Manual processes work well enough when you have a small business. When you only have a few customers, it’s relatively easy to track payments and invoices manually.

But as your business scales, it becomes less and less practical to rely on a spreadsheet to keep your billing operations running smoothly.

An automated billing platform can help you avoid the many pitfalls inherent in manual billing, like inefficiency, errors—and, eventually, customer churn.

These tools are especially necessary for subscription-based businesses that manage subscription billing by invoicing and collecting payments regularly.

The right billing automation system takes care of the heavy lifting involved in the billing cycle, including invoicing, accepting payments, sending payment reminders, and reconciling your payment data.

And the time you save can be spent on more important tasks—like building your business and serving your customers.

In this article, we’ll show you how to choose the right billing software and how to set it up for success.

- Choose the Right Automated Billing Software

- Integrate Billing Software With Accounting Software

- Set up Electronic Invoicing

- Schedule Automatic Payment Reminders

- Launch a Customer Payment Portal

- Automatically Generate Payment Reports

- Scale Your Business With Automated Billing

Choose the Right Automated Billing Software

Automated invoicing and billing are essential activities for any business. They save your team time and money and reduce human error.

But while automated billing tools offer similar benefits to businesses of all sizes and industries, no two companies have the same business requirements or need the same set of features in their billing models.

That said, the first step in automating your billing process is to decide what you’re looking for.

There is a wide variety of billing software options on the market, each with its own pricing and specific features. So determine your budget and consider the specific needs of your business.

With the best billing software—like Regpack—you can expect to find features like the ones described below.

Online Invoicing

Instead of a paper invoice in the mail, your customers should receive an automated email reminding them when a payment is due.

Regpack’s invoicing process lets you send a personalized message along with the payment instructions, which makes it simple and easy to get paid faster.

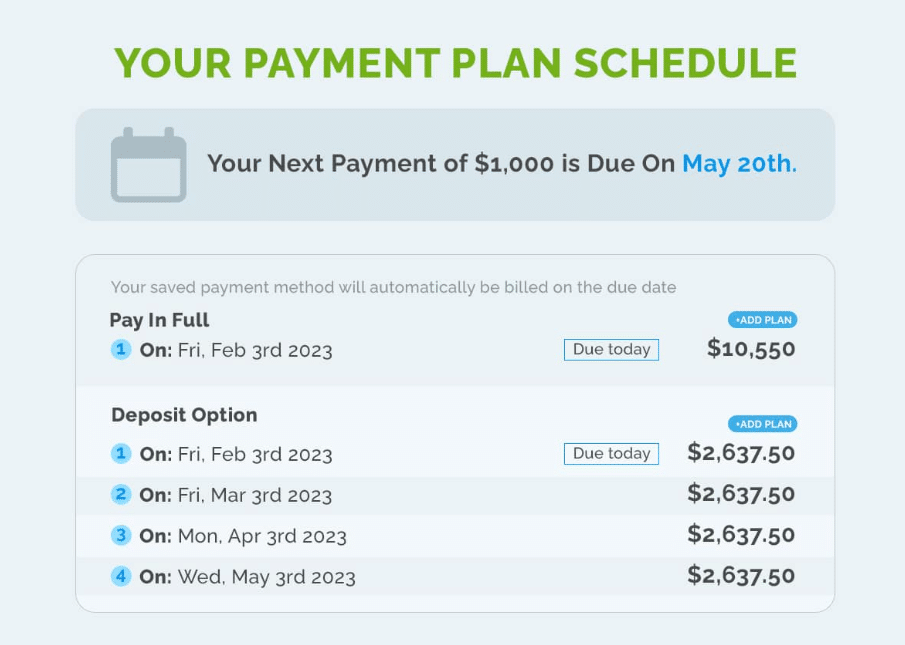

Payment Plans

Another feature to look for is the ability to set up custom payment plans for your customers.

By allowing users to choose an installment plan that works for them, you build more flexibility into your process and improve the customer experience.

Source: Regpack

Regpack clients who use our payment plans report a 75% decrease in non-payments, a 25% cash flow improvement, and a 35% increase in conversions!

