If you’re here, it’s safe to assume you’re already committed to your business replacing its outdated, manual billing processes with an automated billing system, and you’re looking for ways to make that transition as smooth as possible.

And you’re wise to do so.

Even when businesses are aware of the benefits of automated billing—faster payments, more robust payment security, and improved customer experience, to name a few—it’s often the transition process that makes them weary of making the switch.

Against this background, the steps and tips listed below will enable you and your team to successfully switch to an automated billing system and reap the resulting benefits.

- Evaluate Your Current Billing Process

- Find the Right Automated Billing System

- Prepare Your Business for the Switch

- Set Up Your Automated Billing System

- Learn to Get the Most Out of Your System

- Conclusion

Evaluate Your Current Billing Process

Reviewing, analyzing, and evaluating your current billing process can help you prepare for the switch and decide which automated billing software best fits your needs.

To explain what we mean, let’s first define what an automated billing system is and what it does.

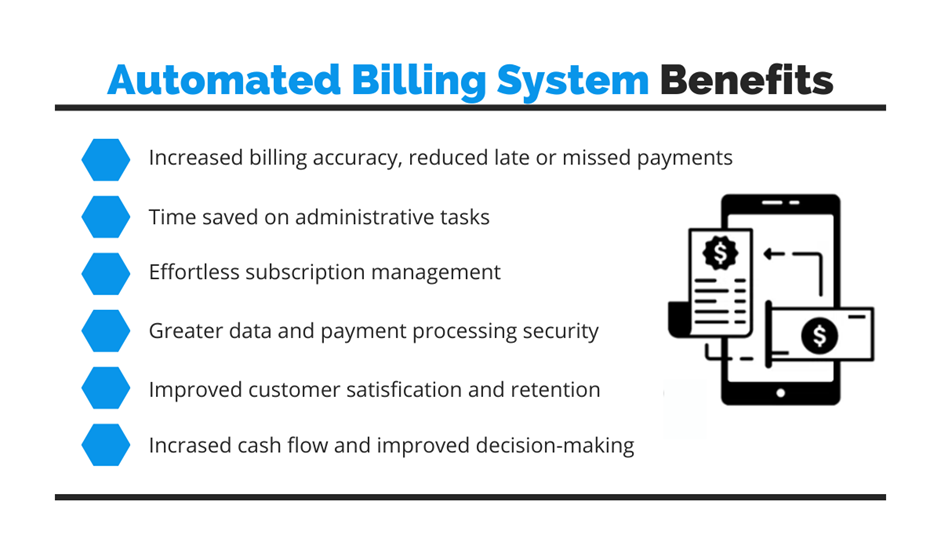

Simply put, an automated billing system will digitize, automate, and streamline your billing and payment processes, thus replacing many time-consuming and error-ridden repetitive manual administrative tasks.

Once implemented, it will generate a range of immediate and longer-term benefits, some of which you can see here.

Source: Regpack

However, if your current billing process is disorganized and inefficient, those issues might not go away with billing automation but be reflected in your new system.

And that’s why you and your team should evaluate your current billing process, review internal workflows, and identify the most significant obstacles and bottlenecks in your still manual, non-integrated billing operations.

These “pain points” can be anything slowing down or obstructing your billing workflows at this moment.

Here are a few examples.

Source: Regpack

As you can see, each of the above points can be boiled down to a lack of billing automation that—as your business grows—can lead to many billing issues that ultimately hurt your company’s productivity and bottom line.

Conversely, these and other friction points can be effectively addressed—and customer experience improved—with the help of an automated billing system.

In summary, the evaluation of your current billing process and the identified weaknesses will inform your selection of the right automated billing solution and guide your preparation for the switch.

Find the Right Automated Billing System

Now that you identified the gaps and inefficiencies in your billing process, it’s well worth investing some time and effort into finding the right automated billing system that will ultimately do what you want it to while enabling a smooth transition process.

Naturally, there are so many such solutions available online that you first need to narrow down your search.

That’s why we’ll first list the key features of an automated billing system you should be looking for and then explain what they mean for your billing operations.

Source: Regpack

For instance, automated invoicing means you can easily create digital invoices and automate their sending to customers by email.

In the same vein, recurring billing enables you to automate the process of invoicing and processing payments of your recurring customers, i.e., subscribers or clients paying in installments.

Multiple payment methods and multi-currency support refer to the system supporting various payment methods (credit and debit cards, online banking, digital wallets, etc.), including international sales in foreign currencies.

Source: Regpack

Secure payment processing implies that the automated billing platform acts as a safe bridge between all actors involved in billing and payment operations, protecting your customers and your business from cyberattacks, data breaches, card fraud, etc.

The analytics and reporting features of your automated billing software allow you to generate custom reports, analyze data, and gain valuable insights for your business.

Automated payment reminders refer to the system enabling you to automate the timely sending of upcoming and overdue payment emails, as well as credit card expiry notifications.

Finally, multiple integration options imply that the automated billing software of your choice should offer easy integrations with your other business systems, such as your accounting solution.

A great example of automated billing software that has all the above-described features is our own solution, Regpack.

Source: Regpack

Naturally, other billing software providers will claim their solutions can provide the same functionalities, and we invite you to research and evaluate how user-friendly their features are, how competitive their pricing is, and what users say about their customer support.

