Every business is unique. Because of that, you, as a business owner, have to decide which mode of doing business best fits your unique goals and clientele.

And part of that is choosing a payment structure.

There are advantages and disadvantages to both a one-time and recurring structure.

In this article, we’ll walk you through them. Then we’ll help you decide which option is right for you.

What Are the Pros and Cons of One-Time Payments?

One-time purchase options are what we typically think of when we talk about making purchases.

The buyer makes a payment in exchange for goods or services provided by the seller, it’s as simple as that.

However, in the contemporary market, it may not be the best approach for either the provider or the customer.

The Pros

One of the biggest advantages of one time payments is the feeling of security they bring to both you and your customers.

You don’t have to wonder whether the customer will make their next payment, and they don’t have to wonder whether you’ll steal their credit card information.

In other words, one-time payments are predictable.

They’re also easier for everyone. You don’t have to go back and forth with customers over late payments. You also don’t have to generate recurring invoices and payment reminders.

Rakesh Patel, the founder of Facile Pay, further explains why customers like one-time payments:

The one-time payment model removes the entry barriers for customers and provides them with more versatility in their choices. This model offers the flexibility of choice.

In other words, not all customers want to enroll in a payment plan. They may instead prefer a single payment—one and done!

The Cons

But one-time payment requests can feel like a big commitment. It’s hard for customers to shell out a lot of money at once.

For that reason, one-time payments present a bigger mental hurdle for some customers compared to recurring payments, which may discourage them from purchasing in the first place.

They also make it hard for you as a business owner to make future plans. Without recurring payments, you don’t have guaranteed income.

That means you don’t know how much inventory to order or how many employees to hire.

The higher amounts involved with one-time payments also mean there’s a higher risk that customer payments will bounce.

What Are the Pros and Cons of Recurring Payments

Recurring payments, on the other hand, involve the customer paying for the seller’s offering in installments, over a longer period of time.

They are particularly popular in the digital landscape, so let’s look at why.

The Pros

As opposed to one-time payments, recurring payments guarantee a future income.

A recent study found that businesses using recurring payment models make up to 217% of the amount of money that businesses using one-time payment models make.

That’s especially true once you have an established customer base.

Unless there’s a drastic change in your customers’ perception of your business, long-term customers are likely to remain customers. That means they’ll keep sending payments!

