Fed up with manual accounting tasks, many small service-based businesses are embracing payment technology that allows for time-saving automation and seamless data transfer between various accounting and payment systems.

Integrated payment solutions bring numerous financial and operational benefits, from faster payment processing and cash flow to more effective customer service and reporting.

Today, we’ll illuminate the many benefits of integrated payments.

Faster Payment Processing

Integrated payment solutions save you time because they automate a lot of the accounting tasks that you’d otherwise have to do manually, like the following:

| Reconciling invoices |

| Plugging data into multiple platforms |

| Collecting receipts |

| Updating accounting software |

Plugging data into various platforms is probably the most significant time waster, not to mention the most boring of the bunch.

With an integrated solution, if you enter a payment into your accounting system, it will connect payments to invoices automatically.

You don’t have to go back into the related platforms to balance your ledger.

Automating these and other accounting tasks will reduce the time it takes for each payment to process, so you’ll receive the funds from your customers’ payments more quickly.

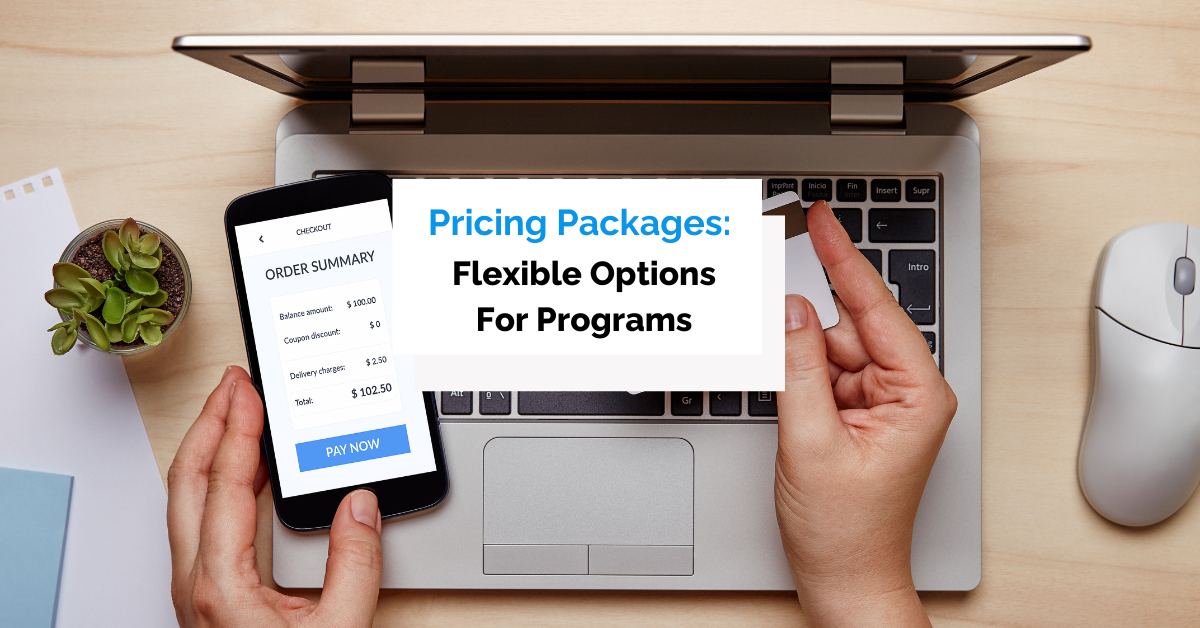

Integrated payment solutions often come with other time-saving features as well, like automated recurring billing.

Source: Regpack

This handy feature will automatically bill your customers on a recurring basis if they choose this option. You don’t have to lift a finger.

In sum, using an integrated payment solution saves you time. Plus, it allows you to focus on other higher-level tasks that only you can do, like strategy or customer satisfaction.

Less Room for Human Error

Processing huge amounts of transaction data manually is an extremely error-prone approach.