Advanced Security

Accepting payments online means having access to your customer’s most sensitive data—like their name, contact information, and credit card or bank info.

That means it’s crucial to choose an electronic billing system that protects your and your customer’s data.

Regpack, for instance, is PCI-compliant Level 2 and has passed all audits since the first scan in 2010. Our best-in-class WAF (Web Application Firewall) filters all possible database attacks at the transmission level.

We also perform regular code audits to ensure data security is a primary objective of all the code we write.

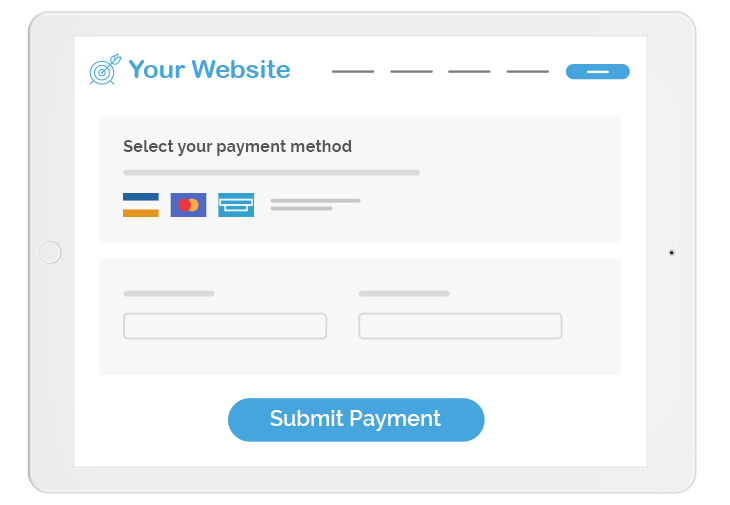

Integrated Payment Forms

Accepting payments should be easy and flexible. Not only should you be able to send your customers a link to pay—they should be able to pay directly from your website.

Customers asked to pay on a third-party payment processor’s website can get spooked easily, and who’s to blame them?

Instead, use a tool that offers integrated payment forms on your own website.

Your customer can easily input their credit card, debit card, or ACH information, knowing confidently that they are paying you securely.

Integrate Billing Software With Accounting Software

After choosing the right payment automation solution for your needs, your next step is to integrate it with your existing accounting software.

When your accounting system is integrated with automated billing software, the information is automatically updated every time a customer makes a payment.

This keeps your accounting records up-to-date and gives you consistency—and peace of mind—across your organization.

Automating your accounts receivable also facilitates revenue recognition and enhances the ability to predict cash flow.

Regpack, for example, uploads to online accounting tools like Quickbooks to automatically track, tag, and reconcile all incoming revenue.

This simplifies your end-period reconciliation and avoids data entry mistakes.

Set up Electronic Invoicing

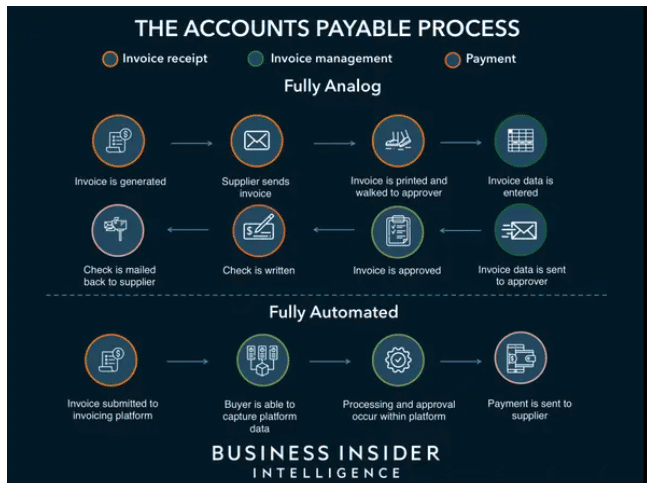

The next step in automating the customer billing process is to set up electronic invoicing: automatically generating and delivering digital invoices to customers.

