Payment failures can frustrate your customers, disrupt cash flow, and create unnecessary stress for your team – but they don’t have to. Understanding why payments fail and how to manage them is key for organizations that rely on online payments.

Whether managing events, courses, camps, or programs, avoiding payment failures improves the customer experience and guarantees financial stability.

What Is a Payment Failure?

A payment failure occurs when a transaction cannot be completed. This typically happens when a customer’s credit card, debit card, or payment method is declined during the payment process. These failures can occur at any point in your workflow, from initial registration to recurring installment payment agreements.

Payment failures can involve:

- Card transactions (e.g., credit card payments)

- Bank transfers or deposit account payments

- Recurring subscriptions

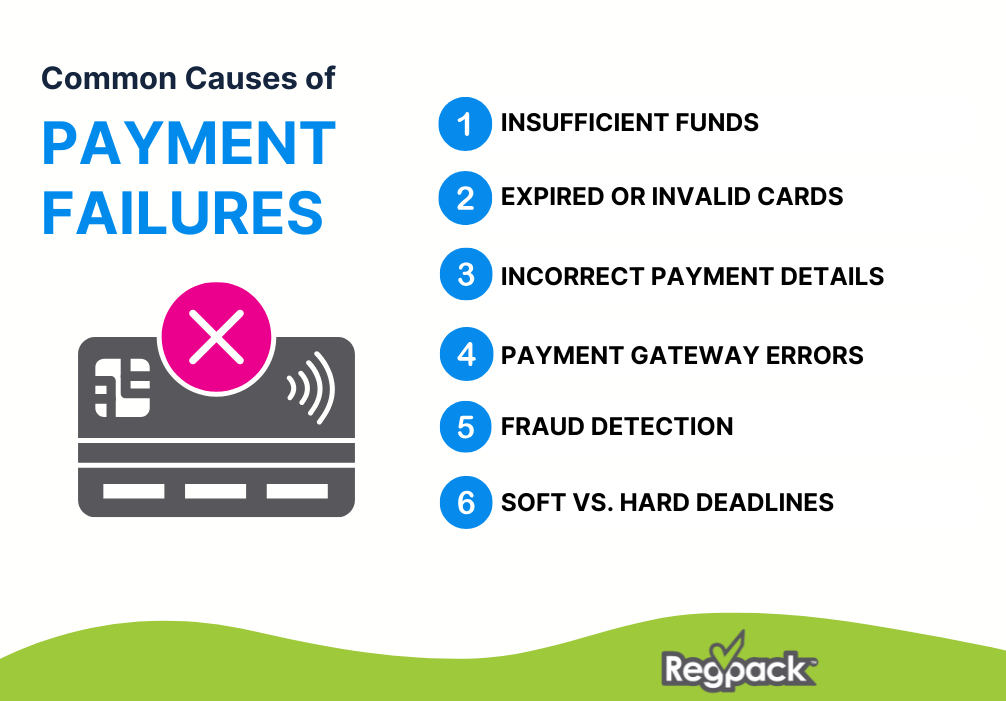

Common Causes of Payment Failures

Understanding the reasons behind a failed payment is the first step toward solving it.

Here are the most common causes:

1. Insufficient Funds

If the participant doesn’t have enough money in their deposit account or their credit limit is maxed out, the card issuer will decline the payment.

2. Expired or Invalid Cards

When the expiration date on a card passes, or the card has been replaced, payments fail automatically.

3. Incorrect Payment Information

Mistakes like entering the wrong credit card details (e.g., CVV code, billing address) can cause an error message and a decline code.

4. Payment Gateway or Processor Issues

Technical errors with the payment gateway or payment processor can lead to a failed transaction.

5. Fraud Protection and Security Threats

Banks and financial institutions use fraud detection systems to flag suspicious card transactions, sometimes resulting in a declined payment.

6. Soft Declines vs. Hard Declines

- Soft Decline: A temporary issue (e.g., insufficient funds, network error) that might succeed upon retry.

- Hard Decline: Permanent failures, like incorrect credit card details or blocked cards.

