For many small businesses, calling invoicing a headache would be an understatement.

But ensuring a reliable cash flow is crucial for keeping your lights on, your employees paid, and your business processes running smoothly.

That’s why it’s crucial for even solopreneurs and small businesses to use proper invoicing techniques—and invest in the technology to help make sure late payments don’t fall through the cracks.

Read on for six best practices to keep in mind when considering invoicing in your own business!

Simplify Your Invoices

As everyone knows, you’re much more likely to read and reply to an email from a coworker if they make the message lengthy, complicated, and dense… right?

Wrong.

Emails like that have a tendency to get left on read and neglected for as long as possible. No one wants to take the time to process paragraphs of legalese or over-explained ideas.

Client invoices are no different.

If you want to make it as likely as possible for your customer to respond immediately to your invoice, remember the KISS principle (keep it simple, stupid).

While the KISS principle was originally coined in reference to the design of military aircraft in the U.S., the idea of simplicity is equally important when designing your invoices.

Customers should be able to easily understand all fees, services, payment terms, and payment deadlines at a glance. This clarity helps prevent disputes and ensures you get paid faster.

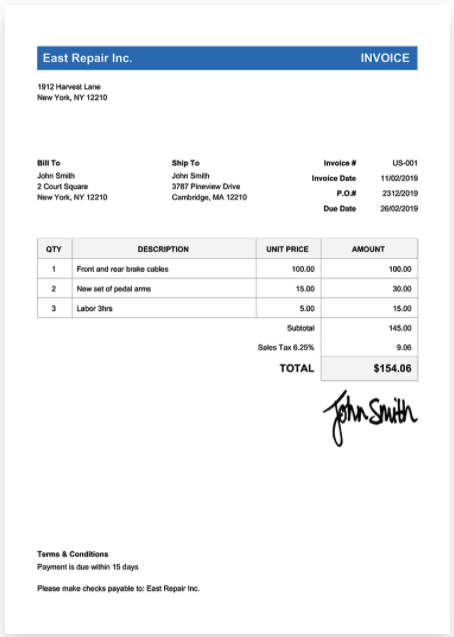

Source: Invoice Home

In the example above, there’s no clutter to distract or confuse the reader.

Your customer can easily see all the important information on one page, from the invoice date and due date in the top right corner to a clearly itemized list of charges (with the total due in bold).

But what if you need to inform the customer about complicated payment terms or terms and conditions?

One workaround for this problem is to post your terms and conditions on your website—then simply link to the appropriate page at the bottom of your invoice.

That way, you keep the invoice simple and sleek, while the relevant information is still readily available.

Include Detailed Item Descriptions

Overcomplicating your invoices is a bad idea if you want your customer to bother dealing with them in a timely matter. However, so is neglecting to properly describe the services or products being bought.

You’ll notice that even in the very simple example from the previous section, the invoice creator still made sure to include a clear list of each individual charge.

Your invoice should be simple, but not at the expense of showing your customer exactly what they’re paying for.

As the Kabbage blog puts it:

“Having detailed information on your business invoice ensures your customer has enough information to send their payment, speed up the payment process and avoid an unpaid invoice.”

Line items are an essential part of any good invoice. A line item is a detailed breakdown of all products or services bought during the invoice period, as well as any additional charges, fees, taxes, and discounts.

Even if your charges are simple and you think your customer will easily understand the total amount, it’s still polite (not to mention professional) to be completely transparent.

Include details about where your charges come from and highlight anything that factors into the bottom line.

Source: Invoice Simple

Your itemized list of products or services should include information like the quantity sold, the unit price, and the total price for each item.

Then at the bottom of the list, include any applicable discounts and taxes before displaying the total balance due.

That way, the invoice’s recipient will be able to follow your calculations at every step. They’ll understand completely how you came to the total.

And remember that someone you didn’t work with directly may be responsible for making payments.

So even if your contact understands the cost breakdown, without an itemized list on the invoice, you risk getting a confused call from their accounting department or office manager.

If you want to go a step further, include a description of each product or service on the line items.

Source: Invoice Simple

These descriptions may help jog your customer’s memory, if the name of the item isn’t enough to remind them what they’re paying for.

Make Use of Read Receipts

If you’re like most iPhone users, you have your read receipts turned off. Read receipts are those pesky little messages that tell the person that texted you if you’ve read their message, and when.

Source: How-To Geek

But when it comes to invoices, a Read Receipt can be a game-changer, so if you can use them, do it.

They can be set up in most email programs, and many invoicing apps also provide this feature.

For instance, if you’re sending invoices through email, it’s simple enough to turn on read receipts either directly in Gmail or through a third-party extension.

If you have a Gmail account, you can request read receipts directly from an email draft. At the bottom right of the draft window, click the three dots to the left of the trash can symbol. Then, select Request read receipt.

Source: Regpack

If this option is selected, you’ll receive an email notification with the time and date that the recipient opens your email.

