Nowadays, accepting online payments and providing customers with a seamless and secure payment experience is paramount for the success of any business, whether it sells goods or services.

Naturally, this includes understanding and managing the underlying mechanisms from when your customers click on the Buy Now button until their money is in your business account, i.e., processing of online payments.

In this guide, we’ll walk you through the fundamentals of online payment processing, so you can make better-informed decisions about payment-related financial and operational aspects of your business.

- How Does Online Payment Processing Work

- Which Online Payment Methods Should You Accept

- How Much Does Online Payment Processing Cost

- How to Start Processing Payments on Your Website

- Conclusion

How Does Online Payment Processing Work

Secure and seamless payment processing—the backbone of any business selling their products or services online—involves a series of largely automated steps and the collaboration of key players that ensure your business gets paid.

The two fundamental stakeholders in any payment process are the payor (your customer) and the payee (your business).

Upon deciding to purchase your product or service for the first time, the customer will typically fill out a registration/payment information form on your website and click the Pay Now or a similar checkout button, thus becoming a payor.

Source: Creative Fabrica

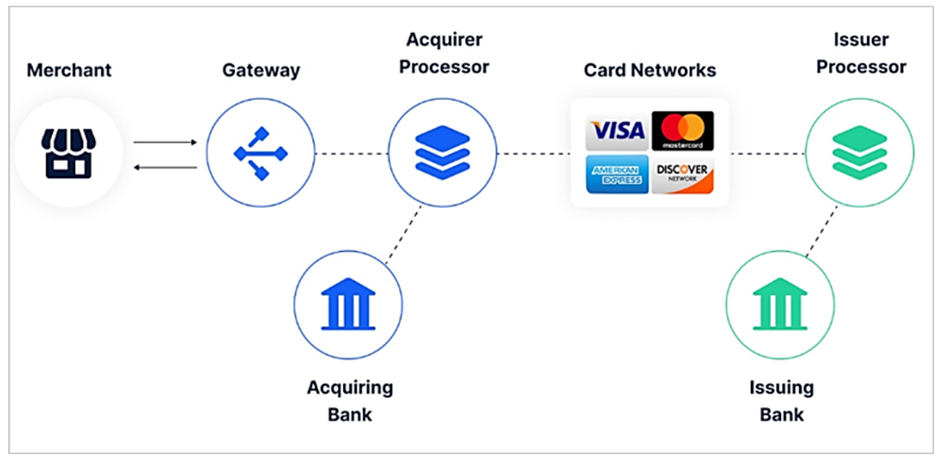

This click—like swiping a credit or debit card at the register—will initiate a payment processing procedure involving other key players, such as acquiring and issuing banks, payment processors, and payment gateways.

These entities aim to securely and quickly process payments to your business, ensuring that the funds—minus processing fees—appear in your company’s bank account.

Which intermediaries will be engaged in processing your customers’ payments, and their role, depends on which online payment method (out of those your business chooses to offer) your customer selected.

That’s why we’ll explore how the three primary methods of online payment processing work: card payments, digital wallet payments, and account-to-account payments.

Processing Card Payments

Using credit or debit cards for online payments is a popular payment method for many customers, but its processing involves multiple entities.

When the customer clicks the Buy button and enters their credit/debit card information, the data is securely transmitted to the payment gateway.

The payment gateway, which can include providers like Stripe, PayPal (also a digital wallet), Authorize.Net, and Square, acts as the intermediary between your business’s website and your acquiring bank.

Source: Very Good Security

The acquiring bank (or its appointed payment processor) then communicates with the card network (such as Visa or Mastercard) to request verification of the card details and check the available funds (for debit cards) or credit limit (for credit cards).

The card issuer (the customer’s issuing bank) plays a role in validating and authorizing the transaction, i.e., it approves or declines the transaction and sends the response back through the same chain to the payment gateway.

The funds from the transaction are then deposited into your merchant account.

Source: Investopedia

In simple terms, a merchant account is a pass-through account used for electronic online payments where the acquiring bank places the funds your customer pays and holds them typically for one to three business days for security and processing purposes.

After that period, your customers’ card payments are transferred to your company’s bank account.

