So much of our lives are now online that online payments are no longer a luxury.

From buying and selling goods, to having online therapy sessions, e-commerce is now a core part of our existence.

There’s apps for everything now. Marketing mediums have switched from billboards to in app ads. And why wouldn’t they? Less than 10% of the current generation, Generation Z, carry out their shopping physically. They rest do the bulk of their purchases online.

Since that’s where the customers are, that’s where your business should be.

Jump to a Solution

Why do I need to offer an online payment option?

What are your online payment options?

Examples of Payment Solutions for Businesses

Stripe

Braintree

Regpack

Shopify

Square

Fastspring

WePay

Bluesnap

Payoneer

Google Pay

Comparing PayPal Processing Fees

Why do I need to offer an online payment option?

For your business to not just survive, but thrive, your clients require payment options that are:

- Secure

- Easy to use

- Efficient – the transaction takes a short time to conclude

- Affordable

With a software platform that can help to automate your online payments, you’ll enjoy:

- Higher sales conversion rates

- Increased cash-flow

- Better debt collection for clients on a payment plan

- Better reputation for customer satisfaction

Sounds good, right?

What are your online payment options?

Now that you know why you need to have online payment options for your clients, let’s look at what the market has to offer.

Payment Apps

Payment apps are a convenient way to collect payments on your website. Apps such as Square and Stripe have various features designed to make it easy for anyone to set up an account.

Most apps are aggregators. That means that instead of dealing with a financial institution directly, they act as your proxy. They group several customers together, dealing with the group as a single account.

Most aggregators don’t charge monthly fees, making it as easy as possible to open an account so that they can benefit from scale. That means you can go from complete novice to “account holder” in just a few a minutes. Newer apps are created to be more flexible, increasing compatibility with other software to ensure you have a seamless experience.

Many of these apps are optimized for payment processing, but not much else. For additional features such as:

- more comprehensive reporting

- database creation

- onboarding

- dynamic product selection

…you’ll probably need different software.

Online Payment Software

With an online payment software, you’ll get more than just payment processing.

Payment software is designed to register clients by collecting all the relevant information as simply as possible. This includes payment details. All this is done without your clients being redirected to another website.

Some of the additional features you enjoy when you sign up are:

- Online Form Builder – With absolutely no coding expertise whatsoever, build a form that captures all the data you need to manage client onboarding or internal data collection.

- Customized payment form – As your business grows, you are going to need some flexibility in payment plans. Ensure that you’re clients are able to transact securely and efficiently by creating the right payment form right on your website..

- Display your offerings – By using conditional logic, your clients can choose their preferred sessions, say a coaching appointment, or the right membership plan, or the right software package. without causing a scheduling conflict. Furthermore, any additional charges that apply to the selection will be automatically added to the bill. No more over/under charging allowing you to make appropriate arrangements for attendees/clients.

- Collect payments on your website – It’s very disconcerting when you’re clicking away on a site, you have your cart ready to check out then you’re redirected to a different site. It makes you think “Maybe this isn’t worth the hustle”. Yet, it is. Make it simple for your client by keeping them on your site.

Examples of Payment Solutions for Businesses

Aggregators

We spoke about these in the section on payment apps. Examples of these include PayPal, Stripe, Square. We will cover some of their features in the section below.

For small businesses whose volume of transaction differs significantly from one month to the next, this is a good option. Pricing is often calculated per transaction so there are no fixed costs associated with these types of accounts.

As your business grows, this model can become expensive. Which is why, many businesses will move to the next model.

Merchant Accounts

Unlike aggregators, merchant accounts are like bank accounts. There’s a vetting process, which means it takes longer to set up an account than you would with PayPal.

It is ideal for businesses that have high business volume and whose income is a little more predictable.

Merchant accounts often come with contracts. Should you decide to switch to a different psp, you’ll be asked to pay a termination fee which can be quite high.

On the upside, most merchant payment processors will offer great customer support. They are also less known to freeze accounts because of the nature of the personalized relationship they have with you. Frozen accounts are the key reason driving business away from PayPal.