Employees can easily make mistakes, from plugging in inaccurate information into your accounting software to misplacing a paper invoice or ledger.

Even small accounting mistakes can have major consequences.

It’s estimated that human error costs enterprises $37 billion per year, not to mention the harm to your brand’s reputation.

Using an integrated payment system dramatically reduces the risk of human error because it automates many of the tedious payment processing and accounting tasks that employees used to do.

For example, data is synced automatically between your payment systems. No one has to plug in the data from a transaction.

That means no fingers can slip and accidentally type an extra zero into your accounting software.

Plus, since the transaction data is recorded in online software platforms, there’s no need to keep a paper ledger, and therefore no way to lose one.

Most platforms are on the cloud, so even if your computer crashes, you still have all your financial data in safekeeping.

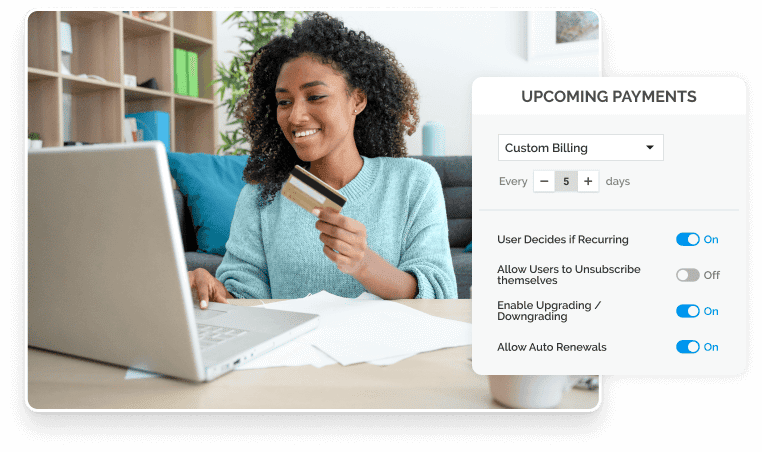

These integrated payment solutions often have a recurring billing feature that automatically invoices your customers or deducts payments from their accounts.

Features like these also reduce human error. In this case, it keeps you from forgetting to invoice your customers at the right time, a mistake that could delay your payment collection and disrupt your cash flow.

Whenever you automate steps in a process, you eliminate the potential for mistakes and the costs they bring to your business.

Increased Payment Security

Increased payment security and better protection of sensitive financial data is a major benefit of integrated payment systems.

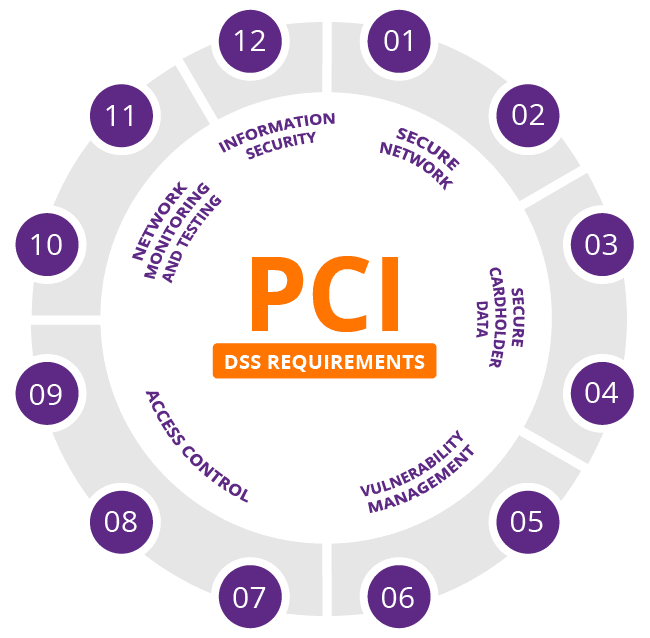

Integrated payment systems must comply with the Payment Card Industry Data Security Standard (PCI DSS).

