Some small business owners hold assumptions about online payments that cause them to ignore this efficient method and stick to what they know.

Unfortunately, this causes them to miss out on all the benefits of online payments, like more customers and increased efficiency, to name a few.

In this article we’ll cover, and bust, eight of the most common myths surrounding accepting online payments.

Hopefully, it’ll help you more accurately and objectively evaluate this popular method of payment collection.

- Small Businesses Don’t Need Online Payments

- Online Payments Are Too Complicated to Set Up

- Accepting Online Payments Is Too Expensive

- Online Payments Come With Hidden Charges

- Processing Online Payments Takes a Few Days

- Online Payment Processing Is Not as Reliable

- Failed Payments and Chargebacks Are Expected

- Online Payments Have Too Many Security Risks

- Conclusion

Small Businesses Don’t Need Online Payments

If you’re running a small business, you may be under the impression that your business is not big enough to need online payments.

However, that is exactly why your business needs online payments.

Online payments will help you grow it into a bigger, or at least more profitable, operation. It’s not just for the big dogs and the tech startups.

More and more customers are coming to prefer making their payments online out of convenience, so offering online payments will help you win more buyers and grow your business.

Source: Fit Small Business

That’s just one of many reasons you should consider online payments. Another is how much easier it becomes to manage your business.

Small business owners already handle enough different types of work. It can be exhausting switching from marketing to accounting to sales in just one day.

WIth online payments, you’re able to devote less of your time and energy to collecting payments and following up with customers who’re late on their payments.

You also don’t have to pay for people to staff your store to facilitate purchases, or do things like run to the bank to cash a check.

Time is often more scarce without a bunch of employees, so the minutes that online payments save you will be precious.

Really, if anyone needs online payments these days, it’s the hustling small business owner.

Losing just one or two customers a month because of a lack of payment options is enough to seriously hurt your revenue.

Online Payments Are Too Complicated to Set Up

One of the most common myths about online payments is that it’s a nightmare to set up.

This is a fair concern.

There’s very little more frustrating than spending a day learning and setting up, then begging and pleading with, a new piece of technology that’s supposed to make your life easier.

In reality though, setting up online payments is not a nightmare. It’s not even some strange and slightly upsetting dream.

It’s usually a pretty quick and painless process, thanks to the tools that facilitate it.

