In a perfect world, dealing with your customers would boil down to something like this—you provide them with the product or service, and they pay you for it.

However, we don’t live in that kind of dreamland.

Late payments can happen to every business owner, and usually, they’re followed by an excuse, ranging from believable to the dog-ate-my-homework level of credibility.

However, every business owner should know how to handle various excuses when they come. In this article, we’ll advise you on how to effectively handle 13 common excuses.

The Customer Claims They Didn’t Get the Invoice

The excuse in the vein of we didn’t get anything, sorry, when did you send it has already become one of the classics when dealing with late payments.

Of course, sometimes it really happens that the snail mail is late or the email ends up in the spam folder or the wrong person’s inbox. Other times, pleading ignorance and blaming those factors are merely delay tactics for the late payers.

Nevertheless, you should first ensure that you did everything correctly. Confirm with your customer over the phone if the address or email address you sent your invoice to is correct.

Also, keep in mind that email is more dependable than snail mail, so try to send out all of your invoices using that method.

It’s easier to track and faster to resend if necessary. You can request an immediate confirmation of arrival, either from the person on the other end of the inbox or from the email system itself.

Source: Regpack

Have a copy of the invoice at hand and email it to the customer right after their excuse. If they then make up some other reason not to pay it, it was a delay tactic all along.

They Say The Payment Has Been Made Already

This is another one of the oldest excuses in the book, only this time, you end up being the one who didn’t receive what you should have.

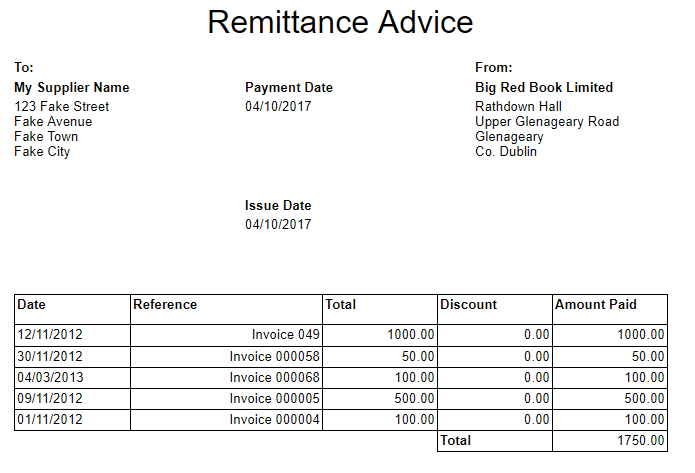

If the customer says they’ve already paid, you can ask for remittance advice from the financial department. It’s a helpful document that confirms if the invoice has been paid.

The remittance advice is not mandatory, but agreeing with your customer that they issue it after payment can be very beneficial in avoiding this excuse.

Here’s an example:

Source: bigredcloud

Similarly, if the customer has sent a check, they need to provide you with some evidence of doing so. You can ask for proof of postage, check the number, as well as determine if they sent it as first or second class mail, and to what address.

If the customer is telling the truth, and their check just didn’t reach you, it shouldn’t be a problem to cancel the lost check and pay by some other method you offer them.

Remember—if the customer pulls out the old payment is on the way card, it’s up to them to provide the evidence.

They’re Waiting For Their Customers to Pay Them

Some clients feel like they have the right to pass on the late payment from their customers to you.

But this excuse is only acceptable if that was your agreement from the start. In other words, if you and your customer agreed that you’ll get paid when they get paid, it’s valid.

If you never made such an agreement, their problems with revenue shouldn’t be of your concern.

Source: Regpack

The way you can handle that excuse is by offering your client to make an immediate partial payment and a strict agreement on when you’ll receive the rest.

Also, you can ask them for information about the customer they’re waiting on so you can contact them yourself. If your client can’t provide you with that information, that could be a sign that they’re not being truthful.

Avoid getting sucked into this excuse, or you might end up as a link in the late payment chain.

The Person Responsible for Invoices is Away

This excuse is of seasonal variety; you can often encounter it in the summer months or during the holidays.

Maybe the director, the accountant, or any other person who’s responsible for invoices really is absent, but that doesn’t mean that no one can handle cases like yours.

After all, there must be some system in place for handling salaries and emergency payments at your customers’ business.

Source: Regpack

You can handle this excuse by requesting the responsible person’s contact information and explaining that the payment needs to be handled soon.

