In today’s world, providing customers with a seamless online shopping experience is the key prerequisite for any business that wants to successfully sell its products or services.

Naturally, multiple payment methods and secure payment processing are two essential elements of that experience.

However, your payment processing software should also provide other vital features that can help you improve customer satisfaction, streamline your payment workflows, and grow your business.

Without further ado, here are eight features you should look for in payment processing software.

- Merchant Account Setup

- Multiple Payment Methods

- Multi-Currency Processing

- Mobile Payment Support

- Automated Recurring Payments

- Secure Payment Processing

- Payment Analytics and Reports

- Multiple Integration Options

- Conclusion

Merchant Account Setup

Setting up a merchant account is a feature of your payment processing software that enables your business to accept all forms of online payments directly on your website while avoiding third-party processing fees.

Simply put, a merchant account is specifically designed to handle electronic payments and process transactions from credit cards, debit cards, digital wallets, and other payment methods.

It acts as an intermediary between your customer’s payment card issuer and your business’s bank account.

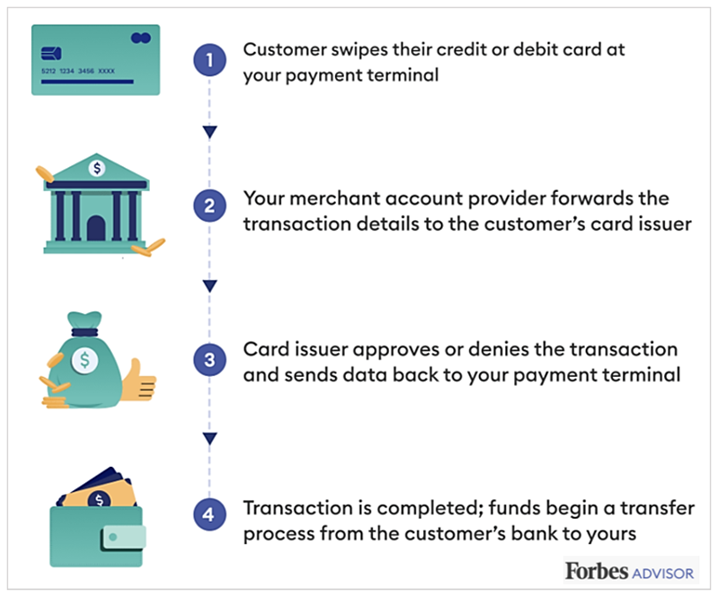

To illustrate, when a customer clicks the “Buy” button online or swipes their credit/debit card offline, this initiates the following process:

Source: Forbes

This process typically takes 1-3 business days, during which your customers’ card payments are held in your merchant account for payment security and processing purposes before they’re transferred to your business account.

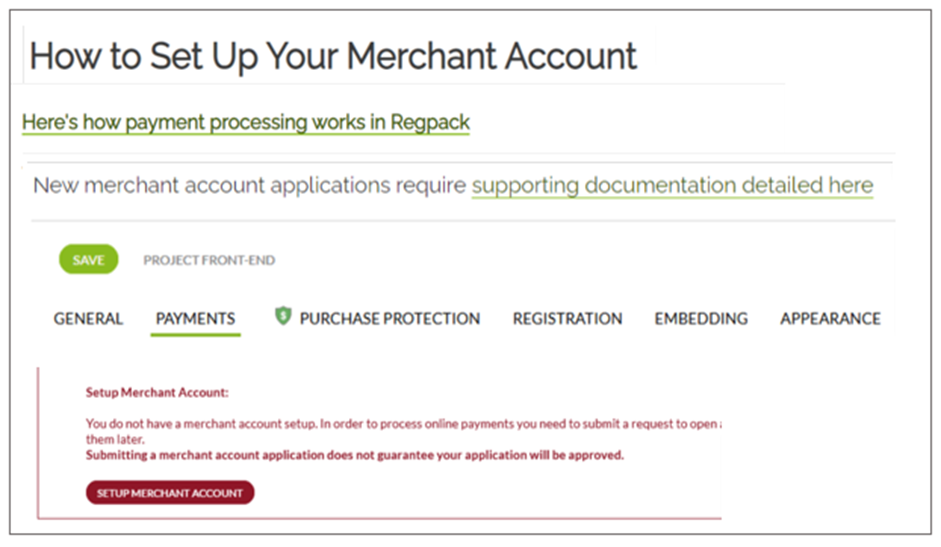

When your payment processing software offers merchant account setup, it means you can register an existing merchant account through the software, or apply for a new one, like in this example.

