When it comes to customer satisfaction, automation is king.

Replacing humans with digital tools for specific user-oriented processes can provide customers with more convenient, more consistent, and less time-consuming experiences.

As manual billing involves performing a large volume of simple, repetitive tasks sensitive to human error, it presents as a logical candidate for automation.

In this article, we bring six tangible ways automated billing leads to a smoother customer experience.

To start, let’s look at how automated billing facilitates payments.

- Makes It Easy for Customers to Pay

- Ensures Billing Accuracy

- Maintains Billing Consistency

- Makes Recurring Billing Possible

- Improves Communication With Clients

- Provides Strong Payment Security

- Conclusion

Makes It Easy for Customers to Pay

One of the main factors influencing customer experience is convenience.

In the online space, with so many options available at their fingertips, customers aren’t willing to go out of their way to pay for any one service.

Instead, if they encounter a big-enough issue, it takes less effort for them to search for a similar service provider without the problem at hand.

Jeff Lyman, the chief product officer at the customer engagement platform Weave, describes this in pretty straightforward terms:

Source: Weave / Illustration: Regpack

He also notes that, despite this, many small business owners still only accept cash, check, and credit cards as payment.

As a matter of fact, in Weave’s survey of small and medium-sized businesses, only 16% of respondents claimed to offer more than three payment methods.

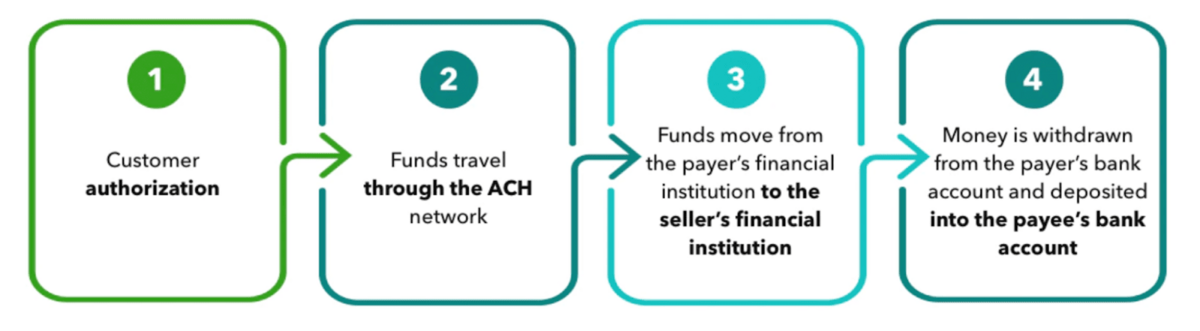

The problem is that today, there are plenty more methods for consumers to pick from. For example, eChecks are slowly rising in popularity.

A digital version of their namesake, they stand out by offering a familiar format, with the addition of speed and affordability. Here’s how they work:

Source: Quickbooks

Using the ACH network, they charge the smallest transaction fees out of all traditional payment methods.

With automated billing software, your business can process such modern, digital payment methods as eChecks.

That way, you will keep a decent amount of customers you would otherwise lose.

For example, Riverty’s research discovered that around one-third of consumers would skip signing up for a service if it lacked their payment method.

In addition, many processing platforms also support payments in multiple currencies. If you cater to customers outside the US, this could be a game-changer for your businesses.

All in all, offering customers more flexibility in choosing their preferred payment options could provide them with just the convenience they need to go through with signing up for your service.

Ensures Billing Accuracy

One of the first concepts people associate with accounting, or anything numbers-related for that matter, is accuracy.

This is particularly true with finances, as one misplaced digit can result in significant personal damage for the customer.

The problem with manual billing is that, no matter how well it’s organized, it will always have a built-in flaw preventing it from achieving perfection—humans.

To quote Alexander Pope: “To err is human, to forgive divine.”

While the first part certainly translates to the modern business environment, remember that your customers will not always be in a forgiving mood.

Instead, if they spot a mistake or an oversight, they could ask for refunds or even chargebacks.

Most of the time, however, you will just have to correct the error in question and resend the invoice, resulting in a late payment. Which is not harmless by any means.