After all, if you have clear payment terms in your invoice, your customer could be facing a late payment fee, and they would certainly want to avoid that.

Payments are a touchy subject sometimes, so when you’re trying to get in touch with someone at the client’s company who can sign off on the payment, do your best to be persistent, yet polite.

They Claim They Didn’t Receive Your Product or Service

When the customer claims that they didn’t receive your product or service, it’s another excuse by which the customer tries to pass the blame for their failure to pay on to you.

Of course, a product may get lost before reaching the customer, or there may be a disruption in service, but that excuse is comparatively weak.

That’s because it’s very easy to handle, provided you are prepared for it. Before delivering your product or service, simply insist on the proof of delivery.

That way, if the customer tries to use not receiving what they bought as an excuse not to pay, you can rely on documentation that proves otherwise.

Source: Regpack

For the same reason, it’s important to store your invoices, purchase orders, delivery notes, receipts and other documents electronically and ensure that they are easily accessible.

That way, if the customer tries to evade responsibility, you have evidence at your fingertips, ready to send along to request immediate payment.

Long story short, preparedness and good record keeping are powerful weapons in your fight against this kind of excuse.

The Customer Disputes the Work

Having an issue with your service is well within your customer’s rights, but not when it’s merely an excuse for late payment.

Your customers should raise their concerns with the product or service shortly after receiving and using it, instead of waiting until it’s time to pay for it to become an issue.

To avoid that kind of problem, you can include a clear timeframe in which the customer can report a problem with your work in your contract or invoice. When the deadline passes, the complaints are no longer valid.

Source: Regpack

Furthermore, remember to be patient when discussing this excuse with the client. You can handle it by asking them to provide a detailed description of the issue in writing. Of course, if it really is a valid issue with your work, be fair and fix it.

However, if the dispute was merely an excuse to avoid payment, the additional effort that goes into drafting the letter will likely deter them from pursuing the matter.

Moreover, having the issue described in writing will also make it easier to detect any potential inconsistencies in their story, so you can dispute it.

In short, if the customer raises an issue with your work after the due date, it is likely that they’re only using it as an excuse for not paying on time.

The Customer Says the Invoice Is Incorrect

Sometimes the customer will say that the reason you haven’t received their payment is that there was an error on the invoice.

In those circumstances, it can be helpful to request from your customer to confirm if all the data on your invoice is accurate; that way, you prevent this excuse and also confirm that the invoice is delivered.

Furthermore, if the invoice does turn out to be the problem, the most efficient way to handle it is to immediately find out what the error is, fix it and send the correct one.

