For a business of any scale, a payment processing strategy is one of the main factors that can spur growth, profitability, and success.

Having an ineffective processing system, failing to consider the security and the needs of your customers, or disregarding the importance of customer data can all be signs that your payment processing strategy needs to be optimized.

In this article, we’ll examine some good practices for optimizing your payment processing strategy and bringing it up to speed with the rest of your business.

Jump to section:

Get Familiar With Payment Processing Systems

Look Beyond Credit Cards

Manage Customer Data

Understand and Reduce Fraud

Keep Your System Updated

Get Familiar With Payment Processing Systems

The first step towards an optimized payment processing strategy is becoming aware and well versed in the different payment processing systems at your disposal.

By learning about your options for payment processing, you can make an informed choice and pick a system that suits your business needs.

While it’s true that most payment processors are fit for any kind and size of business, not every business would benefit the same from every payment processor.

In essence, payment processors authorize and process payments so that customers can securely and seamlessly buy products or services.

They have other elements too, so it’s good to collect all the relevant information about them and their features.

Source: Regpack

A good place to start is with the prices of different payment processors. An obvious strategy would be to pick the cheapest one, but there’s no guarantee that it will meet your needs.

Keep in mind that, in addition to the monthly fee and the cost of the initial setup, there are costs in every transaction that goes through the payment processor, like, for example, interchange and markup from the banks or the processing fee from the provider itself.

Take those fees into account when making a decision. For example, if you have high-value transactions, you might benefit more from a system with a higher fixed monthly fee but a lower transaction fee, and vice versa if the situation is different.

Besides pricing, you could also consider the services you would like to offer to your customers and choose a payment processing system according to that.

For example, suppose foreign clients are a big part of your business. In that case, you could consider offering them a wide variety of payment options in addition to familiar staples like credit or debit cards.

Also, if you have a significant number of clients that prefer checks or bank transfers, look for a payment processor that can offer you those options.

You can consider other factors like fraud protection, customer service, access to your funds, etc. Payment analyst Melissa Johnson suggests having a list of “deal-breaker” features that you must have and a list of “nice-to-have” features.

Source: Regpack

In any case, familiarizing yourself with payment processing systems can help you optimize and customize the payment process according to your customers’ needs, as well as yours.

Remember, you’re not just looking for a piece of software; you’re looking for a partner whose job it is to protect your revenue.

Look Beyond Credit Cards

The days of offering nothing more than a few credit cards as payment options are over if you want to stay relevant in your business. To truly optimize the processing of collecting payments, you need to offer alternatives to your customers.

