It’s 2023, and a large number of customers prefer to pay with a credit card.

In fact, one Zippia study found that, on average, 41% of consumers prefer to pay with a credit card.

Therefore, if you don’t have a secure, efficient process in place for accepting digital payments, you’re likely missing out on almost half of your customer base.

When it comes to improving your business efficiency, every detail counts—which is why you need a payment system that simplifies your processes, keeps customer data secure and provides robust data analytics to help your organization grow.

You may have heard that you could benefit from an integrated payment system. But what, exactly, is an integrated payment solution, and is it right for your business?

In this article, we’ll tell you everything you need to know about integrated payment systems, their advantages, and how to choose the right solution for your organization.

- What Are Integrated Payment Systems?

- What Are the Advantages of Integrated Payment Systems?

- How Do Integrated Payment Systems Work?

- How to Choose an Integrated Payment System

- Monetize Payments With Regpack

What Are Integrated Payment Systems?

An integrated payment system automates payment acceptance and combines it with other systems your company uses, such as accounting, invoicing, and client management software.

Since each payment system is fitted to match each company’s tech stack and processes, no integrated payment system is exactly the same.

Some integrated payment systems are simple, like accepting payments and passing information along to your accounting tool.

Others are more complex—like sending each new payment to your third-party CRM to update that client’s profile with their new balance, then passing that data to your accounting tool to keep accurate revenue records.

Integrating payments with your other critical business processes gives you real-time insights and flexibility, while also saving you the time you would otherwise spend on monotonous data entry from one tool to another.

What Are the Advantages of Integrated Payment Systems?

An integrated payment system makes your entire organization more efficient.

Not only does it lead to faster payment processing, but the right solution will provide enhanced security and data analytics.

Up-to-date access to payments and financial data lets you make educated decisions, predict cash flow and ensure your entire team is on the same page.

Faster Payment Processing

To keep your ledger balanced, you need to follow several steps, including:

- Transferring data between tools

- Reconciling invoices

- Collecting and managing receipts

With an integrated payment system, much of this process is automated.

Instead of manually plugging data into multiple tools and reconciling individual invoices, your integrated solution lets you connect payments to invoices and client profiles automatically.

Automating these accounting tasks helps the entire payments process go faster and more smoothly.

As a result, it saves you time that you can spend on higher-level pursuits, like customer success or business strategy.

Improved Payment Security

One major benefit of using an integrated payment system is the increased security and protection of sensitive customer data.

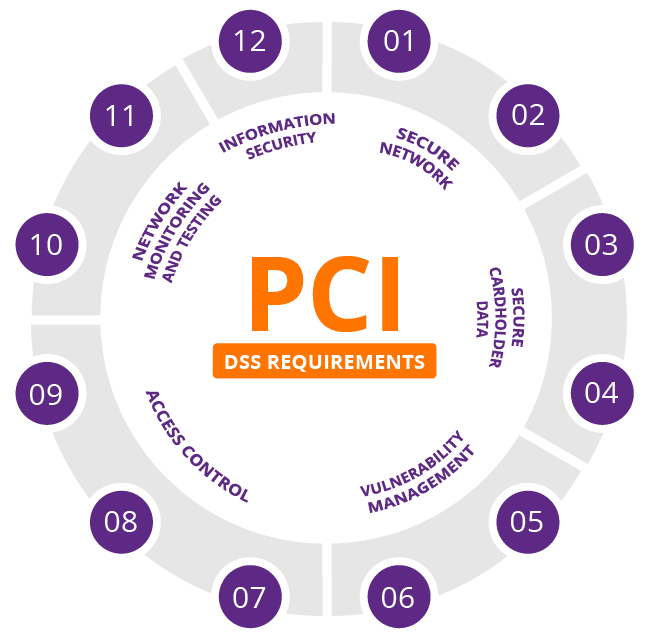

Integrated payment systems are required to be in compliance with PCI DSS (The Payment Card Industry Data Security Standard) regulations, which are global standards for data security and payment safety.

Source: Imperva

To receive a PCI DSS certificate, these tools must maintain an effective firewall, encrypt data transmission across financial data networks, and prevent users’ access to cardholder data.

They must also use updated antivirus software and test security processes frequently.

These integrated payment systems offer safeguards like end-to-end encryption and tokenization, which keep your customers’ card data protected from hackers and data breaches.