While handwritten invoices can feel more personal and be less complicated, fully analog processing doesn’t always provide accurate invoices.

With automated digital invoicing, you skip several steps in the accounts payable process—and have fewer human errors to deal with—resulting in faster payment processing and fewer headaches for everyone.

Source: Business Insider

The less time your teams spend on manual intervention, the more time they have for more important tasks.

When setting up your electronic invoices, don’t forget to customize them and follow invoicing best practices.

Keep each invoice simple enough to read easily—but with all the necessary information.

Include the following in each invoice:

- Your company name and logo

- Your contact information

- Invoice creation date

- Detailed item descriptions

- Payment terms and conditions

- Payment due date

- Instructions on how to pay the invoice (or even better, a direct link to pay)

That way, your customers will have a full view of all the information they need, making it easier for them to make a payment.

Schedule Automatic Payment Reminders

The next step in the automated billing process is to set automatic payment reminders.

Your payment terms may be detailed clearly on your invoices, but everyone gets busy—and without a reminder, your customers are more likely to forget important deadlines.

However, your accounts receivable team could easily spend all of their time tracking upcoming deadlines and sending manual email reminders to your customer list. Instead, it’s better to automate the reminder process.

Thankfully, most billing platforms offer custom payment reminders to help you get paid on time.

Regpack, for example, has robust automated communication features, including trigger-based reminder emails and a customized dashboard to show you payment history and balance due at a glance.

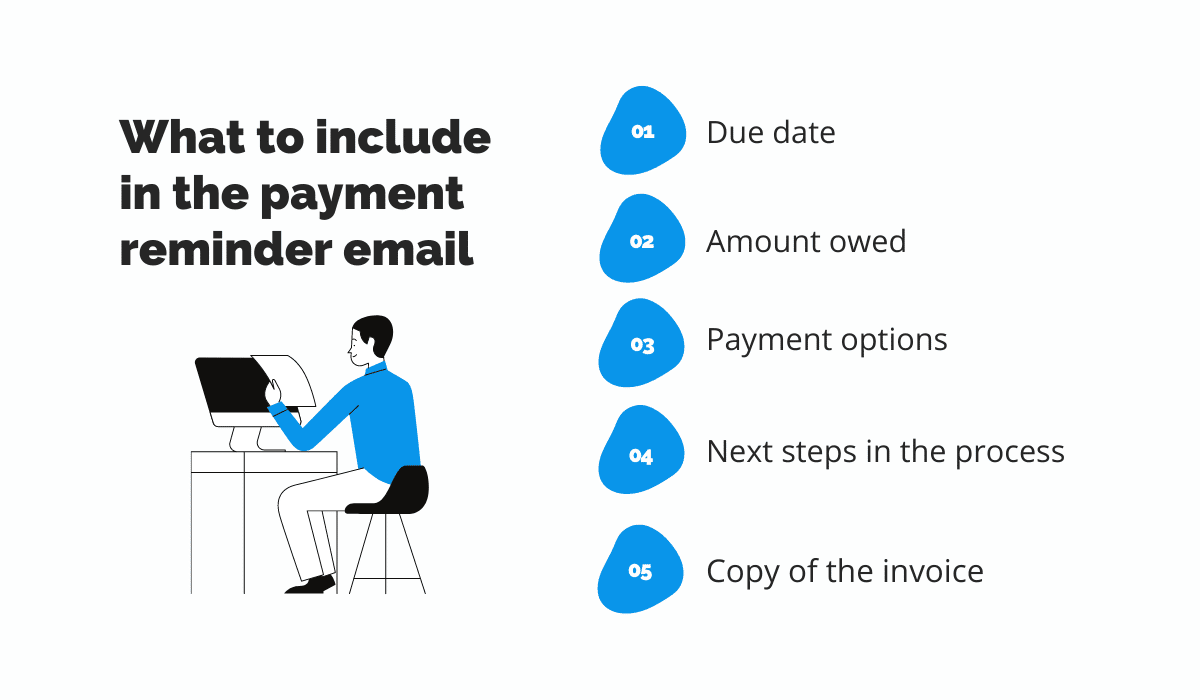

No matter which billing platform you choose, it’s important to optimize your payment reminder email template to increase the chances that customers will pay.