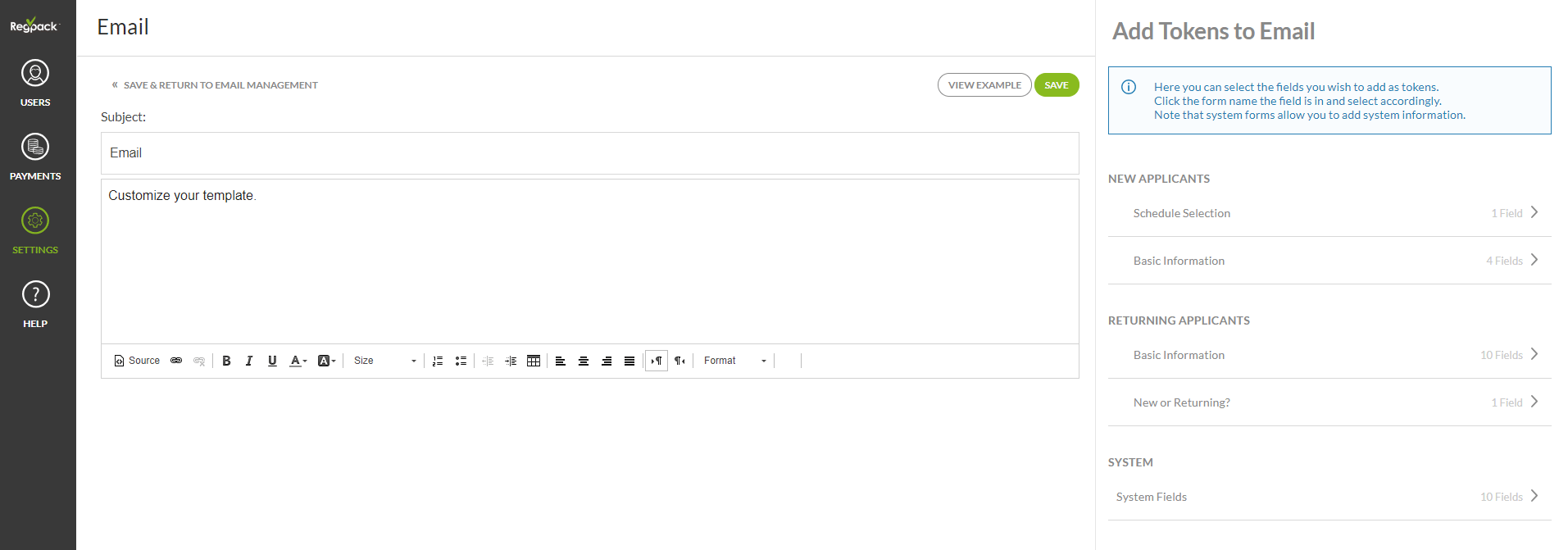

One way to eliminate the chances of ever hearing this excuse is by using a software solution like Regpack. It offers features that let you create templates for invoices, so you don’t have to manually write them every time and risk making mistakes.

Source: Regpack

For example, in the screenshot above, you can see the option of adding tokens to the email, allowing you to add user information directly onto an email.

Effectively handling this excuse boils down to being straightforward and efficient. Identify the error if it really exists, fix it and request your compensation.

They Claim to Be in the Process of Switching Banks

Switching banks can be a valid excuse for the late payment, but it has a very limited lifespan.

The process of switching banks often lasts for about a week; if the client makes this excuse, they should be able to pay you very soon.

Source: Regpack

However, if you’re not willing or able to wait, you can handle that excuse by asking them to pay you in some alternative way.

Most businesses have a system in place for those kinds of situations and have a payment solution at hand, be it a PayPal account, credit card, or maybe even cold, hard cash; everything is better than not receiving compensation for your work.

Also, ask your client for their new bank details and proof of the change to update your information. If they can’t or won’t provide you with that, it’s a good sign that they are just dodging payment.

The excuse of switching banks has a shelf life of a week or so. If the payment comes through soon, then there shouldn’t be a problem. But if it doesn’t, the problem was likely never switching banks.

The Customer Says They Can’t Pay

The inability to pay can be a tricky excuse to handle because, unlike the previous issue we’ve covered, you don’t have an indication for how long it might go on.

Indeed, your customers’ cash flow problems may not be your problem, but they can become one once they start to impact your revenue.

Try to collect as much information from your customer as you can regarding their cash flow problems. In other words, ask them why they can’t pay you and when they’ll be able to.

It’s a good idea to be firm and negotiate for the largest part of the total sum your customer can pay immediately. They can pay the difference that is left at a later date. It’s not ideal, but it’s certainly better than the alternative of never getting your total compensation.

Source: Regpack

It’s also better than dividing the total sum into small installments that could take a long time to add up.

Cash flow issues are challenging for anyone. However, you should put emotions aside and negotiate with your customers for the optimal solution.

They Claim to Be Bankrupt

Bankruptcy, liquidation, insolvency; all of that can happen, and none of it is pleasant to experience. Also, all of that can amount to a single excuse for late payment.

If your customer claims to be bankrupt and therefore can’t make a payment to you, don’t just wish them well and forget about it – get some proof.

Ask your customer for the details of the bankruptcy, like the relevant dates and the documents they’re using for filing it, and contact the regulatory body or insolvency practitioner handling it.

Source: Regpack

The customer should be able to provide you with all that information; otherwise, you might have an elaborate excuse for late payment on your hands.

If the excuse happens to be valid, an efficient way to handle it is to get in line for payment. In other words, lodge your claim for the money they owe you.

Bankruptcy can be a valid excuse or just a way to prolong payments. Your first step should always be finding proof and then considering your next steps. In other words, don’t just take the client at their word.

They Disregard the Due Date

Some customers might present you with an excuse in the line of we thought that the due date is 60 days, not 30! Whoops! In that case, it would be good for your business if you knew how to handle it.

To prevent this excuse from even coming up, it’s a good idea to pay close attention to the due date you put in your invoices and check to see if they are as straightforward and clear as possible.