Access to Payment Analytics

Finally, integrated payment systems give you immediate and real-time access to essential data about your customers and financial trends.

These tools usually offer customized reports and analytics dashboards to give you insight into which payment methods your customers most prefer, for example.

Or you can gather information on things like:

- The parts of the world where your customers live

- Customer shopping behavior

- Average transaction value

- Repeat and loyal customers

The information gleaned from a high-quality integrated payment system can help you make more informed decisions about your business operations.

How Do Integrated Payment Systems Work?

Without an integrated payment system, you rely on manual workflows to accept and account for payments. The process would look something like this:

- A customer gives you their payment information in person, over the phone, or online.

- You input their credit card number into your payment terminal.

- Print an invoice and payment receipt, saving a copy for your records.

- At the end of the day, manually compare paper receipts to your accounts receivable ledger and make sure your records are up to date.

- Update your customer relationship management (CRM) tool to reflect paying customers’ balances or ensure that their accounts are in good standing.

As you can see, this process is both time-consuming and rife with risks. At any point, there’s opportunity for human error.

What if your cashier inputs the wrong credit card number, billing address, or name spelling into the terminal?

What if a receipt is misplaced or someone forgets to manually update your electronic invoices?

How likely is it that every single payment will make its way to your CRM system to keep your customer logs up to date?

On the other hand, the payment process in an integrated payment system would look something like this:

- A customer gives you their payment information in person, over the phone, or online.

- You input their credit card number directly into your accounting software.

- The integration processes the payment correctly and automatically updates any connected tools (such as your CRM).

That’s it! Instead of relying on multiple steps with manual processes to keep all of your records reconciled, you only have to initiate the payment process.

The integrated system takes care of the rest.

Your integrated payment ledger displays your transaction history in real time, letting you access accurate and up-to-date accounting insights at any time.

By automatically connecting all of your business’s critical software related to payments and customer management, an integrated solution creates an encrypted, reliable system for maintaining business processes and agility.

How to Choose an Integrated Payment System

Now that you know how crucial an integrated solution is to scaling your business, let’s cover the most important features to consider when looking for the right fit.

Compatibility With Your Company’s Existing Systems

What tools do you already use? Make sure that whatever integrated solution you choose can work well with your existing tech stack.

Keep your processes in mind as well. Consider the size of your team—how many users and departments will be involved?

What workflows (like updating accounting ledgers or adding entries to a CRM tool) will you want to include in your integrated system?

Finally, an integrated payments system is about more than your internal workflows. As with everything in business, the solution you choose should only enhance your customer experience.

Look for a merchant service provider that offers an integrated payments system with features customers can appreciate, like multiple payment types and a user-friendly interface.

Data Encryption and PCI DSS Compliance

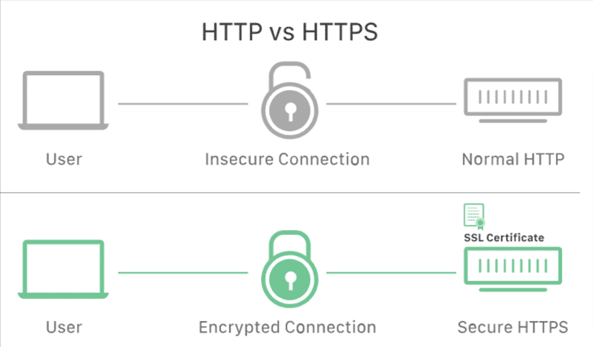

According to the Identity Theft Resource Center, over 90% of data breaches result from cyberattacks—so it’s essential to keep your customers’ online payments secure.

And this starts with your payment processor’s security protocols.

Source: Cloudflare

An HTTPS address shows that a website has a Secure Sockets Layer (SSL) certificate—meaning the connection is encrypted and secure.

An HTTPS address is just one part of a PCI compliance requirement.

Following this and other Payment Card Industry Data Security Standards (PCI DSS) is essential for gaining (and maintaining) your customers’ trust.

These guidelines for handling credit card information help your organization prevent data breaches, stay in good standing with credit card processors, and avoid fines.

The right integrated payment solution will go above and beyond the established security standards to keep your customers’ data safe.

For example, not only is Regpack PCI compliant Level 2, but it also boasts the best-in-class WAF (Web Application Firewall).

The firewall defends from all attacks on your database at the transmission level.