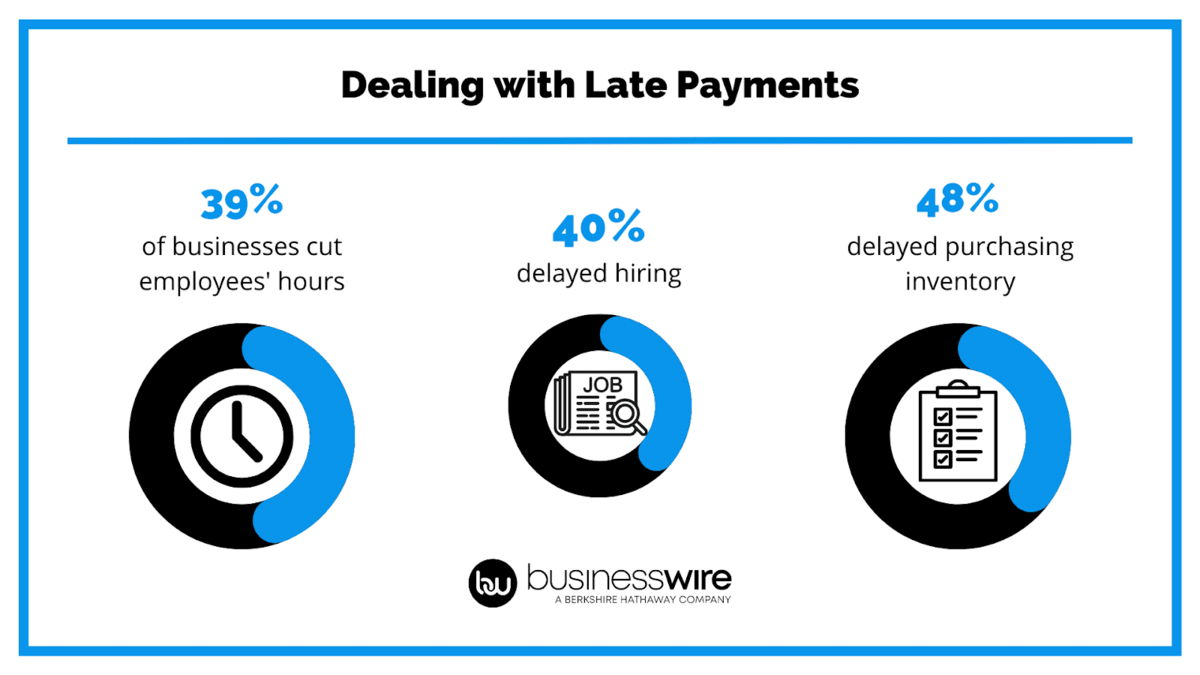

Business Wire reported that 44% of businesses see late payments as a challenge to overcome. Some of their solutions include:

Source: Business Wire / Illustration: Regpack

Fortunately, automated billing offers a better solution by almost entirely removing the human element from the equation.

The system can internally create and send spotless invoices with all the correct information as soon as payments are made.

Furthermore, email addresses are also filled out and sent automatically. The system pulls them from the database, so it uses the email connected with the payment information.

Thus, you eliminate the risk of sending invoices to the wrong recipient and causing confusion.

In conclusion, automated billing will eliminate the most common errors from your billing process and make it more efficient and accurate.

Maintains Billing Consistency

The key to excellent customer service is often hidden in the fine details, such as maintaining consistency.

For customers, consistency makes your business appear well organized and professional, which inspires confidence about choosing your brand.

