Some companies hesitate to send late payment letters, fearing they seem undignified or like begging customers to pay.

However, these letters are crucial for your business.

Ignoring late payments can have a negative impact leading to financial disaster, especially for small businesses. Without ensuring customers pay what’s owed, your company could quickly fall into debt.

To avoid this, it’s essential to understand the process of sending overdue invoice letters.

If you want to improve your chances of getting paid promptly, keep reading!

Choose the Right Time to Send the Letter

Knowing when to send a late payment letter is crucial.

An overdue payment letter means the customer is already late, putting you in a tough spot. Any communication before the due date is a friendly reminder to pay on time. Typically, you’ll send a final reminder on the due date itself.

However, once the due date passes, you send an outstanding invoice letter, informing the customer they’re behind on payment.

It’s standard practice to send this notification immediately after the due date to increase your chances of getting paid.

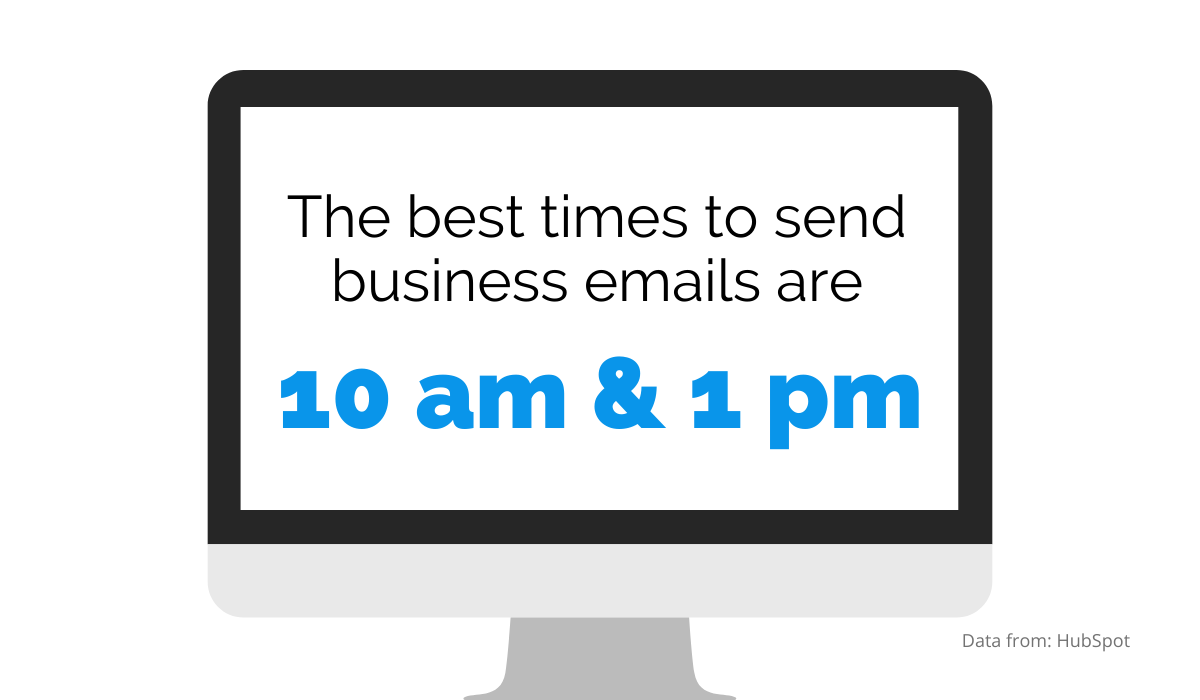

Research shows that the best time to send business emails is at either 10 AM or 1 PM, as that’s when most people have time to read them. So, consider the time and date before pressing ‘send’.

Source: Regpack

After the first late payment letter, companies usually send follow-up notices every thirty days until the client pays. The timing between these overdue payment reminders can vary, depending on how late the payment is.

Using invoicing software can automate this process, ensuring reminders go out on time without burdening your staff.

