There’s a right way and a wrong way to go about accepting online payments from the customers of your service-based businesses.

On the bad end of the spectrum, you have those businesses that think it’s okay to ask their buyers to send their credit card information to them through email.

For obvious security and convenience reasons, this is anything but a wise choice.

On the good end, you have businesses that allow customers to pay securely and easily through online payment forms embedded across their websites.

In this article, we’ll cover what the best practices are that will put you on the good end, as well as explain why they’re so critical to business performance, and how to institute them.

- Having Payment Forms on Your Website

- Making It Easy for Customers to Pay

- Automating Your Invoicing Operations

- Taking Appropriate Security Measures

- Conclusion

Having Payment Forms on Your Website

Businesses that have payment forms on their website can accept online payments directly from the various pages where customers do their shopping.

It’s incredibly convenient for customers, who can place purchases from their desktop or mobile device:

Source: PayLane

This seamless payment experience is much better than directing customers to a third-party website, which can throw up some red flags in the mind of the average buyer, who is often wary of giving their financial information to an unfamiliar site.

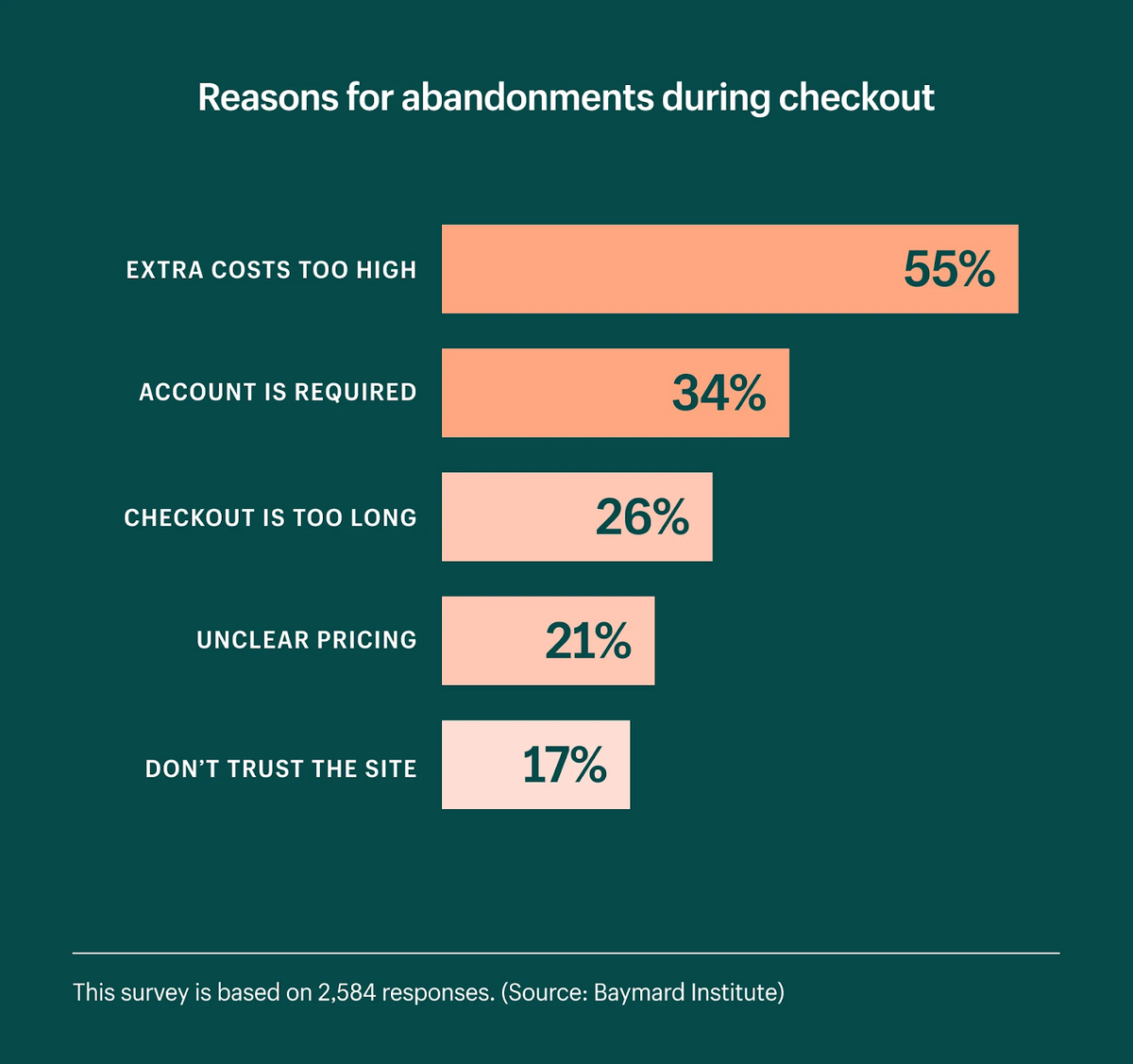

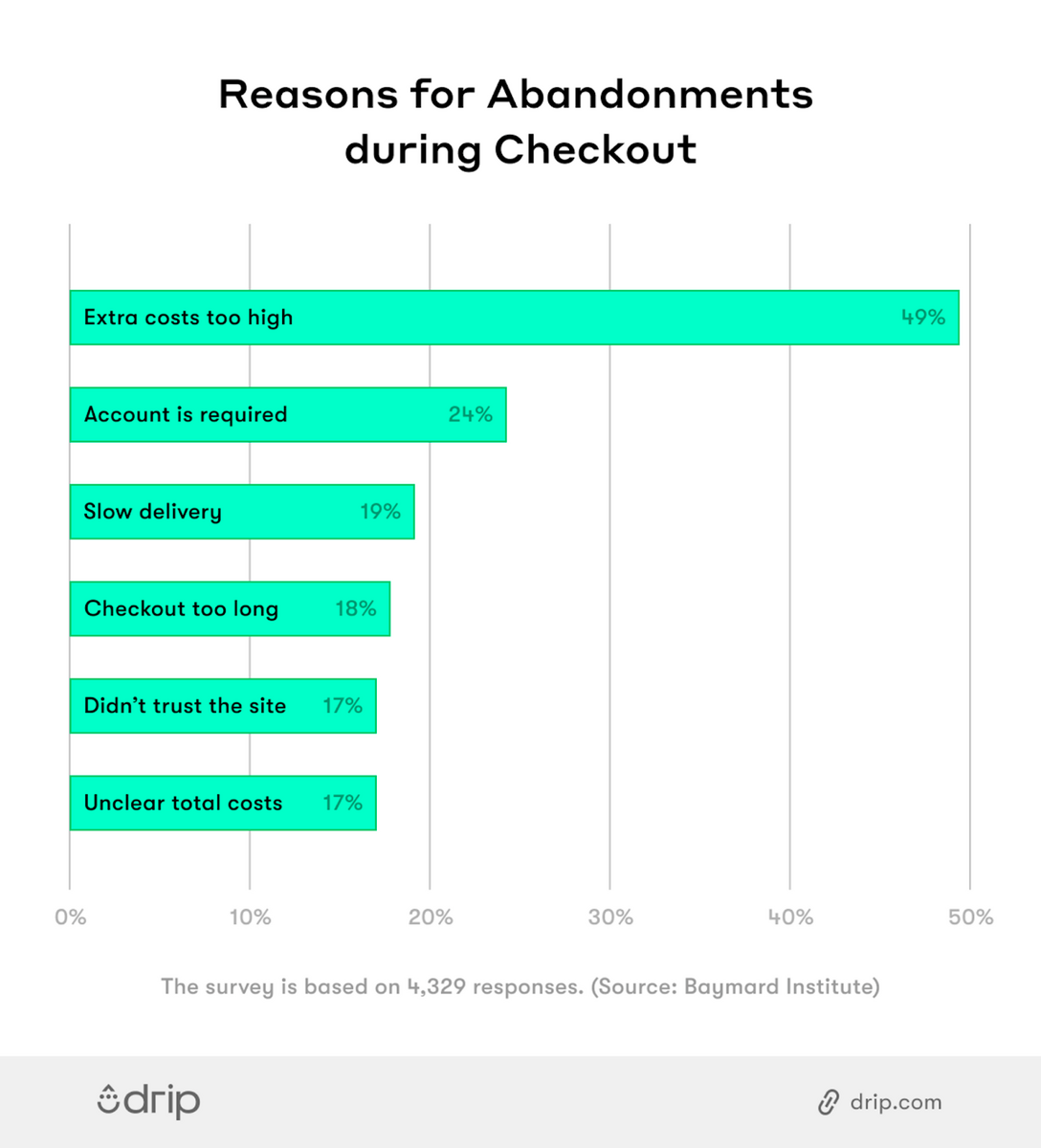

In fact, lack of trust regarding the security of a website is one of the top five reasons buyers abandon a cart while online shopping:

Source: Shopify

Notably, 26% of the respondents in the survey stated that their main reason for dropping out during checkout was that the checkout process was too long.

