A merchant account is a bank account used to process and accept funds from credit and debit card transactions.

It requires a relationship between three parties: your business (the merchant), a merchant account provider or acquiring bank, and a payment processor.

The payment processor is the entity that authorizes and conducts credit or debit transactions, while the merchant account receives funds from your customers.

From there, the funds are transferred to your business account so you can use them.

In this article, we’ll walk you through the steps to set up a merchant account for your business—so you can start getting paid.

- Obtain Your Business License

- Know Your Payment Processing Needs

- Choose a Merchant Account Provider

- Complete Your Merchant Account Application

- Go Through the Underwriting Process

- Review Terms and Conditions

- Final Thoughts

Obtain Your Business License

First, you’ll need a business license, which allows you to operate your business legally within your industry and jurisdiction.

And it benefits your business in other ways, too—as James Gilmer, manager of strategic partnerships at Harbor Compliance, explains it:

“Becoming licensed allows business owners to provide their customers, employees and other stakeholders with the confidence that the business is well run and its goods and services are trustworthy.”

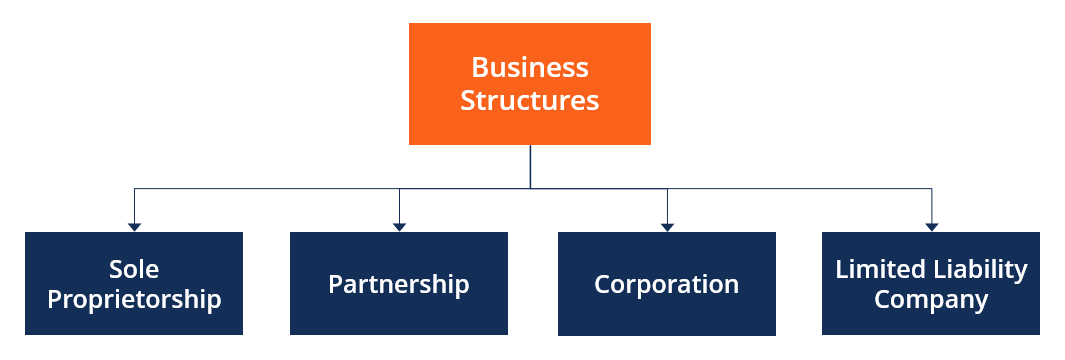

Before applying for a business license, be sure to know how you want to structure your business. The most common options are:

- Sole proprietorship—The simplest structure, for individuals with no employees or partners.

- Partnership—Two or more people own the business and share responsibilities, profits, and liability.

- Corporation—The most complex structure, where the company is a separate legal entity from the owner(s). This setup creates the most protection from liability.

- Limited liability company (LLC)—A hybrid of the structures listed above, it protects the owners from liability but is much less complex than a corporation.

Source: Corporate Finance Institute

Once you’ve registered your business under whichever structure works best for you, you’ll need to apply for an employer identification number (EIN).

This is a federal number used for tax-filing purposes.

Now you’re ready to apply for a business license.

Business license requirements vary depending on your business structure, as well as the industry and location where you’ll operate. But generally, the required documents include:

- Partnership agreement, operating agreement, or articles of incorporation

- Government-issued photo ID(s) of the applicant(s)

- Proof of your EIN

- Regulatory permits for your business type (for example, a liquor license)

To determine which type of license you need, you should visit your state’s Secretary of State website.

Know Your Payment Processing Needs

Next, before choosing a merchant provider, it’s important to understand your payment processing needs—since they determine what type of account you’ll need to open and what equipment you’ll need.

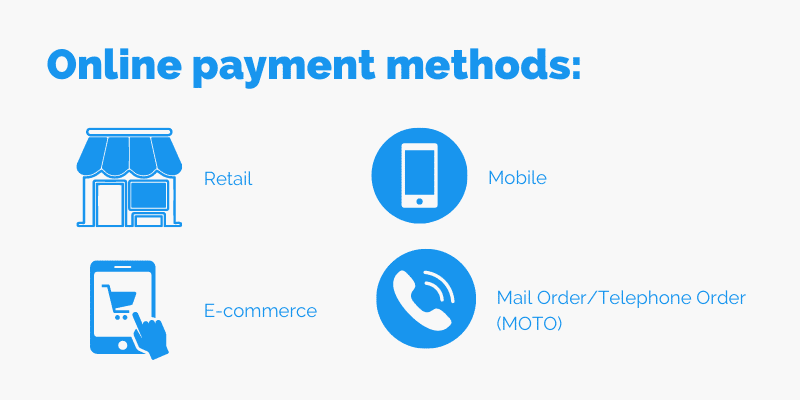

The type of account your business needs depends on what type of payments you plan to accept.

