Navigating the world of B2B invoicing can often feel like a tightrope walk, with delayed payments and administrative complexities threatening to disrupt your balanced operations.

Enter online B2B invoicing—a modern, efficient solution designed to eliminate these challenges.

This digital approach is all about speed, precision, and user-friendliness, offering a competitive edge to businesses that adopt it swiftly.

In this article, we’ll unpack only a few of the multitude of benefits that online B2B invoicing brings to the table, from accelerated payment collection to enhanced accuracy and more.

Ready to transform your invoicing process? Let’s kick things off by exploring how online invoicing can put your payment collection on the fast track.

- Faster Payment Collection

- Fewer Unsuccessful Payments

- Greater Operational Efficiency

- Improved Client Convenience

- Conclusion

Faster Payment Collection

One of the standout benefits of online invoicing is the efficiency with which you can collect payments.

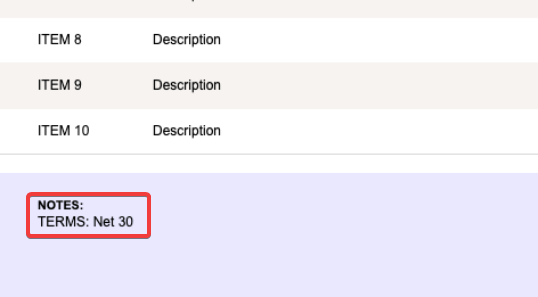

If you’ve ever dealt with traditional invoicing, you’re probably familiar with the term ‘net 30’.

Source: Neat

This term is often included in invoices and refers to the 30-day period that businesses usually give their clients to make a payment.

Businesses often use this method because it enables a predictable cash flow and allows clients to manage their finances effectively.

However, some businesses, especially smaller ones, often need to speed up the payment collection process to increase their cash flow.

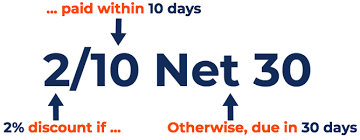

Source: Fool

For instance, the image above shows a 2/10 Net 30 term, meaning clients will get a 2% discount if they pay the invoice within ten days.

But there’s another crucial area where payments can be sped up, and which is often overlooked: the time it takes to prepare the invoices themselves and collect the payments.

Source: Regpack

As you can see above, if you’re using paper invoices, there are a couple of areas where you’re wasting time in getting your invoices paid.

First, the invoice must be carefully written to ensure there aren’t any mistakes, as errors can lead to disputes, delays, and even non-payment. Then, the invoice needs to be mailed.

Compare that with online invoicing, where this process is usually automated, with an invoice being accurately generated and sent to your client instantly.

But even if you have an efficient way of creating paper invoices and your clients receive them in a timely manner, there can still be delays with this process.

For instance, if your clients wanted to capitalize on a discount by paying earlier, you would still have to wait for their check to arrive to you.

Then, you would have to deposit it and wait for the money to show up in your bank account.

And this is the best-case scenario.

Imagine the additional wait time you’d have to deal with if your clients took the full 30 days to mail their checks.

This can be a long time for a business, especially for smaller businesses that rely on a steady cash flow to maintain operations.

We believe that a much better alternative is to capitalize on the speed, accuracy, and efficiency of online B2B invoicing and receive your payments quicker.

Fewer Unsuccessful Payments

While speeding up payments is a significant benefit, arguably a greater one is that online invoicing can prevent unsuccessful payments altogether.