Learn More About How Regpack’s Invoicing Software Can Reduce Time, Stress, and Money

Include All Necessary Data

When sending a late payment letter, include all relevant payment details to increase your chances of getting paid. If you received an overdue invoice that just stated you owe money without specifics, you’d likely ignore it. Your customers are no different.

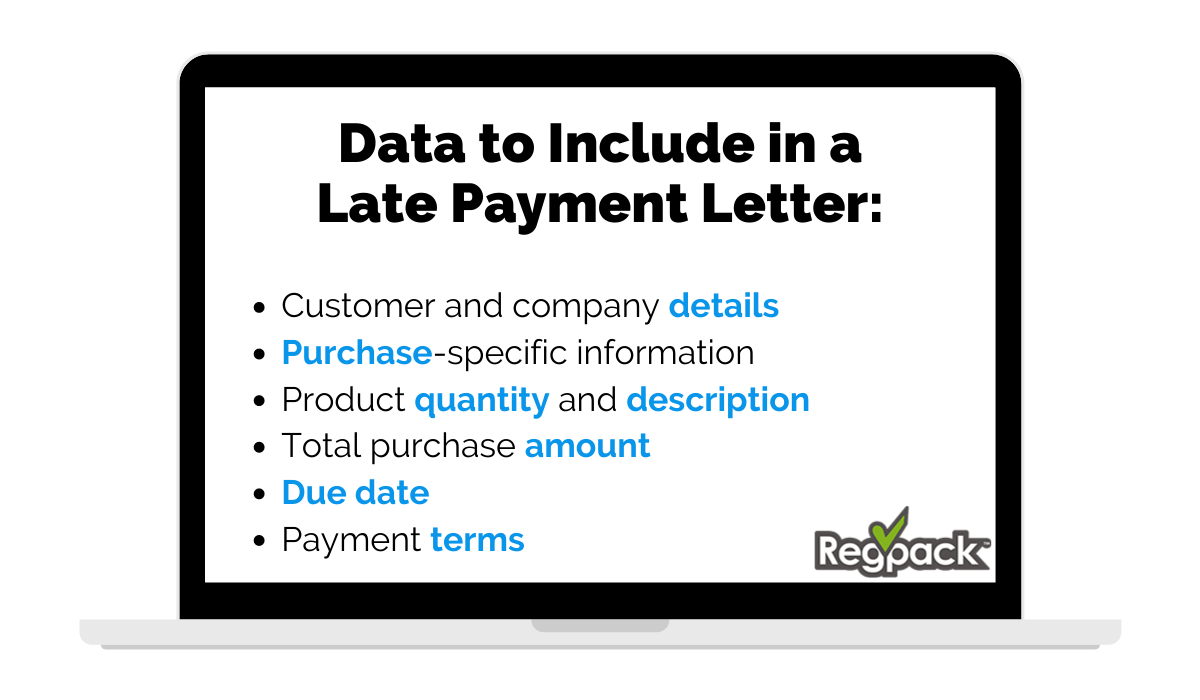

Your outstanding payment notification should contain the same necessary information as your original invoice your invoice, including:

- Customer contact information

- Company details

- Invoice number

- Data about products/services, including quantity, size, and amount

- Total purchase amount

- Due date

- Payment terms

Additionally, remind the customer of the original due date and urge them to pay promptly. Payment terms are crucial; they outline the rules the customer agreed to follow. If the terms state payment is due in 30 days and the client hasn’t paid, you have every right to remind them.

Source: Regpack

Before sending the overdue invoice reminder, ensure it contains all this information. Your email should clearly address every aspect of the purchase and payment, so the customer can quickly identify what they bought, how much they owe, and how they can pay.

Including these details will make your reminder more effective, increasing the likelihood of prompt payment.

Adapt Your Language to the Situation

When reminding customers of an outstanding invoice, be mindful of your language and tone. Politeness goes a long way; a gentle reminder is more effective than a stern reprimand. Remember, you don’t know why they haven’t paid, so avoid assuming bad intentions.

