As a small business owner, one of your main responsibilities is to manage customer billing. You have to send invoices and make sure that your customers are settling their bills on time to keep track of cash flow properly.

In theory, this should be an easy process, but sometimes problems can occur, and you have to mitigate them quickly to keep your business in operation.

Sometimes clients don’t pay on time, your invoices have inaccurate data, or you end up sending the invoice to the wrong person. Even the smallest problem can snowball and delay payments.

Luckily, you can adopt some best practices today to improve the billing process, ensuring that you get paid on time and strengthening the relationship with your customers.

So, read on to find out more.

Jump to section:

Making Your Invoices Look Professional

Always Having Accurate Data

Paying Attention to the Recipient

Customizing the Billing Cycle

Establishing a Non-payment Policy

Tracking Your Invoices Diligently

Making Your Invoices Look Professional

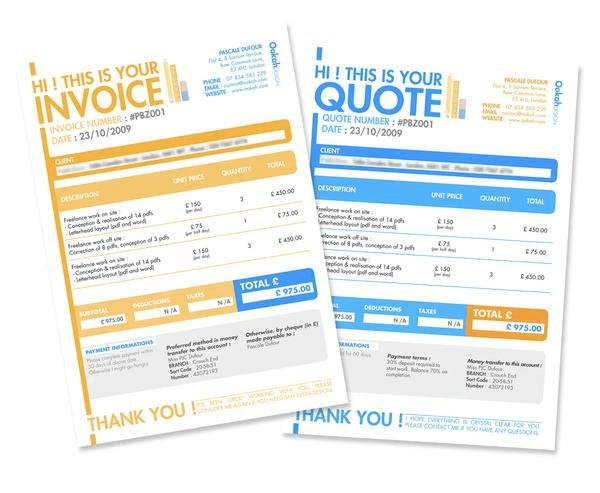

The purpose of an invoice is to deliver the right information to your customer so that they can pay you what they owe you. So, why is it important to put in the effort to make it look nice?

First of all, it can be a marketing tool to show your professionalism.

You want to be taken seriously as a business, so taking the time to personalize a necessary document is one way to tell the customer they’re dealing with a detail-oriented, efficient, and qualified company.

The logo, signature colors, font, and layout are essential elements that will make your invoices unique and direct the customer’s attention to the most important parts of the document.

Additionally, it makes you memorable to the customer and incentivizes them to pay you faster.

If you think you don’t have the required skills to design them on your own, there are a lot of free templates available that can lead you in the right direction.

Maybe you want something minimalistic, clean, and functional to demonstrate your reliability and professionalism?

Source: Fit Small Business

Or maybe you want to appear friendly and approachable with a more bold and playful look?

Source: Fit Small Business

Whichever approach you adopt, it’s important to remember that invoices should be organized and accurate. This means they should highlight all the necessary information while looking presentable to the recipient.

Customers need to be able to read them easily and check the payment information at first glance. So, don’t forget to include the following:

- Business info (your company’s and the customer’s)

- Invoice number

- Issue and due dates

- Description of the service

- Price

- Total and subtotal

- Additional charges

- Payment details

In the end, with some clever design, you can create functional and beautiful invoices that will enhance the experience of doing business with you for the customer.

Always Having Accurate Data

Your invoices won’t seem professional if they are full of mistakes, grammatical errors, or inaccurate data.

Not only does this kind of carelessness make you look bad, but it can also seriously jeopardize your relationship with your customer, especially if you end up overcharging for your services.

You don’t want to create confusion that could lead to a dispute and delay your payment.

Or even worse, give the customer a reason to doubt your competence and stop doing business with you.

Here are five things you should look out for before you send your invoices to customers:

| Correct final amount due | You have to factor in promotions, taxes, or discounts to avoid overcharging or undercharging the customer. |

| Appropriate services are listed | Explicitly state in understandable terms what kind of work was done and which services were provided. This could help avoid confusion between your customer and their accounting department. |

| Two company contacts | Pay attention to the correct names and telephone numbers on the invoice. One should include your company’s information and the other your customer’s (or the person who authorized the purchase at the customer’s company) |

| Send to the right person | When you’re doing business with a large organization, invoices must be sent to the right person in the right department. |

| Updated payment information | If your company moved offices or you operate in multiple locations, make sure your customers know where to send their payments. |

Remember, mistakes can happen, but you should nevertheless do your best to minimize them. So, always check if you have your numbers right and that you addressed the invoice correctly.