Processing Digital Wallet Payments

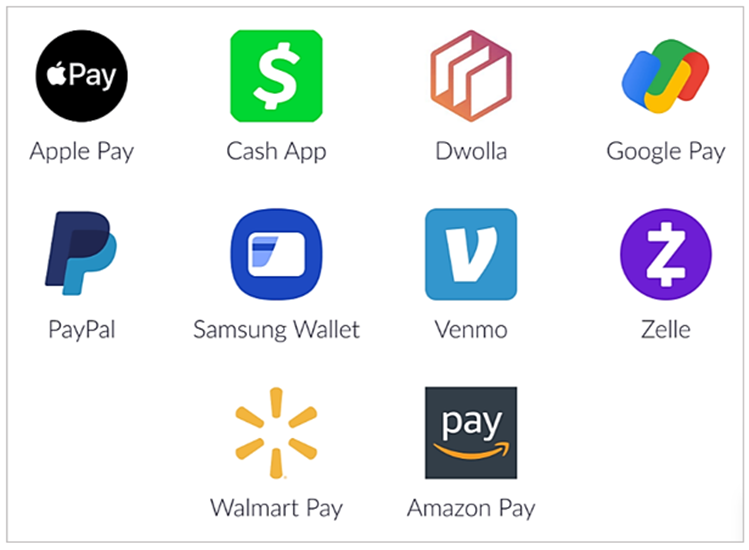

Digital wallets, such as PayPal, Apple Pay, or Google Pay, were primarily created as a convenient way for users to store and manage payment methods for online transactions.

In other words, your “digital wallet” customers can use one or more of these mobile apps to securely store their debit/credit card info and use it when paying online (or offline).

Source: Geniusee

Using a digital wallet eliminates the need to carry physical cards for offline shopping and/or enter payment information separately for each online transaction.

Instead, the data is conveniently available in the app on your smartphone.

In addition to storing card information and turning your phone into a wallet, these mobile apps typically offer a range of other payment options.

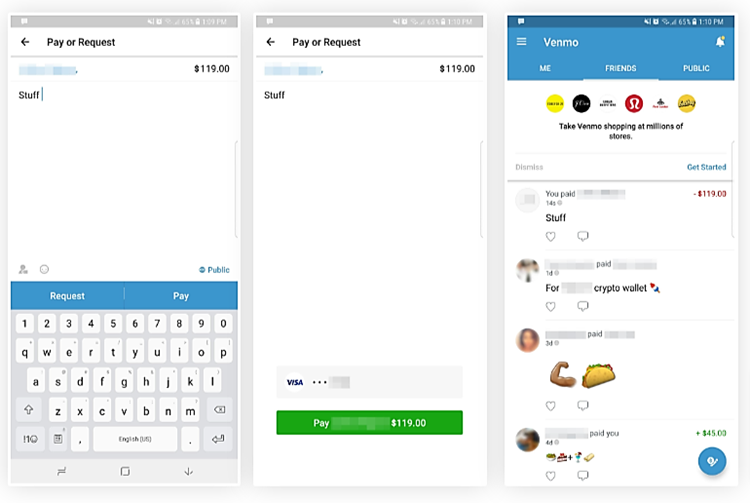

These can include using gift cards, making in-app purchases (primarily for virtual goods like games, subscriptions, or digital content), and even facilitating peer-to-peer payments between users of the same digital wallet, like this example in Venmo.

Source: Gadget Hacks

Naturally, making an in-app payment or sending money to a friend will be processed somewhat differently than, for example, using PayPal to securely pay with your credit card.

In other words, when a customer opts to use a credit card stored in their digital wallet for an online purchase, the transaction will follow the typical card payment processing flow we explained above.

In other cases, the payment processing procedure and the involved entities will depend on the type of transaction being made, typically with fewer intermediaries involved when a transaction is done within the same digital wallet.

Processing Account-To-Account Payments

Account-to-account (A2A) payments, also known as wire/bank payments, direct account payments, and direct debit, refer to direct money transfers from one account to another.

As such, these payments are typically processed by the smallest number of intermediaries, namely:

- the sender’s bank, which fulfills the payment request your customer (payor) initiated

- the receiver’s bank, which receives the payment and deposits it into your business’s bank account (payee)

- automated clearing house (ACH), which often acts as an intermediary that facilitates the settlement and clearing of funds between banks

You can find out more about the ACH network on Investopedia.

Source: Investopedia

Generally, there are two types of account-to-account payments.

First, push A2A payments refer to payers manually sending money from their bank account to the recipient’s account.

These push payments are mainly used for one-off payments.

Then there are pull A2A payments, which refer to money being automatically withdrawn from the customer’s account on a regular basis and, naturally, with their explicit consent.