The best payment reminder emails are informative and succinct.

Make sure each one includes the due date, the amount owed, and a copy of the invoice.

You should also provide payment options—and a link enabling the user to make their online payment quickly.

And for especially late payments, it can be helpful to list the next steps in the billing process (like additional fees or other consequences for non-payment).

Source: Regpack

To learn more about creating effective email reminders, check out our article: 7 Payment Reminder Email Templates for Overdue Payments.

Launch a Customer Payment Portal

After you’ve set up your automatic invoice generation and messaging process, don’t forget to make it as easy as possible for customers to pay and manage their accounts.

A customer payment portal lets customers:

- Make online payments using their preferred payment method

- View and download their invoices

- Monitor their account balance

- Update their personal information and method(s) of payment

- Manage their recurring billing settings

A self-service portal for your customers simplifies the payment process on both sides. It puts all the information in one central location, making it easy for your customers to have quick access to all the information they need.

When customers can edit their billing information and make their own payments, it frees up your accounts receivable team for other more complex tasks.

Most quality billing software solutions let you create and launch a customized customer payment portal.

With Regpack, for instance, you can design and embed a custom payment portal directly on your website.

Source: Regpack

Your online portal being located on your website gives customers peace of mind knowing they’re paying their bills in the right place.

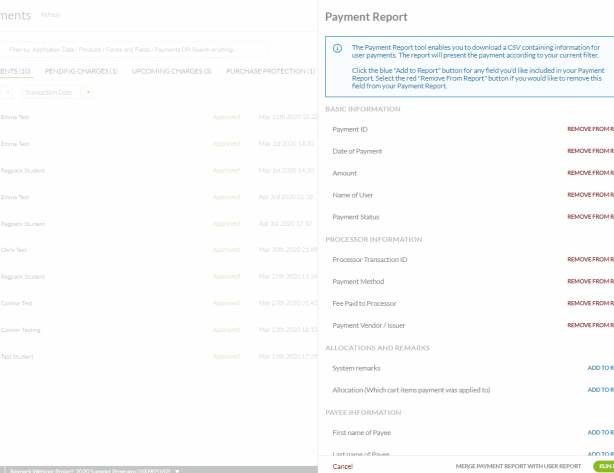

Automatically Generate Payment Reports

The final step to automate the billing process is generating automatic payment reports.

One of the many downsides to manual billing is the lack of easy access to accurate and updated reports.

Calculating gross revenue, predicting cash flow, and identifying overdue accounts would take hours by hand.

Being able to generate payment reports with just a few clicks is invaluable for reviewing transactions and tracking revenue recognition.

With an automated billing system, you can get a birds-eye view of your finances within seconds. This lets you make informed business decisions much more quickly and reliably.

Regpack’s custom sales and payment reports make it easy to filter and download any kind of report you need in just a few clicks.

The powerful filter tool finds transactions by date, customer, program, or other specific data points.

Source: Regpack

So as you’re setting up an automated billing solution, don’t forget to create customized reporting dashboards that reflect the goals and processes of your business.

When you’ve pre-set filters and search terms, it makes it that much easier to find important information at a glance.

Scale Your Business With Automated Billing

Today, manual billing processes just don’t cut it.

Your customers expect a selection of payment methods and subscription packages, and you have to manage invoicing and payment reminders—often on different days and at different intervals.

And, of course, if you’re accepting recurring payments, it can be challenging to stay on top of payment deadlines and track down overdue invoices manually.

Instead, let an automated billing system do the heavy lifting.

Choose a software tool that offers key features like online invoicing, payment plans, advanced security, and integrated payment forms.

Integrate that tool with your accounting platform, set up invoicing and payment reminders, and build a customer payment portal (ideally on your own website).

Finally, set up your payment reporting parameters so you can track your most essential KPIs and customer data.

With the right billing solution on your side, you’re prepared to scale your business like never before.