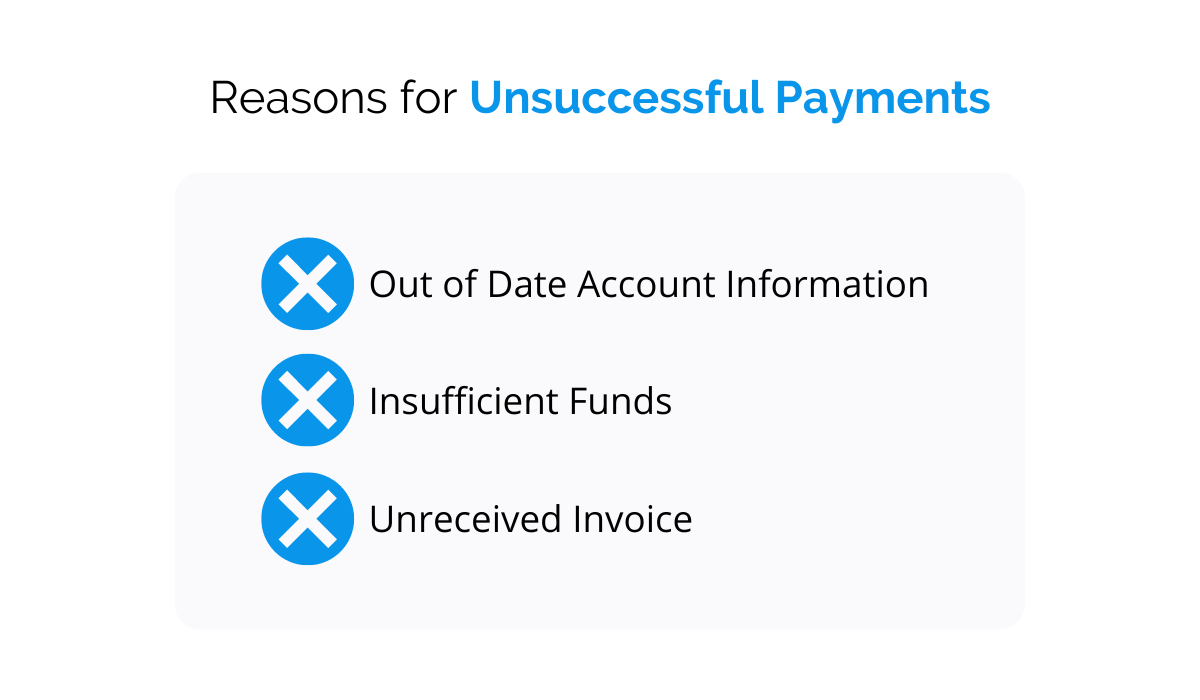

Unsuccessful payments can pose a substantial risk to your business operations.

They can lead to cash flow issues, disrupt service delivery, and potentially damage client relationships due to unfulfilled obligations.

In a traditional paper invoice system, B2B clients can fail to pay for a variety of reasons, some of which are shown below.

Illustration: Regpack / Data: Enterprise Recovery

All of these problems are significantly mitigated when using online B2B invoicing.

For example, clients can quickly update their payment details using online invoicing tools and use them when generating invoices.

Also, the immediacy of this way of invoicing means that, as soon as an invoice is sent, clients with sufficient funds can settle their payments.

Lastly, the problem of unreceived invoices is virtually eliminated. Online invoicing systems ensure that every invoice is sent and received, providing you with a digital record for easy tracking and verification.

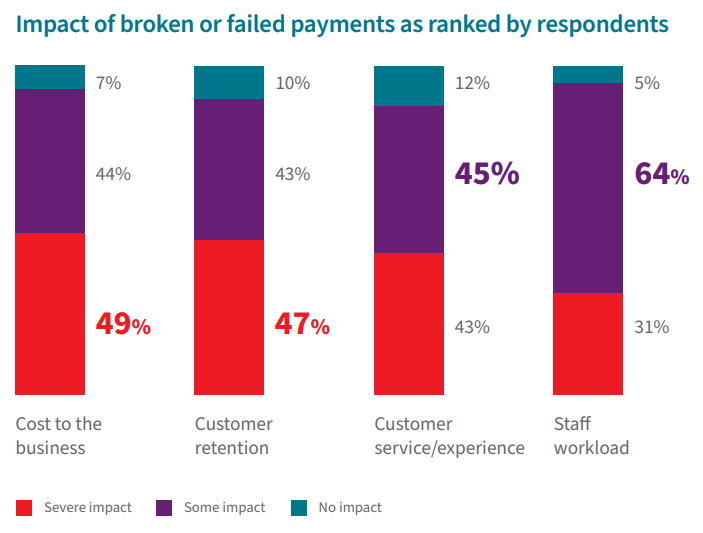

And taking care of failed payments is critical, as they can affect both your business and your clients’ experience and trust.

Source: LexisNexis

As the image above shows, the responses to this LexisNexis survey indicate that these issues can cause a substantial cost to your business, with 49% of the respondents stating that this impact is severe.