Tailor your message based on the customer’s payment history. If a usually punctual client misses a payment, use a gentle tone. For a customer with a history of late payments, you can be more direct.

In your first payment reminder email, simply state that no payment has been received for the purchase and request payment using the available payment methods. Encourage the customer to contact you if there’s been a misunderstanding.

If you don’t process payments electronically, there could be an error on your end, such as a missed or incorrectly entered payment. Offer the customer a way to contact you to resolve any issues.

Either way, it’s better not to assume the customer is at fault.

Describe the Course of Action

Your late payment letter should clearly outline the steps you’ll take to recover the money owed. There should be no room for interpretation—after reading your reminder, the customer should know exactly what will happen if they don’t pay.

This email should not only remind the customer of the overdue payment but also inform them of any additional fees that will be applied. Most companies don’t impose late payment fees immediately after the due date, allowing a grace period. However, once the payment terms expire, and the final notice has been sent, late fees should be added to the total amount owed.

Unfortunately, this approach often motivates payment more effectively than a gentle reminder.

So, ensure that your outstanding invoice payment email lists:

- Late fees that will be added

- The due date for payment reconciliation

- Available payment methods (credit card, electronic check, ACH transfer, etc.)

- Instructions for dispute resolution

- The date when the invoice will be transferred to a collection agency

For customers significantly behind on payments, you have three options: write off the debt, continue pursuing payment, or hand it over to a debt collection agency.

- Writing off the debt means forfeiting your earned money.

- Continuing to pursue payment is proactive but offers no guarantee.

- Turning the debt over to a collection agency ensures payment, albeit through the agency.

Resorting to legal action or involving a debt collection agency should be your last option. However, your email must clearly communicate the steps you’re willing to take if payment continues to be avoided.

Decrease Non-Payment By 75%

With Flexible Payment Plans!

Make Sure Your Late Fees Are Correct

When mentioning the late fees, ensure that they are clear and correct.

If you decide to charge fees for overdue payments, state this in the invoice’s terms and conditions so the customer knows what to expect.

If you don’t mention these overdue payment fees, you cannot charge them.

Not all countries allow sellers to impose late fees for unpaid invoices, which can impact your global customers. Even within your rights, charging late fees might deter clients.