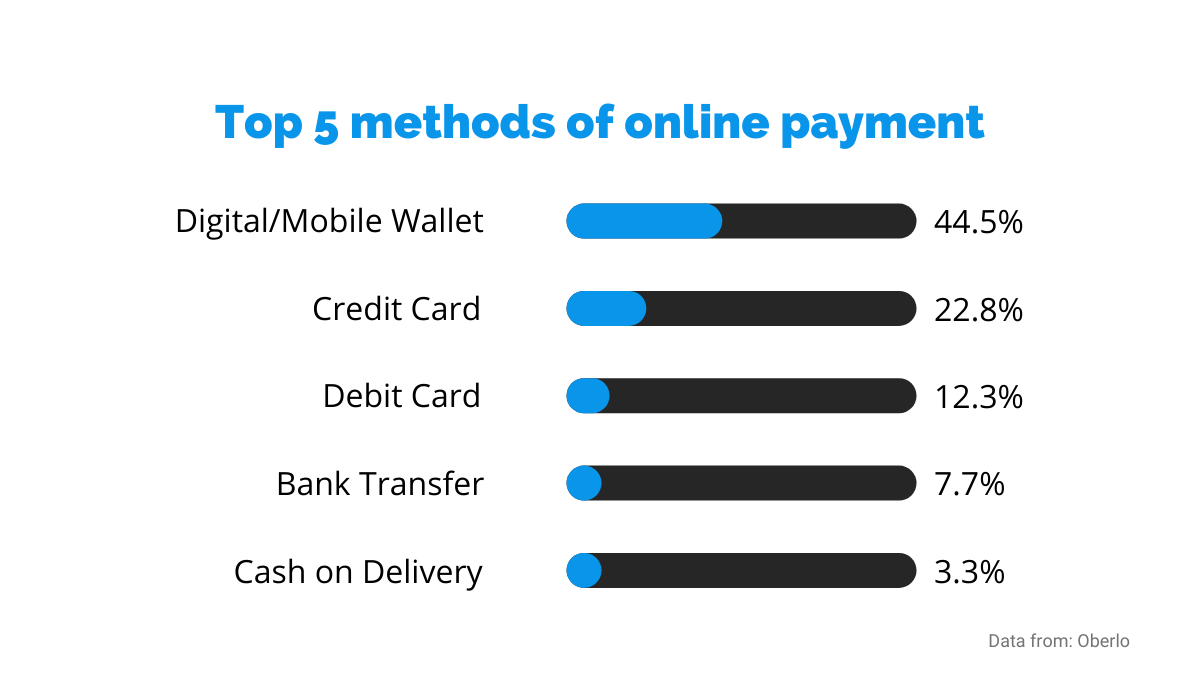

Of course, there’s nothing wrong with credit cards as a payment method. After all, according to the data from Oberlo, they are the second most preferred method of online payment worldwide, so they’re an option you should definitely offer your customers.

Source: Regpack

As you can see above, credit cards are still going strong, and many of your customers use them regularly.

However, regardless of the business you’re in, you can be sure that lots of your customers want the convenience of being able to use their preferred method of payment.

For example, 42% of US customers say they would go to another business if they couldn’t pay the way they wanted to.

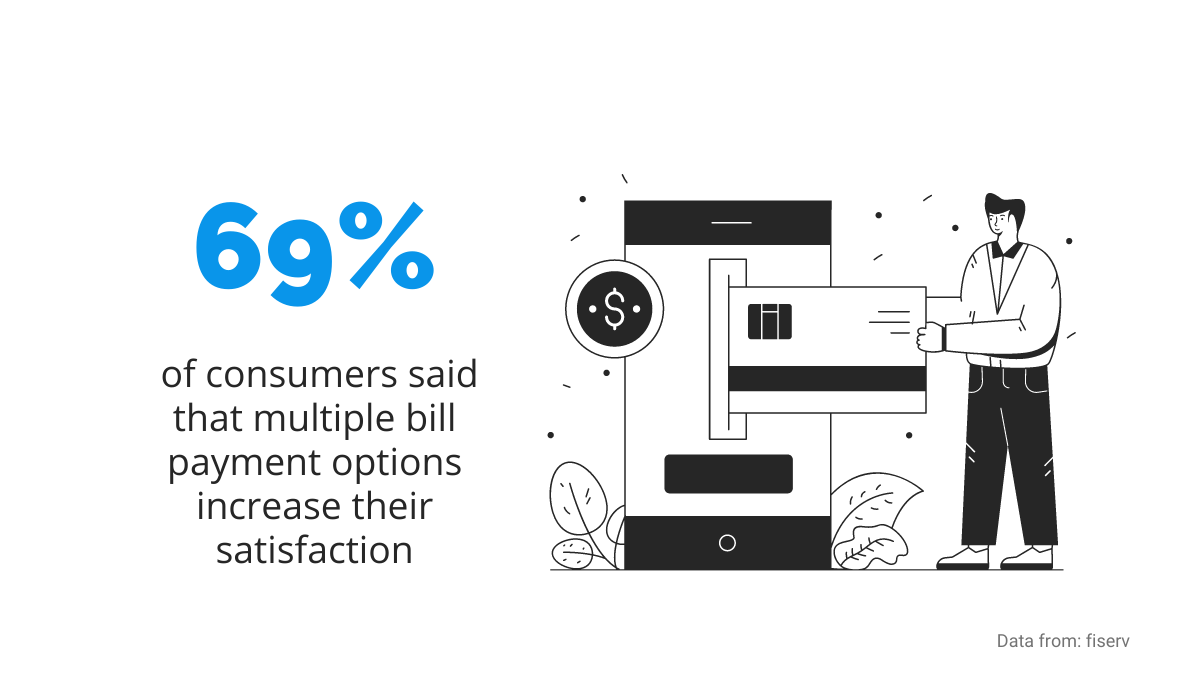

In other words, you can keep more customers by offering more payment options, and they’ll be more satisfied with your service—the data from a survey by Fiserv suggests so.

