In an increasingly digitized society, most businesses must have an online presence of one kind or another.

Whether it be a social media profile on sites like Facebook and Instagram, or a fully-fledged and operating website, companies can use the internet as a way to connect with customers or advertise their product.

However, those that want to take maximum advantage of the internet space to grow their operation have to take one additional step—and that’s implementing online payments.

Only by allowing customers the convenience and speed of electronic payment systems will your business have a chance to compete in the global market.

For those ready to take that step, we share notable benefits and drawbacks of accepting payments online, which should facilitate making the decision.

Let’s get right into the good stuff first.

The Pros

Just as the internet has revolutionized the way people connect and communicate, online payments have transformed the way we conduct business.

Listed below are just some of the examples of the advantages such payments can bring to your company.

Reaching a Global Audience

The internet is vast and full of opportunities.

By accepting online payments, businesses open themselves up to customers over the globe, transcending borders and erasing geographical boundaries between them.

For companies, access to a worldwide audience provides immense potential for growth and expansion. Let’s start by taking a look at the customer base.

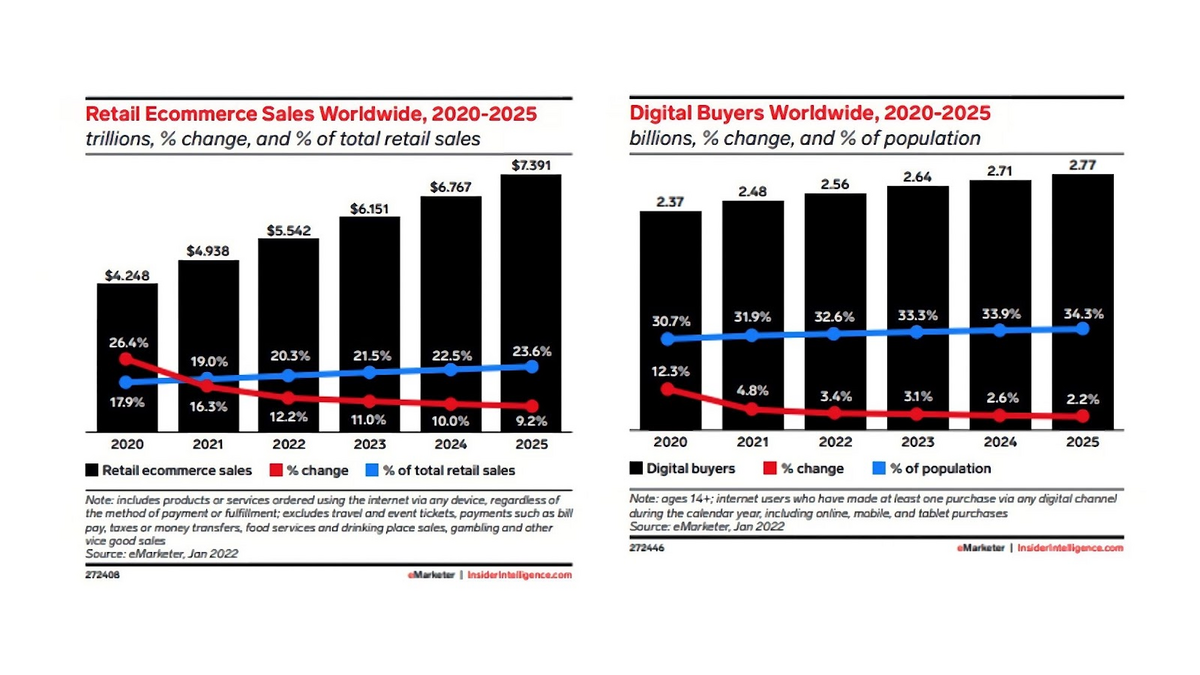

According to eMarketer’s Global Ecommerce Forecast, in 2022, there were around 2.48 billion people buying goods and services online.