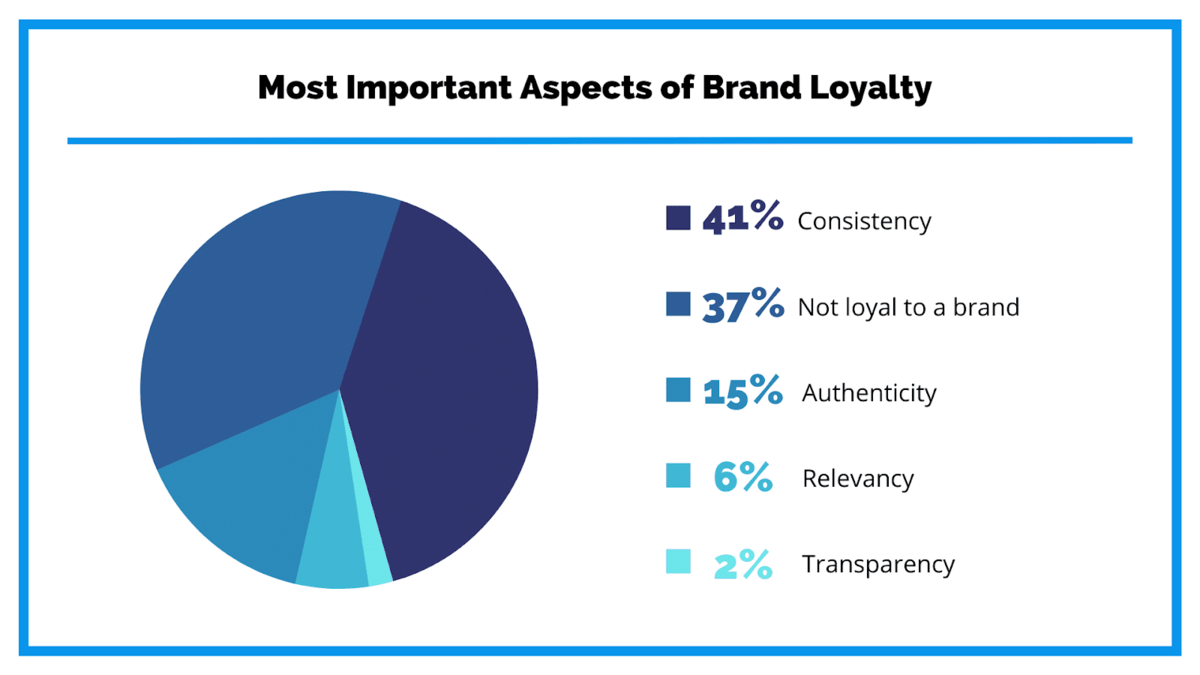

A survey by Software Advice suggests this is the most important aspect of brand loyalty to customers:

Source: Software Advice / Illustration: Regpack

As Sherp Hyken, a customer service and experience expert, explains on his website:

The customer has to have confidence that one and two will happen. In other words, there has to be consistency. Confidence comes when the customer knows what to expect, and gets it every time. Their experience becomes predictable.

So, how does this apply to billing?

It’s simple. You just need to provide customers with the same invoice every time you bill them for a service your business provides.

This applies both to the design and the information within:

Source: SumUp / Illustration: Regpack

Five mandatory sections don’t sound like a lot to fill out.

However, if you multiply it by the number of users and do it on a regular basis, it will produce enough small errors for it to have an effect on your business.

The reason is that, as with accuracy, human error plays a part in consistency too. As Neil Ferguson, a Vice President of Sales Engineering at Opsview, states:

Regardless of the ability level of your employees, however, the biggest factor impacting human error is that of consistency. When people are given a litany of monotonous tasks, consistency will drop.

Automated billing software, however, does not suffer the same issue. Therefore, it’s much easier to use in developing processes for reliable, repeatable invoice creation.

You just need to create one professional-looking template containing all relevant payment and customer information and your job is finished.

From there on, all invoices will have the same look, giving your brand a more polished feel.

Ultimately, in order for the customers to have a positive impression of your brand, you have to maintain consistency, and that extends to billing as well. Automatization helps you achieve that.

Makes Recurring Billing Possible

There is one feature of automated billing software service-based businesses should find particularly useful, and that’s recurring billing.

Of course, recurring billing just means continuous billing over a period of time. Subscription services, such as magazines, for example, have already been using this model for a long time.

However, automated recurring billing comes as a small revolution in this regard.

If billing was done manually, employees would have to make every single invoice by hand.

And since growing subscribers means a proportional increase in invoices, a sudden expansion would easily overwhelm the department dealing with accounts payable (AP) and lead to burnout.

As one AP worker said in a 2022 IOFM survey:

I have a never-ending to-do list, and I am not able to get caught up. I feel like I’m always scrambling. It doesn’t matter how many hours I work. I just can’t see the light at the end of the tunnel.