Source: Regpack

In other words, this feature facilitates the process of setting up your merchant account and enabling your business to accept online payments.

It should be noted that some businesses may elect not to have a merchant account but hire third-party payment processors like Braintree (by PayPal), Stripe, or Square to handle their card payments.

However, this usually implies higher payment processing fees, less control over chargebacks, and redirecting customers from your website to make their payments.

Therefore, you should look for payment processing software with integrated merchant account setup options as that will enable your business to accept electronic payments directly on your website and enjoy lower processing fees.

Multiple Payment Methods

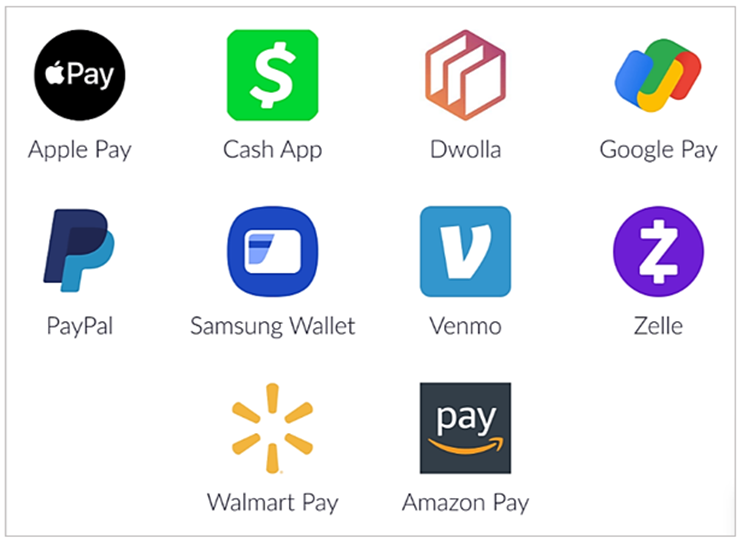

Naturally, you want your payment processing software to support a wide range of payment methods so you can offer your customers more convenient payment options, increase their satisfaction, and boost your revenues.

In other words, although your business will probably only use a limited number of payment methods, your initial selection might change over time, and your software should be able to seamlessly integrate such changes.

For example, as your business grows, you might want to offer a broader range of digital wallets like Apple Pay, Google Pay, or Alipay to cater to younger and/or international customers.

Source: Geniusee

Considering how customer preferences and market trends change over time, being able to easily integrate and enable such additional payment methods within your payment processing software without any disruptions to your existing payment workflows is crucial.

This flexibility will allow you to:

- initially select payment methods preferred by your target customers, which can prevent shopping cart abandonments, improve customer retention, and increase your business’s cash flow

- adjust your selection according to evolving customer demand and your business’s preferences (including specific conditions and processing fees charged by payment providers like credit card companies or digital wallet providers)

Overall, the ability to offer multiple payment methods and seamlessly integrate any future changes is a key feature that allows you to provide your customers with a targeted range of convenient payment methods that ultimately lead to higher revenues.

Multi-Currency Processing

Multi-currency processing refers to your payment processing software allowing customers to pay in their currency.

Likewise, it refers to your business receiving such payments in the currency of your choice without worrying about unfavorable currency conversion rates or hidden fees.

Of course, this feature becomes increasingly important when your business plans to sell its services or products to customers around the world.

Source: Regpack

Naturally, by allowing your customers to pay in the currency they want, you’re localizing their shopping experience, which can help build trust and increase customer retention.

Therefore, your software should enable multi-currency payment processing while your software provider should keep you informed of all conversion rates and fees as they change over time.

Additionally, your provider should appoint a dedicated account manager and/or support team experienced in handling any currency conversion or processing issue that might come up.

To recap, this feature of your payment processing software allows you to accept online payments in different currencies, making it crucial for boosting international sales.

At the same time, your software provider should ensure a transparent conversion cost structure and help you address any potential multi-currency processing issues.

Mobile Payment Support

Mobile payment support is a combination of functionalities your payment processing software should provide that cater to the increasing number of customers who prefer making purchases through their mobile devices.

In other words, the software’s interface and checkout experience should be optimized not only for desktops and laptops but also for different smartphones and tablets.