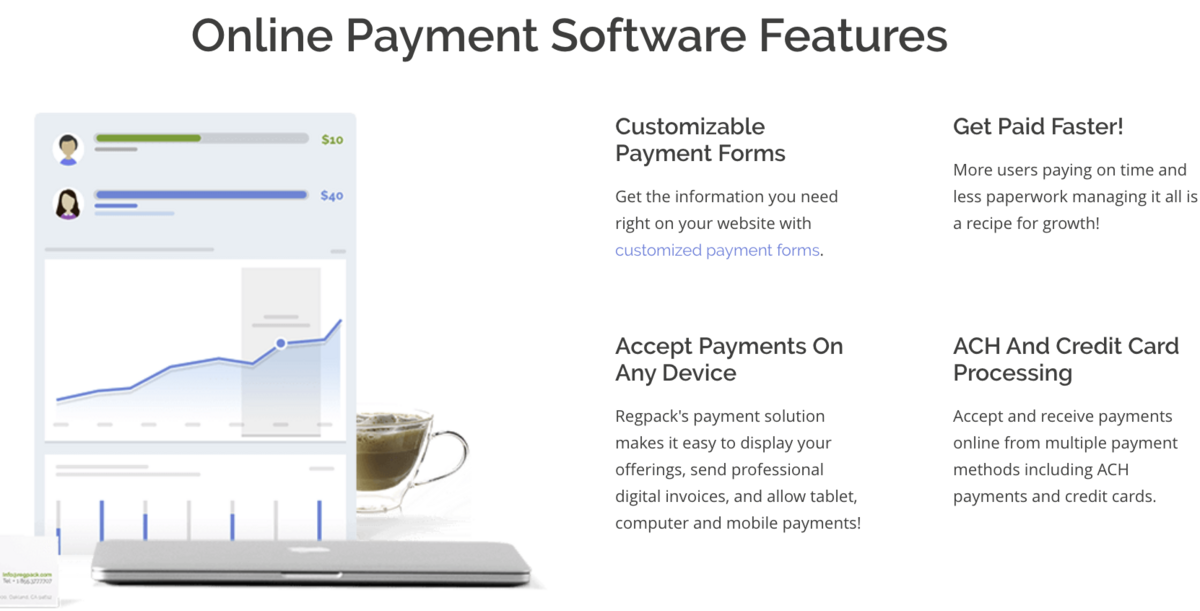

Online payment software like Regpack make it super easy to set up online payments for any business, regardless of how tech-savvy you are.

Source: Regpack

Regpack’s system will walk you through the step-by-step process of setting up online payments.

It’ll ask you for the information it needs to set up the system, and allow you to create a merchant account right from the platform.

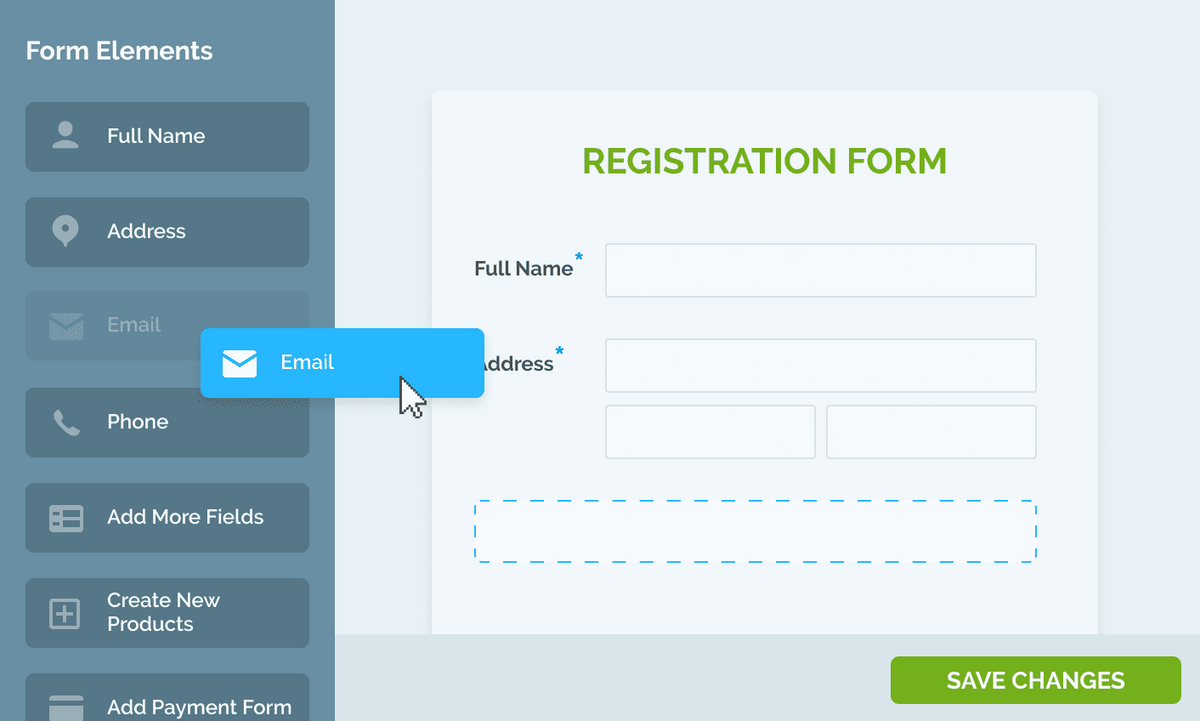

With its drag-and-drop form builder, it’s easy to create custom payment forms and embed them on your website:

Source: Regpack

Of course, even with the most user-friendly technology, there can be hiccups along the way. So make sure your chosen vendor offers great customer service.