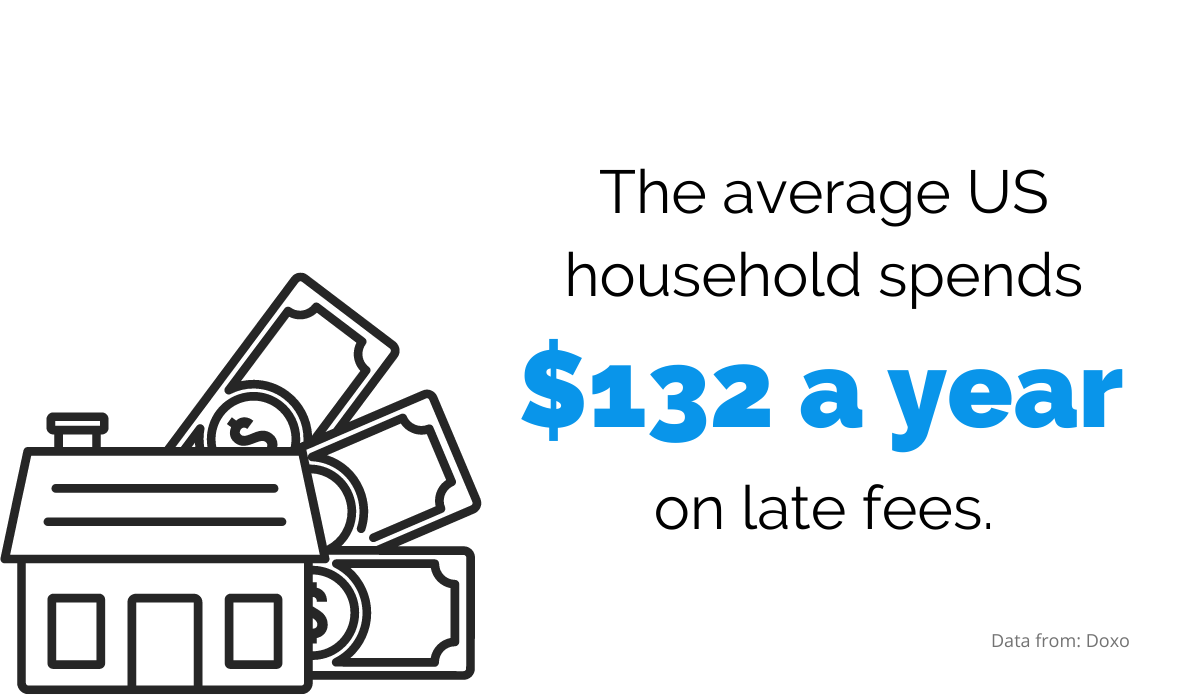

Also, you need to think about what amount is reasonable to charge for an overdue payment fee. The average US household wastes $132 a year on late fees, with many late on at least one payment. Remember, not everyone can pay on time. Charging a 10% late fee might get you paid but could cost future business with that customer.

Source: Regpack

You should also consider whether to enforce the late fee in all situations. For instance, if a loyal customer who usually pays on time is late once, it might be better to find an alternative solution rather than charging extra. It’s best to assess each situation individually.

Suggest Alternative Ways to Pay

When reminding customers they owe you money, always restate all available payment methods.

The more options you provide, the higher your chances of getting paid. While traditional methods like cash are fine, consider offering digital wallets as well.

Digital payments are convenient—no manual entry, fewer mistakes, and better security against payment information theft. It’s wise to offer various options, including credit and debit cards, cash, PayPal, GooglePay, and any other methods your customers might prefer.