This is a set of guidelines and regulations that software platforms must follow to ensure that the merchant and customer interacting with the software are safe from security breaches.

Source: Imperva

Here are some of the things payment processing tools have to do to receive a PCI DSS certificate:

| Install and maintain an effective firewall |

| Encrypt transmission of financial data across networks |

| Use and update anti-virus software |

| Prevent physical access to cardholder data |

| Consistently test security processes and tools |

Additionally, when you use integration payment solutions, your important financial information will be stored online, not on paper ledgers or other physical documents that can easily be lost or stolen.

Most solutions are cloud-based accounting tools, meaning sensitive financial data will be stored across a vast network of secure and remote servers.

Plus, cloud-based accounting software is typically supported by data centers that offer various levels of cyber and physical security—much more than you’d find in the average small business—making it a safe option.

For example, cloud-based software with integrated payment capabilities also tends to offer safeguards like end-to-end encryption and tokenization, which prevent hackers from accessing your or your customers’ data.

Security should be taken seriously where financial transactions are concerned. A breach can significantly undermine the trust you’ve built with your customers.

Integrated payment solutions typically offer better payment security than manual methods.

Improved Cash Flow

According to a QuickBooks State of Small Business Cash Flow survey, 61% of small businesses frequently struggle with cash flow issues.

As a result, too many business owners aren’t able to pay their vendors and employees, so they are forced to pause or shut down operations.

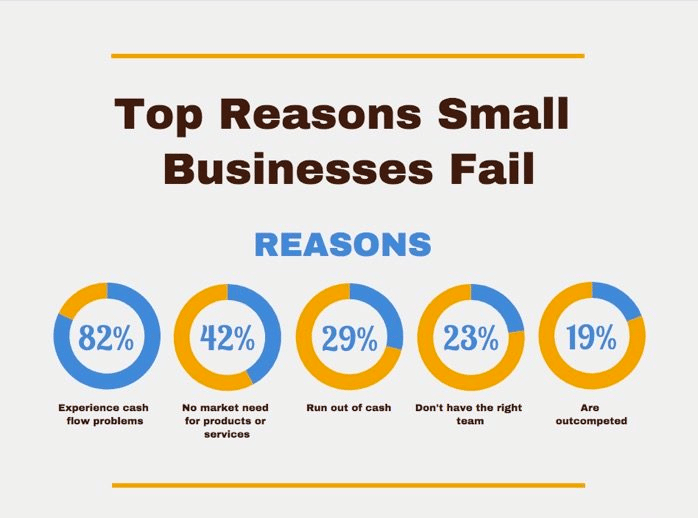

In fact, cash flow mismanagement is the number one cause of small business failure:

Source: Monetize

Therefore, it’s important that small businesses follow cash flow best practices like sending invoices right after providing the service or reconciling invoices at the end of every day.

Because integrated payment solutions automate best practices like the above, they indirectly help businesses achieve stronger cash flow and avoid cash flow problems.

The time between when the service is rendered and the payment is processed and turned into funds is dramatically shortened when you don’t have all this manual work to do.

You’ll never run into the issue of forgetting to reconcile invoices at the end of one day and the next experiencing a huge pile you have to get through in order to get your funds on time.

Further, if your solution has an automated recurring billing function, you and your staff are off the hook for sending invoices on time.

You’ll almost never receive a delayed payment because of some internal accounting mishap.

Many of these tools also come with reporting and forecasting functionality that can help you predict future cash flow and analyze your payment processes to figure out how to improve your account receivable management process and cash flow.

With the right integrated payment solution, receiving and processing your payments will be fast and effortless.

It’ll help you avoid the uncomfortable experience of looking at an almost empty business bank account.

Cost Reduction

A major advantage of using integrated payments is that doing so reduces your overall operating costs via automation.

With integrated payments, you won’t have to allocate as many resources and employees to accounting as before.

It takes fewer hours, people, and even business supplies to accept and process payments.