This number is up from 1.66 billion in 2016 and is projected to rise even more in the following years.

Source: eMarketer

Furthermore, retail e-commerce sales reached over $5.5 trillion in 2022 alone.

Tapping into that thriving and developing market allows companies to maximize their sales potential.

In a way, accepting online payments is like opening a global storefront that never closes. And for that store to make a profit, you need to think of the customers.

Optimized Customer Journey

Whatever part of the world they come from, there is one thing online shoppers share—a desire for convenience.

In fact, research shows that more than three-quarters of online buyers named convenience as their number one reason for making purchases over the internet.

Source: IAB Australia

It’s the same reason 98% of consumers want to connect with businesses through their mobile devices, which is what Contentful found in their survey.

This is because online payments provide customers with the ultimate convenience—the ability to purchase anything, at any time, from anywhere, often getting to use their preferred payment methods, and even their own currencies.

Not only will offering streamlined purchases be a surefire way to attract customers, but those customers, used to instant gratification will be more prone to impulse buying, bringing even more profit to your business.

High Transaction Speed

Customers aren’t the only ones benefiting from the immediacy of online payments.

For businesses, waiting for the payment to clear can feel like watching paint dry.

Not only does it prevent access to money they already earned, but it also stops them from utilizing those funds for furthering their goals and objectives.

In comparison, online payments offer a breath of fresh air.

They are processed much faster than traditional payment methods – such as checks, for example – even if the payment comes from the other side of the globe.

How fast, you ask?

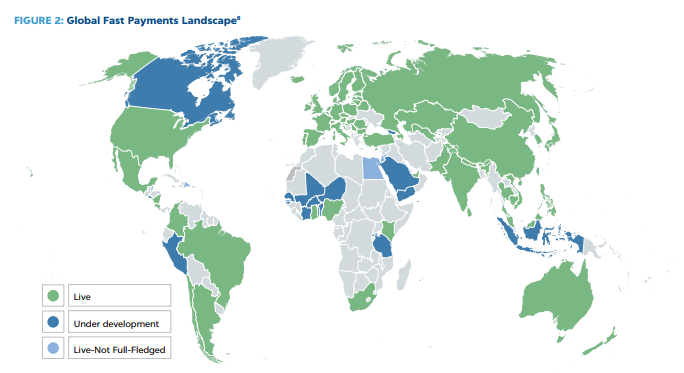

For the answer, let’s turn to the World Bank Group. Recently, they made a report on the so-called “fast payments”, which they define as:

payments where the transmission of the payment message and the availability of final funds to the payee occur in real time or near real time, and as near to 24 hours a day, seven days a week (24/7) as possible.

A majority of the world’s population has access to a type of fast payment system, with others doing their best to follow suit.

Source: World Bank Group

Businesses selling online in these areas will receive payments more quickly, enabling them to manage their cash flow effectively, make prompt business decisions, and seize opportunities as they arise.

Strong Payment Security

There is one aspect of online payments that raises a concern for both retailers and customers alike, and that’s payment security.

The early days of the internet were plagued with cases of fraud, identity theft, and data breaches.

Today, several regulatory frameworks later, online payment software must comply with strict security standards and employ the latest security measures to protect customers’ sensitive information.

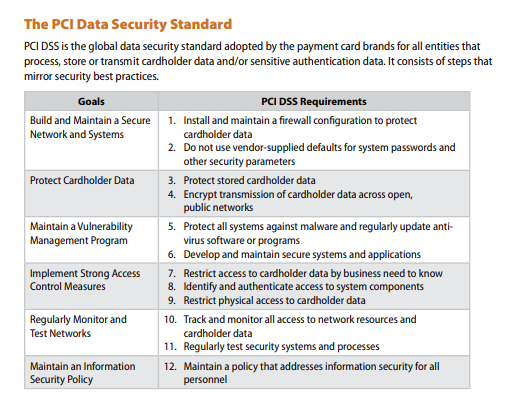

Firstly, there’s the Payment Card Industry Data Security Standard (PCI DSS).