Integrated Registration Solutions

If you’re in the service industry, offering courses, or coaching sessions, or a software as service product, you are going to have a long-term relationship with many of your clients.

How do you ensure that your products are meeting the needs of your clients?

You need data. That’s why you need to customize your forms to ensure that you collect all the information you need from your students. This includes their payment status.

In addition to that, you’ll need to track those who are on a payment plan.

The easiest way to do this is to automate the whole system.

Once your clients fill in the form, that information feeds the whole system, including an automated email management module that sends reminders to your clients when payments are due.

Payment Processing for Non-Profits

The options available for nonprofits are very similar to those of businesses. In fact, many non-profits use aggregators like Stripe and PayPal. However, there are processors who work exclusively with nonprofits such as iATS Payments and Charity Engine.

With the complexity of tax implications, it is wise to choose a provider that understands the unique needs of the not-for-profit sector.

Many donors will have a monthly, quarterly or annual provision to direct to your charity.

In addition to processing those payments, providing them with the right forms and payment notifications helps with transparency and efficiency.

Find a donation management platform that will work for you and that offer the following features:

- Low processing fees – paying over 4% per donation is too much!

- Options to pass the processing fees to donors so you collect 100% of the donation

- Full suite of communication, filtering, and reporting tools so you don’t just collect money but can manage it as well

Alternatives to PayPal

PayPal was revolutionary when it first started. It afforded small businesses quick and simple access to online payment facilities. As the platform grew, some weaknesses were exposed. Other software companies have developed products that offer a smoother payment process for sellers and buyers alike.

Here, we’ll explore our top picks if you are looking to move away from PayPal.

Stripe

Stripe is an online processor that bears some similarities to Paypal. The product is targeted at web developers, focusing on customization. Some technical knowledge is required to maximize on all the features of the platform.

The PSP allows you to build customized forms that suit your needs for the business. It can be integrated with various POS systems available in the market. Their pricing model is pay-as-you-go, which is similar to PayPal, with more acceptable terms for businesses transacting high volumes of sales.

Stripe facilitates payments globally in more than 135 currencies. Stripe also provides comprehensive documentation which is very helpful to developers.

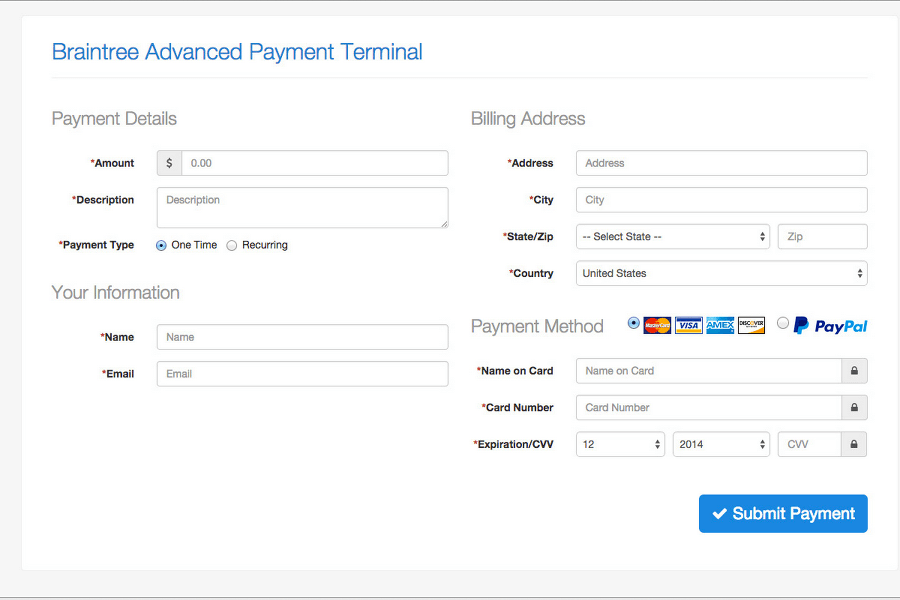

Braintree

Braintree is a subsidiary of PayPal, but it does not compete for the same clientele. While PayPal is an aggregator, Braintree is a merchant account. If you’re moving from PayPal, because your sales volume has increased, this transition will be easy.