If the invoicing problems originate from your end, you can even impact customer retention and the overall customer experience and service, as clients quickly lose trust in your reliability.

All of these issues also increase your staff’s workload because they have to spend additional time resolving unsuccessful payments.

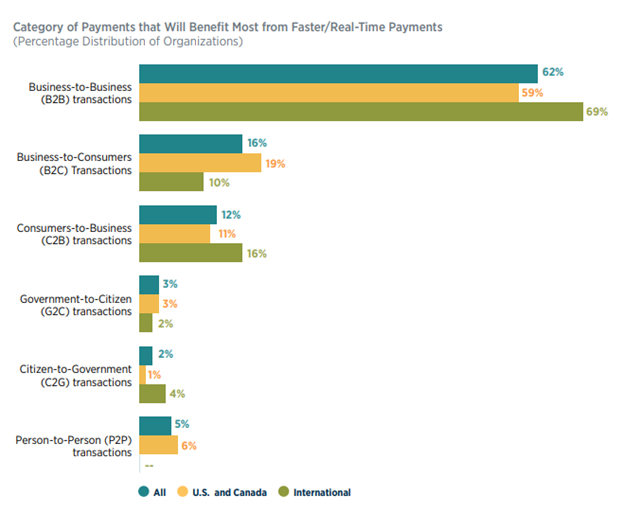

Given these challenges and their impact on your business and your clients, it’s no surprise that faster, real-time payment methods are greatly beneficial to B2B transactions.

Source: AFP

As visible in the AFP survey data above, respondents overwhelmingly stated that B2B transactions benefit the most from switching from checks to alternative payment methods, with 62% of them agreeing with this statement.

In conclusion, by reducing the risk of unsuccessful payments, online invoicing can enhance your business’s financial stability and improve your client relationships.

Greater Operational Efficiency

Now, everything we discussed so far can significantly benefit operational efficiency when managing payments.

When we talk about the benefits of online B2B invoicing, we’re not just referring to a faster way of collecting payments.

It’s also about streamlining your business operations in general, particularly within your accounting and finance teams.

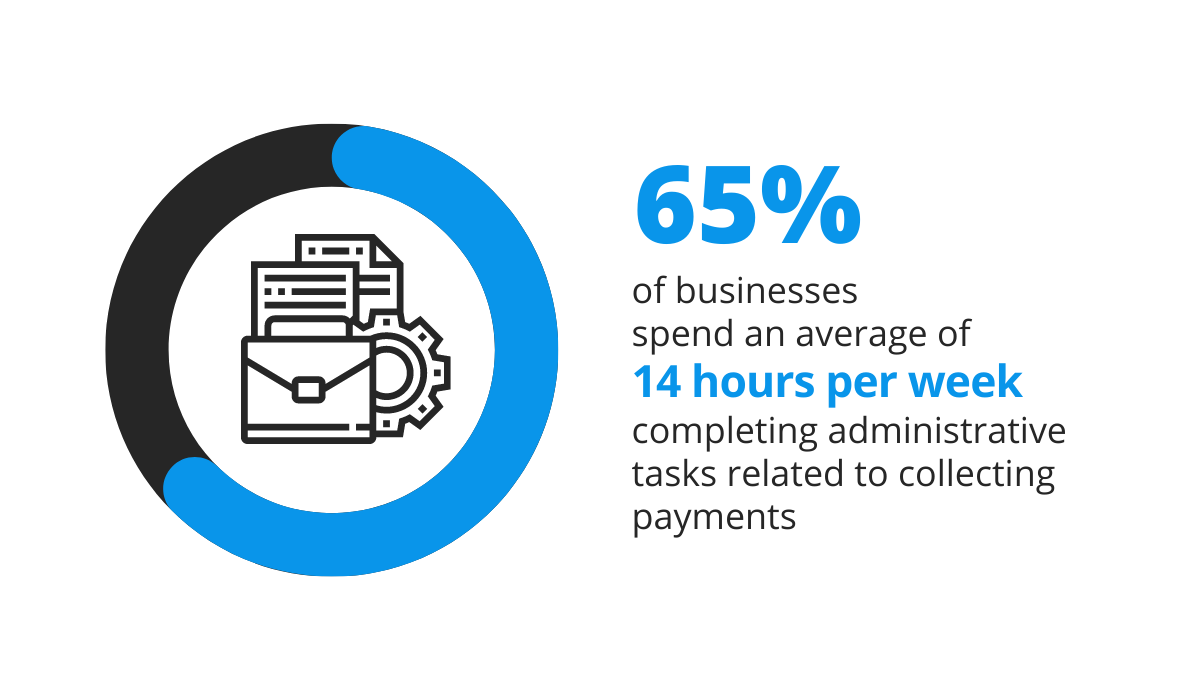

Consider the data shown in the illustration below.