To ensure compliance, the PCI DSS has 12 main requirements which mirror security best practices, and those are as follows:

Source: PCI Security Standards Council

Security measures other than PCI DSS include Secure Sockets Layer (SSL) and Transport Layer Security (TLS) protocols, as well as tokenization for encryption and secure transmission of data, and 3D Secure and the address verification service (AVS) for fraud prevention.

With these robust encryption protocols and advanced fraud detection mechanisms, businesses and customers alike can rest assured that their customers’ payment data is protected.

Accepting Recurring Payments

Expanding on the idea of convenience, some online payment software solutions such as Regpack give businesses the ability to go beyond one-time transactions and accept recurring payments as well.

Source: Regpack

Instead of billing the whole transaction amount at once, recurring payments allow customers to pay for their purchases in periodic installments.

These are spread out over a defined time period and billed automatically at regular intervals, such as weekly, monthly, or annually.

Regpack offers a flexible payment plan which can be tailored to the needs of individual customers.

That way, you can be certain that people buying your product have all the options they would want to ultimately decide on the purchase.

While predominantly used for subscription-based businesses, it can also be used for e-commerce, especially for products on the expensive side.

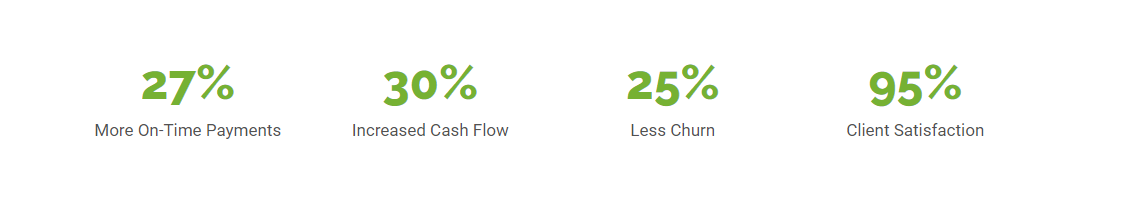

Whichever your case may be, by implementing recurring billing, Regpack’s clients have seen a 30% increase in cash flow and 27% more on-time payments.

Source: Regpack

Therefore, using this system means businesses can create a steady and predictable cash flow stream, facilitating easier decision making, better-grounded planning and faster growth.

The Cons

While online payment systems offer a sea of advantages for businesses, there are also drawbacks to consider before you plunge yourself into the water.

However, these are all manageable and should not present a problem for well-run companies.

Nevertheless, it’s important to be cognizant of potential issues with online payments to properly prepare, so you can ultimately ensure smooth sails for your business.

Unforeseen Technical Issues

Like any system reliant on technical infrastructure, online payments can become subject to unforeseen technical issues and unexpected downtime.

As illustrated by the example from Immigration, Refugees and Citizenship Canada below, even government sites are not exempt from this problem:

Source: IRCC on Twitter

There are several reasons problems of this nature occur. In most cases, causes of payment system downtime are related to network/connectivity issues, server or power outages, system maintenance or hardware failure.

As Razorpay defines it:

An outage or partial degradation in a payment system or a failure at bank or integration that could impact a customer to complete the transaction is considered to be a downtime.

In case of downtime, customers are prevented from purchasing your product or service, which can cause frustration with some people.

It’s no surprise customers consider technical issues as the number one con of online payments.

However, everyone experiences them eventually, and all you need to do to curtail the worst effects of downtime is to be prepared.

The best route to take is to determine the cause of the problem and get people working on fixing it.

At the same time, inform your customers and payment processor of the problem, and offer an alternative payment method you prepared especially for these types of situations.

Overall, unforeseen technical issues can be nerve-wracking for first-timers, but a well-made contingency plan should have you resume business in no time.

