Recurring billing software has become one of the critical tools companies use to manage their finances. The main benefit of this tech solution is that it allows you to automate your billing processes, manage payment plans and subscriptions, and avoid errors.

If your business is scaling, your company’s operational needs are probably growing, too.

Meanwhile, specialized software is moving forward and constantly improving to meet the needs of the ever-changing business environment.

Chances are that the billing software you’re currently using is outdated and no longer serving your needs, which can substantially impact your company’s operations, bottom line, and customer satisfaction.

But how would you know if your billing software was inadequate and no longer doing the job?

This article reveals several signs that will help you determine if it’s time to look for a better billing system.

Your Software Doesn’t Accept Multiple Payment Options

In this day and age, businesses increasingly rely on technology as customers often prefer to pay with cards or digital payment methods.

On top of that, different generations favor different forms of payment.

For instance, Gen Z and Millennials are heavily inclined toward non-traditional payments. They are more willing to explore tech-enabled payment methods—like in-app purchasing, mobile wallets, and mobile payments.

At the same time, Gen X purchasers prefer to use debit or credit cards.

Considering that younger consumers are dictating the future of payments, accepting credit cards is the minimum requirement.

Furthermore, as recent research revealed, nearly one-third of consumers would rather skip signing up for a service if it didn’t include their payment method of choice.

All of this suggests that if your billing system does not accept various payment options, you risk turning customers away, potentially hindering your revenue growth.

So, it’s time to consider switching to recurring billing software that would offer your customers multiple payment options and make the purchase experience more convenient.

In addition, you need to ensure your billing system can accommodate global payments in any currency, allowing prospective customers worldwide to complete their purchases seamlessly.

Only recently, providing customers an option to pay in foreign currencies was virtually impossible. But, an integrated payment system allows your clients to pay in any currency they wish without the hassle of multiple bank accounts across the globe.

In summary, payment flexibility is a core element of modern-day business operations.

By including multiple payment options and currencies in your recurring billing system, you will position yourself as a forward-thinking company that cares about its customers.

As a result, your brand’s profile will rise, and so will your sales.

You Have Very Little Control Over the Payment Plans

In today’s fast-paced business landscape, adaptability is key to staying ahead of the competition.

One crucial aspect in this regard is the ability to tailor your billing processes to meet the evolving needs of your business and customers.

If your current recurring billing software offers limited control over payment plans, it might be time to turn to a more flexible solution.

The limitations of inflexible billing software can be stifling for any business. Imagine being unable to adjust billing plans to accommodate new offerings, modify existing plans, or change billing amounts and schedules.

This lack of control can impede your business’s growth and responsiveness to market changes.

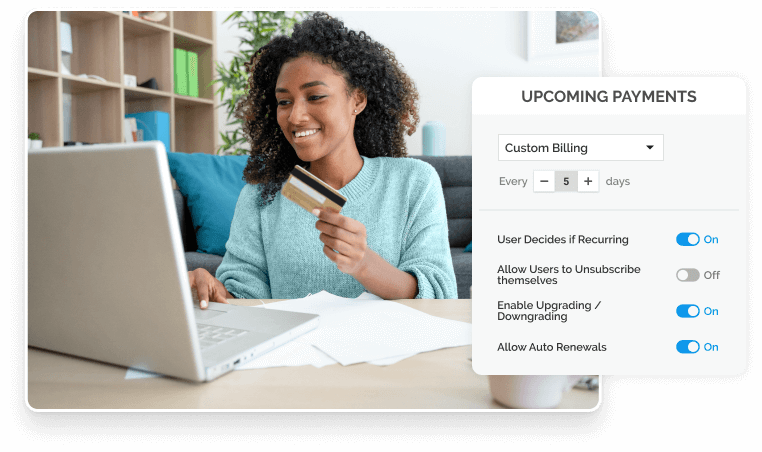

The automated billing software developed by Regpack offers a refreshing solution. It empowers businesses to customize their recurring billing plans, billing amounts, and billing schedules according to their specific needs and those of their valued customers.

With this software solution, you would have the freedom to create a wide range of billing plans, choosing from multiple available options or crafting entirely custom plans that align with their unique offerings.

What’s even more notable is the ability to revisit and edit billing plans whenever necessary, ensuring that your billing strategies stay in sync with your evolving business model.