Fortunately, both of these common complaints—security concerns and frustration with duration—can be prevented by putting easy-to-use payment forms on your website.

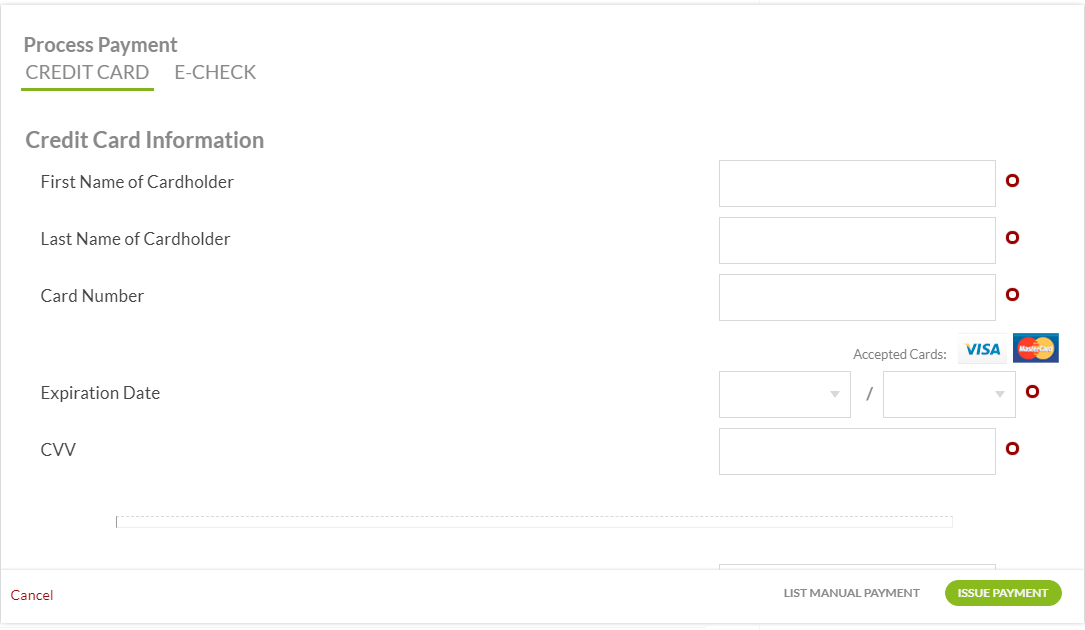

To do this, use an online payment software like Regpack, which will help you quickly create custom forms like the one below (no coding required):

Source: Regpack

Customers can quickly fill in the fields with their payment information, such as their name, card number, expiration date, and CVV.

They can also select from a menu of payment options. In the example above, they could switch to e-check if that’s their preferred method. Either way, placing a payment takes about a minute.

Additionally, since the forms are mobile-adaptive, customers will be able to shop from their phones. Janky, illegible forms that take up half of their screen won’t deter them from buying.