These pull payments are widely used for paying monthly subscriptions, utility bills, and other recurring payments and spreading payments over multiple installments.

However, both push and pull payments are processed similarly with the key players we described above.

Which Online Payment Methods Should You Accept

When deciding which online payment methods your business should accept, you should consider your target audience, the nature of your business, and the associated costs and benefits.

Naturally, offering a variety of payment options can enhance customer satisfaction and increase conversion rates.

We already described how the three most widely used methods work, and now we’ll explore how each can affect your business’s bottom line.

Card Payments

Card payments, including credit and debit cards, remain the most popular and widely accepted method for online transactions, so they should definitely be among your accepted payment methods.

Simply put, accepting card payments allows customers to conveniently use their existing payment cards, providing long-established familiarity and ease of use.

However, on the business side, card payments typically involve higher transaction fees due to more intermediaries (discussed later), higher rates of chargebacks, and higher risk of fraud, all of which can impact your business’s profitability.

Source: Shopify

Therefore, although your business should accept card payments due to their popularity, it should also be aware of the associated costs and potential downsides.

Digital Wallet Payments

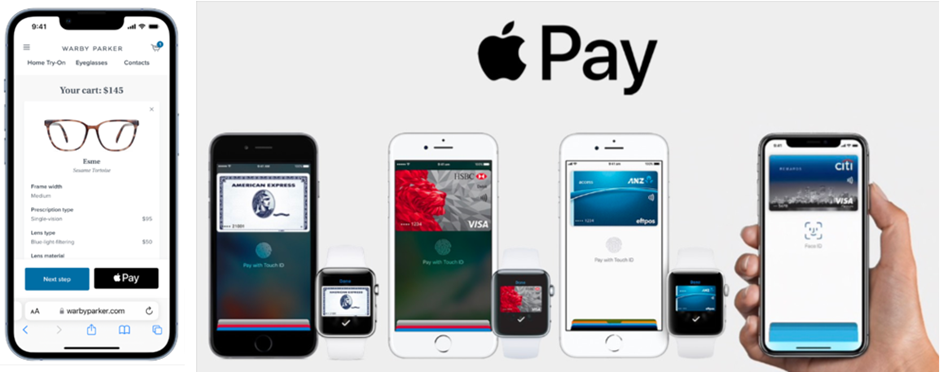

Digital wallet payments have gained significant popularity in recent years, offering customers a secure and convenient way to make online payments.

However, whether your business will choose to accept them will—in addition to their processing fees—depend on your target audience and how they access your website to purchase something.

Source: Apple

Simply put, if your target market includes young people (under 35) who primarily use their smartphones for making online (and offline) payments, digital wallets could play an important role in boosting your sales.

Conversely, if your target audience is older and usually makes online purchases with their laptop or desktop, you might consider skipping on digital wallets (or focusing on just the most popular one).

Likewise, you might not need digital wallets if your business sells services or products primarily to other businesses (B2B).

Bank Payments

As said, bank payments (account-to-account) enable customers to initiate transactions directly from their bank accounts and can allow businesses to automatically charge the customer’s account on a recurring basis.

Such automated payments can be “standing orders” or “direct debit,” as explained in the article discussing the differences between the two.

Source: Genome

In any case, this payment method eliminates the need for card details and offers an additional level of security while cutting down the number of intermediaries and typically providing lower transaction fees compared to card payments.

From your business’s financial perspective, direct bank transfers are probably the most affordable payment method, so such payments should be part of your payment method mix, particularly when selling subscriptions or offering installment plans.

How Much Does Online Payment Processing Cost

As you might’ve guessed, the ultimate cost of getting the money your customer paid online into your business account will depend on the payment method they used.

For instance, if your customer initially bought a subscription using a direct bank transfer, they usually pay the first processing fee.

Upon agreeing to their account being charged regularly, the merchant (your business) is usually charged such fees from that moment on.

Of course, the account-to-account payment processing fees will vary depending on the provider and other factors, but they’re typically lower compared to other payment methods.

Usually, only a flat fee per transaction (e.g., $0.10-0.50) is charged, as opposed to the percentage of the transaction amount charged by credit and debit card companies.

