What is dunning management, exactly?

It is a process of communicating with clients about payment failures. These can happen for numerous reasons, and companies use dunning to recover revenue and retain customers.

So, if you’re thinking about whether dunning management is worth it, the simple answer is yes.

The main purpose of dunning management is to create a positive customer experience while getting paid for overdue subscription fees.

Basically, you’re hitting two birds with one stone—solving payment issues and ensuring your customers continue doing business with you.

But that’s not all there is to dunning management. In this article, we outline four main benefits to good dunning management.

Let’s see what else you can gain from an effective dunning process, shall we?

1. Preventing Involuntary Churn

Customers leaving your company is not desirable because when customers leave, money goes with them. That’s why so many businesses try to find a way to reduce churn.

But churn still happens, even with all the efforts SaaS companies put in. Some companies report churn rates of up to 10%. Even though that might be the industry standard, these numbers can always be improved.

Yet, there’s something SaaS companies often miss, and that is the type of churn they have. In fact, there are two distinct types.

The most common is voluntary churn. This type of churn refers to the number of customers who actively cancel their subscription plans. Their reasons can be numerous, from bad onboarding experience to better offers from the competition. The point is that they encountered a problem with a product and they decided to leave.

But there’s another often-overlooked type of churn that can be easily solved with proper dunning management and that is involuntary churn. This type of churn happens when customers have problems with their payment—their credit cards expire or they don’t have enough funds on their accounts.

This means customers don’t necessarily want to cancel their subscription, yet something they weren’t aware of prevents them from paying for a product. However, if customers are not properly informed about what happened, they will be locked out of their accounts, and they will inevitably stop using the product.

Even as little as 2% of failed payments can rack up significant revenue loss. You might think that it’s not that bad, but those numbers can easily add up.

So, consider this example.

Imagine you have 200 customers with $100 monthly subscription plans. In a year, your revenue amounts to $240,000. In theory, you’d be collecting that amount regularly each year.

But if 2% of your customers don’t pay on time each month, you’d be losing $4,800 just in the first year of doing business.

Year after year, you’d end up losing hundreds of thousands of dollars from something that you can easily prevent. The only way to do that is to inform your customers on time.

You can reduce your involuntary churn and prevent further revenue leakage when you have an excellent dunning management system.

And what can help you with that? Payment processors.

They often have a great integrated dunning management system that automatically alerts the customers about payment problems. You can send email notifications as soon as possible to rectify the issues with users’ accounts.

When you do that, customers will have enough time to update their billing information and continue using your product without interruptions.

Which is what everyone wants, right?

2. More Revenue

If you manage to keep your customers with good dunning management, you can also expect more revenue.

As we said before, some churn will inevitably happen, and some customers might stop paying for their subscription plans. But that’s not an invitation for you to give up on dunning.

If you do nothing about failed payments, you lose more revenue than you should. Coming back to our previous example, if you’re losing $4,800 a year from the involuntary churn and you do nothing about it, you can expect to lose the full amount every year.

But if you do something about it, like setting automated alerts, then your customers can update their billing info and pay you.

Simply by being proactive about dunning, you can recover up to 80% of overdue payments!

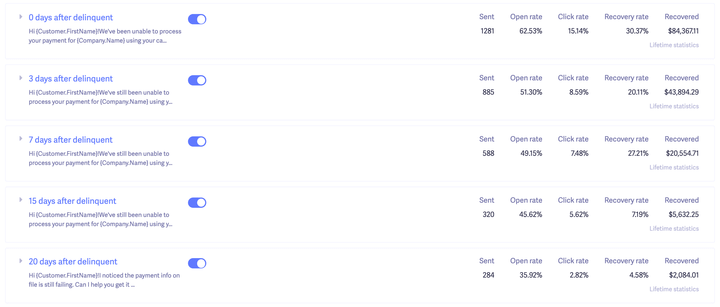

Look at how much revenue Baremetrics recovered with their dunning management.

Source: Baremetrics

They set up a 20-day dunning cycle in which they send dunning emails to the customer and inform them about their payment issue.

After a customer’s credit card gets declined the first time, Baremetrics automatically sends a dunning email. They managed to recover 30% of their revenue simply by sending one notification!