Illustration: Regpack / Data: Paystand

This Paystand survey reveals that most businesses spend an average of 14 hours per week on administrative tasks related to payments. That’s almost two full workdays!

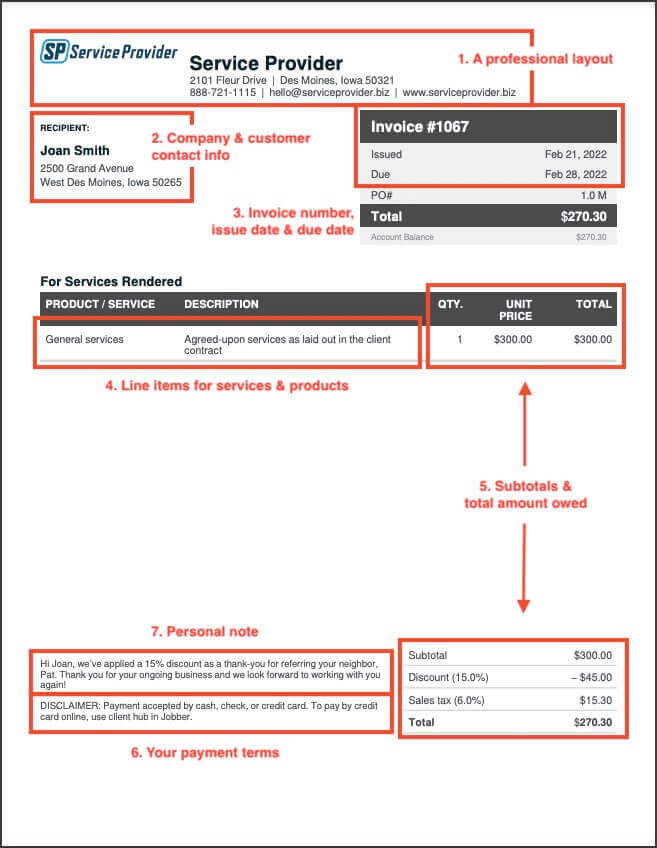

A considerable portion of this time is devoted to creating invoices, which, as you can see from the image below, can be quite complex.

Source: Jobber

Each section of the invoice requires attention to detail, making sure the client information, payment amounts, and payment terms, as well as any due dates, are written accurately.

As you can imagine, this can be a very time-consuming process.

But this is where online invoicing shines. It automates the entire process, from generating the invoice to including all the details needed for processing it.

This automation not only saves time but also reduces the risk of errors, leading to more accurate invoices.