Regpack, for instance, comes with a stellar customer support team that will answer any of your questions and provide clear guidance in the rare chance that you get stuck.

Source: G2

In sum, yes, manually creating online payments would be challenging. But online payment software is designed to make it easy.

Accepting Online Payments Is Too Expensive

Online payments are sometimes thought of as being too expensive for small business owners, especially when compared to cash transactions which are, of course, free.

Though there are going to be some fees, they’re usually pretty low, and they vary depending on the type of online payment method.

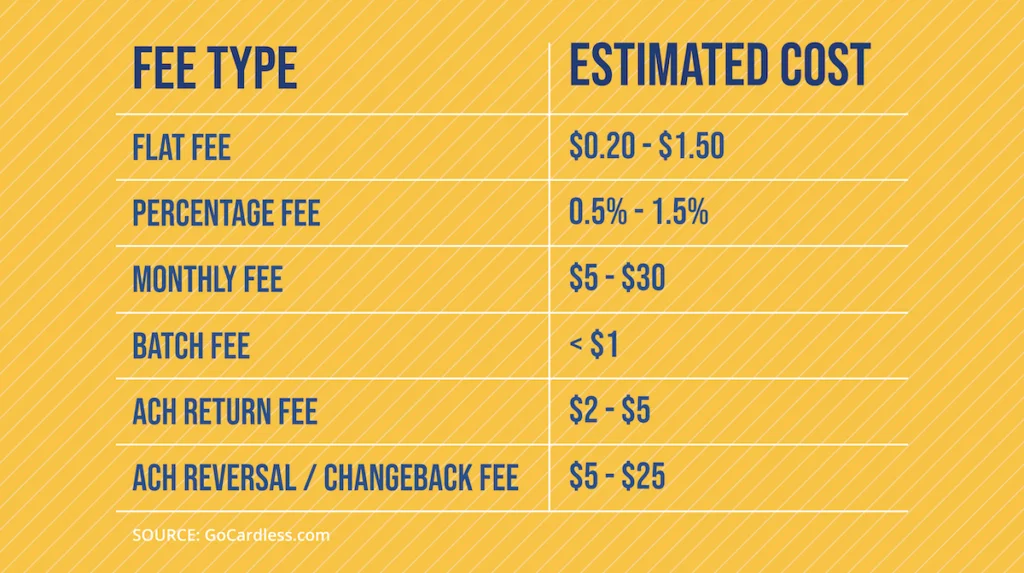

For example, in general, ACH transfers have lower fees than credit card transactions.

Most credit card payment processing is going to cost around 2.5% to 3.5% of the total transaction value, while ACH transfer processing fees fall anywhere between .5% and 1.5%.

ACH payments might be priced differently depending on your vendor:

Source: Stampii

Either way, the cost is usually well below the benefits you get from the online payments, one of which is how it’s easier to convert prospects into buyers.

For instance, if your transaction rate was 1% for ACH payments, and a customer made a $1,000 purchase, you’d pay $10 in fees.

That’s a price well worth paying if that customer would have chosen another brand had you not offered online payments, which are increasingly becoming the expectation.

Not to mention the money you save by not having to pay someone to stand in your store and collect payments from customers. The same goes for credit and debit card payments.

Note that the cost of online payments also depends on other factors, like which payment processing tool you choose, and the number of transactions you make in a given month (more is often cheaper per transaction).

Some providers might also charge for international transactions.

Be sure to shop around to find the right one for your particular business. Odds are you’ll find a tool that has reasonable rates and satisfies all your requirements.