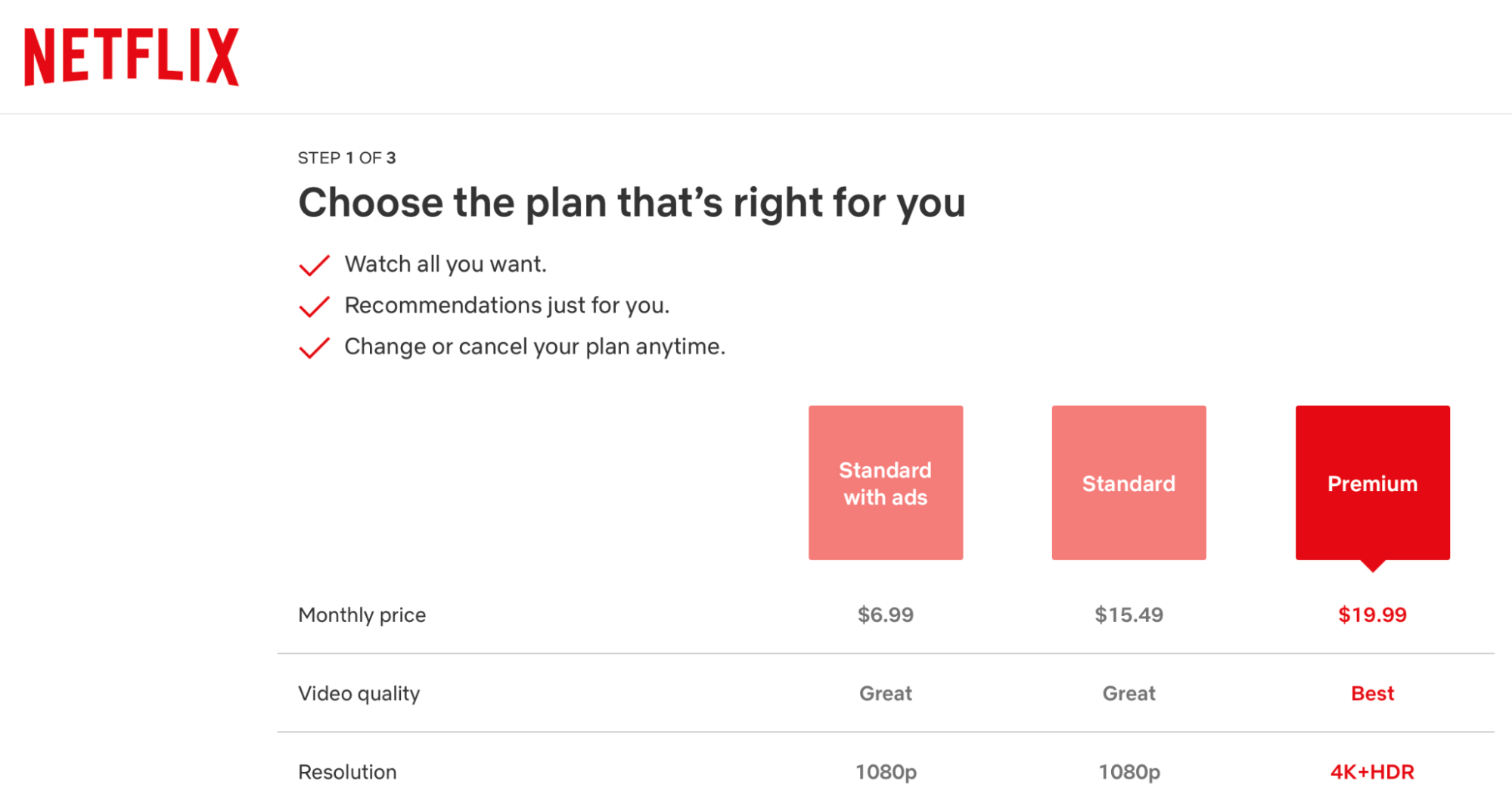

Take Netflix, for example. They have a recurring payment model and a loyal customer base, which guarantees them future income.

Customers can choose from several monthly payment plans:

Source: Netflix

Recurring payments are a hands-off way to have guaranteed income. With the right payment software, customers only have to enter their payment information once.

After that, the software will automatically charge them an agreed-upon amount at regular intervals. That leaves both you and them free to spend your time on more important things.

And recurring payments are more palatable for customers. They prefer not to spend large amounts of money at once, and recurring payments help them accomplish that.

The Cons

Although there are many benefits to recurring payments, the initial payment setup can be daunting. First, customers are wary about giving you their card information.

Second, there are more hoops to jump through when setting up recurring compared to one-time payments. This means more time and effort from both you and your customers.

It also takes longer to generate income because customers pay small amounts over time instead of a large amount right off the bat.

That can be problematic, especially for small businesses.

Customers may also occasionally miss the due date for their monthly bill payment. In this case, you may have to charge your customers a monthly fee due to their late payment.

Lastly, you run the risk that customers stop buying your product before you’ve generated enough income to cover your costs.

One-Time vs. Recurring Payments: Key Differences

The biggest difference between one-time and recurring payments is the number of transactions involved.

One-time payments only involve a quick one-time payment, whereas recurring payments involve multiple transactions.

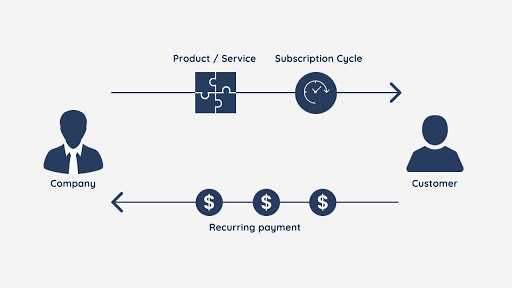

The diagram below illustrates the continuous nature of a recurring payment system:

Source: Hubspot

In this diagram, repeated transactions take place between the company and the customer.