However, it’s not advisable to alter your billing plans after your customers have already started making payments.

Furthermore, the automated billing software also simplifies the customer experience by allowing them to subscribe to multiple plans simultaneously.

This versatility ensures that customers can pay for different products on different timelines.

Moreover, Regpack introduces flexibility at the customer level. You can extend due dates for specific customers, accommodating individual circumstances, and providing a more personalized experience.

Additionally, customers can pause their plans when necessary, ensuring that their financial commitments align with their changing situations.

In conclusion, your business deserves a recurring billing software that adapts to your specific needs, offers flexibility and enhances the customer experience by allowing for individualized billing adjustments.

You Can’t Keep Track of All the Payment Schedules

Managing recurring payments efficiently can be a daunting task.

When your recurring billing software fails to keep pace with the complexities of varied payment schedules, it’s a clear signal that it’s time to upgrade to a more sophisticated solution.

This transition becomes even more critical when your business grapples with manually tracking and managing diverse payment frequencies, including yearly, monthly, weekly, and custom schedules.

As you may have already experienced, the manual process is rife with potential pitfalls, including errors, missed payments, and, inevitably, disgruntled customers.

That being said, efficient recurring billing software not only saves time but also ensures accuracy and precision and elevates customer satisfaction.

Within the realm of effective billing systems, several critical features demand attention.

One is the ability to filter billing plans, allowing businesses to accurately segment and target their customer base.

Additionally, the option to view a list of users on specific billing plans will help your business foster a stronger connection, ensuring alignment with your clients’ preferences.

Another crucial aspect is the ability to view upcoming recurring payments. This will give you complete visibility into your company’s revenue streams, helping with financial forecasting and budgeting.

Furthermore, the option to promptly identify customers with overdue recurring payments plays a pivotal role in maintaining a robust cash flow while reducing payment delinquencies.

Overall, managing different payment schedules and billing cycles efficiently is imperative for businesses of all sizes.

While your business adapts to the evolving financial requirements and obstacles, investing in a robust recurring billing system becomes a strategic imperative for sustainable growth and financial stability.

You Aren’t Able to Reliably Collect Recurring Payments

The software you choose to manage your recurring payments is key in ensuring a continuous and reliable revenue collection process.

If a recurring billing software fails to fulfill its primary purpose of collecting payments reliably, several issues can arise, including billing errors, revenue leakage, and customer dissatisfaction.

A substantial number of businesses have encountered frequent billing errors that not only impact a company’s bottom line but also erode customer trust and satisfaction.

In fact, customer dissatisfaction stemming from billing issues is a major driver of churn, leading to further revenue losses.

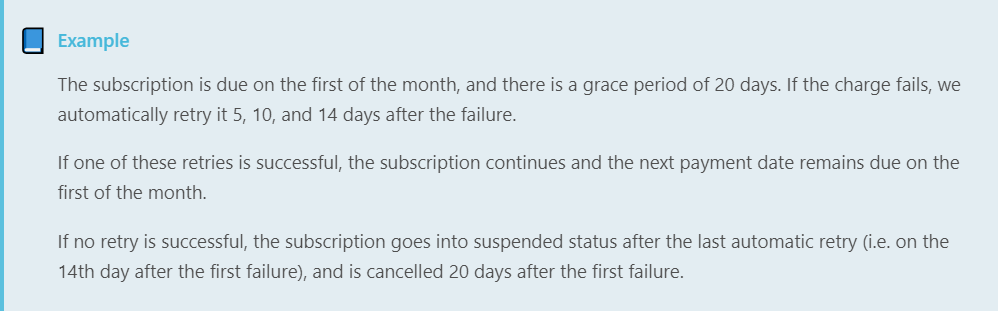

One critical aspect of dependable recurring billing software is its ability to manage payment collection issues, particularly failed payments.

An effective system should automatically retry failed payments, minimizing disruptions and ensuring a steady revenue stream.

The CEO of sticky.io, Brian Bogosian, detailed why failed payments can affect more than the company’s short-term bottom line:

Failed payments are not only a revenue problem but also a branding problem. Customer experience is at the core of brand loyalty. Imagine suddenly getting disconnected from YouTube Live because of a single, accidental failed payment and being unable to watch NBA star Stephen Curry make his famous three-pointer in real time. Customers who want hassle-free subscriptions don’t want to think about payments, especially failed ones that cause disconnection and headaches.