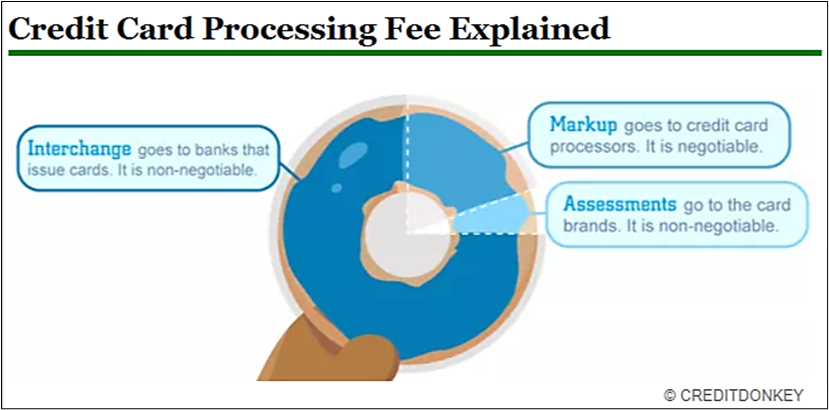

Here is an overview of credit card processing fees.

Source: CreditDonkey

In essence, interchange fees go to the bank that issued the credit card (e.g., Chase or Capital One), assessment fees go to the credit card network, and markup fees go to the processing provider that helps you process online payments.

As for interchange and assessment fees, their cost is nicely summed up by CreditDonkey:

The average credit card processing fee is 1.5% – 2.9% for an in-person swiped transaction and 3.5% for an online transaction (due to higher fraud risk).

Therefore, if your customer opts to use a credit card, you can expect to be charged those fees, whereas debit cards generally provide lower processing fees.

As for the payment processor’s markup fee, it may be a flat rate percentage, or rates can vary depending on various factors, including the type of business, transaction volume, industry, and the specific services provided by the processor.

When it comes to using digital wallets as a payment method, some are essentially free (e.g., Apple Pay), and some come with costs to consider (e.g., Google Pay and PayPal).

For instance, Apple Pay does not charge users or merchants to use Apple Pay for payments, but merchants will still pay typical transaction fees for credit or debit sales charged by their providers.

Source: Apple

Conversely, Google Pay won’t charge users for sending money to friends and family but will charge a 1.5% fee for debit card transactions in some cases and a 2.9% fee for credit card transactions.

Lastly, PayPal will charge transaction fees based on a percentage of the transaction amount, typically from 1.9% to 3.5%, plus a fixed fee per transaction.

Overall, the highest costs of online payment processing go to credit card payments, while bank transfers typically ensure lower processing costs topped off with, if applicable, digital wallet provider’s processing fees.

How to Start Processing Payments on Your Website

As for how to start processing payments on your website, there are different options to consider.

One common option is to integrate a payment gateway we already mentioned (e.g., Stripe, Square, etc.) to act as a bridge between your website and the payment processor (your bank or selected payment processing software provider).

However, using just a payment gateway usually implies you need to deal with limited customization options, advanced IT developer knowledge requirements, and a lack of integration between payment processing and billing systems.

Therefore, a better option is to select an all-in-one solution that also easily integrates with your other systems like accounting or customer relationship management (CRM) software.

Source: Regpack

When it comes to such all-in-one payment processing platforms, businesses selling physical goods should consider e-commerce platforms like WooCommerce, Shopify, or Magento.

Conversely, if your business sells services like events, educational programs, camps, trips, training, consulting, and more, a cloud-based payment processing software like Regpack can be an ideal solution to start processing online payments on your website.

Source: Regpack

In short, Regpack enables businesses to seamlessly accept payments on their website, manage billing and payment operations efficiently, and enhance the overall user experience.

For instance, this means a prospective customer can easily register and pay for your offerings by selecting the payment plan (one-off, installments, subscription, etc.) and then choosing their preferred online payment method (credit/debit card, ACH transfer, etc.).

The entire user shopping and checkout experience occurs directly on your website, and organizations using Regpack reported 31% more completed orders and 25% less customer churn.

All in all, by choosing the right online payment processing solution for your business, you can ensure a smooth and secure payment experience for your customers and effectively manage your registration, billing, and payment processing operations within one platform.

Conclusion

To summarize, your business needs to identify its target audience, establish its payment processing requirements, decide which payment methods to accept, and choose a suitable payment processing software (and provider).

Such a solution will help you digitize, automate, and streamline the management of payments your customers make using any online payment methods your business offers.

At the same time, aware of the potential costs of specific payment options, you can devise incentives to gently steer your customers towards using payment methods that are less expensive for your business, thus improving your bottom line.