The pricing structure is very similar to PayPal’s though it is a little high for a merchant account. As with Stripe, it is well documented for developers to use. The major benefit above other merchant accounts is the lack of a contract. You are free to switch to another platform without incurring termination fee. Braintree accepts bitcoin in addition to many other payment options.

Regpack

Regpack is a comprehensive solution that incorporates payment processing into its other services. It is particularly suited to cater for the needs of educational institutions and other organizations that hold events such as seminars and camps, both physical and virtual.

Build forms that can be embedded to your web-page so your clients or students can provide all their necessary information and pay without ever leaving your site. The platform helps you manage processes and manage payments. You can apply discounts and coupons to your products.

Although Regpack is a registration software, the platform can also be used to sell goods. Payment reports and email management are just a few of the services one can enjoy with Regpack. There is a monthly fee that is dependent on the number of admins, but with it comes all the additional features.

Shopify

Shopify is another option which isn’t just a PSP, but also a gateway. That means that you can choose to integrate Shopify with your existing payment account. Unfortunately, if you choose not to use a Shopify account, the gateway will be less charitable.

If you opt to use only the gateway, you will have to pay a monthly fee, which is waived when you use a Shopify account. The platform is a good place for beginners who are new to world of e-commerce. They have 24/7 customer support which you won’t get with PayPal. For those with more than one store, they can enjoy inventory management. One main drawback is that it doesn’t work well off-line.

Square

Square is quite similar to PayPal though it has many more integration options. It is also ideal for beginners whose transaction volumes fluctuate, sometimes erratically from one month to the next. It is a use as you go model with a flat rate per transaction.

They also offer point of sale equipment, specifically chip card readers at affordable prices. That makes it ideal for both physical and online payment processing.

Their weakness lies with their customer support. Although they provide several self-help resources on their site, you can only get personalized assistance during office hours.