Employees under this amount of stress are sure to make mistakes, in addition to the ones they would have statistically made regardless.

Meanwhile, the backlog of late invoices will continue to rise. As time passes and they pile on, it will increasingly hurt your reputation with the customers.

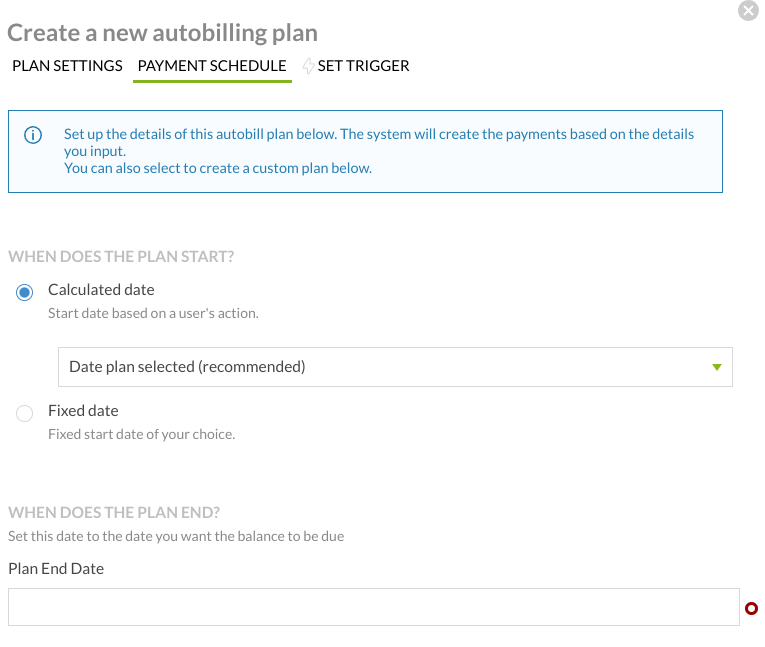

With automated billing software like Regpack, recurring billing is not nearly as nerve-wracking. In fact, it’s just the opposite.

First of all, you can effortlessly create as many billing plans as you like.

Furthermore, most of the settings can be configured, such as what product or service the plan applies to, start and end dates, billing frequency, the maximum number of installments, etc.

Source: Regpack

In addition, you can set up a completely custom payment schedule. Some customers might have specific needs as to the payment dates and deadlines.

If you find their requirements reasonable, this will enable you to grant them the request.

Ultimately, recurring billing is another way to disarm your customers with options, making them more susceptible to giving your service a try.

Improves Communication With Clients

As payments go, there still remains one final step your business needs to set up to earn itself a fully satisfied customer.

Have you guessed it?

That’s right, payment confirmation emails. Don’t worry if you didn’t get it—it’s easy to overlook the importance of this part.

After all, you already received the payment, which was your goal in the first place. Right?

You certainly know the answer to this one. In the words of Peter Drucker, the founder of modern management:

Quality in a product or service is not what the supplier puts in. It is what the customer gets out and is willing to pay for.

Therefore, you ought to think of the customer first. If they don’t receive their payment confirmation, they might be left wondering if their money went through.

Or even worse, they might get the impression that your business has something to hide.

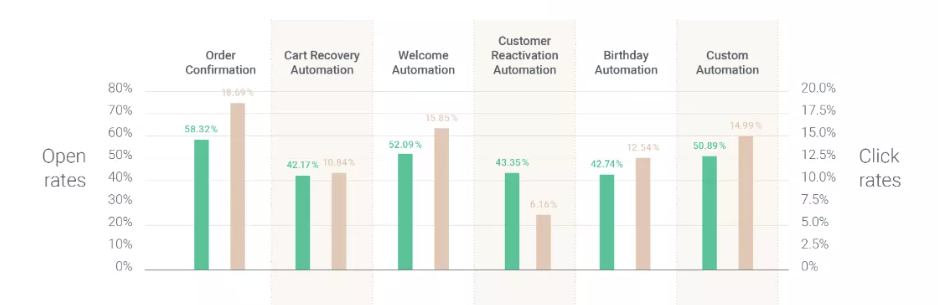

It’s no wonder that, according to research, order confirmation emails have the highest engagement rates out of all automated emails:

Source: Omnisend

People want to know that their money went into the right hands.

