companies could solve their customer’s issues during the first interaction, they would retain up to 67% of customers, and 78% would become repeat customers.

So, it’s evident that good customer service is important during the payment process.

What you can do is offer ways for your customer to contact customer service during the payment process.

A great example is Nike, which provides a phone number and a live chat option in case a customer has additional questions or problems with their purchase.

Source: Bolt

Just like Nike, you also have to provide different options for your customers when contacting customer service. The more options you have, the better because customers want more options for their own convenience.

After that, make sure you understand the customer’s problem and solve it in a respectful and friendly manner.

This is essential since you want to guide them to end the transaction on your website, but also provide a great customer experience.

Actually, 67% of customers are willing to pay more if the company boasts great customer service.

Prioritizing customer service shows the buyers that you have their interest in mind, that you’re willing to cooperate, and that you’re trustworthy. These are integral ingredients in convincing the customer to come back.

Conclusion

Giving your customers a variety of payment options, disclosing all your additional fees, or providing different payment plans are great ways to create a seamless payment process and ensure that transactions get completed.

In turn, this can result in faster payments and higher-value sales, while prompting customers to come back.

Take the time and effort to communicate with your customers, help them, and cater to their needs and preferences during the payment process. That way, you’ll create a better experience for them.

So, start applying some of our tips today to improve your sales efforts and create long-term success for your company.