Online Payments Come With Hidden Charges

One can easily imagine a person avoiding the mechanic or car dealership for years, despite a loud rattling in their car’s engine, because of the belief that the business is going to slip in a few hidden charges and scam them out of their hard-earned money.

This, of course, is an unreasonable belief. Most businesses that work on cars are honest and transparent.

The same goes for payment service providers. They’re not going to shred your savings with stealthily hidden fees.

If a payment service provider did trick their customers, they’d go out of business pretty soon. As an ongoing software service, they rely on long-term customers, not one-time users.

When you set up a merchant account through your online payment software, you’ll be able to see the fees before signing anything.

On the service agreement will be the rates for each transaction type, clearly marked, as well as any other payment terms like late fees.

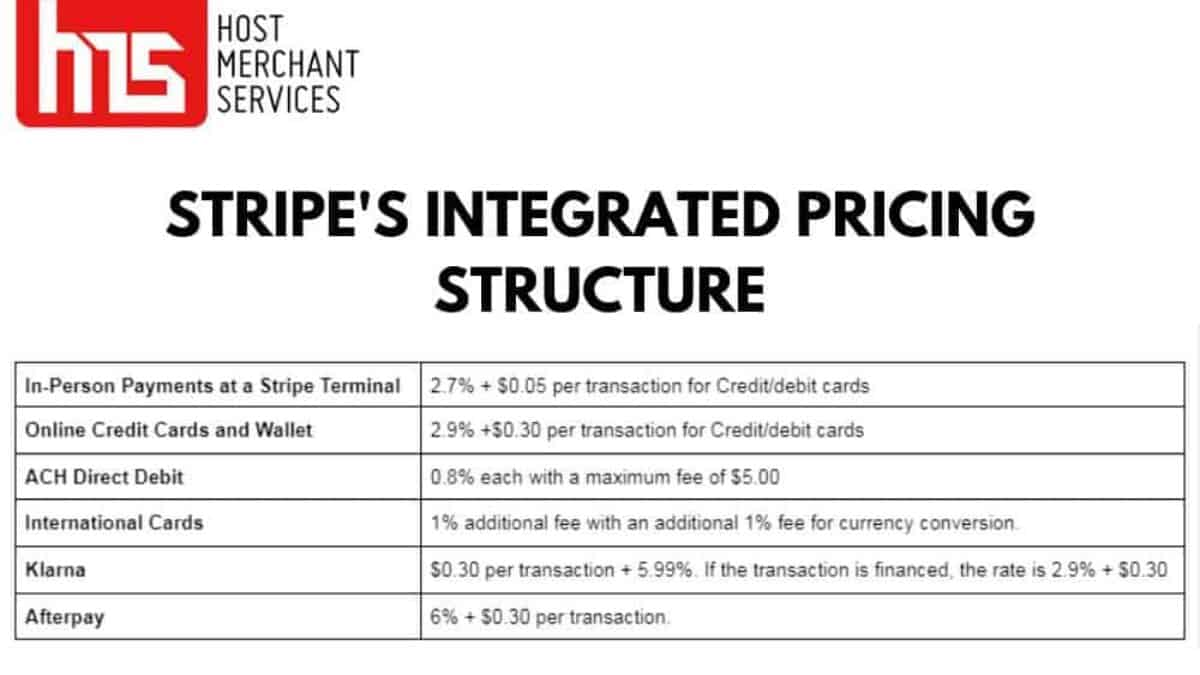

For example, here’s Stripe’s fees:

Source: Host Merchant Services

If you don’t agree with the terms, you can negotiate, or decide to go with another merchant account provider. If the company is shady, walk away and find another vendor.

Processing Online Payments Takes a Few Days

Some people worry that if they start accepting online payments then they’ll always be waiting for money to enter their account and be free for use.

Compared to cash, these skeptics do have a point. There are no transfer times or clearance periods when you get paid in cash.

But, too many people overestimate the difference in time between cash payment and online payment processing. In most cases, it’s not as big a gap as most people think.