If you were to do it manually, payment processing tasks like reconciling invoices or plugging data into multiple platforms can take upwards of 2 hours per day, sometimes more.

Automation reduces or eliminates many cost categories: late fees, personnel costs, postage costs, discounts, human errors, and data storage.

Plus, it precludes mistakes and errors that can lead to expensive legal fees.

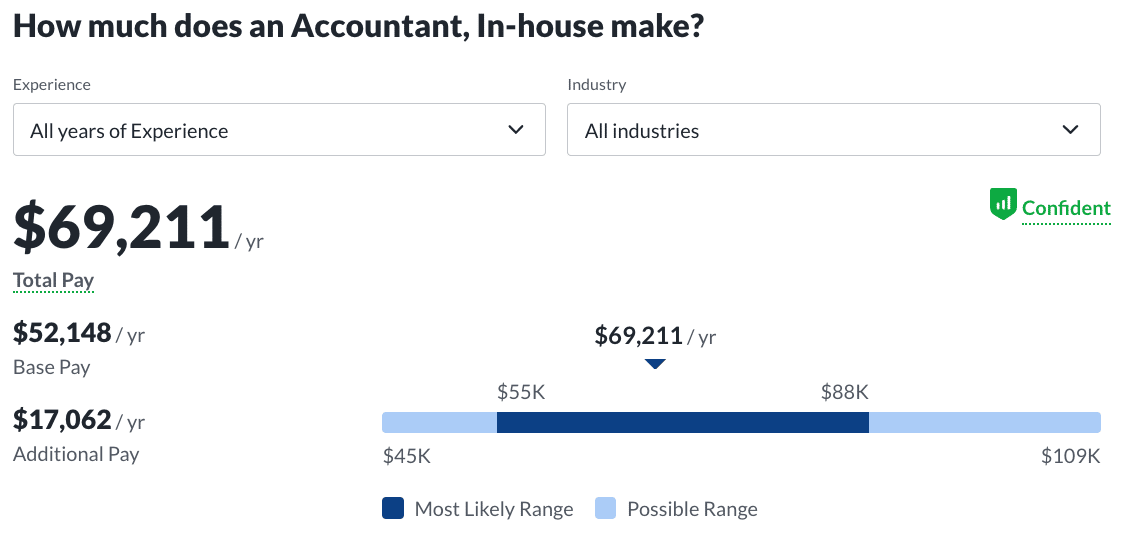

One of the biggest areas of cost savings is personnel. While you’ll still likely need a trained accountant to handle your books, you’ll need a smaller accounting team.

For small businesses, just one team member might do the trick.

And when an in-house accountant costs an average of around $70,000 per year, the savings from cutting back on hiring new employees can be high:

Source: Glassdoor

The same goes for outsourcing accounting, which is often around $100 to $250 per hour, depending on the services.

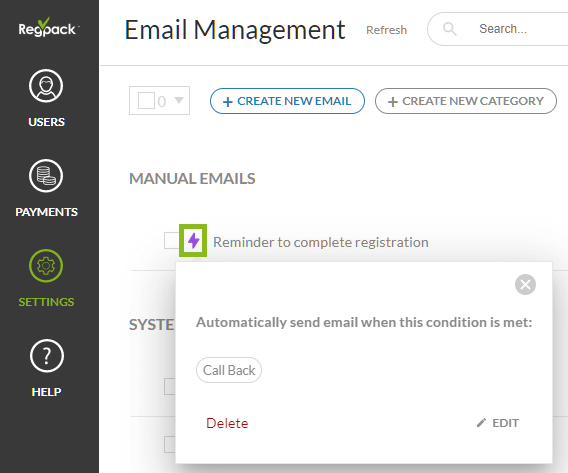

Furthermore, integrated payment platforms often come with other features that help your business earn more money, such as automated email communication systems, which can be used to build relationships with customers so that they buy more of your services.

