If you’re selling services online and charging your clients regularly, you know they expect a seamless signup and payment process. They likely want multiple options and easy automation of their payments, all done through a secure payment portal.

To provide such a user experience, you’ll need to automate and streamline these processes with the help of a recurring billing payment gateway.

So, here are eight features to look for when choosing a platform that will best fit your business needs.

Merchant Account Setup

Before venturing into merchant accounts, let’s make one important and often overlooked distinction.

A payment gateway is a third-party service that allows your business (the merchant) to accept electronic payments such as credit cards, debit cards, digital wallets, and other payment methods.

However, to fully automate recurring payment and billing processes related to your customers, you’ll typically need a more comprehensive software solution. Preferably, one that can integrate with one or more payment gateways, i.e., a full payment platform.

Such all-in-one solutions include collaboration and integration with payment gateway providers but offer much more in terms of streamlining payment processes. as illustrated below.

In essence, such a platform acts as a bridge between the user signup/registration and the payment process hosted on your website and the payment gateway. It facilitates the exchange of payment data while keeping it secure and compliant.

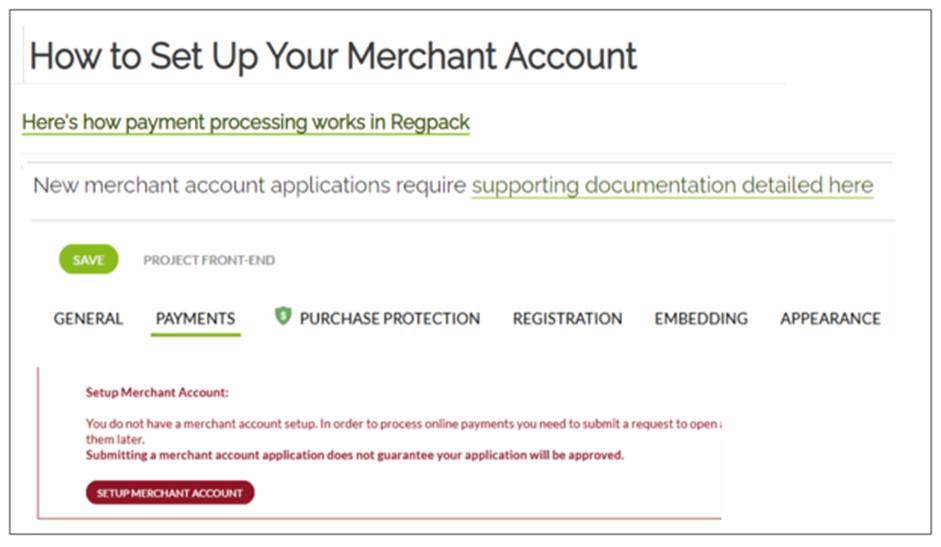

That distinction made, one of the key features a payment gateway or a full payment platform should provide is the ability to set up a merchant account.

Simply put, merchant accounts serve as temporary placeholders for the funds your customers paid to you via a specific payment service provider (e.g., a credit card company).

In such cases, funds are held in your merchant account until the card issuer approves and processes the transaction, and the funds are transferred to your business’s bank account.

When setting up a merchant account through your payment processing software, you get the advantage of streamlined account setup and your provider’s specialized user support.

However, the process will still require supporting documentation.

Although there are payment processors that do not require a merchant account for processing electronic payments, such solutions usually involve higher processing fees.

In addition, some will give you little or no chance to dispute a card chargeback.

Overall, your payment gateway or platform should facilitate the merchant account setup process, allowing your business to accept online payments with lower transaction fees and less administrative hassle.

Gateway Integration Options

Since the goal is to provide your customers with a seamless online shopping experience, you should look for software solutions that integrate the payment gateway with other payment-related processes.

In comparison, if using a hosted (non-integrated) payment gateway, your staff is forced to manage two systems in parallel, increasing the chance of human errors and reducing efficiency.

When your billing processes are directly linked to the payment gateway, this integration allows for additional automation, which saves your administrative staff a lot of time otherwise spent on reconciling records.

The same applies to other software solutions your business uses, such as accounting and customer relationship management (CRM).

In any case, your payment gateway should provide multiple integration options that enable data exchange between various business applications.

For instance, most such integrations are enabled by open application programming interfaces (APIs) that allow real-time data synchronization between two systems based on mutual automated data requests.

Then, there are webhooks that enable one software to automatically notify the other when something happens, such as a customer’s credit card expiring.

Overall, to get a single recurring billing payment gateway solution and provide a smooth user experience, you should opt for a comprehensive platform that integrates the payment gateway with other software-based billing processes.

Recurring Billing Customization

When customers make payments for your services at regular intervals, you want your payment gateway or all-in-one platform to enable the customization of all recurring billing parameters according to your and your customers’ needs.