For CFOs and finance professionals, accurate revenue collection is of vital importance. Revenue leakage and billing errors can cast doubt on the accuracy of financial collections, which is a significant concern.

A robust recurring billing system can resolve this issue without the need to manually sift through spreadsheets to identify the source of revenue discrepancies.

Let’s be honest, the last thing customers want is a confusing invoice that leaves them scratching their heads or feeling overcharged. Invoices serve as essential touchpoints with customers, making it imperative to get them right.

A capable recurring billing system allows businesses to customize invoices to meet the unique needs of their customers.

However, frequent billing errors and issues serve as clear indicators that change is needed.

Reliability and accuracy are non-negotiable traits for billing software, and if your current solution falls short, it’s time to consider an upgrade.

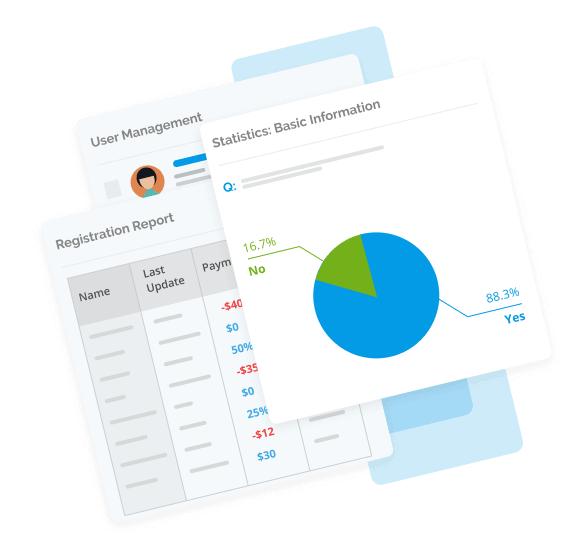

You Find It Very Difficult to Create Payment Reports

In the rapidly changing business environment, relying on data to make informed decisions is essential for achieving long-term success.

If the recurring billing software you currently use fails to simplify the process of generating detailed payment reports, your finance department will face an undue burden.

Manual report generation or struggling with software ill-suited for the task, often results in reports riddled with errors. This situation is far from ideal and can lead to costly financial outcomes.

One key aspect that modern billing systems address effectively is the ability to produce comprehensive recurring billing reports.

These reports offer invaluable insights into various aspects of your business’s financial health, which can help you understand the long-term customer relationship and revenue potential.

Furthermore, businesses can gain clarity on the annual recurring revenue generated by customers within a year, which is essential for financial planning and forecasting.

Armed with this data, finance teams can make informed decisions about resource allocation and growth strategies.

Your Billing Software Can’t Keep Up With Your Needs

A telltale sign of success is the ability to scale your operations seamlessly.

When your recurring billing software falls short in this regard, hindering growth and relying on cumbersome manual processes, it’s a clear indication that a change is in order.

Scalability is a critical factor as your business expands its horizons. The right automated billing system alleviates the burden of manual labor and the constraints of traditional processes, ensuring that growth remains unhindered.

With automation, you can achieve better and faster results without the need to significantly expand your finance department.

Moreover, it’s essential to keep your software up-to-date to align with the pace of technological advancements and security measures. Outdated software can pose a considerable obstacle to your business’s growth.

Without regular updates and maintenance, it may not seamlessly integrate with newer technologies or adhere to robust security standards.

This can lead to system downtime, data breaches, and other issues that have the potential to disrupt your business operations.

To bypass these drawbacks and maintain the smooth flow of your billing processes, upgrading to newer software is a prudent move.

It ensures that your systems remain compatible with the latest advancements, safeguarding your business against unnecessary setbacks.

By embracing automated billing systems and flexible payment solutions, you empower your business to evolve seamlessly and navigate the ever-changing landscape of modern business.

Conclusion

If you are experiencing any of the issues mentioned in this article, it might be time to consider gearing up with enhanced recurring billing software.

With a better automated payment system in place, you can save time and money, reduce human error, and unlock your business’s untapped potential.

By assuming control of your recurring billing processes, you can ensure that you’re getting the most out of this vital part of your business operations.