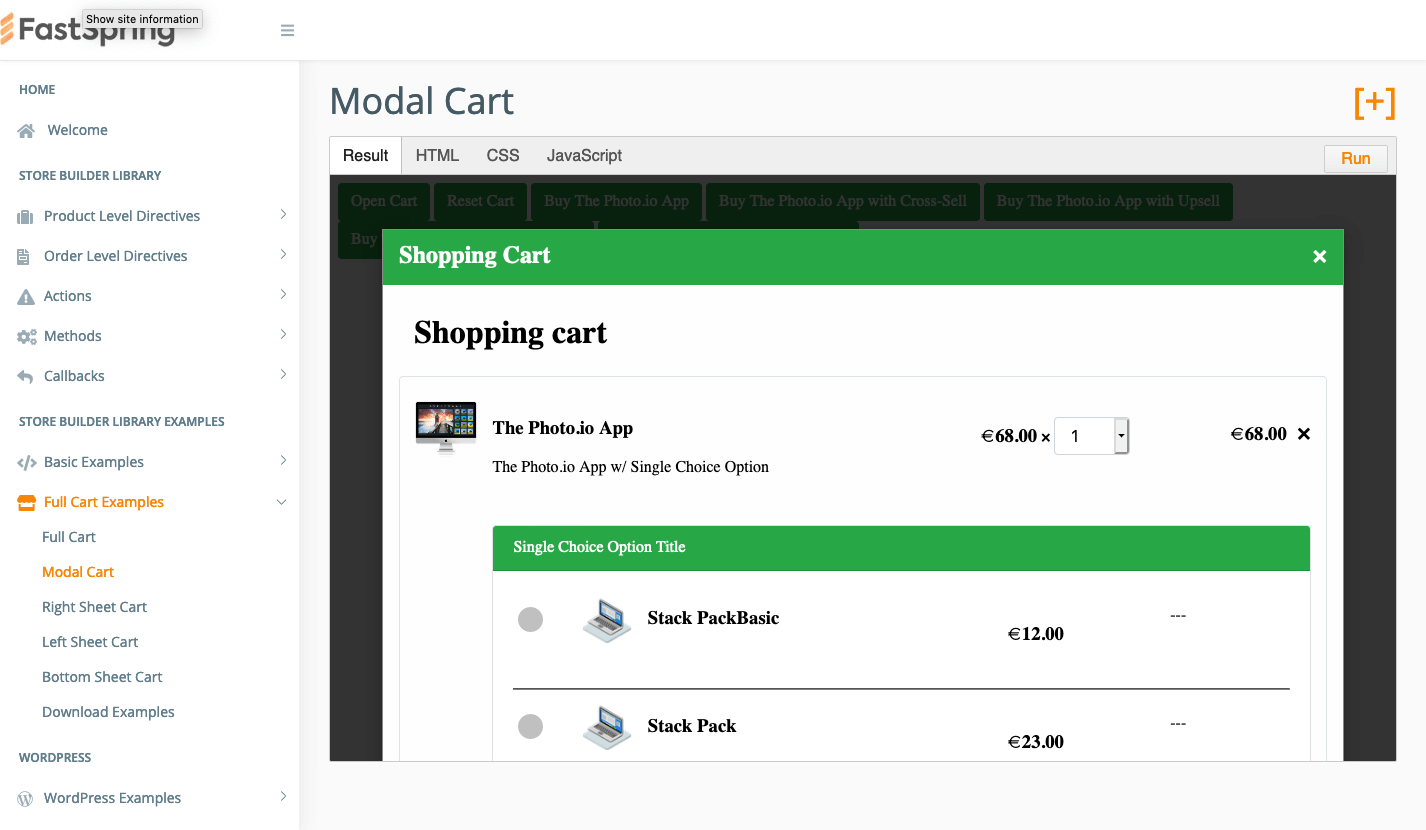

Fastspring

With the help of Walkme, clients are guided through the process of setting up their online store. The platform is optimized to handle subscription billing without you having to do so manually.

It allows several modes of payment and is available globally. Opening an account is easy and free.

One draw-back is that the pricing information is provided on an individual basis, which is a slight inconvenience.

WePay

This is a fast growing software company that focuses on partnering with online market places. They don’t target the individual businesses.

Instead they are the gateway used by platforms that serve small businesses, such as www.timetopet.com , which serves dog-walkers looking for business.

WePay was acquired by JP Morgan which helped to spread the technology much further through the bank’s customer network.

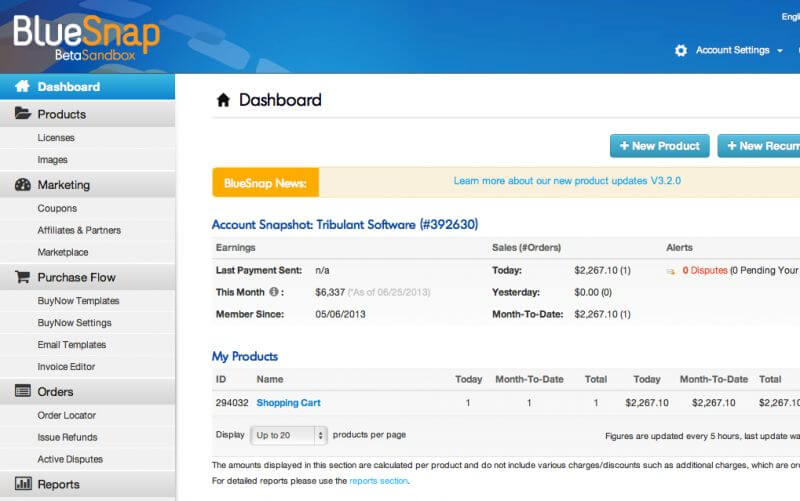

BlueSnap

This is another gateway service that can be integrated with several existing PSPs.

With their global network of banks, they reduce the risk of credit card declines when transacting with clients in other countries. This results in increased sales for you, the business owner, and increases the probability of repeat business.