Unfortunately, Gmail’s built-in read receipts have a few limitations:

- You’ll need to manually request read receipts for every message you send

- The recipient will need to accept the request

- It doesn’t work for bulk email lists; only recipients in the To and CC fields

Another option is to use third-party tools to track the email open rates for your invoices. If you’re a very small business, you may find that a Chrome extension like Boomerang for Gmail serves your needs well enough.

But if you’re working with long email lists or want to automate your messages, you’ll need a more powerful solution like a customer relationship management platform (CRM) or email marketing software.

These tools give you advanced analytics on not only open rates, but whether the recipient clicks the links inside each message.

Source: Regpack

No matter the method you choose, enabling email read receipts gives you more control over your invoice responses.

Knowing whether each recipient has opened your invoice lets you take action from here, whether it’s resending the invoice, following up, or sending a reminder.

Send Invoices Immediately

For many small business owners, the question of when to send invoices is a complicated one.

Should you send your invoice:

- Before work is completed?

- Immediately after the product or service is delivered?

- A period of time after the work is completed (or the product is purchased)?

There are valid reasons to choose each timing method. For example, some businesses that request a deposit before starting work (such as consultants or freelancers) choose to send the invoice ahead of time.

That way, the client can make the deposit as a show of good faith. This method helps to ensure a reliable cash flow and make the client financially invested in a good outcome for all.

Other small businesses choose to send invoices after the fact. Perhaps it’s a time-saving method to send all invoices on the last Friday of the month.

However, as Nick Darlington writes for FreshBooks:

“When I started my writing business, I once waited a week before sending an invoice. The thing is, I wasn’t doing myself any favors; cash flow quickly became a problem, and I was always worrying about money.

The funny thing was, all I had to do was invoice to get paid. It’s such a simple thing, yet many of us struggle with it because we have this preconceived idea of how we should act. Or, we’re fearful of what the client may say.”

While the timing of your invoices can vary based on your services, processes, and relationships with your customers, it’s usually best to send invoices immediately after the purchase is made or the service is delivered.

Sending the invoice as soon as you deliver the work ensures it’s fresh in the client’s mind.

Immediate invoicing has many other benefits, too, including ensuring that you don’t accidentally forget to send the invoice, and avoiding long delays if the client might have a long payment cycle.

As a result, you will appear more professional and ensure the client knows you’re keeping track of your accounts receivable.

Automate Invoicing to Reduce Errors

Many small business owners opt to create invoices manually, for a variety of reasons. Perhaps you’re a contractor or home inspector who fills out paper invoices while on the job site, or maybe you like the personal touch of a handwritten invoice.

However, in 2022, there are too many benefits to automated invoicing and billing software to ignore.

Automating your invoice processing can save you and your client multiple steps, not to mention hours of cumulative time.

Processing an invoice manually means personally overseeing its delivery, entering data into your accounting system, mailing a check, and approving (and recording) the invoice payment.

Source: Business Insider

On the other hand, automatic invoicing systems like Regpack’s can help you by:

- Getting you paid faster

- Creating personalized invoices, payment instructions, and reminder emails

- Accepting payments online

- Using automated data entry, so you don’t miss any essential customer or payment data

- Avoiding double invoicing or misplacing payments

In other words, automatization streamlines the process and improves the efficiency of your entire operation.

Don’t Forget to Follow Up

Don’t make the mistake of thinking your work is over once you’ve sent the invoice.

Unfortunately, we don’t live in a perfect world where every customer pays promptly and never forgets an invoice.

You’ll need to keep careful tabs on each invoice you send to ensure it’s been paid.

Make it a habit to follow up on outstanding invoices on a regular basis, such as three and seven days after a missed due date. You may also consider implementing a late fee (once a payment is more than a week late, for example) to incentivize clients to pay on time.

Don’t let the fear of seeming too pushy stop you; if the customer has made a purchase or ordered a service from you, you’re owed the compensation that was agreed upon.

This is why it’s essential to include clear terms in every invoice. From a glance, the reader should easily be able to see:

- The payment due date

- The payment terms (net 15, net 30, a payment plan with next payment due, etc.)

- The penalty for late payments, if any

If payment terms are clearly outlined in your invoice, it makes it that much easier to be firm if and when the client misses a due date.

When it’s time to follow up on outstanding invoices, remember to be polite but firm. Everyone’s busy, and it’s understandable when an email or two slips through the cracks.

Approach the situation by giving your customer the benefit of the doubt—but also make it clear that you won’t be letting non-payment slide.

Make it clear what your email is about by using a subject line like Outstanding invoice ##—Please pay promptly!

Then, your email might look something like this:

Source: Clockify

Finally, your follow-up email should be quick and courteous. Gently remind your client of the overdue invoice, using reference information like the payment amount, invoice number, and missed due date.

Invoicing Best Practices: Use Technology to Keep Payments Running Smoothly

For small businesses, the practice of charging and collecting payments is often tricky at best. Designing an effective invoice, making sure the customer has seen it, and tracking overdue invoices can take a good chunk of labor hours—especially if done manually.

That’s why it’s crucial to choose invoicing and payments software that comes with automation tools to help you.

Look for solutions like Regpack that let you automate emails, track overdue balances, and get paid faster.