In other words, while your payment gateway will ensure funds securely end up in your business’s bank account, you still need to set up your offer, tailor the pricing plans and billing schedules, automate invoicing, etc.

For this purpose, you should look for recurring billing software (integrated with the gateway or as part of the same package).

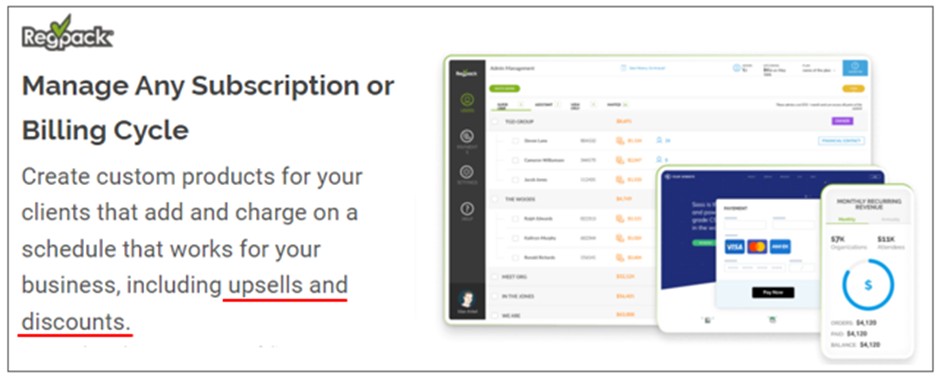

For instance, our automated billing software, Regpack, allows businesses to automate the entire payment process by creating custom billing workflows.

Regpack is a complete payment platform. As such, it streamlines all payment-related processes, from initial offer settings, payment options, and invoice creation to secure processing and collection of electronic payments (using an integrated payment gateway).

When businesses utilize automated billing software functions, they see major improvements, such as up to 75% fewer non-payments, 35% more timely payments, and 25% higher cash flow.

In essence, the software allows you to set different billing parameters (pricing plans, invoice amounts, billing schedules, etc.) to suit your business needs and use the system to automatically charge your customers.

For example, you can set the initial price of the service or product and then apply special discounts or offer coupons, and automated billing will calculate and charge the exact billing amount.

Likewise, you can offer your clients several payment plans and schedules to choose from.

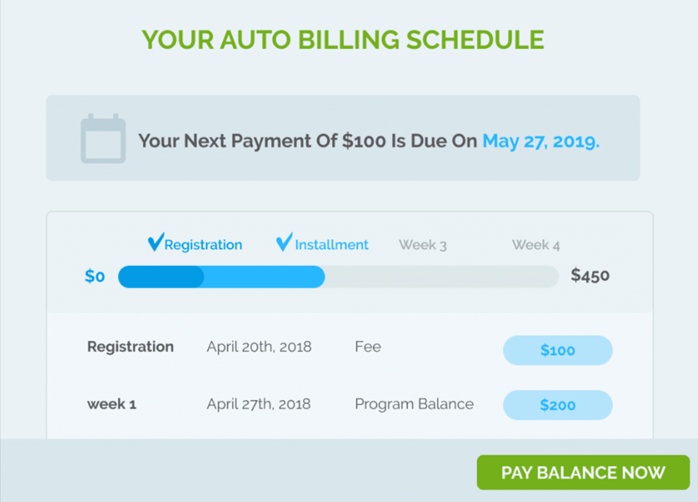

Once they opt for a payment plan (e.g., installments), the automated billing system will create a user-specific payment portal. Clients can then use that portal to track payment dates, make secure online payments, and update their info (e.g., add a new credit card number).

Long story short, this feature of your payment gateway/platform enables you to offer different pricing models and schedules and provides your customers with flexible payment options and a secure portal to manage recurring payments.

On the management side, you can set auto-bill plans where the billing system will automatically charge your customers in line with how you customize the recurring billing parameters.

Multiple Payment Methods

Nowadays, offering multiple online payment methods to your customers is a must, and your payment gateway should support a variety of payment cards and methods, allowing you to provide your clients with the ultimate payment convenience they’ve come to expect.

Naturally, the primary goal is to prevent customers from leaving because their favorite payment method is not available (which 42% of US consumers will do, according to research).

Of course, this doesn’t mean you should use all the possible payment methods.

Instead, make sure that your payment platform supports all those methods (credit cards, debit cards, digital wallets) preferred by your target customers and can easily accommodate any future changes.

To recap, your payment gateway/platform should allow you to offer multiple convenient payment methods to your customers, helping you prevent shopping cart abandonments, improving customer conversion rates, and increasing cash flow.

Concurrently, your payment solution should make it easy to add or remove offered payment methods as your needs, market trends, and customer preferences change over time.

Multi-Currency Support

In the same vein as securing various payment options, you want to ensure your payment gateway supports payments in multiple currencies.