While the primary goal of a merchant account is to accept credit and debit payments, there are a few different contexts to be aware of.

Source: Regpack

In the following sections, we’ll go over the basic requirements for each of these payment methods.

Retail

For retailers and other brick-and-mortar businesses, it’s essential to have a point of sale (POS) terminal to accept card payments in person.

These POS terminals are usually leased by the payment processor or merchant software.

E-commerce

If you make sales through an e-commerce store or site, you should choose a merchant services provider that provides an online payment gateway.

This gateway makes it simple to accept customer card payments online.

Mobile

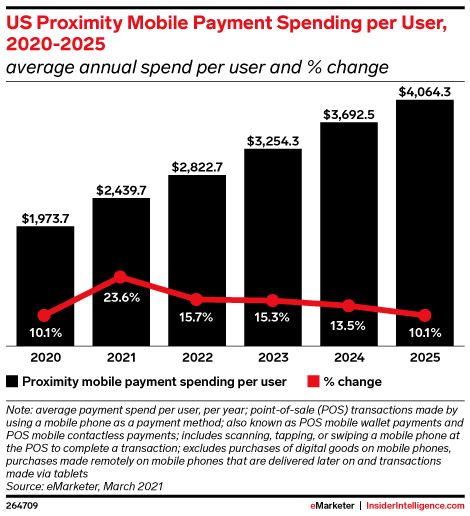

Pandemic health and safety precautions have led to the increased popularity of touch-free payments like Apple Pay and Android Pay.

In fact, experts predict that mobile payments will exceed half of all smartphone users in the US by 2025.

Source: Tech Crunch

Especially if your customer base trends younger, it makes sense to embrace this payment method.

Many merchant account providers offer mobile payment processing solutions like wireless card readers that process iOS or Android mobile payments.

Mail Order/Telephone Order (MOTO)

If you accept customer payments over the phone, look for a merchant account provider that offers card-not-present transactions.

In these transactions, the shopper gives you their order and payment information via phone, mail, or email—then, you manually enter customer card details into your system using a virtual terminal.

Meeting the customer where they are—like letting them make mobile payments or pay over the phone—creates a better customer experience and leads to more sales.

Choose a Merchant Account Provider

Choosing a merchant account provider is not just looking for one that offers your preferred payment types.

Business owners should also understand their industry requirements and financial history—as well as the fees, customer support, and unique selling points of different merchant services providers.

Ask yourself what your customers’ current preferred payment methods are and whether you need hardware like POS terminals to offer it to them.

Do you need a merchant provider that offers recurring billing?

Also, do you plan to scale over the next few years? If so, you’ll want to choose a merchant provider that you won’t outgrow quickly.

Knowing your unique needs ensures you can choose a merchant provider that offers every feature you need—without paying for the service that offers more than you want.

Source: Regpack

The right merchant account provider should also fit within your budget.

Merchant account fees vary widely from one provider to the next. And even for a single provider, fees are often not cut-and-dried.

Aside from a one-time setup fee, many providers charge monthly fees, cancellation fees, per-transaction fees, and chargeback fees.

And if you pay for a POS terminal, you’ll likely need to pay for hardware leasing and maintenance.

Most merchant account fees do not come in fixed amounts, either. Transaction fees are often calculated as a percentage plus a fixed amount.

For example, a common fee rate is 2.9% + $0.20 for every card transaction.

Different pricing models work better for different businesses.

Small businesses may prefer a flat rate pricing model, which is more transparent and predictable—while larger businesses may save money with an interchange or cost plus pricing model.

Other features to look for in a merchant account service include:

- Excellent customer service

- Flexibility (and the ability to scale with you)

- The ability to integrate with your tech stack, like Quickbooks or your CRM

Finally, be sure to review the merchant service provider’s security policies.

They should be compliant with PCI standards and encrypt stored data so that your and your customers’ information is protected.

For more information on choosing the right merchant account for you, check out our in-depth article on that topic.