Source: Regpack

7. Recurring Payments and Involuntary Churn

For organizations with a subscription business, recurring payments can fail due to expired cards, changes in billing details, or insufficient funds. These failures can result in involuntary churn, where customers unintentionally drop off.

Why Payment Failures Matter for Your Organization

Payment failures have significant consequences, particularly for event organizers, education providers, and subscription-based businesses:

- Cash Flow Disruptions: Failed payments delay revenue, making it harder to plan budgets, pay bills, or allocate resources.

- Frustrated Customers: A declined payment can cause a frustrated customer, leading to dissatisfaction or even drop-offs. They may abandon registrations or events altogether.

- Administrative Overload: Chasing down failed payments, sending reminders, and collecting additional information create extra work for your team.

- Program Delays: Unresolved payment failures can result in event delays, cancellations, or limited access to services.

How to Minimize and Manage Payment Failures

Here are proven strategies to prevent and manage payment failures effectively:

1. Send Automatic Payment Reminders

Set up automated reminders before the due date and after a failed transaction. Sending an email with clear next steps can help customers update their credit card details or choose a different payment method.

2. Offer Multiple Payment Options

Expand payment options to include:

- Credit card and debit card payments

- Bank transfers

- Flexible installment payment agreements Offering alternatives ensures customers have a fallback if their preferred payment method fails.

3. Implement Payment Retry Logic

Use systems with automatic retry features for soft declines. For example, a payment processor can attempt to process the payment at scheduled intervals.

4. Proactively Address Expiring Cards

Identify cards nearing their expiration date and notify participants to update their payment information. Automated systems like Regpack make this process seamless.

5. Communicate Clearly with Customers

If a payment fails, send an email explaining the issue and providing clear instructions. Avoid technical jargon and be empathetic to avoid a frustrated customer.

6. Simplify the Payment Process

A complicated checkout process increases errors. Ensure your payment gateway is mobile-friendly, secure, and easy to navigate. Use real-time validation to catch mistakes in payment details.

7. Ensure Secure and Reliable Systems

Work with trusted payment gateways and card networks to reduce downtime and security threats. Secure systems also help prevent fraud and ensure customer trust.

The Role of Technology in Handling Payment Failures

Technology is key to reducing administrative burdens and improving the payment process.

Platforms like Regpack automate many steps involved in managing failed payments:

- Automated Follow-Ups: Instantly notify customers of a failed transaction and allow them to retry or provide additional information.

- Flexible Payment Processing: Regpack supports multiple payment options and flexible plans, like installment payment agreements.

- Advanced Reporting: Gain insights into declined payments, track recurring issues, and resolve failures quickly.

- Payment Retry Logic: Regpack automatically retries payments based on optimal intervals, reducing manual follow-ups.

Tips for Communicating with Participants About Failed Payments

Clear communication is critical when handling a declined payment.

Here’s how to approach it:

- Be Empathetic: Use polite, helpful language when addressing the issue.

- Offer Solutions: Provide a step-by-step guide for updating credit card details or using a different payment method.

- Send Personalized Follow-Ups: Use participant names and include specific payment details for a professional touch.

Example Email: “We noticed your recent credit card payment didn’t go through. This might be due to an expiration date, insufficient funds, or other technical issues. Please update your payment information here [insert link] to continue enjoying our services.”

Prevent Payment Failures Before They Happen

Here are proactive steps to reduce payment failures:

- Collect Accurate Payment Information: Validate credit card details during registration.

- Enable Auto-Pay: Simplify recurring payments for your customers.

- Update Systems Regularly: Work with reliable payment processors to prevent downtime.

- Educate Participants: Inform users about updating cards and avoiding late payment penalties.

Payment failures are an inevitable part of managing online payments, but with the right tools and strategies, they can be minimized. By understanding the causes, automating follow-ups, and offering flexible payment options, your organization can improve cash flow and provide a smoother customer experience.

Simplify Payments and Reduce Failures

Learn how Regack can streamline the payment process, from handling failed transactions to automating reminders and retires. Don’t let payment failures disrupt your programs – take control today.