Here’s an example of Regpack’s email feature, which enables you to set up automation options that will send emails to specific customers when a certain condition is met:

Source: Regpack

And reporting capabilities enable you to dig down into your payment data to see how you can create a payment collection process that costs less for your business.

In sum, switching to an integrated payment solution allows you to save money by ensuring lower personnel costs, fewer costly human errors, and more time to invest in cost-reduction initiatives.

Access to Detailed Payment Reports

When you use an integrated payment solution you gain access to its reporting features like pre-built reports, custom reports, analytics dashboards, and more.

Detailed payment reports help you uncover payment trends, service seasonality, or payment process issues.

And you can then make more informed data-driven decisions about your accounting operations.

For example, payment reports can give you insight into which payment methods your customers prefer and then decide to focus on streamlining the payment process for the most popular methods.

Or, you can run a report to see which customers are late most often and then set up an automation that sends them a few payment reminder emails before every due date.

This is a great way to prevent those customers from continuing their payment trend of paying late, which always hurts cash flow.

True visibility into your payment collection process will also enable you to improve your current process by identifying the real roadblocks.

For instance, if you found a specific payment method (ACH, e-wallet, etc.) that was taking a long time to process compared to other methods, you could figure out why and then decide to fix it or get rid of it as an option.

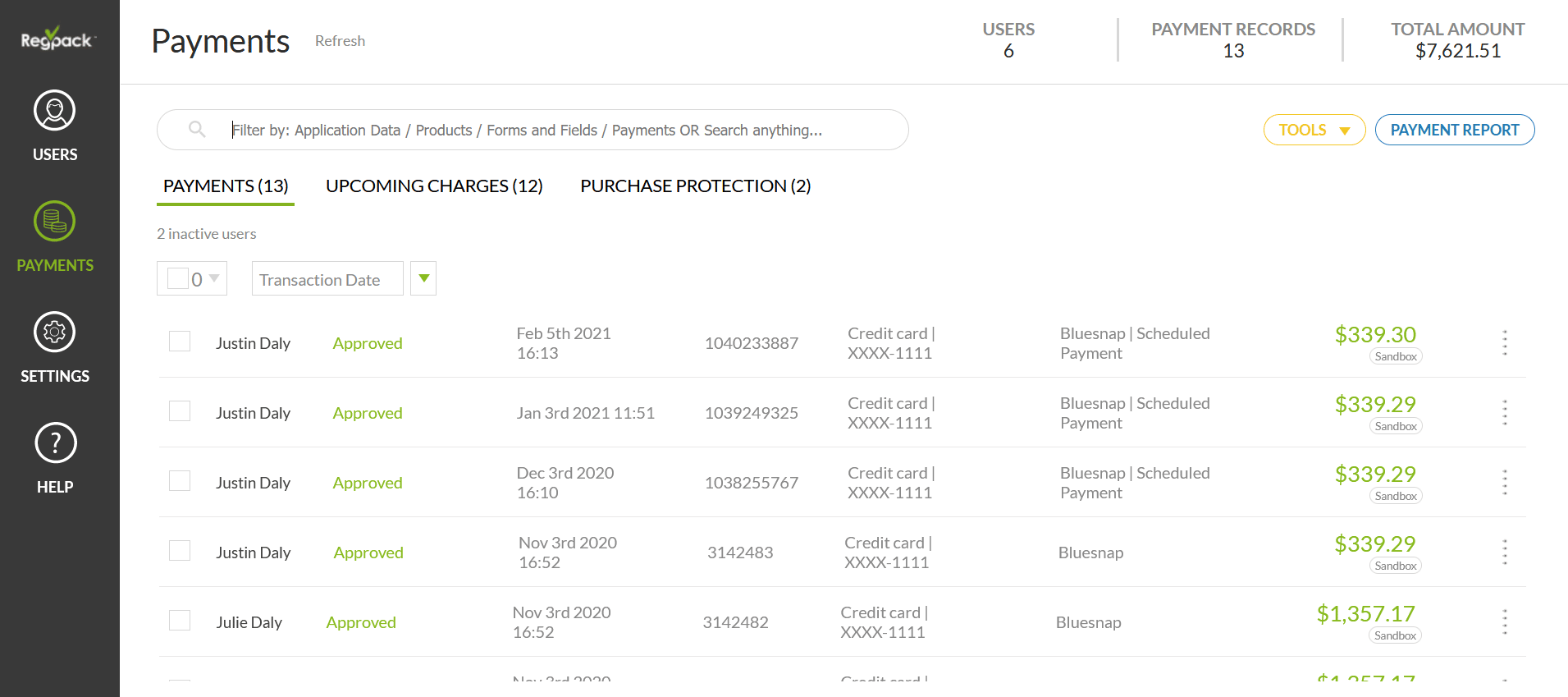

With an integrated payment software solution like Regpack, which comes with dozens of filters, you can view the entire payment history of a specific customer, a segment of customers, a specific service, a payment method, and other categories.

For example, here’s a simple payment report highlighting a business’s most recent payments:

Source: Regpack

It tells you who made each payment, whether it’s been approved, the date, payment method, and the amount.

Here are some of the other common payment reports users run in Regpack:

| Overdue payment reports |

| Overdue auto bill reports |

| Balance due reports |

| Emails sent to users |

| Monthly payment reports with date range |

Tools like Regpack provide clarity about your business’s sales and payments, allowing you to make decisions based on hard data rather than on a hunch.