To recap, finding the right automated billing system is crucial for the future success of your customer registration, invoicing, payment processing, and dunning workflows.

Therefore, all the time and effort invested at this stage will be quickly paid off by the ensuing benefits for your business.

Prepare Your Business for the Switch

Before implementing the automated billing system you selected, you need to prepare your business for the switch, namely, appoint the responsible team, organize your business’s offer, and review the data in your customer base.

Similar to evaluating your current billing process, these actions aim to eliminate discrepancies that could be unintentionally transferred into your automated billing system.

Naturally, the first step is getting all relevant team members (and management) to buy into the switch and clearly understand their responsibilities during the process.

Depending on your catalog of services or products, this includes tasking one or more persons to organize the catalog in a way that will facilitate the transition to automated billing.

This typically involves classifying your products or services into different categories and deciding on their names in the future billing system, like in this example.

Source: Regpack

Naturally, each catalog item should also have a defined price and, in the case of different payment plans, the period in which it should be paid by the customer (billing cycle duration).

Once your business’s offer is organized, it’s time to review the data of your existing customers.

In other words, you should ensure that each customer’s contact and payment info is accurate and up to date to avoid any billing mistakes later on.

Next, you should identify when their billing cycle began, when it will end (if they’re not subscribers), and any special payment terms or discounts.

All in all, preparing your business for the switch by appointing the responsible team and reviewing your offer and existing customer data will help you make the transition to automated billing easier.

Set Up Your Automated Billing System

So, everything is ready for the transition to automating your billing.

Depending on the automated billing system you selected, this may involve different steps and processes.

In other words, there’s no “one-size-fits-all” setup to follow.

However, there are general steps usually involved in setting up an automated billing system, so let’s look at what they are, and then we’ll explore what they entail.

Source: Regpack

Since you already made the first step and selected the automated billing solution, we’ll start with the second step—integrating the solution with your existing software.

In essence, this means your billing system should come equipped with tools that will allow different software systems to communicate between themselves, exchange data, and provide cross-software notifications.

This is usually done by your software provider, ensuring an open application programming interface (API) that will allow your IT staff to integrate your billing system with, for example, your accounting software.

Source: Regpack

Such integrations can help you automate billing processes outside your billing solution, ensuring that data in different applications are synced in real-time and, therefore, accurate and updated.

Mind you, integrations can be postponed for later or replaced with data exports from one solution to another, but this can result in more manual work and no real-time data synchronization.

The next step in setting up the system is converting your product/service catalog into auto-billing plans.

In other words, you’ll be setting the billing parameters for each product or service your business offers, such as the pricing, payment schedule, and billing automation rules (automatic sending of invoices and reminders by email).

Here’s what selecting the payment structure for subscribers or installment payers looks like in Regpack.

Source: Regpack

As said, this process will also enable you to set up different auto-billing rules, including electronic invoicing.

Simply put, you’ll be able to configure the system to generate digital invoices depending on your customer’s payment plan and automatically send them by email on predetermined dates or when the system registers a specific action (e.g., payment) has been performed.

The same principle applies to scheduling upcoming or late payment reminders that can be emailed to customers automatically and can also be triggered by a specific date or event.

Finally, all of the above will enable your business to create a customer self-service payment portal where users can track invoices, make secure online payments, and update their payment info.

Source: Regpack

Long story short, setting up your automated billing system will result in your customers filling out forms and payment details and choosing their preferred payment plan and payment method directly on your website.

After securely paying their first subscription/installment, they can agree to be billed by your business regularly and also get access to their portal.

On the business side, after an auto-bill plan, invoicing, and reminder parameters are set, the future billing processes are entirely automated, saving you time and reducing the risk of human error.

Learn to Get the Most Out of Your System

Naturally, before, during, and after establishing your automated billing system, you should learn how to get the most out of it.

In other words, you should pay attention to client training and support provided by your software provider from the start, i.e., when searching for the right software solution.

For instance, the best-case scenario is when your provider is ready to appoint a dedicated project manager to your business.

It’s even better when that manager can configure and customize your billing system to reflect your current billing process and address your specific digitization and automation needs.

Source: Regpack

Suffice it to say, such support can significantly simplify the system setup and ensure a smooth switch to an automated billing system.

Of course, other forms of client support, such as initial training, ongoing support, and an extensive self-service knowledge base, are also crucial for getting the most value out of your automated billing system.

For instance, your business can benefit from having a clear view of all payment processing fees associated with different payment methods (credit/debit card, bank transfer, digital wallet, etc.).

Instead of keeping track of these constantly changing and often confusing rules and fees, you can rely on your provider to update you on all changes and transparently lay out the cost in advance.

To sum up, you should ensure that the automated billing system of your choice comes with dedicated and ongoing client support, allowing you to use all the advantages such a system can generate.

Conclusion

Having covered the five steps needed to successfully switch to an automated billing system, it’s clear that this usually daunting task can be transformed into a well-planned and smooth transition process.

Of course, much of the success will depend on your choice of automated billing software, its user-friendliness, and the support provided by its software provider.

Nevertheless, all the time and effort invested in automating your billing will quickly pay off through generated time and cost savings, improved customer experiences, and higher profits.