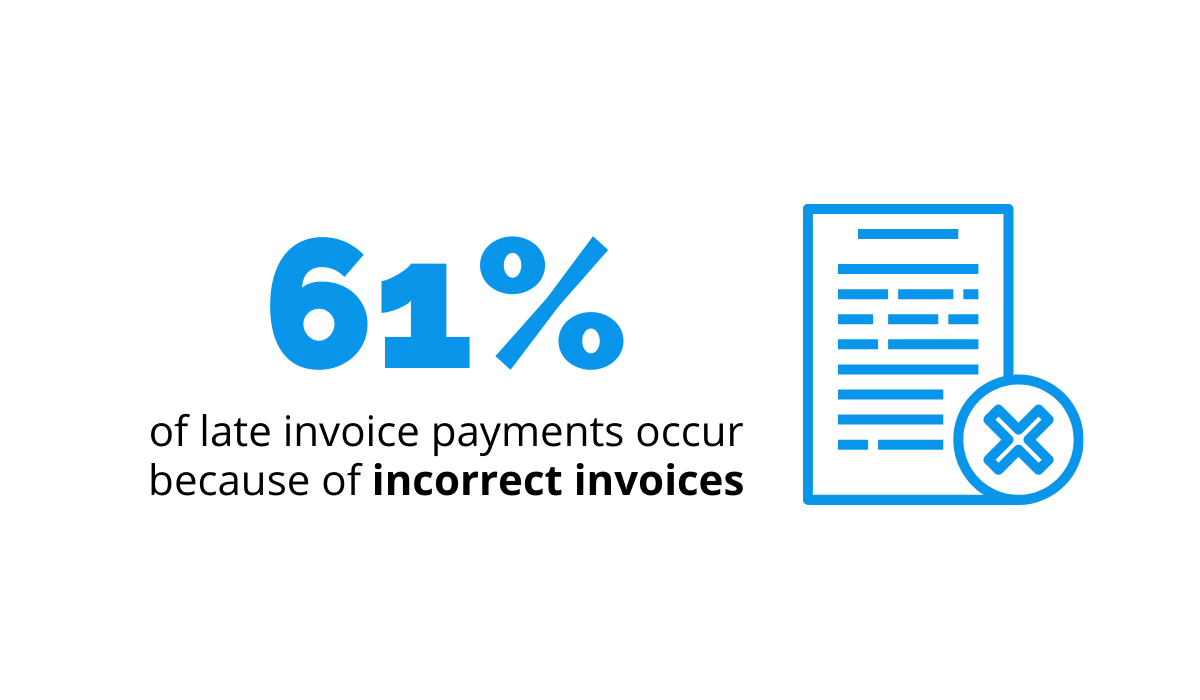

Increasing the accuracy of invoices is especially important, considering the following statistic.

Illustration: Regpack / Data: OnlineInvoices

Did you know that a significant number of late payments are due to incorrect invoices? When invoices are manually created, the risk of errors increases, leading to potential delays in payments.

However, with online invoicing tools, your clients enter their details once, and the system takes care of the rest. The result?

Accurate invoices every time, with correct emails, precise costs, and clear due dates. And staff can now spend less time dealing with invoice-related issues and focus on more critical tasks.

So, by enhancing operational efficiency, online invoicing makes your business transactions run smoother and allows your teams to work smarter.

Improved Client Convenience

Finally, let’s take a moment to consider what online B2B invoicing can do for your clients.

If the previous benefits didn’t convince you, consider that this method of charging clients can be more convenient and desirable for them.

In fact, the trends in the B2B sphere show companies are slowly but surely moving towards more payment automation options.

In the traditional invoicing system, clients may face limitations.