But, the company knows that there are many more customers who will ignore their first email, so they send more.

After each email, Baremetrics allows the customer a grace period to update their billing information. Offering a grace period is actually one of the best practices in dunning which we discussed here.

Then, the company retries the payment process until the final notice. They stop doing business with that customer if they still haven’t received payment after a fourth dunning email.

The good news is that you can do the same with your payment processor.

Most of them have this useful feature that enables you to set a schedule for your dunning emails to alert the customers about their payment issues.

That way, you can recover more revenue from forgetful customers who need several reminders about paying for their subscriptions.

Remember that the best way to recover revenue is to have smart retry logic in your payment processing system.

When a payment fails, you need to find the most optimal time to contact the customer because transactions can’t be retried every day. It’s very costly for the business, and after too many failed attempts, it might put the account on hold.

You don’t want to prevent your customers from accessing their accounts because then you can lose them for good.

So, the solution is to space out your retries to find the best time to contact the customer and have a higher rate of successful payments.

Smart retry logic in your payment processor will account for the customer’s payment history, card brand, time zones, and payment gateways.

With that data, you can see when they’re most likely to update their billing information and pay you for overdue subscription fees. That way, you recover revenue faster.

Maximizing your revenue boils down to having smart solutions and automated systems that can help solve payment issues as soon as possible.

3. Saving Time

When you let one person manually send reminders about failed payments, you’re wasting time and resources.

First of all, what if that person gets sick and can’t send out payment reminders? Your business will be held back because you’re not receiving the money you’re due for other essential business costs.

Also, humans are prone to making mistakes. They make typos, send dunning emails to the wrong customer or forget about payment reminders altogether. Not to mention that these mistakes increase as your customer base grows.

If you’d opt for manual dunning management, you’d create an unprofessional image for your company, and customers might rethink continuing doing business with you.

Would you trust someone who misspells your name or forgets to inform you that your credit card was declined? That doesn’t evoke trustworthiness at all.

Luckily, we’ve already been hinting at a great solution: an automated dunning management system.

Apart from saving you costs of human error, you’re also saving so much time. Some tasks that are a part of dunning might take hours for your employees, but to the automated system, it takes several minutes or seconds.

Essentially, automation can help you create a seamless and accurate process of collecting payments, and you’re also saving your employees from the tedious workload.

To further illustrate why automated dunning management is important, let’s imagine you have 70% of customers on the lowest plan and 30% of enterprise customers that need a more hands-on approach.

Your small customer success team can’t handle all of them, so delegating your employee’s efforts to high-value customers makes more sense. But you also don’t want to neglect that 70% of customers because you’re still earning a significant amount of revenue from them.

When you automate your dunning process, you can ensure that payment collection goes smoothly for your customer base without further intervention. In that case, you could let your payment processor handle them while your customer success team focuses on collecting payments from enterprise customers.

That way, you’d be covering all bases of recovering revenue while optimizing your company’s operations at the same time.

In the end, when you have more money and more time, you can allocate those resources where they are needed most.

4. Better Customer Experience

Here’s a little secret: every other benefit we’ve outlined is a side effect of the biggest benefit from dunning management–better customer experience.

The simple truth is that customers are the ones keeping your company in business. They are the ones paying for your product and deciding to continue doing that for the foreseeable future, so making their experience enjoyable should be your main goal.

