Whether you’re running a small business or growing a startup, you know that one thing is absolutely non-negotiable: getting paid. This is why understanding how to send an invoice is critical.

Sending an invoice is more than just asking for payment; it’s a key part of maintaining cash flow and ensuring smooth business operations. While the basics—like including an invoice number and payment terms—are a must, there are additional strategies that can ensure you get paid on time and avoid unpaid invoices.

1. Use a Professional Invoice Template

First impressions matter, and this holds true for your invoices as well. A professional invoice template ensures consistency and presents your business in the best light. When creating your invoice, be sure to include critical details such as the invoice number, due date, contact information, and payment details. Having a clear, organized layout will prevent confusion and speed up the payment process.

Many invoicing software options provide professional invoice templates that allow you to plug in your details quickly. Not only does this save time, but it also ensures that your invoices look polished every time.

Source: Regpack

2. Include Clear Payment Terms

Clients should never have to guess when the payment is due or what penalties apply for late payments. Whether you’re offering 30-day terms or expecting payment upon receipt, make sure these details are prominently displayed on your invoice.

3. Send Invoices Promptly

Timing is everything when it comes to getting paid. The longer you wait to send an invoice, the more likely it is that cash flow disruptions will occur. Once the project or service is completed, make sending the initial invoice or new invoice a priority. Invoices that are sent promptly after work is finished are more likely to be paid on time.

For recurring clients, consider setting up draft orders or recurring invoices so that you can automatically bill them at set intervals without delays.

Learn more about Recurring Invoices

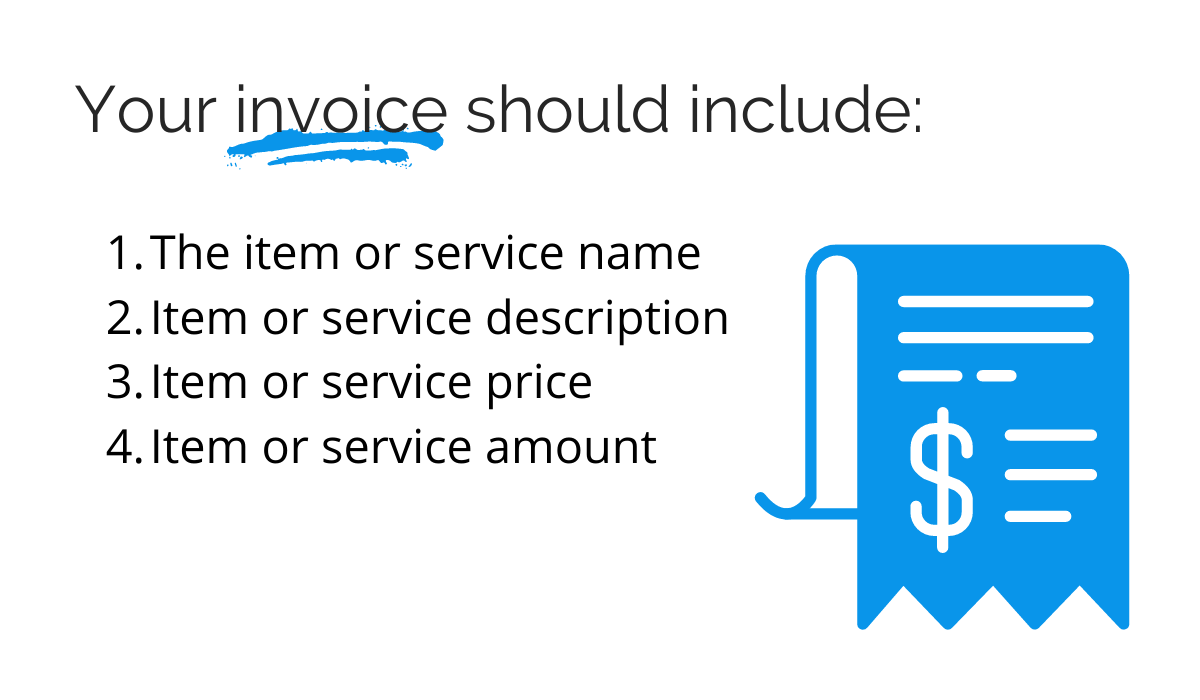

4. Be Detailed and Transparent

Transparency is key when it comes to invoicing. Provide a detailed breakdown of the services or products rendered. Include any applicable tax rates and meet any legal requirements to ensure your invoice complies with regulations. By being transparent, you reduce the chances of disputes and improve the likelihood of getting paid on time.

Clear, itemized invoices also help avoid situations where clients may argue about what they’re being charged for, reducing the risk of unpaid invoices.

Tips for How to Deal with Overdue or Unpaid Invoices

5. Automate the Invoicing Process

Manually creating and sending invoices can be time-consuming. Instead, opt for invoicing software that automates the process. Not only does this help you send invoices quickly, but many tools also provide features like automatic reminders and payment reminders for overdue accounts. This can be particularly useful for small businesses that don’t have a dedicated accounts receivable team.

6. Include Clear Payment Options

Another way to make sure you get paid on time is by offering multiple payment methods. Providing clients with a variety of payment options such as online payments, credit cards, ACH bank transfers, and debit cards can make the process easier and faster for them. The easier you make it for your clients to pay, the less likely you are to have unpaid invoices lingering.

Make sure to specify these payment options clearly on the invoice, so your client knows exactly how they can pay you.

7. Use a Clear Subject Line for Invoice Emails

When sending an invoice email, the subject line plays a big role in whether your invoice is paid promptly or not. A clear, direct subject line ensures that your client knows exactly what the email is about without having to open it. For example, use “Invoice #123 – Due [Due Date]” or “Your Invoice for [Service Name].”

Including the invoice number and due date in the subject line is a simple way to increase your chances of getting paid on time.

8. Personalize Your Invoice Email with an Invoice Template

Personalization matters even in your invoice emails. A warm and professional tone goes a long way in maintaining positive relationships with your clients. Customize your email template to include a short thank-you note or acknowledgment of your client’s business. This small touch can leave a lasting positive impression.

Many invoice templates allow for customization in both the invoice and the accompanying email template, so you can tailor each message depending on your client and the nature of the work.

How to Write the Best Payment Acknowledgement Emails

9. Set Up a Draft Order or Use Recurring Invoices

For clients you work with regularly, it’s worth setting up a draft order or recurring invoice to simplify the billing process. This method works particularly well for service-based businesses with ongoing contracts. Automating these invoices ensures you never miss a billing cycle and your clients receive consistent, timely invoices.

Recurring invoicing not only saves you time but also ensures your clients know when to expect their invoices, which helps avoid late or unpaid invoices.

10. Follow Up with Friendly Payment Reminders

Even with the best practices in place, there will always be clients who need a nudge. Sending payment reminders for unpaid invoices is a necessary part of the invoicing process. Keep your reminders polite but firm, and ensure that your clients have all the information they need to complete the payment.

Setting up automatic reminders with your invoicing software can help ensure you follow up in a timely manner without the need for manual intervention.

7 Invoice Reminder Email Templates to Ask for Late Payments

Benefits of Using Regpack for Invoicing

By following these 10 tips, you can ensure that your invoices are professional, clear, and effective in getting you paid on time.

At Regpack, we understand the importance of efficient, reliable invoicing.

Our platform helps businesses automate the entire process, from creating and sending invoices to managing payment reminders and tracking unpaid invoices. With Regpack, you can customize your invoice template, set up recurring invoices, and offer a variety of payment methods, including online payments via credit card or ACH bank transfer.

Try Regpack today and take the stress out of sending invoices.