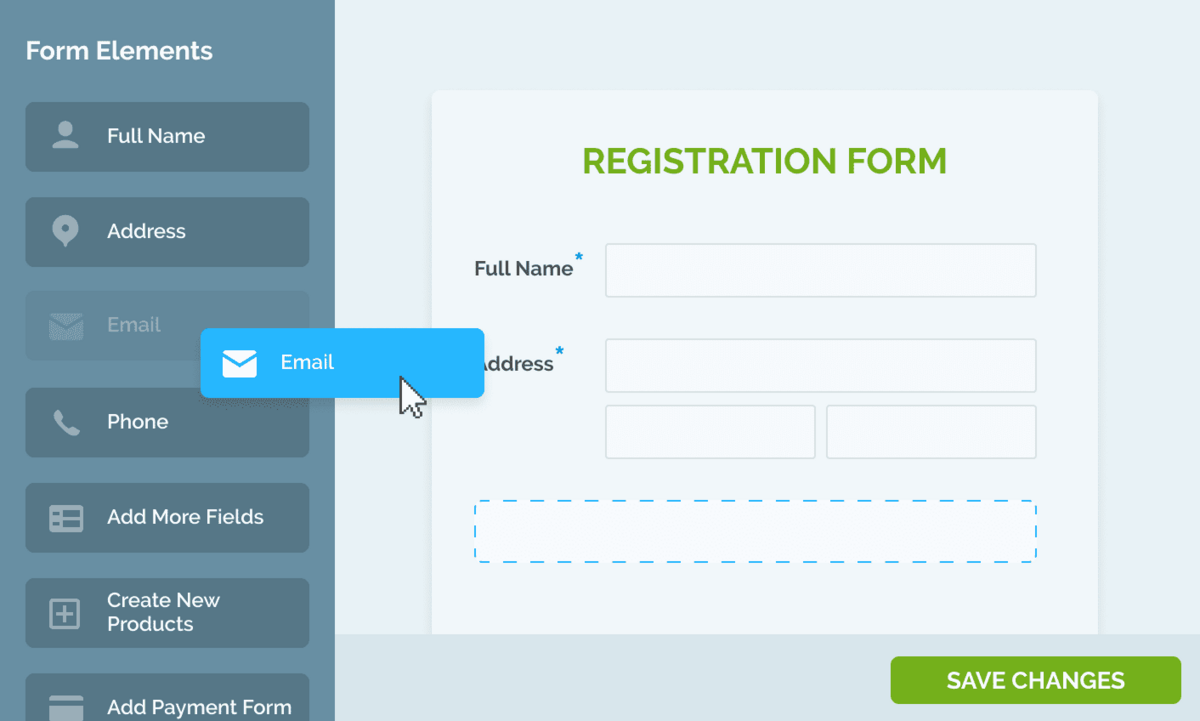

On your end, it’s easy to build these custom payment forms and embed them on your website, thanks to Regpack’s drag-and-drop form builder:

Source: Regpack

You can also create registration forms for events, camps, programs, and other situations that require customers to register.

This is an easy way to collect information, whether it’s food allergies or preferred seating, that will help you provide your attendees with an amazing experience.

Some other great features of these custom online payment forms include:

| Mandatory fields | Make certain fields necessary to fill out in order to submit the form. This way you will always collect the intel you need. |

| Conditional logic | Create adaptive, smart forms that reveal only the relevant fields to each customer. |

| Custom styles | Use custom styling to build aesthetically pleasing forms that are on brand and consistent with the rest of your website. |

| Data validation | This ensures that email addresses, card numbers, and dates are valid before the customer can submit the form. |

On top of all this, you’ll be able to use Regpack’s platform to analyze all this new payment information that you’re collecting from buyers.

Custom and pre-built reports will enable you to spot opportunities to improve your payment collection process as well as your form conversion rates.

Making It Easy for Customers to Pay

Some people only bring cash to a bar for two reasons, the first being to limit themselves to a specific cash amount.

The second reason, which matters for this article, is that using cash is psychologically more taxing than using a credit or debit card.

Actually watching those bills go from your hand to the cashier’s is painful. The customer feels like they’re losing money.

Therefore, when you offer online payments, which is likely even less psychologically painful than credit cards in-store since the transaction is happening in a virtual space, you’re taking advantage of a strong version of the cashless effect:

Source: Moneythor

To increase this effect, make sure that it’s also easy for your customers to make these online payments.

The shorter the payment process, the less they will ponder losing money, and the less likely they will be to walk away before submitting the payment.