Paying Attention to the Recipient

The fact that you have to make sure that your invoice reaches the right recipient is self-explanatory, but it’s even more important when the payment situation isn’t entirely straightforward.

For instance, sometimes, the person you’re in contact with won’t be the same person that pays for your services in the end. Maybe they have an in-house accountant, or they’ve outsourced their billing.

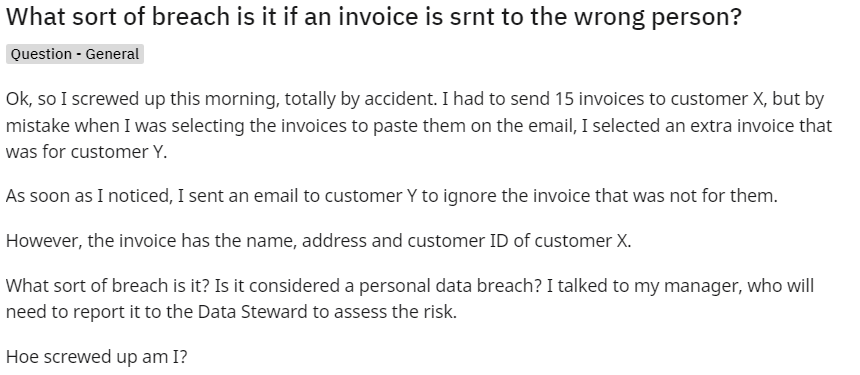

Or in some cases, you might be juggling many customers at once, and mixing up email addresses becomes too easy.

Source: Reddit

Now, what happens if you send an invoice to the wrong person?

There are two likely scenarios. In the first one, you’d be left embarrassed, and the payment will be delayed until you track down the person responsible for paying the bills.

In the second one, you can find yourself in a serious breach of contract and face financial loss, operational downtime, and legal action.

Data breaches are a serious offense, and you can cause serious damage to your company if you’re not careful.

This is because invoices contain sensitive information that can be misused if a third party obtains unauthorized access. You could be exposing your customer’s Personally Identifiable Information (PII) and other data.

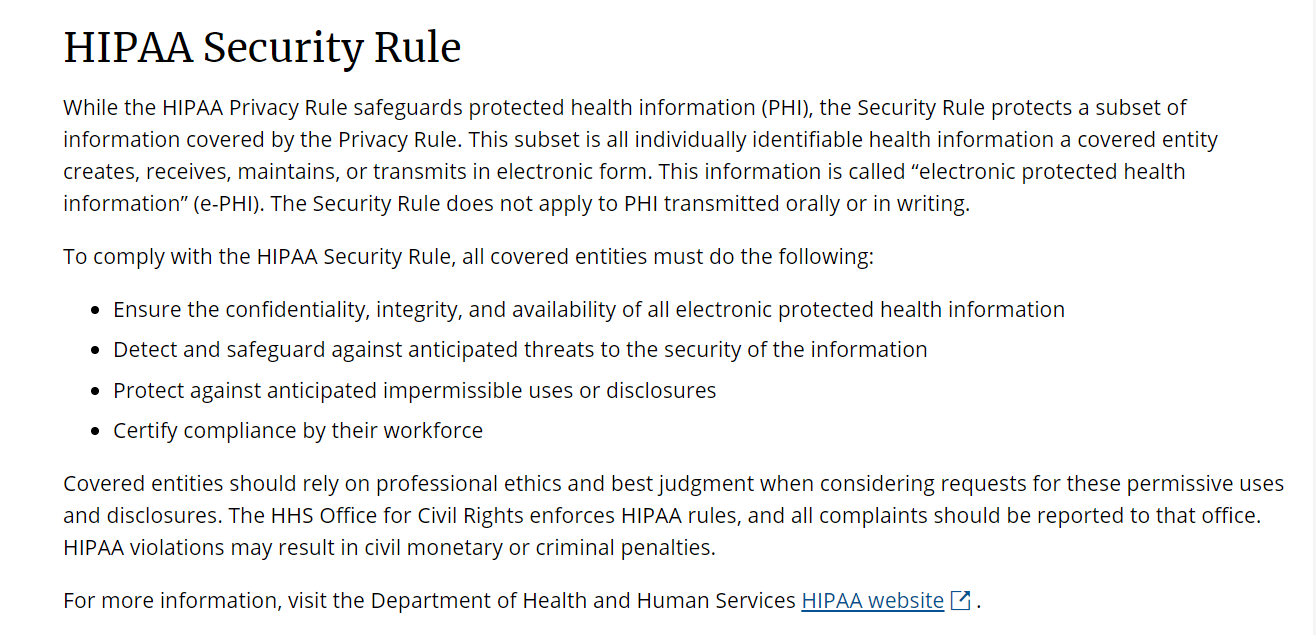

For example, medical bills contain highly sensitive information about a specific patient’s health and treatments. That is why the Department of Health and Human Services (HHS) considers them protected information.