Having to Pay Processing Fees

As discussed in the first half of the article, online payments offer many benefits to businesses. However, as the old adage says: “There’s no such thing as a free lunch.”

In other words, there is a price to pay for access to the global market, and it comes in the form of processing fees.

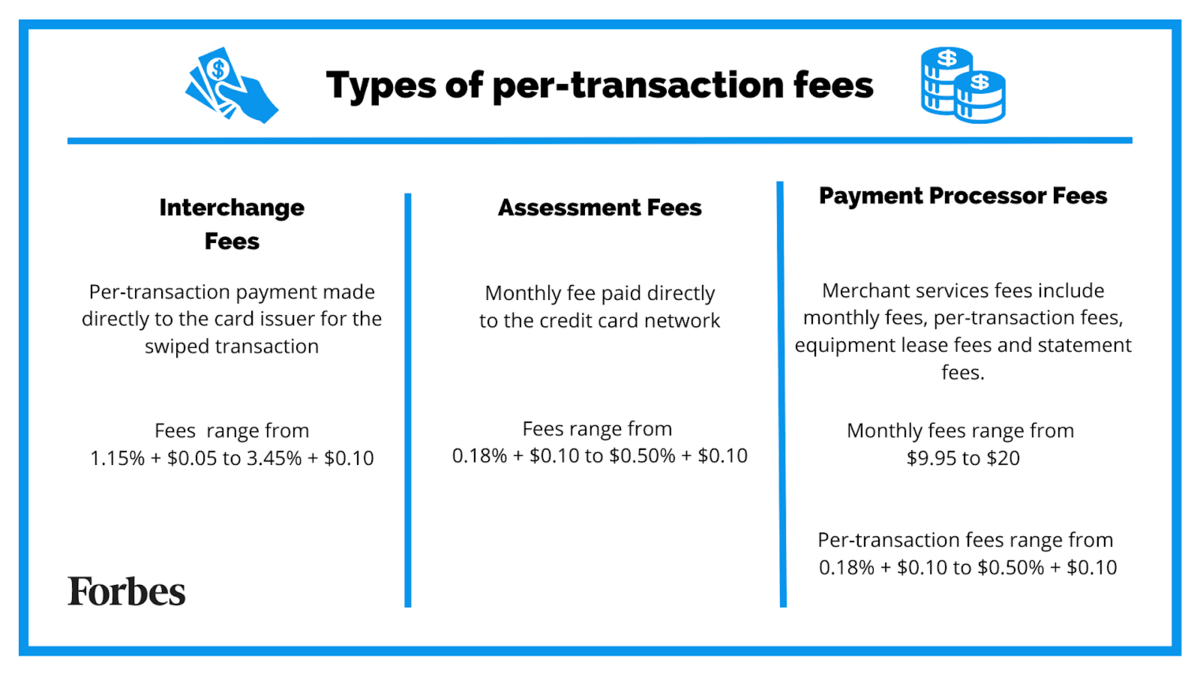

Going by Forbes’ breakdown, there are three main types of fees for credit card purchases, listed below:

Source: Forbes

There are other mandatory fees as well. They are charged for the following:

- acquirer processing

- fixed acquirer network

- kilobyte access fee

- network access

- brand usage

All of these may seem like minor expenses at first. However, they can slowly accumulate, eating away at your profits.

The exact amount businesses have to pay depends on a variety of factors, including the type of transaction and the service provider.

While navigating them requires careful consideration, they are rarely a dealbreaker for businesses. After all, the lion’s share of each transaction is still coming your way.

With that in mind, be sure to research and compare different service providers to find the most cost-effective solution for your business.

Dealing With Cases of Fraud

While online payment software provides robust security for internet-based businesses, there are still cases of fraudulent credit card transactions resulting from identity theft outside the online space.

Just a few years ago, in a well-publicized case, a man was convicted to 21 years in prison for running a $3.3 million credit card scheme using stolen identities and social security numbers belonging to local children.