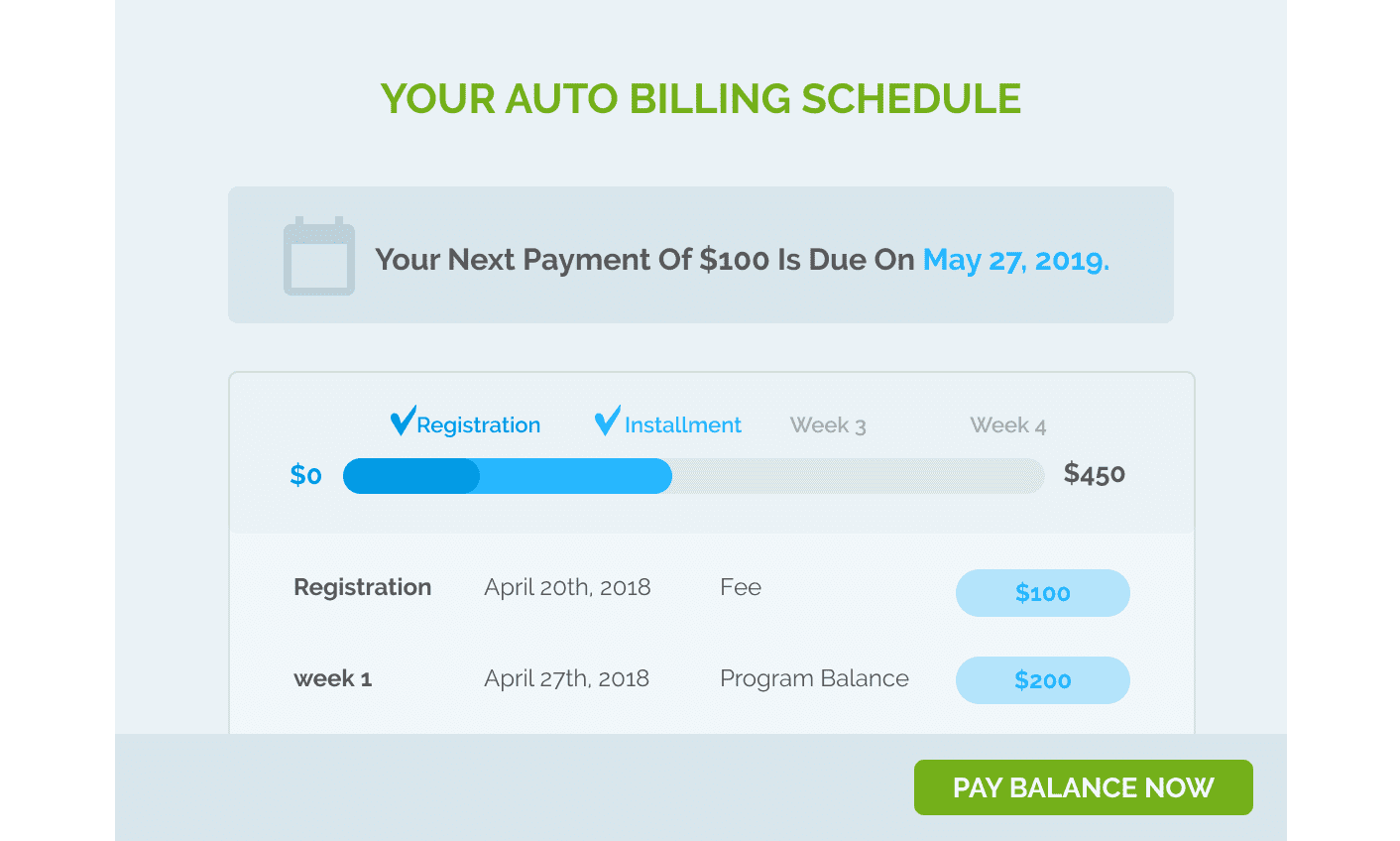

Some companies use recurring billing to ensure timely payments. However, if a client can’t pay off the entire debt at once, especially if late fees are involved, consider offering a payment plan. Allowing customers to pay in installments ensures you eventually receive the full amount, even if not immediately. This approach helps retain customers while still collecting what’s owed.

Source: Regpack

The bottom line is that you’ll be more successful in getting paid if you offer multiple payment options. By providing a variety of methods, you’re more likely to find one that suits both you and your customers, increasing the likelihood of prompt payment.

Send the Late Payment Letter

Once your outstanding invoice notification is perfected, it’s time to deliver it. Gone are the days of relying on snail mail for invoices and late payment letters. If you’re still using the post office, it’s no wonder your payments are late—letters can be delayed, lost, or damaged in transit.

In the digital age, using software to send invoices and follow-up communications, like reminders and outstanding payment emails, is the way to go. With technology, you can automate this process, ensuring emails are sent on schedule without lifting a finger. Simply set up the software to trigger late payment emails as needed.

However, if previous reminders are ignored, consider alternative methods—send a letter by post, deliver it personally, or call the customer’s phone number. Technology helps ensure your emails are sent on time, but if a customer isn’t opening them, you’ll need to switch tactics.

Email providers now offer read receipts, so you can tell if your messages are being opened. If emails aren’t effective, don’t hesitate to change your approach. A different contact method might be what you need to get results.

Using a combination of technology and personalized follow-up can increase your chances of getting paid in a timely manner.

Don’t Limit Your Customer Pool!

Offer Multiple Payment Options Seamlessly

Payment Success with Regpack

Your late payment letter’s primary purpose is to notify the customer of the outstanding debt towards you and all the available methods for settling that debt.

When sending the outstanding payment letter, include the same data your invoice contains to remind the customer what kind of service they’ve received from you, and adapt the tone based on your relationship with the customer.

Through Regpack, you can automate the process of sending outstanding payment emails, ensuring they are delivered on time and include information about late payment fees and available payment options.

This automation saves you time and effort, increases cash flow, and improves the likelihood of prompt payment.