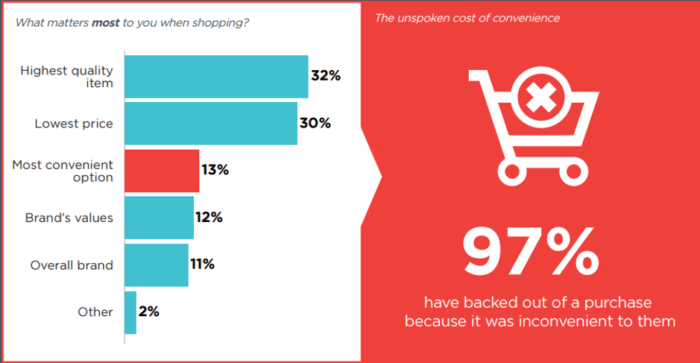

By making it easy for your customers to place payments online, you’ll also appeal to a wider demographic, especially those who value convenience more than anything else in their business relationships.

You’ll also avoid cart abandonment, which is common. Customers have a tendency to leave when the purchasing process proves frustrating.

In fact, according to research done by the National Retail Federation survey, 97% of buyers have backed out of a purchase because it was too inconvenient:

Source: Smart Insights

In sum, the main reasons to make online payments easy are to enhance brand perception, maximize conversions, and minimize cart abandonment.

As for how to streamline the online payment process, there are many things you can do:

| Accept multiple payment options. | Give customers the ability to pay using ACH bank transfer, PayPal, credit card, and debit cards. These being the most popular methods, most buyers will find a method that works well for them. |

| Support various languages. | Your online payment platform should allow buyers to see payment forms that are written in their language. |

| Allow multi-currency payments. | When customers can pay using their own currency, they don’t have to do any calculations. This can be tricky to manage on your own, so look for online payment platforms with a multi-currency feature. |

| Offer autopay and payment plans. | Give subscription customers the option to set up autopay and custom payment schedules that work with their financial situation. |

When you make payment easy for your customers, you’re signaling to them that your brand will be easy to work with going forwards.

And this promise of a happy future is just another reason for a potential buyer to click submit on the payment form.

Automating Your Invoicing Operations

By automating your invoicing operations, you’ll no longer have to manually create and send every individual invoice.

Using templates, data, and trigger-based automations, the online payment platform will do it for you whenever a customer makes a purchase online.

This will save your team a ton of time that they can spend on more impactful initiatives, such as instituting a plan to reduce late payments.

On that note, one of the leading causes of late payments is none other than mistakes on invoices:

Source: Regpack

With automated invoicing, you’ll erase human error and drastically reduce these inaccuracies, thereby ensuring you get your money on time.

You will no longer have to deal with accidentally mistyping the order’s total cost and then having to fix it before the customer can make the payment.

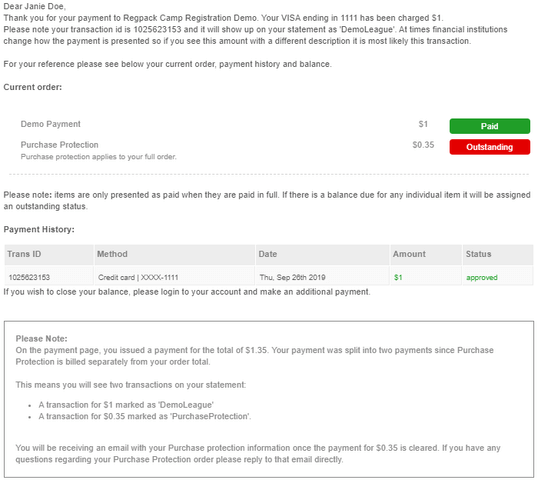

Businesses should automate their invoicing operations by configuring their chosen online payment software to automatically generate invoices and immediately send them directly to customers by email.

For example, here’s an automatically generated and sent email invoice:

Source: Regpack

Most software tools provide you with invoicing templates that you can edit to fit your needs.

You can make sure they contain fields for the information you need your customers to see on the invoice, from customer name to payment date.

These templates should be smart, meaning they’ll auto-populate with the customer’s data and order information that’s held in the platform’s database, all without your intervention.