If the due date is apparent, that can signify that your customer is just trying to get an extension and pay you at a later date.

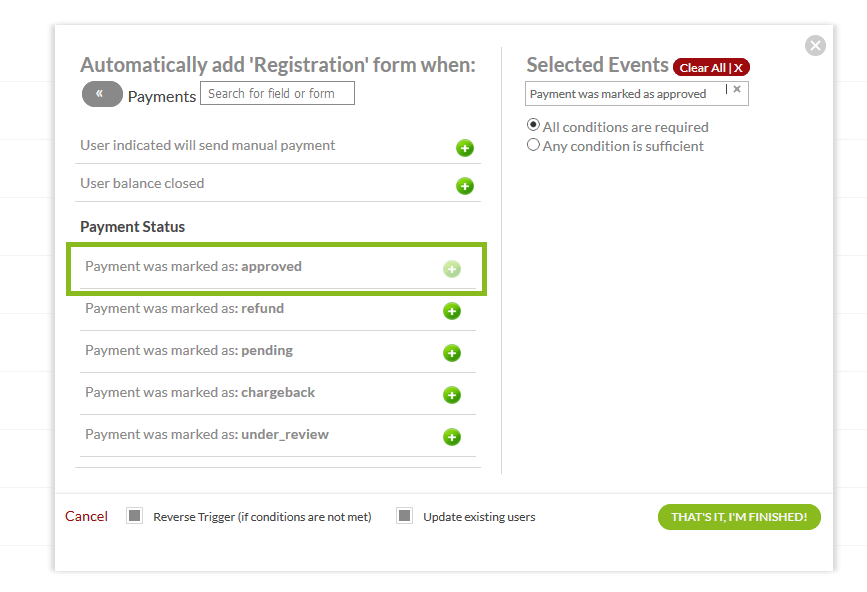

It can be helpful to have a system for overseeing and managing payments, so you know immediately if a customer is late.

For example, you can set up triggers in Regpack that automatically notify you when the customer pays.

Source: Regpack

It is also a good idea to set up reminders for the customer as soon as they miss a payment. That way, they won’t be able to disregard the due date.

Disregarding the due date is only acceptable if you never included it in the invoice. In every other case, it can be considered the client’s fault.

The Customer Has Specific Payment Policies

Some customers might have a non-standard way of paying their dues, and they may use that as an excuse to delay their payment as much as they can.

For example, big companies sometimes have a policy of paying within 90 days of receiving the invoice. That is not good for most small businesses and their cash flow.

Source: Regpack

If that kind of timeframe doesn’t work for you, you can handle this excuse by being insistent and relentless in your demands. Remember, if the payment terms are clearly stated and agreed upon, you won’t be out of line if you demand what you’re owed.

On the other hand, small businesses sometimes pay all their invoices once a month.

However, if you notice this client’s invoice hasn’t been paid within your 30-day payment deadline, that means they haven’t paid your invoice according to their own payment policy and they are now late.

Therefore, their payment policy isn’t a valid excuse.

Whatever the payment policy of your customers might be, you can handle their excuses by being persistent and reminding them of the terms you both agreed on.

They Flat Out Refuse to Pay

The last excuse we’ll cover in this article is not a valid excuse at all—your customer just refuses to pay without any real reason. What can you do?

The only thing left for you is to try to collect your payment any way you can. Within the limits of the law, of course.

Source: Regpack

You can send reminders and make it clear that you’ll be forced to take legal action if they don’t pay for your work.

Also, you can hire a professional debt collector that can handle the case for you, or take the customer to court. There’s also the option of writing off the debt if nothing else succeeds.

The customer who flat out refuses to pay might have their reasons, but that really shouldn’t be your concern.

As a professional, you deserve payment for your work, so don’t let this kind of thing slide. Try to remain professional, but don’t hesitate to get legal experts involved if need be.

Conclusion

Handling late payment excuses can take a lot of effort, patience, and strategic thinking.

It’s not easy to assess whether the excuse you’re facing is a genuine reason why the customer didn’t pay on time or merely a way for them to buy some more time and take advantage of the relationship you have.

Some of them lean more obviously on the one side than on the other, but the basic principles of handling them can apply across the board.

Adequate preparation, polite persistence, communication, and quickness in handling excuses can nip most of them in the bud.