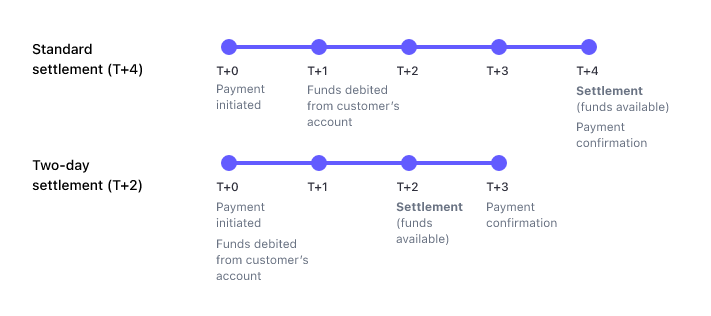

The majority of online payment methods won’t take any longer than five days to process. And that’s at the long end of the spectrum.

Square, a popular online payment tool, says that it takes about 3-5 days to process ACH transfers, one of the most popular payment methods for online payments.

The average payout timing for Stripe is about 3-5 days as well:

Source: Stripe

And when it comes to credit cards, that average processing time is even shorter.

The average online credit card payment takes 1-2 business days to process, according to Bankrate.

Not to mention, your customers will appreciate how much easier it is to pay online. They won’t have to drive to your store or wait in line.

This increased convenience can cause your buyers to make their payments earlier. They won’t procrastinate because it’s not an errand; it’s too easy to be considered that.

The bottom line is that if you can wait a few days for a payment to process, and don’t need payments to become liquid right after purchase, then the slight delay in online payments transferring into your account probably won’t make much of a difference.

Online Payment Processing Is Not as Reliable

Some people worry about trusting technology to handle something as important as collecting money from their customers.

The last thing they want is for some technical error to cause them to lose out on what they’re owed, or experience some ridiculously long processing delay that holds up business.

These are very common fears. But they’re usually supported by misunderstandings about how the software actually works.

When you do some research into online payments and their pros and cons, you’ll soon learn that online payment processing tends to be just as, if not more, reliable as physical payment collection.

One of the reasons for this is that online payments reduce the chances of human error, in both payment collection and accounting tasks.

Because processing happens through automated systems, a mistake such as overcharging a customer is very unlikely to happen.

A machine isn’t going to fail in adding the sub costs of five different items to get the total price, but a tired employee might.

And for the customer, submitting an online payment is a breeze. Even if there’s the rare technical difficulty at checkout, fixing the issue is usually quick and simple.

Failed Payments and Chargebacks Are Expected

Another common myth about online payments is that there will be a lot of failed payments and chargebacks — when a customer successfully disputes a charge and you’re forced to refund them.

While these are potential challenges of using online payments, most online payment software come with tools that help you prevent them from happening.