Our servers sit behind a physical firewall that is overseen by a dedicated external security team, and each server is encrypted at the disk level.

To learn more about our dedication to security, check out our security statement.

Payment Analytics

Choose an integrated payment solution that offers comprehensive payment analytics and the ability to create custom reports.

These reports give you insights into the status of your business’s payment collection process and make it easier to find ways to improve the customer experience.

The right payment gateway should provide detailed records of all transactions, making it easy to see which balances have been paid and which are outstanding.

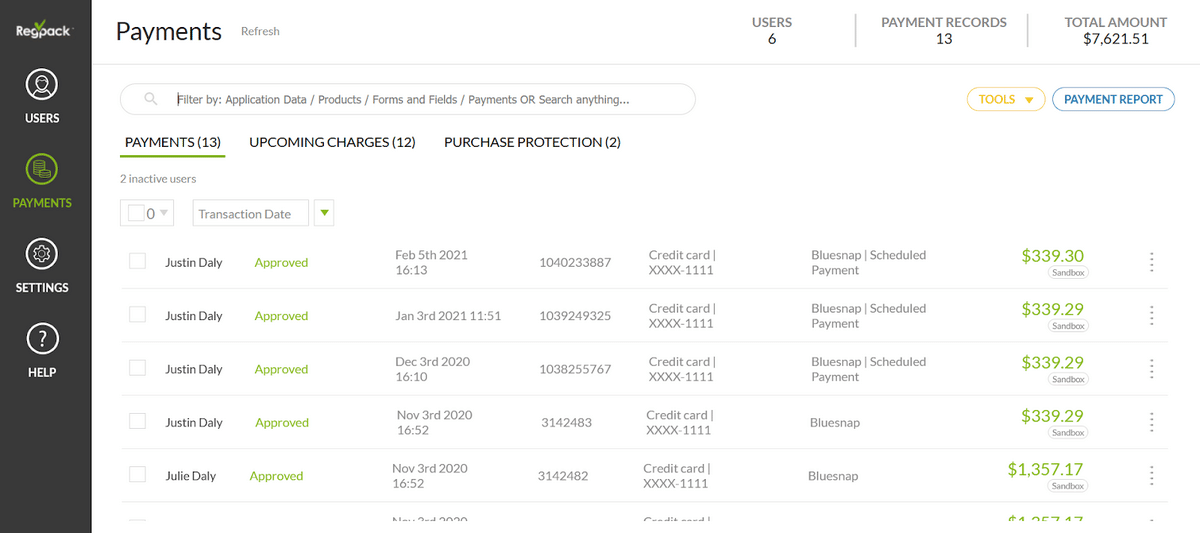

Source: Regpack

Your integrated payment system should also let you filter customer payment data by product, payment method, and other categories.

These customizable views allow you to get a quick understanding of your customer base, which payment methods they prefer, and overall spending patterns.

For instance, with Regpack, you can filter by:

- Products

- Forms and fields

- Payments

- Application data

- And more!

A filtering function lets you analyze customer behavior and adjust your business practices accordingly.

For instance, you might learn that the customers who tend to be late on payments aren’t using the auto-billing option—which means you can get more on-time payments by encouraging more customers to move to recurring billing.

Additionally, your integrated payment tool should also provide a search function to let you find customers and invoices quickly.

With the right information at your fingertips, your team can answer customer questions and develop an effective business strategy.

Excellent Customer Support

Any change in business technology necessarily comes with bugs and interruptions.

The best strategy for shifting to an integrated payment system includes choosing a provider with exceptional customer service.

The right customer service will be there for you not only while you’re setting up your system, but afterwards as well.

Therefore, ensure that the brand you choose provides excellent client support.

Monetize Payments With Regpack

If your business wants to succeed in 2023 and beyond, it needs to accept credit cards.

But payment processing can quickly become a massive drain on your resources, especially if you have to manually enter credit card data, reconcile accounts, and update multiple apps.

The best solution for creating a seamless customer experience is to implement an integrated payment system.

When choosing an integrated payment solution, keep compatibility with your existing tech stack and workflows in mind, prioritize data security and PCI compliance, and make sure your solution offers reliable payment analytics and excellent customer support.

Integrated, automated payment systems make your organization more efficient and your payments more reliable.

The right tool, like Regpack, can help your business scale by automating payment processing, keeping customer data secure, and offering payment analytics to help you make essential business decisions.