And that was not an isolated incident.

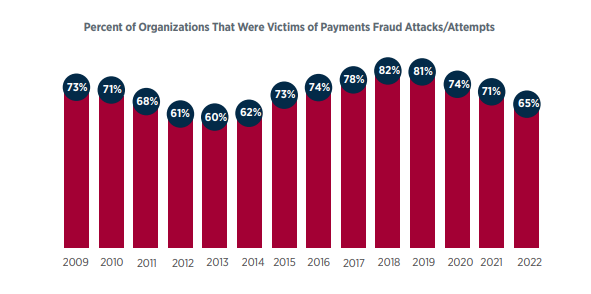

According to industry research by J.P. Morgan, a global authority in financial services, the percentage of organizations victimized by payment fraud attacks has been steadily fluctuating between 60% and 80% for more than a decade.

Source: J.P. Morgan

Fortunately, they are currently on a downward trend, which will hopefully continue in the future.

Still, to help safeguard your business against these risks, businesses should implement additional security measures and stay up-to-date with the latest fraud prevention technologies.

Possibility of Chargebacks

Speaking of fraud, businesses offering online payments have another issue to contend with, and that is the possibility of chargebacks.

A chargeback occurs when a customer disputes a transaction and requests a refund from their card issuer.

Some chargebacks are legitimate, stemming from issues like billing errors or dissatisfaction with a product or service.

However, others are less genuine and may constitute attempts to fraudulently exploit the system for personal gain.

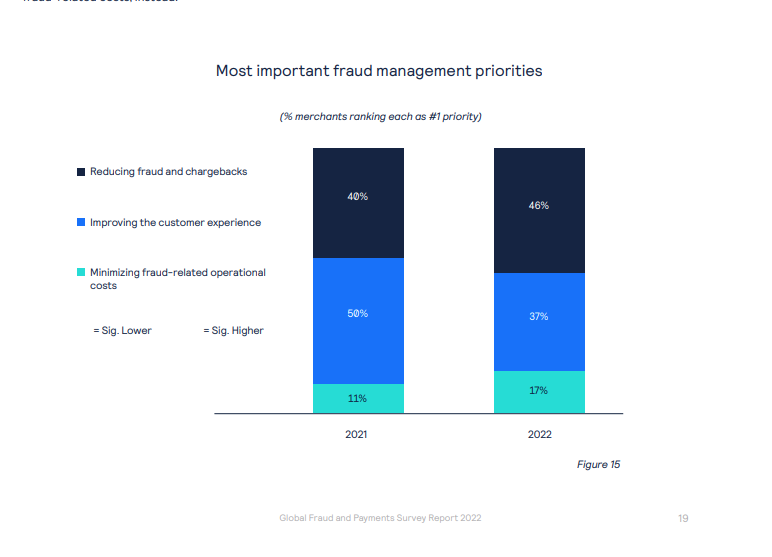

In 2022’s Global Fraud and Payments Report, merchants selected chargebacks as the number one fraud management priority.

Source: CyberSource

This perception is not out of the blue, as one-third of global retailers experienced chargeback fraud.

In fact, it has been among the top four most reported types of fraudulent payment activity for several years now.

Businesses must accept this risk if they want to accept online payments, but it’s essential to be aware of the potential consequences.

Chargebacks not only result in lost revenue but also incur fees imposed by payment processors. A high chargeback rate can hinder your ability to conduct business online effectively.

However, vigilance and effective customer service can help mitigate chargeback risks and maintain a healthy financial ecosystem for your business.

Conclusion

Accepting online payment brings tangible benefits to your business, but to make it work, it is also crucial to be aware of the challenges that lie ahead.

Remember, by accepting online payments, you’re not just accepting money, you’re accepting the possibilities of growth, convenience, and security. So, why wait?

Set sail on your payment processing voyage, armed with knowledge and preparedness, and may your journey be one of success and growth.