Efficient registrations and payment management constitute a crucial component of running a successful service-based company.

Anyone researching the subject is most likely aware of the numerous advantages automated billing offers businesses in that regard.

However, when it comes to implementing any changes to your system that are related to payments, there is another party you have to convince of the advantages—the customers.

In this article, we will explore six methods you can use to encourage your clients to adopt automated billing.

Whether you aim to merely introduce it as an option or upgrade your business’s entire payment system, here you will find practical advice on how to do so.

To start, let’s go over how to alleviate the customer’s fear of rising prices.

- Offer Customers a Fixed Cost for a Fixed Term

- Consider Offering Flexible Billing Schedules

- Promote Automated Billing in Your Invoices

- Provide Customers With an Incentive to Switch

- Run Targeted Campaigns to Increase Adoption

- Start Accepting Automatic Payments Only

- Conclusion

Offer Customers a Fixed Cost for a Fixed Term

For businesses, automated billing is simply a time-saving payment management tool. For customers, it’s a potentially risky commitment.

To understand, you have to think about it from their perspective. Imagine your electric company suddenly wanted you to subscribe to automatic payments.

You would probably reject that suggestion—and rightfully so.

Why?

For one thing, because the price of electricity frequently fluctuates, and for another, because costly mistakes can happen.

Fox News reported on a Pennsylvania case where a woman was served a $284 million electricity bill when it should have been $284.

Of course, this is an extreme example. Even with automatic payment, a mistake this huge should not have gone undetected.

However, research by Engie has shown that nearly 17% of utility bills contain errors.

No wonder people are worried about being charged too much or taken advantage of.

To prevent that from happening, the most logical approach is to check the amount and purpose of each charge before making payments.

Therefore, to alleviate their concerns, you need to offer customers an option that guarantees no such fluctuations happen.

Of course, that doesn’t mean you refrain from ever raising your prices.