Source: Regpack

Taking all that into account, to optimize your payment processing strategy, you should look for a versatile payment processor that offers a variety of options.

And there can never be too much that you can offer. Look beyond credit cards and consider including mobile payments, checks, bank transfers, cash, etc.

You offer your customers convenience by covering more options, and they’ll have one less reason to go to your competitor.

Whichever options you choose, don’t forget about e-wallets like Paypal, Venmo, or Google Pay. As you can see in the graph we’ve referenced above, it’s the most popular payment method, and the forecasts predict that it’ll only rise in popularity even more.

When you’re planning to optimize your payment processing strategy, you should consider offering e-wallets.

It would also be a good idea to research your market and familiarize yourself with the preferred payment methods in different countries.

For example, if many of your customers are based in Asia, including Alipay and WeChat is a must if you want to retain them.

Also, if you’re doing your business in Eastern Europe, allowing cash payments would be wise; according to research, in Slovakia, for example, 72% of online purchases are paid via cash-on-delivery.

In short, offering a variety of payment methods can be your driver of success; you can increase customer retention and satisfaction, which leads to more revenue for your business.

Manage Customer Data

If your customers mostly use online payment methods, you have a treasure trove of data available. To optimize your payment processing strategy, you should consider managing that data and taking advantage of it.

When you accept online payment from your customer, the data is collected automatically as long as you have the necessary tools. Payment providers sometimes offer data collection and analytics tools, but there are also separate platforms that you can use for that.

However you do it, it can be very beneficial to your business.

Collecting and analyzing data is a great way to learn about your customers and their behavior, preferences, and potential problems they face when going through your payment process.

With a foundation like that, you can take action and efficiently optimize the processing strategy of your payments.