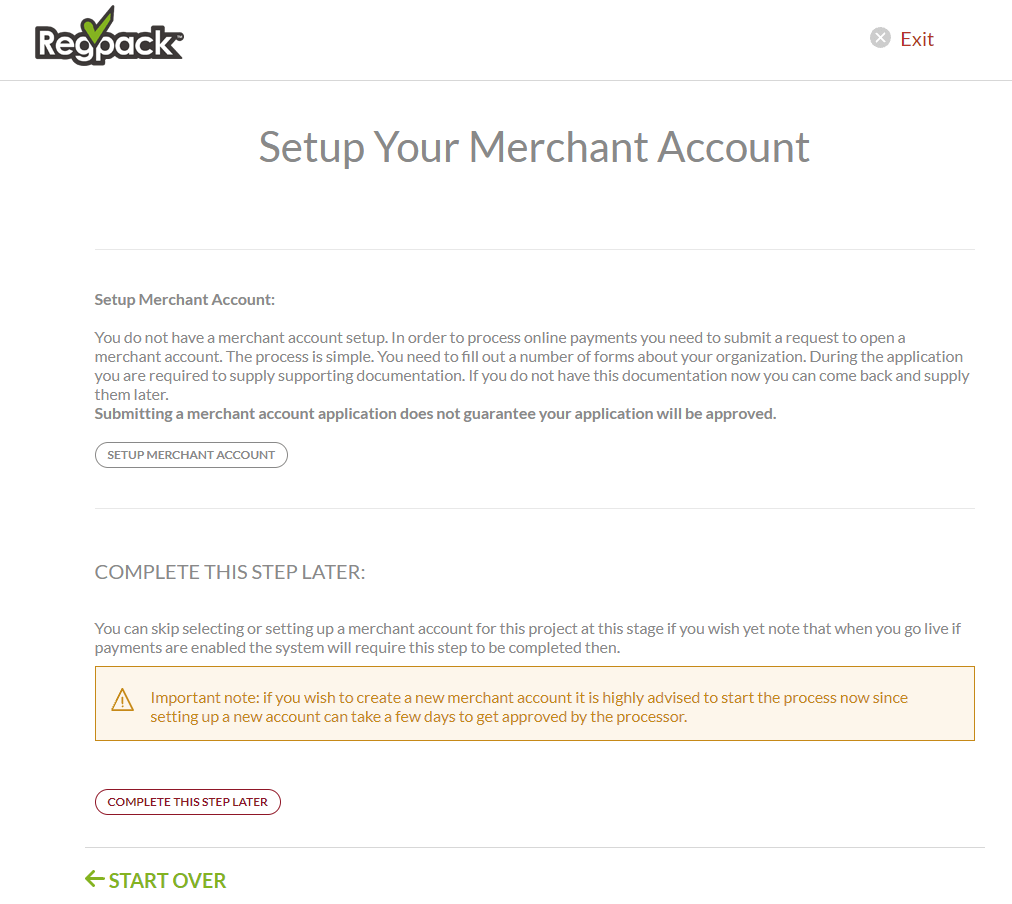

Complete Your Merchant Account Application

Once you’ve settled on a merchant services provider, it’s time to set up your account.

While you used to have to submit your business license, verify your location, and get a credit check, thankfully, the account application process has become much simpler in recent years.

Financial technology innovations reduce the process to a few clicks.

Source: Regpack

Start by navigating to your chosen provider’s website. Select your chosen payment processing options and use their application form to submit the required details and documentation.

The application will most often require your personal and business information, as well as any additional information requested by the specific provider.

The provider will use the documentation to verify your application.

The most common documentation required for merchant account applications includes:

- Business license and employer identification number (EIN)

- Articles of incorporation or operating agreement

- Business address

- Recent bank statements

- Financial statements, including balance sheets, income statements, cash flow, etc.

- Proof of credit history

- Supporting documents to show your financial viability, like a business plan and marketing materials

The type and amount of documentation required usually depend on if the merchant account provider considers your business to be low-risk or high-risk.

The provider might consider your business high-risk if you haven’t been in business very long, if your credit score is low, or if you are operating in a highly regulated industry like tobacco, firearms, legal services, or software.

If you’re considered high-risk, you’ll likely need to provide more robust proof of your financial stability, like bank statements going back two years or more.

Go Through the Underwriting Process

Once your application has been submitted, the merchant account provider will review all of your documentation.

The underwriting process includes scrutinizing submitted applications and documentation, as well as subjecting the business to risk evaluation.

This strict underwriting process is necessary to protect the provider from potential fraud and from taking on other financial risks they can’t mitigate.

When analyzing an application, underwriters take the following into consideration:

- Credit score—The underwriters conduct a credit check to review your financial history and evaluate your creditworthiness.

- Financial accounts—They then verify that the account you provided does indeed exist. Your financial statements are reviewed as well.

- IRS tax identification—Your EIN is checked to verify the information you provided against official tax records.

- OFAC review—Merchant providers follow a regulatory procedure to ensure you aren’t on the US Department of the Treasury Office of Foreign Assets Control (OFAC) sanctions list.

The underwriting step can take anywhere from a few minutes to multiple business days, depending on your risk factors, industry, and the provider in question.