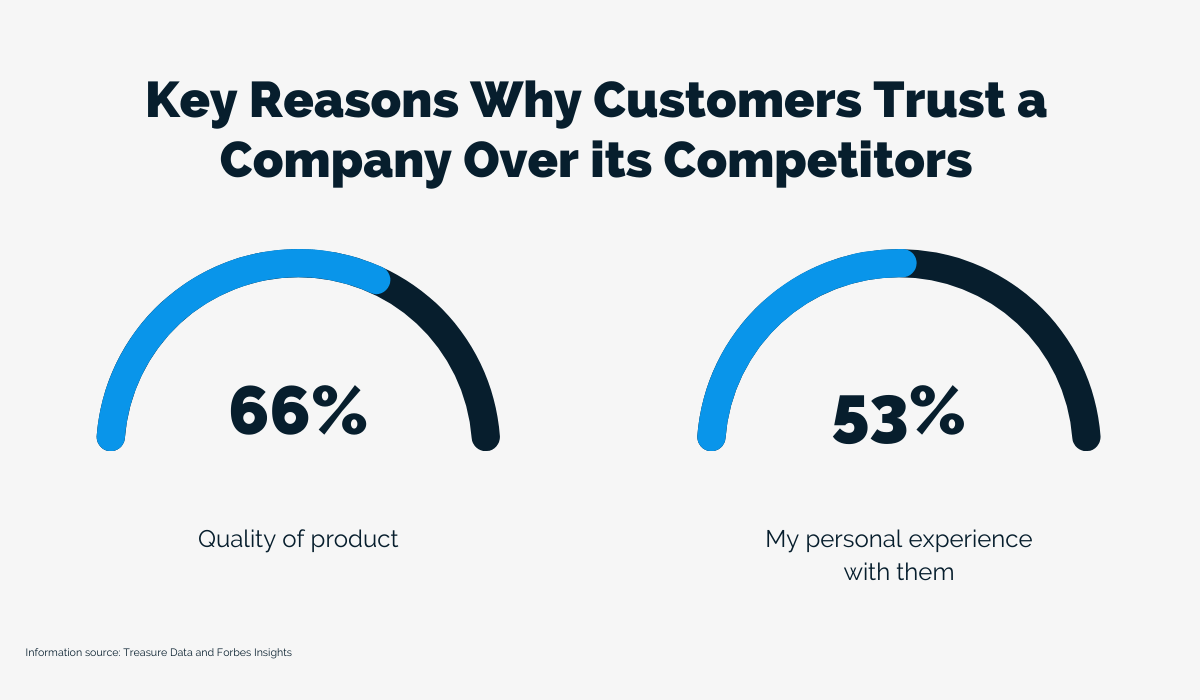

If you’re still not convinced how important customer experience is, let these results from a recent survey make up your mind.

We see that 53% of customers value personal experiences with a company which helps them build trust and loyalty.

Those are important ingredients in customer satisfaction that can bring you higher LTV rates. When you build trust, you can tie customers to your product and company, and they will bring you even more revenue in the future.

Dunning is an important part of a customer’s experience with a company.

Nobody likes to bring bad news to their customers, but you can spin failed payments into a positive experience and reap other benefits we’ve already mentioned.

The first thing you have to keep in mind is that most dunning management happens over email.

Even with other communication channels popping up, like social media, email continues to be the most effective way to reach customers.

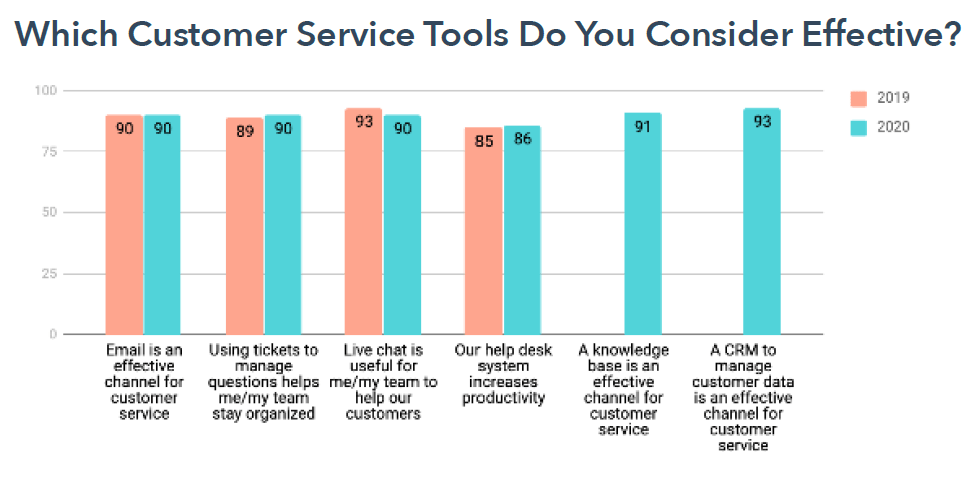

Even customer service agents agree. Almost 90% of them believe email effectively reaches customers and provides great customer service.