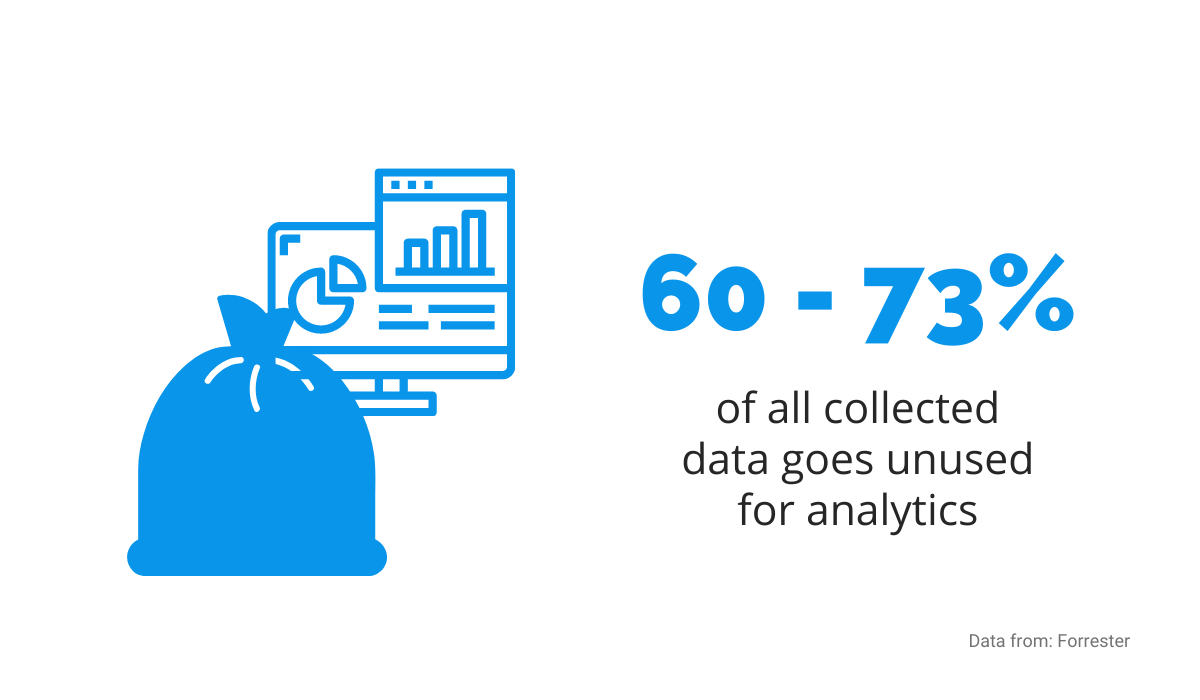

By analyzing your customers’ data, you turn it into actionable information, which is crucial to moving forward. It’s easy to forget that part; unfortunately, according to research by Forrester, most collected data doesn’t get used for analytics.

Source: Regpack

With managing customer data, you can therefore learn valuable insights—how many of your customers are regulars, how do customers move through the payment process, where are the friction points?

Those are just a few pieces of information that can be vital for your business.

Some of the most important information you can collect pertains to the reasons payments fail.

For example, by managing customer data, you can see how many payments were unsuccessful and see if the reasons are on the customer’s end, like expired credit cards or incorrect payment information.

On the other hand, if the failed payment reasons are mostly due to a bad user experience or an inefficient payment processing system, you can take the necessary steps to fix those problems.

Also, by managing customers’ data, you can see what payment methods are used the most and optimize your payment process accordingly. For example, if some methods are almost never used, you can save money by removing them, reducing the support cost.

Luckily, managing customer data doesn’t require a mile-long Excel spreadsheet anymore; more efficient and accurate solutions are available.