The customer keeps paying, and in return, the company keeps making its product or service available. It’s a win for everyone.

In a one-time payment, customers let you access their payment information temporarily—just long enough to process a single transaction.

But with a recurring payment model, customers give you long-term access to their payment information.

Your customers have to trust that you’ll keep their bank account and or checking account information secure. They also have to believe in the quality of your product or service.

If they start to doubt either of those, they’ll stop sending payments.

That makes it important to consistently communicate with customers if you work on a recurring payment model.

Send clear, personalized invoices and payment reminders. You should also send payment confirmation emails. Answer customer messages promptly and professionally.

And don’t forget to listen to their feedback! Read customer reviews of your product or service and use them to improve your business.

Adam Altman of Rebilly explains the difference between one-time and recurring payment models this way:

With a magazine subscription, a customer gets their favorite fashion or food magazine delivered to their house once a month. If they were buying the same magazine based on the pay-as-you-go model, the customer would need to go to the grocery store or go online and buy just one issue of the magazine when they wanted to read it.

In other words, recurring payments let customers use your product or service continuously over time.

On the other hand, one-time payments mean the customer has to come back every time they want to use what you offer.

One-Time or Recurring Payments: How to Choose

Recurring payments make sense for businesses that provide a product or service to customers continuously.

For example, you use electricity every day, so your utility bill payments are recurring.

Software is another example. If you sell software, it makes sense to use a recurring payment model.

Your customers continuously use your product, but they don’t own the software—you do. As soon as they stop paying, they lose access.