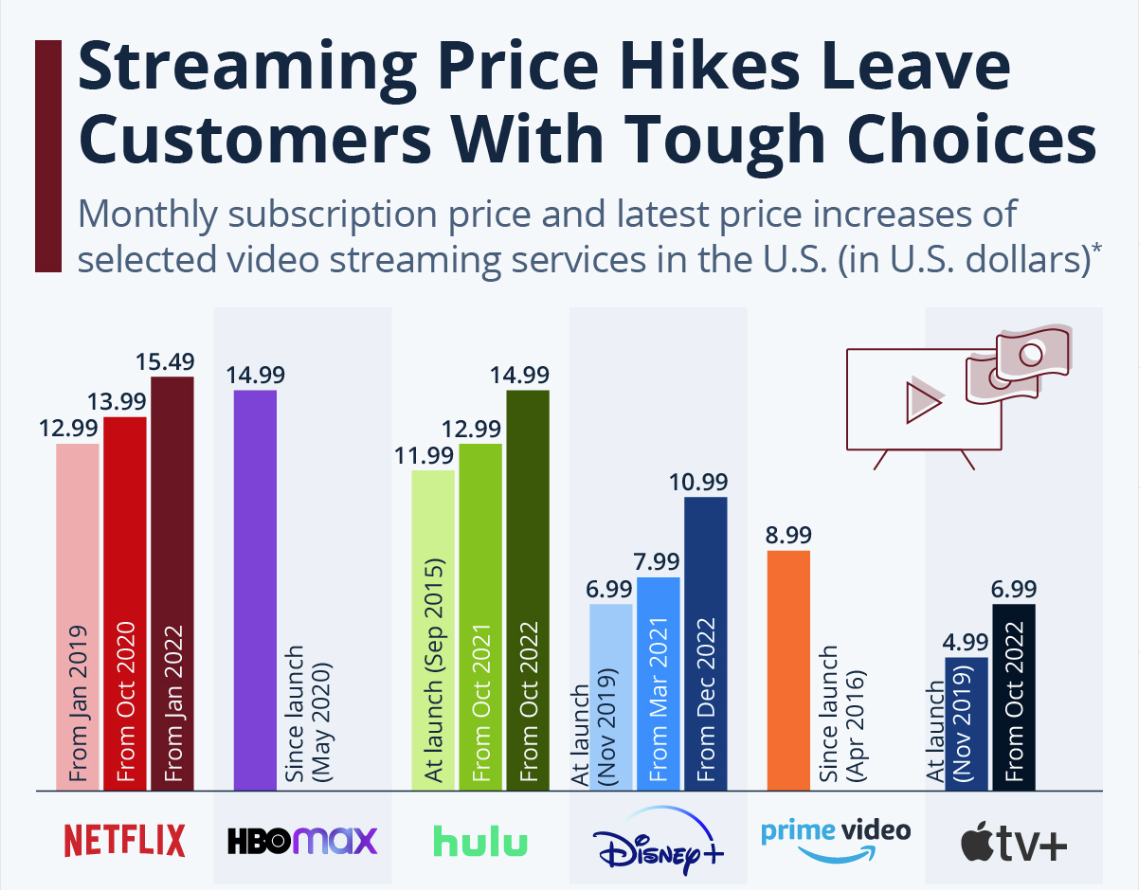

For example, most of the biggest streaming services have raised their prices one or more times since their launch.

Source: Statista

As you can see, Disney+ almost doubled its price, and it’s still running.

The key is to ensure the price doesn’t increase for an agreed-upon period.

Choose the timeframe you feel is appropriate for your service, but six to twelve-months is most commonly used.

Six months is ample time for the customers to prepare for the upcoming change.

Ultimately, offering your customers a fixed price for a fixed term will enable them to trust your business more and give automated payments a shot.

You can also give your customers more flexible options for a better experience.

Consider Offering Flexible Billing Schedules

Automated billing is highly convenient for businesses. It positively affects every aspect of subscription management, offering speed, accuracy, and streamlined procedures.

Extending some of that convenience to improve the customer experience is only fair.

They will surely appreciate it. After all, over 9 in 10 buyers are more likely to choose one retailer over another because of convenience.

Source: National Retail Federation

Moreover, about one-third are significantly more likely to do so.

One way to make your payments more convenient is by offering flexibility in billing schedules.

If you look at your user base case by case, you will find that not all consumers have the same financial needs and habits.

Instead, each has a unique combination of spending habits, payroll schedule, and level of trust for online vendors.

They will also have different preferences regarding the amounts they are willing to pay per installment, as well as the frequency.

With Regpack’s automated billing software, you can create any number of payment schedules to fit your customers’ unique needs. The setup is simple.

Source: Regpack

In settings, go to autobill and create a new autobilling plan. There, you can choose between monthly or bi-weekly payment structures, starting on the 1st, 7th, or 15th of the month.

There is also the custom option for specific cases, such as weekly or irregular payment schedules.

Source: Regpack

Looking at the payment schedule tab, you can add, edit or delete units, depending on the number of installments you plan to split the payments into.

Editing allows you to adjust the dates the payments are due, as well as the amounts in question.

Source: Regpack

While this takes more time than simply providing a predetermined pricing plan, it is crucial to have these options available.

Most of your subscribers will still opt for one of the former.

However, everyone will appreciate having the option, especially those looking for more control over their payments.

If offering flexible billing schedules alone doesn’t convince your audience, you can try doing some promotion.

Promote Automated Billing in Your Invoices

When you decide to present automated billing to the customers, there will naturally be those that oppose the idea for one reason or another, and it’s your job to win them over.

Remember, if you want to convince someone of an idea, you can’t beat them over the head with it. It’s the same with automated billing.

Constantly sending email reminders will most likely just annoy the naysayers and further strengthen their resolve.

But without any promotion, you have to depend on customers stumbling upon the information themselves, which is also not viable.

Therefore, you must find a middle ground between the two to appropriately and subtly remind customers of automated recurring billing.

What better time and place to do so than in your invoices?

After every manual payment the customers make, businesses should automatically send them a digital invoice by email.

Source: Listrak

Numerous studies, like the one above from Listrak, have found that transactional emails have the highest open rate, with customers clicking on almost two-thirds of them.

In the email, you should incorporate a persuasive call to action that motivates clients to take steps toward adopting automated billing.

Don’t freestyle it. There is a science behind writing emails that convert, which you should research before crafting your message.

For example, according to HubSpot’s research, personalized call-to-actions (CTAs) lead to 202% more conversions than basic CTAs.

Source: HubSpot / Illustration: Regpack

The information from the chart alone can lead you to change your approach radically.

For example, starting to use the person’s name, address them directly, and contextualize the offer to their specific case goes a long way in getting customers to convert.

Overall, promoting automated payments in invoices is a subtle yet effective way to remind your customers how easy it would be if they switched their plans.

If they still don’t bite, you’ll have to get more potent bait.