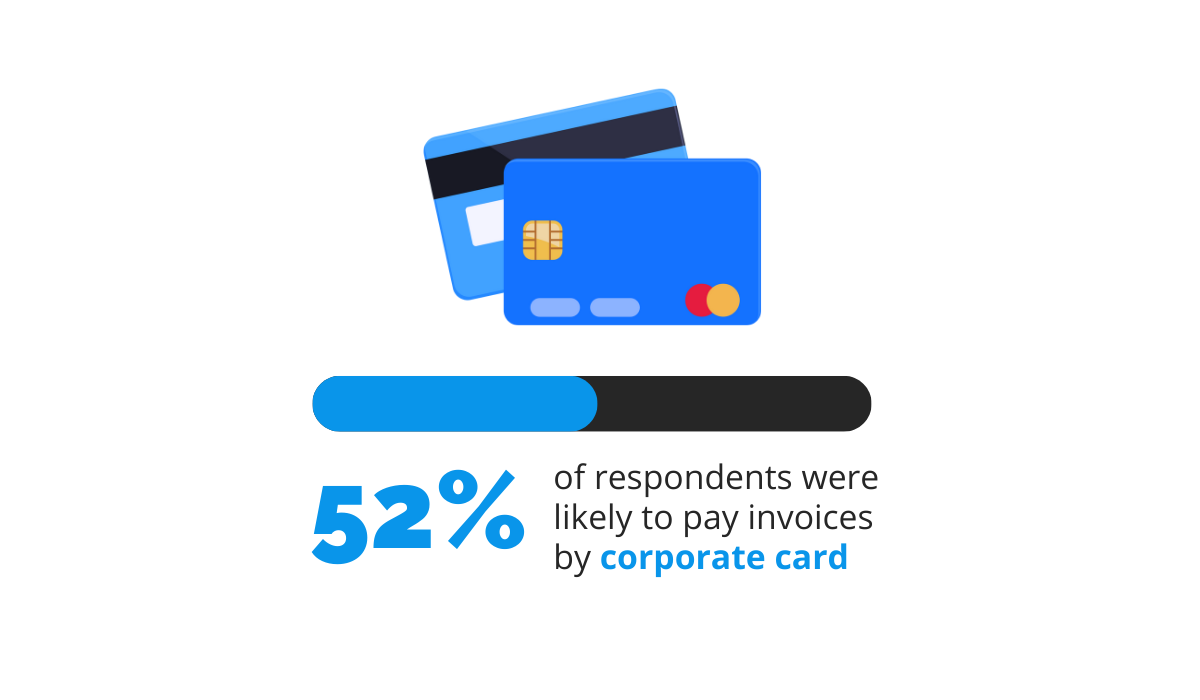

For instance, as reported by this GoCardless survey, many buyers want to pay with their corporate cards.

Illustration: Regpack / Data: GoCardless

Clients may prefer this method, as they don’t have the authority to write checks on their company’s behalf, or may simply find it to be a more straightforward way of doing business.

However, traditional invoicing systems may not accommodate this preference,thereby limiting your clients’ payment options.

On the other hand, online payment processing and invoicing tools can easily give this convenience to customers and make it possible for you to accept online payments.

Source: Regpack

Our own tool, Regpack, is a payment processing software that enables your customers to have flexible payment options.

This includes allowing them to quickly pay invoices with their corporate cards, as well as other popular B2B payment methods like ACH transfers and e-wallet payments.

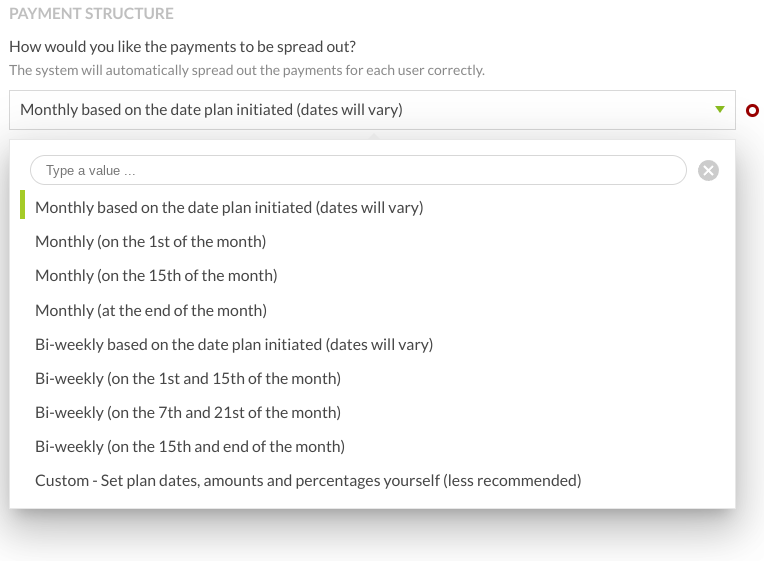

It also comes with customizable features like the option to create automatic billing plans.

Source: Regpack

This feature is handy for recurring payments or if you want to spread out the payment of a larger amount into monthly, weekly, or bi-weekly payments, or even custom schedules where you set the dates, payment amounts, and percentages manually.

The added flexibility can be a game-changer for your clients, allowing them to manage their cash flow better and making it easier for them to keep up with their payments.

So, if you want to improve your invoicing process, increase operational efficiency, and offer your clients the convenience and flexibility they desire, it’s time to consider online B2B invoicing through secure and powerful software like Regpack.

Conclusion

And that concludes our journey through online B2B invoicing, highlighting only a few of its many benefits.

From speeding up payment collection to simplifying administrative tasks, we’ve covered some key advantages of adopting this practice that you might want to consider.

Hopefully, you’ve gained some valuable insights that may encourage you to apply this practice in your business.

By leveraging online invoicing, you can streamline your operations, improve your cash flow, and stay ahead of the competition by offering your clients efficiency and convenience.

Remember that in the fast-paced business world, staying ahead of the curve is vital to your success. So, why wait? Embrace the future of B2B invoicing and watch your business thrive.