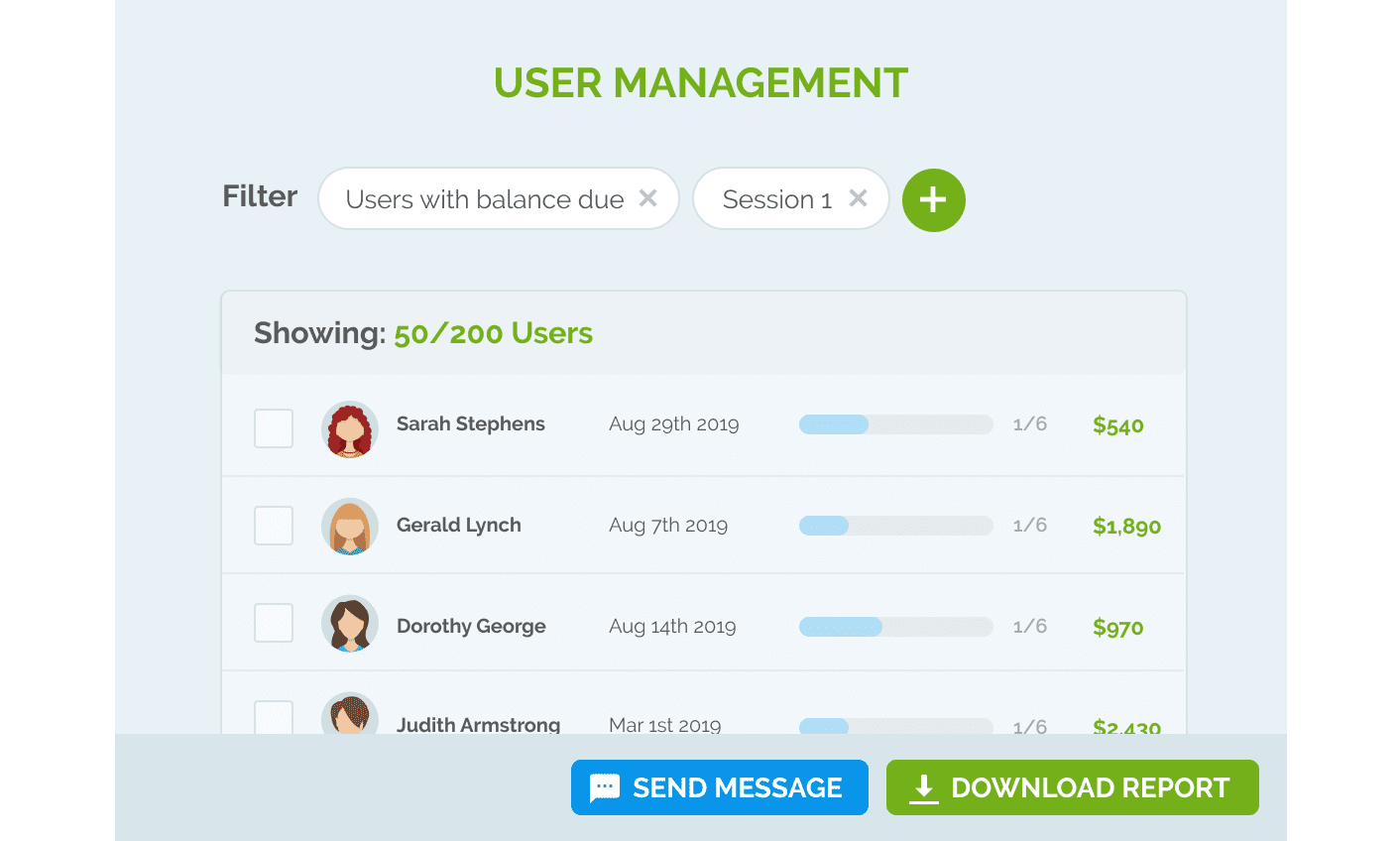

For example, with an automated payment solution like Regpack, you can create a database of your customers, filter the data, organize it and analyze the way you want to.

Source: Regpack

Regpack is also a payment processing solution, so it offers everything in one package. Your customers pay you through it, and you can pull up payment data, create payment reports, track your revenue and get the financial insight you need.

Customer data is one of the most valuable resources in the world, if not the most valuable, according to one report. If you manage it and use it for optimization and improvement, it certainly can have a significant positive impact on your payment processing strategy.

Understand and Reduce Fraud

When optimizing the payment processing strategy, you should be aware of the possibility of fraud.

If your payment process is vulnerable to scams and breaches, neither you nor your customers can have a pleasant experience, to put it mildly.

Fraud can cost you money, but more importantly, it can drive your customers away.

And you couldn’t blame them; who would want to do business with a company that can’t prevent data breaches and risks compromising their customers’ sensitive information?

Therefore, to build long-lasting relationships founded on trust with your customers, you should tackle the problem of fraud.

Be aware that credit cards are especially vulnerable to fraud. According to the Nilson report, card fraud losses reached 28.58 billion dollars worldwide in 2020.

Source: Regpack

According to the Federal Trade Commission, credit card fraud is the leading form of identity theft.

Since you most likely have credit cards as an option for payment in your business, your payment processing strategy should have security measures to prevent people from using stolen credit card information.

There are multiple credit card fraud schemes. For example, credit card tumbling uses complex algorithms to create random credit card numbers and test them on websites until they find a bank account attached to them.

Also, there’s refund fraud, where the fraudsters pose as their victims and collect a refund for a purchase.

But often, it’s simply a case of a stolen credit card or credit card information that someone uses to make a purchase.

You can ensure your payments are conducted securely by choosing a payment processor that’s secure and reliable and has encryption protocols during transactions, as well as customers’ data encryption.