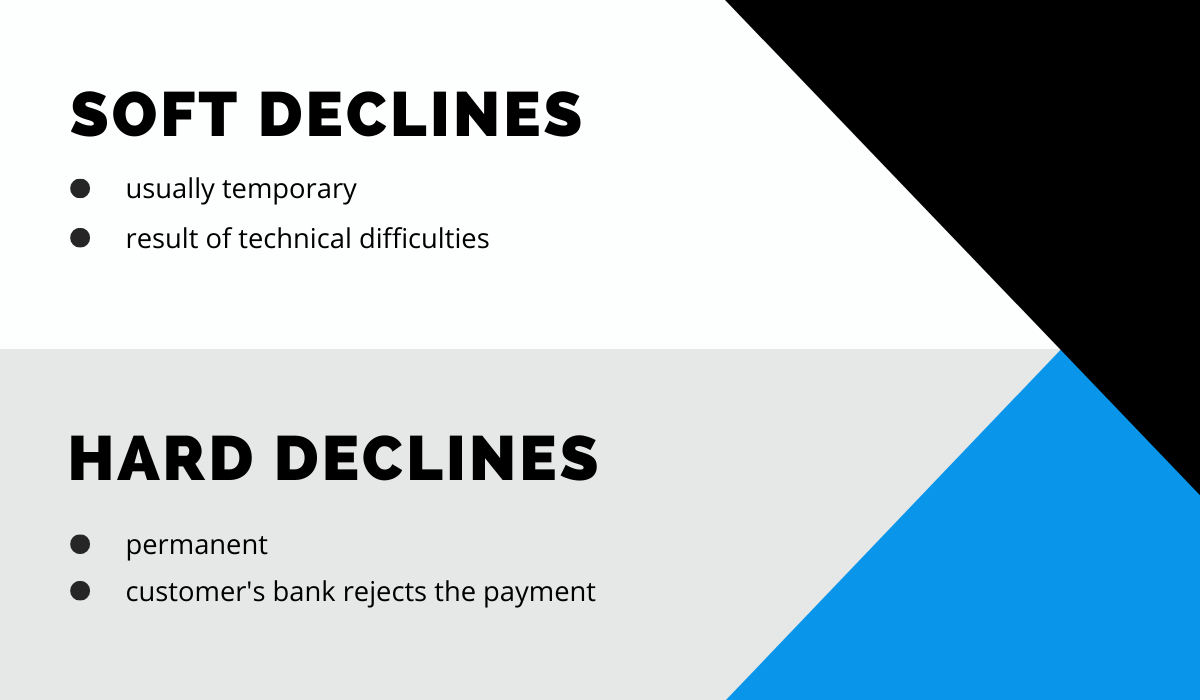

For example, most software offers automatic payment retries whenever a credit or debit card payment fails.

That means that the system will automatically charge the card on file a few more times at several different intervals.

Automatic retries are a great way to reduce soft decline card failures.

Source: Regpack

These are failures caused by temporary things like insufficient funds, surpassed card limits, or network errors.

Often, after a retry, the payment will go through because the buyer has added money into their checking account or fixed something on their end.

As for chargebacks, most tools help you create clear e-invoices and purchase descriptions that appear on a customer’s bank statement.

As a result, you’ll avoid many accidental chargebacks.

Further, these platforms help you keep accurate records of your sales and payment transactions, meaning you’ll be equipped with the evidence you need to win a chargeback dispute.

When the bank launches an investigation into the transaction, you’ll be able to show them records proving that you’re not the one at fault.

Online Payments Have Too Many Security Risks

A big concern for some people considering using online payments for their business is security.

They don’t want fraudsters getting a hold of their customers’ account numbers, credit card information, or anything else that can result in identity theft.

Although online payments do come with a few more security risks than cash transactions, the majority of these risks can be mitigated through the use of a PCI-compliant online payment processor, like Regpack.

When a company has this certification, it means they follow protocols and standards that protect data from hackers and other fraudsters during online transactions.

Source: Varonis

Requirements for this certification include maintenance of a firewall, updated antivirus software, and security methods like tokenization and encryption.

Trustworthy platforms also come with SSL certificates that protect data in transit from sites to servers.

If you’re concerned about a payment platform’s ability to protect your data and that of your customers, be sure to read their security page.

If they take this seriously, they’ll have one, like this payment security page from Regpack. It’ll tell you all that the company does to protect users.

When you work with a payment software that follows the standard protocols you’ll highly reduce your risk of security breaches, and your customers will feel comfortable buying from your site.

Conclusion

Some of the common myths that hold business owners back from offering online payments are exaggerated, and some are just plain incorrect.

Most of the potential risks that come to mind can be dramatically or entirely reduced with the help of a reputable online payment software.

The right tool will help you offer online payments to customers while maintaining high levels of security, low processing fees, and simple payment management.

And it’ll seriously reduce your team’s workload and empower you to meet the expectations of today’s customers.