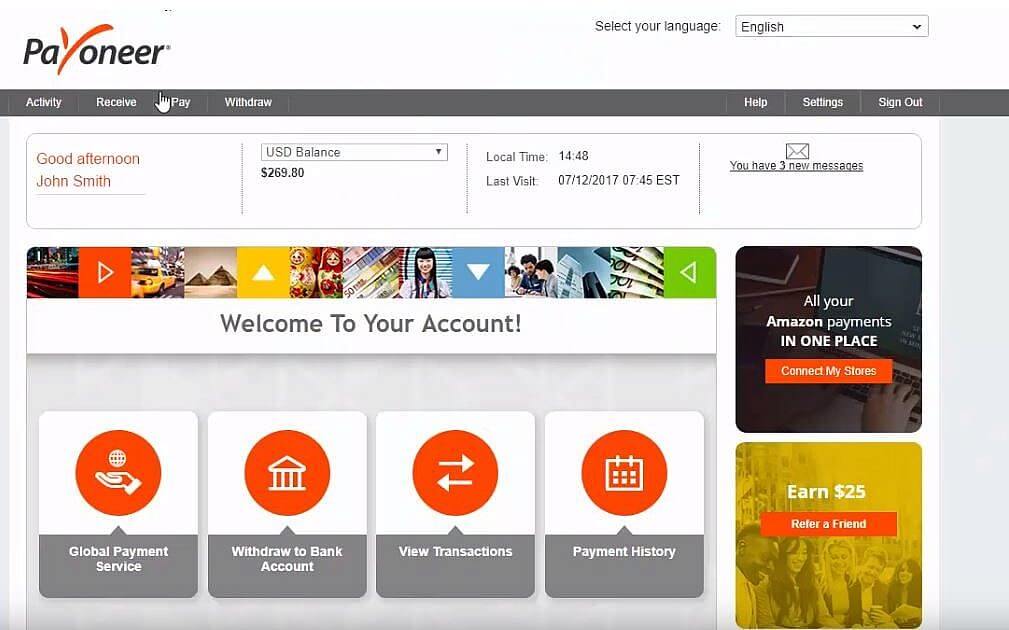

Payoneer

This company has been operating for over a decade and in that time has earned a loyal following around the world. It is well suited for freelancers who offer their services often from developing countries. They offer reasonable exchange rates, though there is a catch.

If, for instance, you are in a country outside the US, and you want to withdraw your money in dollars to a dollar account that you hold in that foreign country, the platform will do so by first converting the funds to the local currency, and then converting it back to dollars. That can be quite costly.

Other than that, it is a good platform for payment processing and you can find customer service support in several languages.

Google Pay

Google Pay is the utopic check-out solution for your clients. If you have enabled google pay on your site, they can complete their purchase without having to fill in a form. That’s great for your clients and for you if your interest begins and ends at payment.

If you need more information for future offers and monitoring payment plans, you, as the seller will not benefit. If your simply selling goods and services with one off payments, this is definitely an option you want to consider.

Comparing PayPal Processing Fees

Let’s look at what you’ll be giving up if you move away from PayPal for online transactions.

- 2.9% of the transaction + 0.30 USD per transaction (if both parties are in the US)

- 4.4% of the transaction + a fixed fee depending on the currency used.

For PayPal Pro there’s a monthly fee of $30. For additional prices including charge back fees, micropayments and more, you can visit their website for the detailed price list.

Advantages

For a starting small business, the fees charged are in the “best practice” range in the market.

Disadvantages

All the fees pertain solely to payment processing. With Regpack, once you pay the standard monthly fee, you gain

- Registration tools: These include online form builders, simple code that allows you to embed the form right on your website, session and attendance tracking, and a customized registration for your applicants.

- Online Payment tools: These include Purchase Protection, automated billing, and offer payment plans.

- Reporting and Analytics: These include Sales and Payment Reports, registration templates, mobile friendly online registration and email communication tools.

Virtual meetings and events are now common-place. 2020 was the year we found out that office space was not the necessity we thought it was. The primary priority is connectivity and convenience.