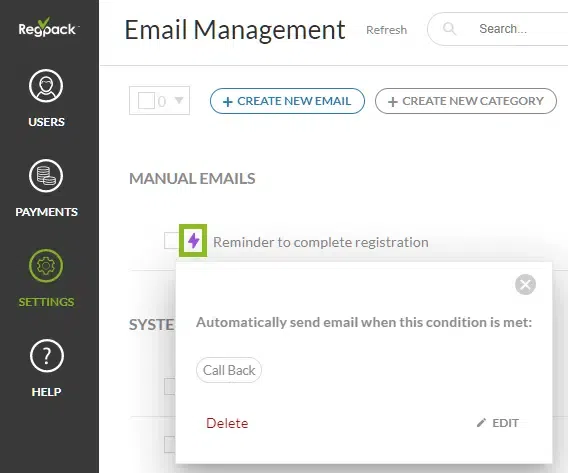

Your software should also allow you to choose the conditions under which an email invoice is sent to the customer.

Most tools will use some sort of event-based automation for this, that you select:

Source: Regpack

Usually, the condition will be “customer made a payment”.

However, if you use non-autopay recurring billing, you might configure the email invoices to go out 30 days prior to the payment deadline so customers can log into their user portal and make the payment.

Keep in mind that automated doesn’t always have to mean impersonal.

When configuring automated invoicing, you should use the emails to thank the customer for making a purchase.

At the top of the invoice email, write a few sentences telling the customer how grateful you are to have them as a customer.

And include a field for “client name” so that it feels personalized. Customers will appreciate this simple gesture.

Also, don’t forget to use the reporting functionality of your online payment platform to track outstanding invoices and identify customers who regularly pay late.

Overall, tracking online payments and generating invoices for each one is a tedious and time-consuming process.

It’s, therefore, best to find an online payment tool that allows you to automate it so that you can spend your energy elsewhere.

Taking Appropriate Security Measures

When implementing online payments, it’s crucial that your business takes appropriate security measures.

You don’t want a breach of sensitive financial information on your hands. That’s a great way to lose customers and tarnish your brand’s reputation.

In fact, according to research by Varonis, 65% of customers who experience a data breach lose faith in that company, and 80% will stop buying from that organization if their information was compromised in the breach.

Not to mention, a high percentage of these customers will spread the word to their friends and colleagues.

Check out some other negative effects of data breaches below:

Source: Varonis

If you take payment security seriously, you’ll reduce the vulnerabilities that bad actors and identity thieves are looking to exploit.

When you take proper security measures, you also improve the credibility of your brand, and customers will be more likely to go through with the purchase.

Companies that fail to highlight their security measures to customers might lose people at checkout.

Another common reason for cart abandonment happens to be a lack of trust in the website:

Source: Drip

In order to ensure your online payments will be transacted securely, you need to really investigate your chosen online payment software’s security technologies and practices.

Below are a couple of security features to look for in a payment processor:

| PCI-compliance | This means the software is following the security protocols laid out by the Security Standards Council. Examples include using a firewall and cybersecurity software. |

| Data encryption | This feature makes it impossible for people to access credit card information without the correct encryption key. This drastically reduces the chances of a data breach. |

| Secure Sockets Layer (SSL) | This measure protects data submitted into the tool’s payment gateway. The connection between the server and the browser is encrypted. A solid tool will apply SSL throughout the entire payment or registration process. |

| 2-Factor authentication | Upon purchase, this feature prompts customers to plug in a code that was sent to their email or phone number, thereby ensuring it’s them and not a thief using their credit card. |

If you find a tool that’s strict when it comes to keeping data secure, you’re going to protect yourself from potential risks of data breach and identity theft. You’ll also sleep a whole lot better.

Plus, customers are going to be less hesitant to make transactions with your brand online, leading to increased conversion rates.

If you want to hear about some other big issues to avoid, check out these 6 common mistakes businesses make when setting up online payments.

Conclusion

To get the promises of online payments—the increased sales, efficiency, and customer retention—you need to do it correctly.

That means using online payment forms, making the process convenient for customers, automating invoicing, and using online payment software that prioritizes security.

If this sounds manageable and you want to learn more about how online payments can help your business, check out our article covering the 5 reasons to accept online payments from customers.