So if you send a medical bill to the wrong person, you’ll directly violate the Health Insurance Portability and Accountability Act (HIPAA).

Source: CDC

If this happens to a patient, they have the right to report you to the HHS, which will look into how you handled the breach. They will also investigate what protective measures you put in place to prevent it in the future.

Failing to adhere to the proper protocols and sending medical bills to the wrong person can have serious consequences.

Sentara Hospitals in Virginia and North Carolina had to settle $2.175 million after sending wrong medical bills to 577 patients. This only seriously affected eight people, so Sentara Hospitals incorrectly assumed they didn’t have to report the breach.

However, the number of affected patients didn’t matter because they were still violating HIPAA regulations.

Moreover, the consequences wouldn’t have been so severe if the hospital had appropriately self-reported the breach.

What can you do to avoid the same fate?

The most obvious solution is to double-check the email addresses to which you’re sending your invoices. If you’re unsure who is the right person to handle your payment, ask someone at the company.

This way, you’re not just protecting yourself and your company from an accidental data breach, you’re also ensuring you get paid on time.

Customizing the Billing Cycle

How much time should you give your customers to pay for their invoices?

Well, it depends on the industry. Sometimes it’s more common to wait 100 or more days to get paid for goods and services, while some companies collect their dues within a month.

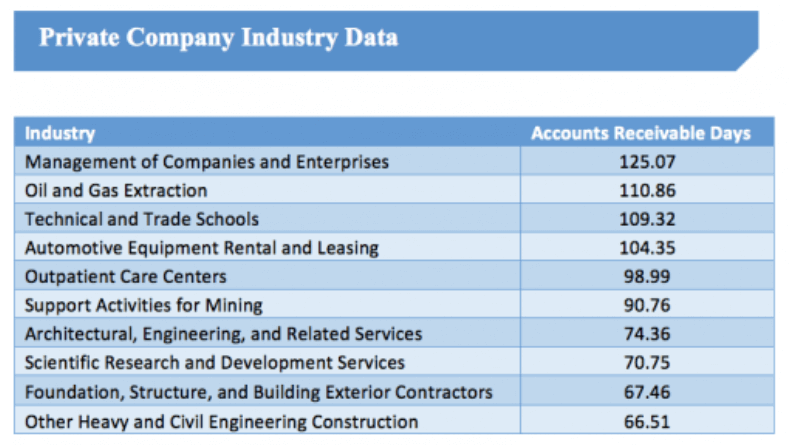

According to Sageworks, here are some of the top industries that have the highest average accounts receivable days:

Source: Sageworks

So, if you have customers in these industries, you’ll probably have to be more patient and flexible with your billing cycles.

Additionally, Edward Castaño, former Vice President of Marketing for BlueVine, recognizes three categories of billing cycles for small businesses:

- Net 30: most common for manufacturers of physical goods

- Net 30 to Net 60: for fashion and construction industries

- Varying terms: freelancers

But the good news is that the average private company’s payment cycle usually falls between 20 to 45 days.

The most popular payment method is an invoice on completion (with 30 days to pay), with 30% of small businesses relying on it to get paid.

Basically, there is no one-size-fits-all solution for setting the best payment terms. What can be more convenient for you might not be the best for your customers.

So, it’s best to employ some flexibility when it comes to payment terms for different customers.

But to ensure you set terms that will benefit your business the most, look into these factors:

| Customer’s payment history | For customers who don’t pay bills on time, consider asking for a deposit upfront. In some cases, you can bill in installments. |

| Size of the invoice | Larger invoices will require a more extended deadline for the customer to find money to settle them. For smaller invoices, it makes sense to shorten the billing period as much as possible (e.g., Net 7, Net 14). |

| Timing | Send the invoice when the customer is most likely to see it (during working hours, on specific weekdays, etc.). |

On the one hand, you have to be mindful of the industry standard regarding payment practices. But on the other hand, you have every right to put appropriate processes in place to protect yourself if that period is too long.