For starters, this means your software should be designed to work seamlessly on popular mobile platforms like iOS and Android.

Source: BuildFire

Other than this general compatibility, your mobile-friendly payment processing software should—as we already discussed—support different mobile payment methods like digital wallets.

Your software provider should also provide robust security measures and encryption protocols to protect sensitive customer information during mobile transactions.

All in all, proper mobile payment support means your customers will enjoy the same level of convenience and security regardless of whether they’re buying your products and services on their computer, smartphone, or any other device.

Automated Recurring Payments

This is an essential feature for any business that offers subscription or installment payment plans and wants to automate its billing and payment processing operations for customers making recurring payments.

From the customers’ perspective, automated recurring payments provide convenience and ease of use since they—once they’ve paid the first installment of their subscription and agreed to be regularly billed—don’t have to remember to make payments manually.

Instead, their bank account/credit card is charged automatically, and they receive an upcoming payment reminder and a payment confirmation email with an invoice, ensuring a seamless and hassle-free experience.

Source: Microsoft

Naturally, this convenience enhances customer satisfaction and helps increase customer retention rates.

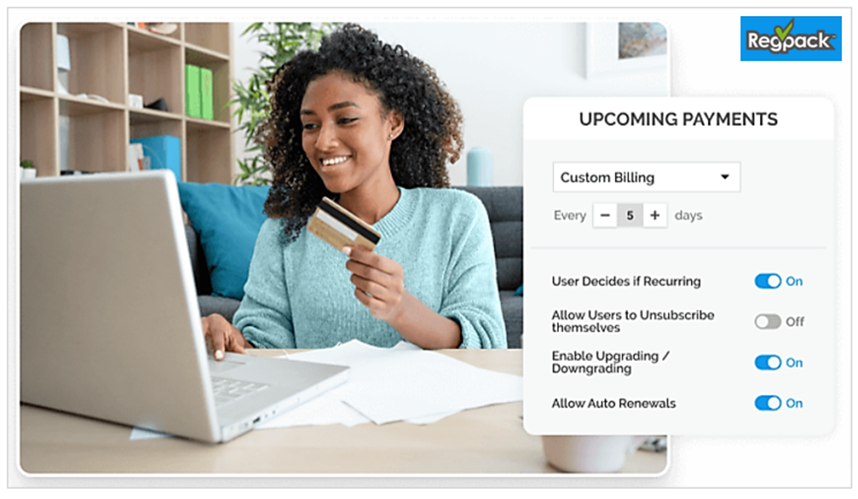

From your business’s perspective, automated recurring payments—as an overarching feature—allow you to automate workflows related to pricing plans, payment schedules, invoicing, payment collection, and late payment (dunning) management.

For instance, our payment processing software, Regpack, enables you to set a range of different parameters for recurring payments, like in this example:

Source: Regpack

Simply put, Regpack allows you to automate your customer onboarding, billing, and payment processes from start to finish.

This includes customizable payment forms embedded on your website, custom payment plans for your customers (including upgrades/downgrades, discounts, and free trials), automated electronic invoicing, and payment collection management.

Considering that Regpack has all the other features described here, it serves as an excellent example of a user-friendly and affordable payment processing software geared toward service-based businesses.

To recap, automated recurring payments are a crucial feature that enables your business to set and manage automated recurring payment processes, minimize manual data entry and errors, and provide your regular customers with a seamless user experience.

Secure Payment Processing

As we established, the right payment processing software should provide your customers and your business with a seamless payment processing experience.

A critical component of providing this service is secure payment processing or, in other words, protecting all involved actors from cyberattacks, data breaches, identity theft, and card fraud.

Generally speaking, by using payment processing software, you’ll be outsourcing a significant part of your business’s overall IT system security measures (and their costs) to the software provider.

To rephrase, your provider is responsible for ensuring their software encrypts, securely transmits and safely stores sensitive customer identification and payment data (e.g., credit card numbers) in compliance with the highest data security standards.

Source: Regpack

Naturally, because your software provider specializes in streamlining payment processing workflows, they’ll typically use a range of advanced security protocols and multiple security measures like encryption, firewalls, fraud detection, and two-factor authentication.

To sum up, it’s clear that secure payment processing is a key feature that ensures a seamless customer experience, reduces the risk of data breaches and fraud, and outsources some online security requirements and costs to a reliable software provider.