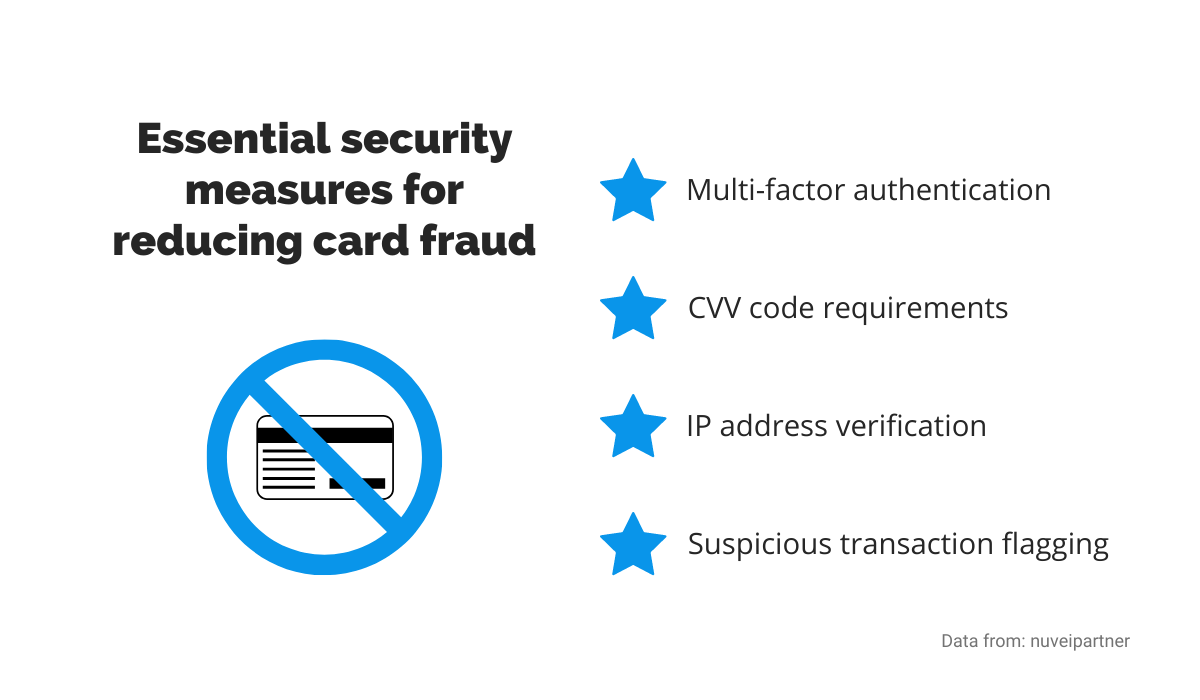

Below you can see what protection you should provide during credit card transactions. These aren’t the only methods that exist, but they’re the most common and offer a good baseline of protection.

Source: Regpack

For example, even if someone has your credit card number, they would also need to have a CVV number to make a purchase. Besides that, with IP address verification, your payment processor matches the IP address with the address on the customer’s credit card.

Even credit card tumbling can be reduced with minimum transaction limits, which would prevent fraudsters from testing credit card numbers with micro-purchases.

And multi-factor verification is already a security staple; the customer has to verify their identity by responding to an email or text message.

You can use all of the mentioned methods to reduce fraud. When you’re optimizing your payment processing strategy, amping up the security and fraud prevention levels should be on top of your list.

Keep Your System Updated

Keeping your payment system updated is an important element of an optimized payment processing strategy. By staying on top of that, you can prevent all sorts of potential problems.

If your system is up to date, you minimize the chances of payments failing because of issues with the system itself.

For example, an out-of-date system may not be able to process a new credit card, or it could glitch because of the piece of data it cannot manage—and that certainly isn’t good for your payment processing strategy.

Functionality is especially important for a payment processor, which is in charge of financial matters; for instance, if your software is not processing payments or it’s randomly crashing, that can bring the whole business to a halt before you manage to resolve those issues.