Of course, this feature is essential if your business sells products or services internationally.

However, even if you sell only in North America, you might still have clients or partners from, say, Canada, who prefer to pay in their local currency.

Thus, whether your sales are global, regional, or local, you should ensure your payment platform supports payments in multiple currencies.

More specifically, the payment processing component of your software allows customers to pay in their preferred currency while your business gets paid in your preferred currency.

On one side, this increases customer convenience and provides a localized user experience.

On the other, this feature enables you to receive payments without dealing with multi-currency processing issues like unfavorable conversion rates, hidden fees, and lengthy procedures.

Instead, all fees should be transparently communicated, and your software provider’s support team should help you resolve any payment issues.

To sum up, multi-currency support is one of the recurring billing payment gateway features to look for, enabling your customers to pay in any currency they want and allowing your business to operate in a global or cross-border context.

Automated Account Updater

This simple feature can save you time and money by automatically updating your customers’ credit or debit card information when they change.

Whether their card expires, is lost, or stolen, your client’s payment info will change over time and, when not timely updated, lead to failed payment attempts.

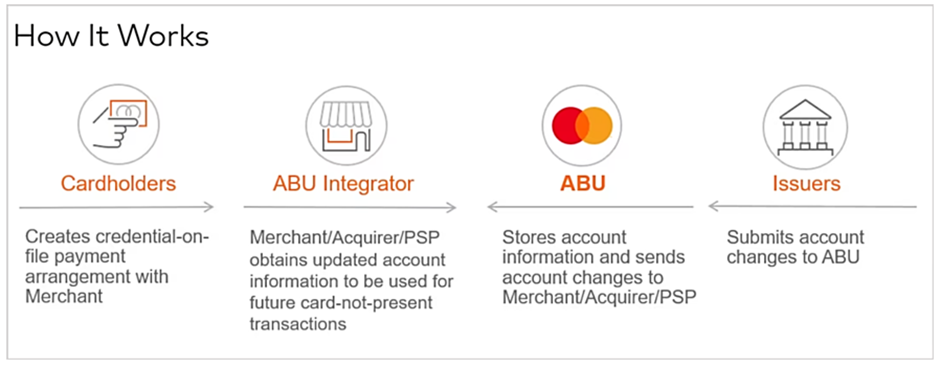

To address this issue, major credit and debit card companies have launched account updaters that automatically update their databases when client card info changes.

For instance, here’s how MasterCard’s automatic billing updater (ABU) works.

In a nutshell, your customer agrees to be charged by your business with no card present (recurring billing), and your payment gateway/platform enables you to integrate your client database with ABU, ensuring your billing data is automatically updated.

This can help you reduce the number of failed and late payments, prevent service disruption due to unintentional non-payment, and maximize user convenience.

Therefore, when looking for the right recurring payment solution, ensure the payment gateway includes automated account updater options.

Automated Payment Retries

Automated payment retries are another helpful feature of your payment gateway.

Simply put, when the system initiates a scheduled card charge, and that request is declined, the payment gateway should recognize the type of charge decline (soft or hard) and automatically retry the charge after a certain period for soft declines.

Since these are typically temporary and technical in nature, this feature allows you to address failed payment attempts before moving to dunning management, i.e., the process of chasing down late payments.

Moreover, using software-based triggers, your recurring billing software can be instructed to automatically send email notifications of failed payments, informing clients they might need to update their card details.

Naturally, the payment gateway should enable you to set the number of retries and days between them as you see fit.

For instance, the system can be configured to retry a failed charge after 5, 10, and 14 days.

If the payment is collected in one of those retries, case solved.

If not, the user will be notified that their payment failed and that their account (and any services) will be suspended pending payment.

All things considered, automated payment retries are another helpful feature that automates the collection of recurring payments, adds user convenience and simplifies late payment management.

Payment Reporting and Analytics

The integrated nature of your payment gateway and billing software allows you to get much more than seamless payment collection and billing processes. Namely, valuable insights into your customers’ behavior and your business’s cash flow.

In other words, your platform’s payment reporting and analytics features should enable your staff to monitor payments in real time, filter and analyze payment data, and create tailor-made payment and sales reports.

The ability to have a bird-eye view of past and upcoming payments and filter customer and payment data according to different criteria gives rise to valuable insights into your customers’ preferences and your company’s cash flow.

This enables you to make better-informed, data-based decisions about your business’s current state and future direction, making payment reporting and analytics a must-have feature of your integrated payment gateway/recurring billing solution.

Conclusion

In summary, these eight features of your integrated recurring billing and payment gateway solution will provide all the elements necessary for providing your customers with a seamless payment experience.

At the same time, the various automated functions we discussed will increase your staff’s productivity, save time, and minimize errors.

Ultimately, the right payment gateway/recurring billing platform will help your business control and improve workflows, attract more customers, and increase cash flow.