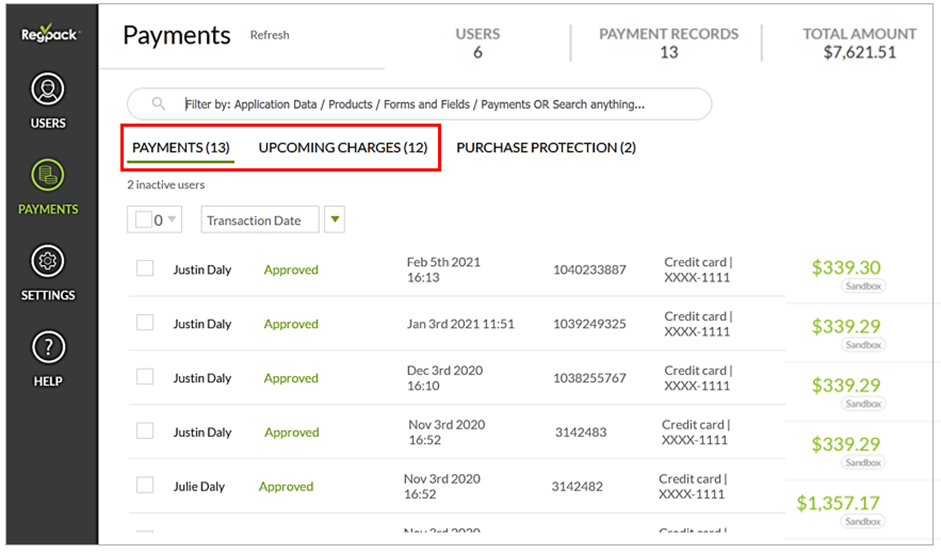

Payment Analytics and Reports

In addition to smoothly connecting different components of your payment processing workflows, from invoicing to late payment management, your payment processing software should provide payment analytics and reports.

In other words, once the software system is set up, you can track payments in real time, analyze different payment data, and generate custom payment reports.

For starters, you can pull up the payment status of all or specific customer groups and see who is late with their payments, allowing you to investigate further and consider appropriate payment management measures.

Source: Regpack

Beyond that, you can filter your customers and their payment records according to criteria like the initial purchase date, specific service/product, or certain information in their application forms.

The point is that analytics and reporting enable you and your team to gain valuable insights into your customers and your business, allowing you to make data-backed, better-informed decisions.

You can use this feature to identify the most popular pricing plans, calculate customer retention rates by service/product, determine the percentage of timely and missed payments, and much more.

Naturally, your accounting department will also enjoy time savings and simplified financial reporting processes.

Given the benefits that can be derived from their smart use, easy-to-use payment analytics and customizable payment reports represent another must-have feature of your payment processing software.

Multiple Integration Options

Last but not least, your payment processing software should offer multiple integration options that enable you to connect it with other software systems your business is using.

By enabling communication between different software solutions, you’re ensuring that data across multiple applications is updated in real time without the need for manual updates.

This saves time and prevents errors stemming from one system not having the same, up-to-date info as the other (until they’re manually updated).

The most typical candidate for integration with your payment processing software is your accounting solution, followed by customer relationship management (CRM) software.

Integrations usually come in the form of an open application programming interface (API) that enables integration between different business applications.

Source: Regpack

Although API-based integrations typically require some programming expertise, your provider should offer integration support in various formats (e.g., automated integration wizards, how-to videos, dedicated live support team) to simplify the process.

The ultimate result will be that your employees will work with the latest data regardless of the software system they’re using, thus not having to check or worry whether that data is accurate.

For example, if a client misses their payment for any reason, your payment processing software will record that fact and automatically send notifications to your accounting and CRM software.

As a result, this info will be instantly available to any team members responsible for monitoring and managing payment collection when they access any of these systems.

All in all, multiple integration options enable your business to automate and streamline payment workflows outside the bounds of your payment processing software, thus ensuring cross-software synchronization of data in real time.

Conclusion

To summarize the main points, the eight features of your payment processing software that we’ve listed here will enable your business to organize and automate not only payment processing operations but all billing and payment workflows.

Ultimately, your staff will be able to work more efficiently, avoid many errors associated with manual entry or non-synced data, and set payment parameters according to your business’s needs and customer preferences.

Concurrently, your customers will be able to choose their payment plan and preferred payment method and generally enjoy a seamless checkout experience, which will help your business attract and retain customers, increase cash flow, and improve profitability.