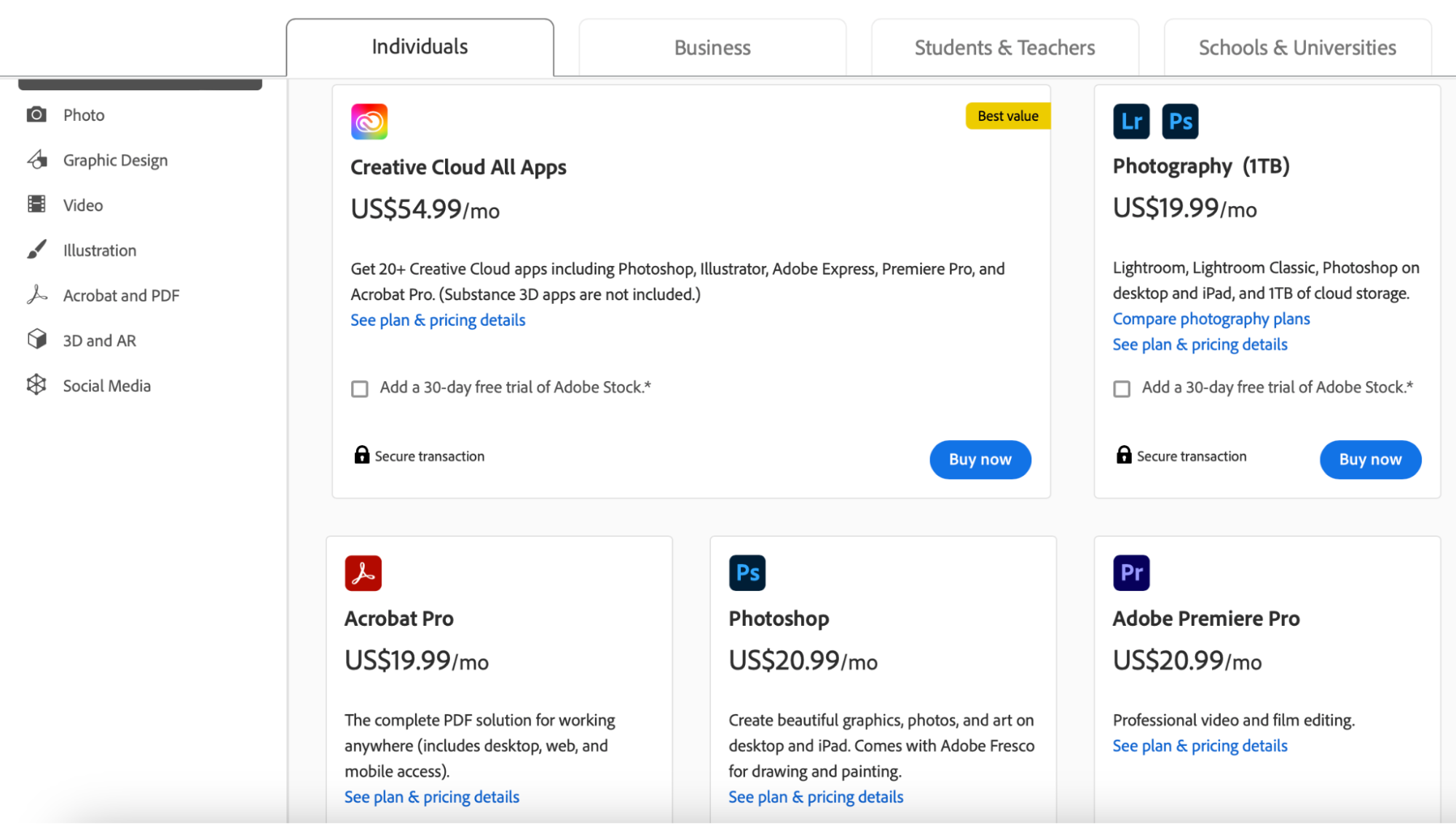

Adobe, the popular creative software suite, illustrates the use of recurring payments by a software company:

Source: Adobe

As you can see, Adobe charges monthly for its software. Customers pay for the tools they’re using.

You can think of this recurring payment system as borrowing access to Adobe’s products. As soon as the customer stops making payments, they’ll have to stop using the software.

Recurring payments are also useful for growth-oriented businesses.

There are few better ways to guarantee the growth of your company than to guarantee future income through recurring payments.

On the other hand, one-time payments make sense for small companies or those just starting out. You’ll get instant cash payments rather than waiting for small payments to roll in over time.

Daniel Ndukwu with PayKickstart, a subscription management company, highlights the value in one-time payments for small businesses:

You unlock the complete value from your products and services as soon as your customer pays. You don’t have to wait months or years for it to materialize.

As Ndukwu points out, one-time payments provide an instant return on your investments.

They’re also useful for companies that want customers to own, instead of borrow their products.

For example, clothing stores typically use a one-time payment system. When you buy a shirt, you own the shirt!

But there’s a third option: accept both one-time and recurring payments. Let your customers choose which method they prefer.

Or sell some products using one payment structure, and other products using the other.

The easiest way to give yourself and your customers that flexibility is through online payment software, removing the hassle of paperless billing for you and your customers. With online payment software, you can set up payment plans that make sense for everyone involved.

Then you can automate them, walk away, and let them take care of revenue generation.