More Efficient Customer Service

The last advantage of using integrated payments is that you’ll be better equipped to serve your customers, both during and after the checkout process.

During the checkout process, your customers will be able to easily pay for their service, especially if you’re using payment software that allows for online payments via various methods like bank transfers and credit cards.

If you have a brick-and-mortar store, the fast transfer of data between the POS system and payment processor will enable customers to quickly pay for your product or service and get on with their day.

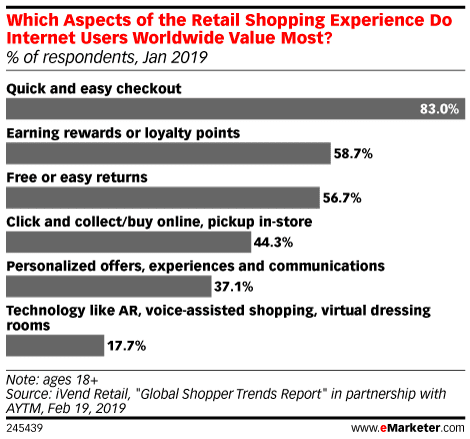

Consumers put a high premium on fast and easy checkouts:

Source: Insider Intelligence

After the checkout process, some customers might have questions about their transaction or want to initiate a refund or dispute a specific charge.

Since all your financial data is just a few scrolls of the mouse away, you will be able to quickly find the information necessary to help them get the answers and services they want and expect.

You won’t have to sift through paper documents, receipts, and invoices to find the necessary information while taking up the customer’s time.

And there’s no chance that you’ll have lost the payment information—a scenario that would frustrate the client and hurt your brand’s reputation. If that were to happen, customers might think of your business as disorganized and illegitimate.

If you do have to reverse a transaction or something similar, the process is simplified via software, and all of your systems involved in payments and accounting will be updated automatically to reflect the change.

Because the systems talk to each other, there’s no need to go into multiple payment systems and submit the changed data.

In sum, when you make it easy for yourself to find and access critical payment information, you also make your customers’ lives easier as well.

They get fast and competent service from their service provider, and going forward they will think of you as easy to work with.

Conclusion

Implementing an integrated payment solution empowers your business to process payments more quickly, reduce human error, and improve cash flow and profits.

Most important of all, automation frees up your team to focus on parts of their job that are more difficult and rewarding.

Instead of entering data and searching for documents, you can engage in deep, impactful work, such as strategy and analysis.

Let the robots do the tedious stuff. They’re better at it anyway.