Michelle Messenger Garrett, the owner of Garrett Public Relations, says that she generally gives her customers 30 days to pay for her services. But after dealing with many late payers, she started to bill a part of the fee upfront.

In the end, billing cycles should accommodate your customers and help you get paid on time, so you have better cash flow management. One of the best ways to achieve that is to customize them.

Establishing a Non-payment Policy

Setting appropriate billing cycles is great, but what if your customers still don’t pay?

Late payments or non-payments are not a rare occurrence. On average, 1 in 6 small businesses have to deal with late payments. Even worse, 10% of invoice payments are never paid.

In the UK, as many as 51% of small and medium-sized businesses experienced delays in payment for their goods and services. Companies were collectively owed over £17.5 billion in 2020.

One of the biggest offenders for late payment was Meggitt, a British aerospace and defense company that failed to pay 85% of its invoices within contract terms. It took the company 132 days on average to settle their invoices.

Remember that non-payment can happen even with your best clients.

Market shifts can lead them to financial trouble, and they could stop paying you, even if they were diligent about it for years before.

Late payments or non-payments can seriously hurt your business operations, especially if they happen often. You rely on that money to pay expenses, materials, and wages, among other things.

So, one of the best strategies is to have a plan to protect yourself from non-payment. Here are some methods you can adopt:

| Determine your options | Ask yourself if the invoice amount is worth chasing. It might be better to let go and simply write off the customer for small amounts that won’t severely affect your business. |

| Follow up | Remind your customers about their past-due bills with a non-payment letter, emails, or calls. Communicate fast but respectfully to explain the issue and maintain good relations. |

| Weigh your options with a lawyer | If a client ignores you and refuses to pay, talk to a lawyer to find out about legal action you can take against the customer. |

| Send a letter of intent | This is a formal letter you send to customers informing them you plan to take legal action. |

| Go to small claims court | Small claims court is a quick solution to handle small debts (the minimum is $2000). You also don’t have to hire a lawyer. |

| Have a formal dispute mediation | For this method, your client has to agree to mediation. Then you can reach an agreement with the help of a paid mediator. |

| Contact a collection agency | Find a reputable collection agency that will get you back the money you’re owed. Most collection agencies handle payments that are over 90 days due. |

When it comes to non-payments, you must communicate your measures clearly and in advance.

That way, the customer is aware of the consequences of non-compliance with your payment terms, which can weed out bad customers and decrease the number of outstanding invoices in your books.

Tracking Your Invoices Diligently

To ensure you’re handling the billing process efficiently, ask yourself what kind of tracking system do you have?

If you’re still using manual systems like Excel, you’re shooting yourself in the foot. Using spreadsheets is time-consuming and a fruitful ground to make numerous mistakes we’ve warned about before.

Manual systems might be a good temporary solution, but if you want to grow your customer base and company, you should seriously consider switching to invoicing software.

First of all, these digital tools and solutions can help you send and receive payment electronically in a fraction of time.

In fact, recent research by American Express and PYMNTS.com showed that companies who rely on manual systems spend 67% more time following up on late payments than those who use digital processes.

Source: Regpack

Other useful features include customizing payment terms, invoicing multiple clients, setting up recurring payments, and sending payment reminders.

But the best part is that you have a centralized source from which you can access that information, and you can rest assured that it’s safe and up to date.

Source: Regpack

For example, Regpack can automate the payment process, so you don’t have to worry about having access to a client’s payment history and chasing down payments.

Also, to speed up the billing process, you can create personalized invoices and send the customers instructions to get paid faster.

Among the great benefits to Regpack’s online payment system is the fact that your customers can pay in any currency, and in various payment methods.

You can also seamlessly add taxes, discounts, and other charges into the system.

Basically, if you want to have a better overview of your invoices, speed up the billing process, and eliminate errors, invest in good payment software.

Conclusion

Knowing your options and best practices will help you solve some of the most common issues with invoicing customers.

So, if you pay close attention to the look of your invoices, correct errors, and send them to the right person, you’re already one step ahead to simplify the billing process and optimize your business operations.

You’ll also be better prepared if the worst happens, like customers refusing to pay.

Small business billing may look daunting, but it’s a necessary process to stay in business for a long time.