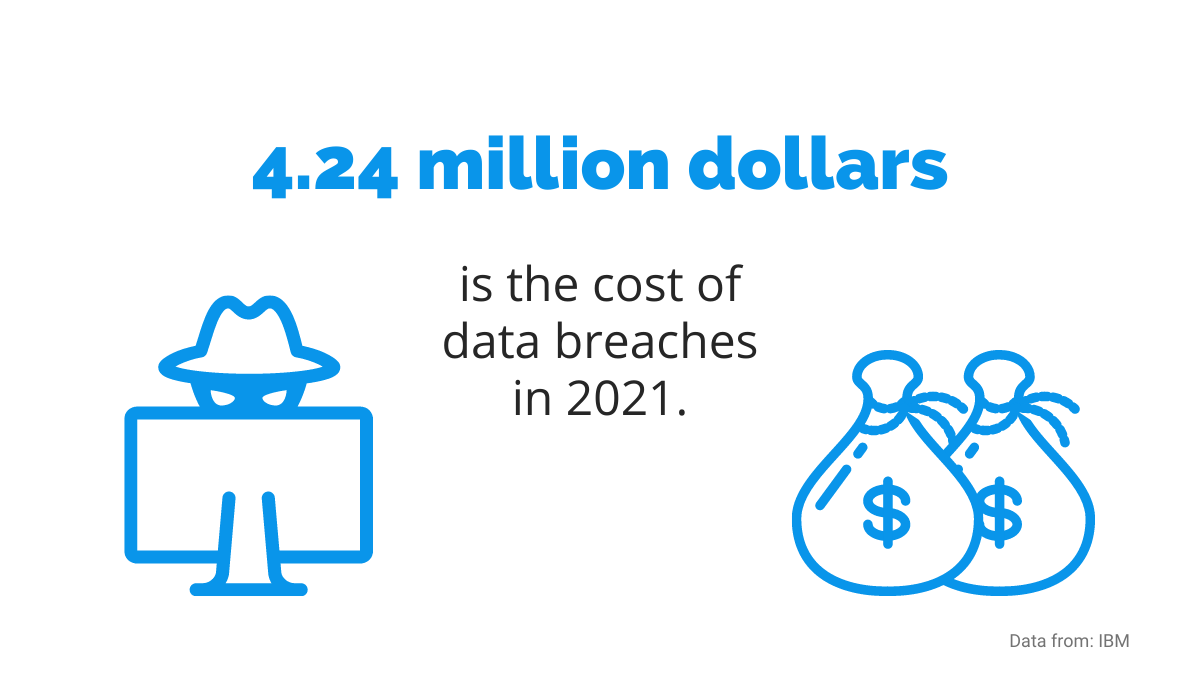

One more important factor to keep in mind regarding system updates are the security benefits. If you’re not updating your operating system or payment software, you leave yourself open to data breaches and cyberattacks.

And that doesn’t happen only in the movies. The costs of data breaches in 2021 amounted to 4.24 million dollars, according to IBM’s report—the highest amount in 17 years.

Source: Regpack

The customer data that payment software can store, like personal and bank account information, is especially enticing to hackers; that’s one more security reason for regularly updating your software.

Besides that, updates often provide various new features that improve the system’s functionality. Having a functional and efficient system is vital to optimizing your payment processing.

For example, Regpack regularly issues updates for their software. They improve different features, add new ones, or sometimes just optimize them for a better user experience.

Source: Regpack

For instance, one of the latest updates included filtering users by items in their cart, which is a helpful feature for analyzing customer behavior.

Keeping your system updated can regularly bring you practical options like that, leading to a more optimized payment process.

Luckily, keeping your system updated isn’t complicated. Some payment solutions automatically update and present you with a list of new and improved features.

However, it’s a good idea to regularly check for updates yourself to avoid missing any new versions that may have rolled out.

Keeping your payment processing system up to date is vital in holding the reins of your business. If you want to optimize your payment processing strategy, keeping your system in top shape is an essential first step.

Conclusion

Customers today have big expectations from companies they entrust their money with.

Every part of their experience has to be smooth and pleasant, from the first interaction to the last, including the payment process.

Optimizing your payment processing strategy should be at the top of your list of ways to grow and strengthen your business, and you can do it by following the tips in this article.

With a good payment process, you can ensure that your existing customers will stay with your business and that you’ll attract new ones. And that’s a great way to propel your success.