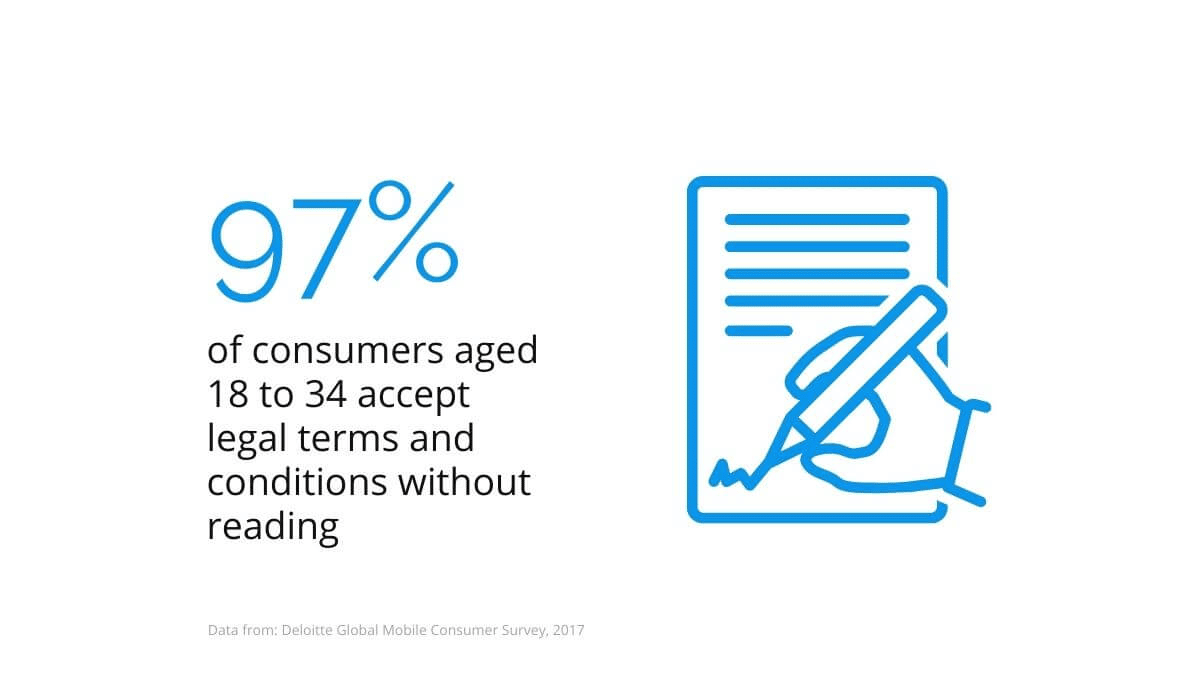

Review Terms and Conditions

Once the underwriting process is finished and the application has been approved, the final step is to review the terms and conditions thoroughly before signing or agreeing to them.

You probably aren’t surprised to learn that 91% of consumers breeze through legal terms and conditions without reading them.

And for those between 18 and 34 years old, the percentage increases to 97%.

Source: Regpack

It’s easy to let that habit seep into your professional life—but try to resist the temptation.

Reading the terms and conditions of a legal agreement can prevent you from locking your business into an unfavorable contract stipulation.

Make it a point to dedicate enough time to thoroughly review the contract you’re about to sign.

Ensure you know exactly what you’re agreeing to, and that you understand all the terms of the partnership with your new merchant services provider.

One specific element to watch for is the early termination fee (ETF). If you’re agreeing to a long-term contract, the provider may charge you a massive fee for breaking the contract early.

It’s best to find a merchant provider that doesn’t charge ETFs at all, but if you do sign a contract that includes an ETF, it’s best to know ahead of time so you can avoid incurring exorbitant fees if you switch providers.

Other terms to watch out for include:

- Equipment restocking fees

- Buyout fees

- Equipment lease early termination fee

- Liquidated damages

Contracts and terms and conditions can be difficult to parse.

If you’re struggling to understand a portion of the contract—or you just want a second opinion—you may want to seek legal advice from an attorney before finalizing the agreement.

Final Thoughts

To avoid headaches after setting up a merchant account, you’ll need to ensure you have all of your ducks in a row first.

Register your business and obtain an EIN and business license before even beginning the search for a merchant account provider.

Then, think about what you need out of your merchant account services.

Keep in mind the types of payments you’ll accept—like retail, e-commerce, mobile, or MOTO—and consider your business’s long-term goals as well.

Be sure to choose a merchant account provider that not only offers the features, security, and fee structure that benefits you now, but one that can scale with you later.

Once you choose a provider, you’ll need to complete an application on their website and wait for the underwriting process to complete.

And before finalizing the agreement, be sure to review the terms and conditions to make sure you aren’t hit with any surprises later.

Opening a merchant account is no minor task.

The right merchant account provider can facilitate seamless transactions, boost your customer experience, and provide the flexibility and support you need for the future.