Source: Hubspot

So, when you’re trying to reach customers and inform them about their failed payments, your best option is to use emails.

But how to approach email communication when it comes to dunning management?

Well, first of all, it has to evoke trust and empathy.

Remember that failed payments aren’t your customer’s fault and that they’d be happy to fix any issues if you give them the right information with a positive attitude.

You have to work together on solving issues; otherwise, you can forget about improving customer experience.

Let’s look at real examples to show you some good dunning email communication practices.

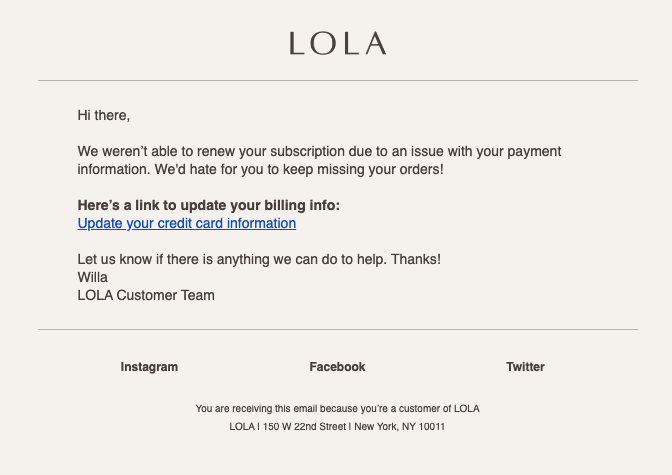

Here’s how Lola, a financial operations platform creates dunning emails:

Source: ChurnBuster

What’s great about Lola’s email is that they keep them short and to the point.

They explain what happened, provide useful links for the customer to take action, and offer further assistance.

The company remained polite and professional in their copy, even showing appreciation for the customer at the end with simple ‘thanks’.

You can emulate the same in your dunning emails. Keep your tone friendly and helpful, but also urge your customer to update their billing information as soon as they open the email.

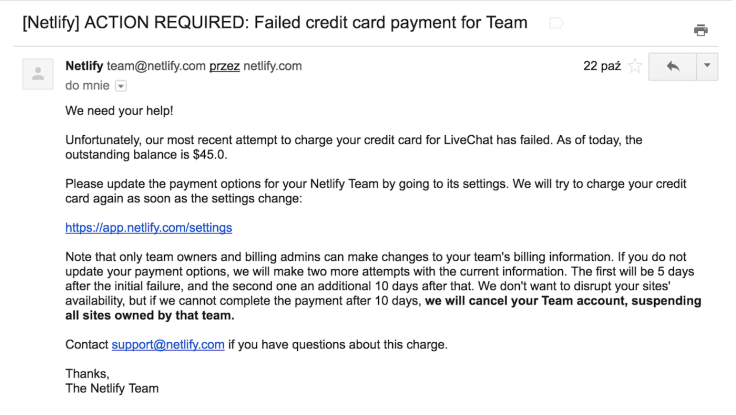

Creating urgency in your emails is important because then the customer will react faster. Take a look at how Netlify creates urgency in their dunning emails:

Source: LiveChat

Netlify’s emails are slightly longer, but they put more emphasis on convincing the customer to take immediate action. From the very beginning, they’re asking for collaboration from the customer in this stressful situation.

After explaining the problem and providing a link to their payment page, the company dedicated a separate paragraph to further explain the next steps in the payment process.

Finally, they underline how urgent this matter is by explaining what the customer will lose if they ignore the email.

Notice that Netlify employed the right balance of urgency and professionalism without harassing the customer or seeming predatory.

All they needed was to inform the customer about a problem and they nailed it.

In the end, great customer experience can be found in unlikely places, and dunning is one of them. So seize every opportunity to help your customers and remind them how great your product and company are.

Conclusion

Yes, dunning’s main purpose is to fix payment issues, but that’s a too narrow view of this process that can bring you other opportunities.

First, you can optimize your business operations and save time by implementing automated solutions.

But most importantly, you should treat it as an opportunity to strengthen relationships with your customers. Because if you frame it in the right way, you can make them feel that you have their backs even in times of trouble.

In the end, if you want to be regarded as a forward-thinking and customer-centric company, then you should have good dunning management.