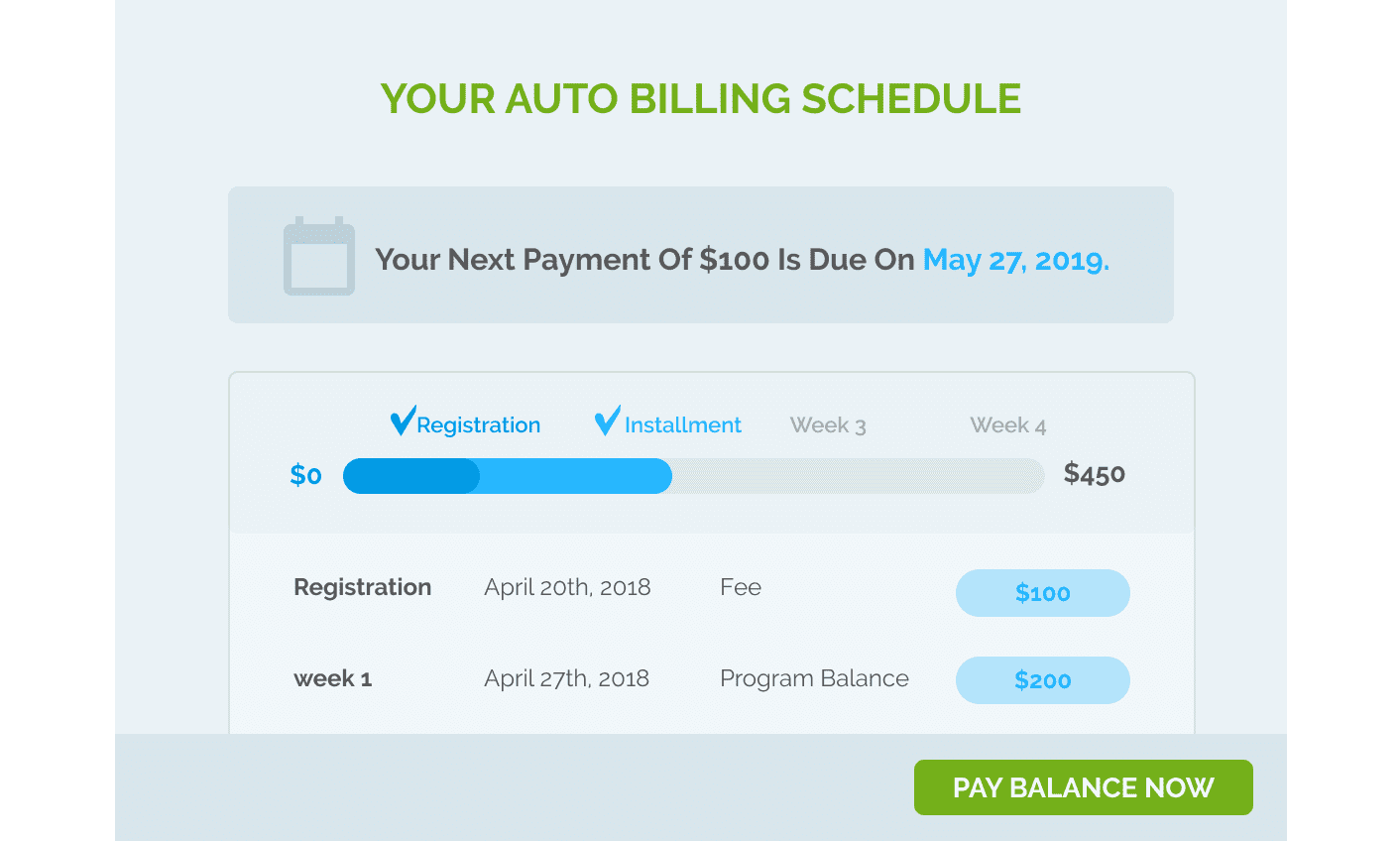

For example, Regpacks’ online payment software lets you create custom payment forms and embed them onto your website.

Customers can pay in the way that works best for them, with no effort on your part.

Source: Regpack

As you can see, our payment software shows customers how much they owe and when the money is due. It also lets them make immediate one-time payments, or set up recurring online payments.

Online payment software gives you and your customers the flexibility you need.

Every Business Is Unique

Whether a one-time or a recurring payment model is best for you depends on the unique needs of your business.

As we’ve explained, there are pros and cons to recurring payments and one-time payments.

One-time payments ensure quick money, but can be daunting for customers. On the other hand, recurring payments ensure a stable income over time, but less money right off the bat.

Regardless of which type you choose, it’s important to make an informed decision. We hope this article helped you take that first step.