Provide Customers With an Incentive to Switch

If strategies you’ve learned of so far don’t convince the customer to make that final step, offering an incentive could be the thing that pushes them over the line.

And that’s not just an empty assertion.

Studies, such as the one from RetailMeNot, show that special offers have a significant effect on online shoppers’ purchasing decisions.

Source: RetailMeNot / Illustration: GoCodes

In fact, they found that three out of four US citizens consider offers a high priority in choosing what to buy and where, and nearly all of them search for a deal before making a purchase.

The most straightforward and enticing incentive to give, other than literally handing out money, is a price discount.

Your automated billing software should have features allowing you to select between discounts on the first payment or across multiple installments.

To see why this matters, take Verizon’s deal for AutoPay.

Source: Verizon

They opted for a monthly discount. Why?

Probably because mobile users expect to stay on the plan for a long time and, therefore, would recognize the greater value of a lower monthly charge compared to a one-time price reduction.

Another thing to notice is they are offering a flat discount rate of $10.

As you know, mobile bills vary in amount. Therefore, in this case, offering a percentage on the bill would be inconsistent and impractical for the user or the business.

However, most automated billing solutions will provide a percentage option, which benefits subscription services offering fixed installments.

Because there are so many online buying options, customers like to be rewarded for picking you out for their purchase.

By providing an incentive in the form of a discount, you will retain the customers who would’ve walked without it and attract those looking for it.

Run Targeted Campaigns to Increase Adoption

When it comes to encouraging clients to adopt automated billing, one size doesn’t fit all.

Running targeted campaigns that resonate with specific customer segments is crucial to maximizing your chances of success.

Even consumers recognize the benefits of targeted promotion.

In a survey conducted by Visual Objects, 52% of respondents could name at least one advantage of the approach, with finding promotional sales and incentives being the top one.

Source: Visual Objects

We already covered discounts, which can undoubtedly be used in a targeted campaign.

However, the chart above gives us two additional reasons for making a targeted campaign—personalized product recommendations and increased online shopping efficiency.

One of the keys to running successful targeted campaigns is categorizing your customers based on their payment habits.

For example, take those who consistently make late payments. First, identify the main problem they have. While lack of funds accounts for a part of the issue, some could merely be forgetful.

In fact, research by Echo MS has shown that most people, almost half of them, have missed a payment because they forgot to pay.

Source: Echo MS

Fortunately, this is a condition you can remedy.

Armed with this information, you can create email campaigns centered around the notion of automated billing as a solution to their problems.

Try to paint a vivid picture of how relying on automated billing could allow them to stop worrying about forgetting payments and late fees.

Remember, convincingly conveying what benefits they can expect from the new solution is half the battle.

Start Accepting Automatic Payments Only

Finally, if the ultimate goal you are working toward is to ensure every one of your customers adopts automated billing, consider drawing a line in the sand by making it the only payment option available.

At first, you might be hesitant to opt for this approach. After all, customer convenience is all about providing opportunities, and you are taking one away.

However, if you do everything right, customers will find a way to adapt.

As an example, Acquia has found that once they decide on a brand, 59% of American consumers stay loyal to it for life.

Source: Acquia

Furthermore, 78% of the respondents pointed out they would be even more loyal to a brand that understood what they were looking for.

As concluded in the report, establishing trust comes down to being transparent, emphatic, and sincere.

Therefore, if you are planning on performing a system-wide switch, make sure to embrace those values.

Inform your customers well in advance about any upcoming changes, allowing them ample time to prepare.

Use that time to familiarize them with the benefits of automatic billing, highlighting the improvements it can bring to their financial management.

However, don’t shy away from questions or remarks. Reticence will just make your users trust you less.

Instead, ensure your customer support is ready to answer any and all inquiries, or even consider making a public post covering the most common ones.

Overall, setting the date for the switch to automation and providing customers with information and support is the best path forward.

Conclusion

When implementing new billing systems, there are always two sides to consider—the business and the customers. After all, what good is a payment platform that no one uses?

Luckily, automated billing provides a better experience for both.

Strategies to make your company’s customers aware of the benefits include offering more payment options, incentives such as discounts and targeted promotions.

In the end, completing a transition boils down to determining a date and managing your way through it.

It’s like ripping off a band-aid—it will be difficult to bear at first, but it will save you a lot of pain afterward.

It’s important to let your consumers know that they can expect long-term benefits from automated billing, and they’ll be more prepared to accept automated billing.