Confirming the payment went through for the specified service and charge will bring closure to the ordeal and allow customers to have peace of mind.

However, for businesses that have automated billing software, this is just one more task that can be easily automated with a few mouse clicks.

If the platform you (decide) to use offers trigger-based communication, you can set up other useful transactional emails as well, such as order confirmations.

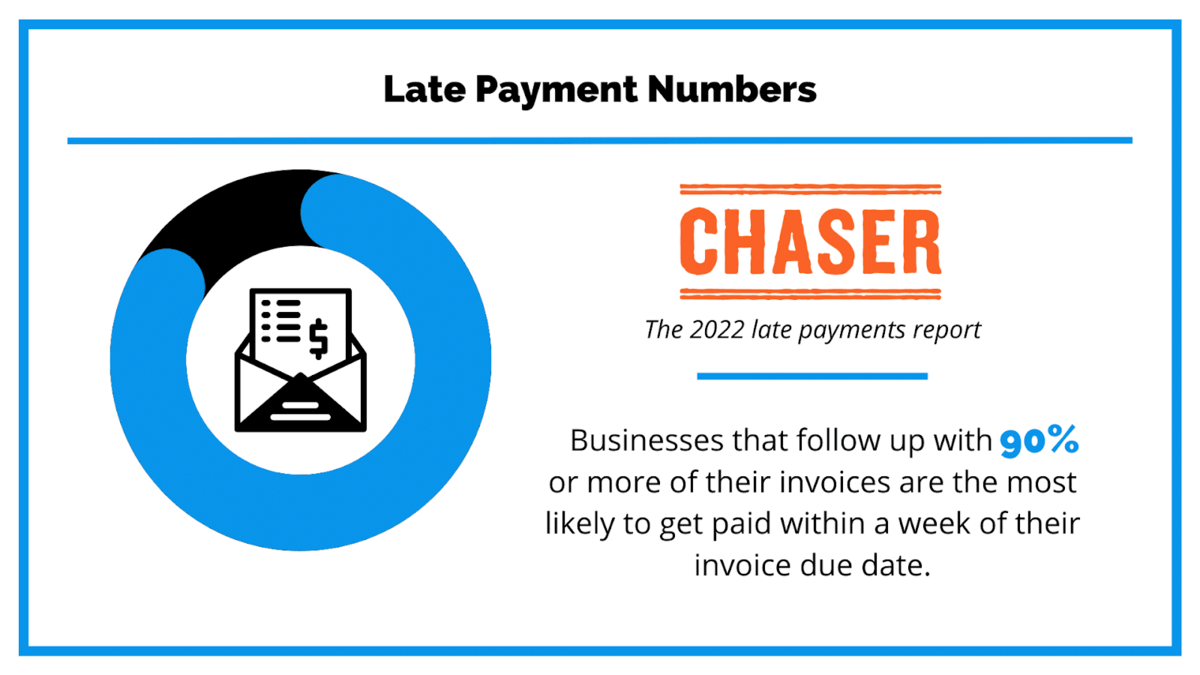

Saying that, we still haven’t properly discussed the elephant in the room—what happens if the customer fails to pay in time?

If we take Chaser’s 2022 late payments report into account, that happens to around 9 out of 10 small and medium businesses.

Well, the answer lies in the same report:

Source: Chaser

Therefore, for the most part, dealing with late payments can be as easy as setting up automatic email notifications.

Polite, timely reminders of their obligations will grant customers another opportunity to pay without feeling like offenders.

This will reinforce the positive experience you already provided, strengthening their relationship with your business.

Finishing with payment confirmations and reminders, we have covered the automated billing process front to back.

However, there is still one crucial feature to go over, which is payment security.

Provides Strong Payment Security

Security has been a top priority for online shoppers since the early days of the Internet.

Giving out your credit card information to a website without knowing who is behind it was a scary proposition. And a potentially damaging one at that.

Today, there is a lot less fear surrounding online payments.

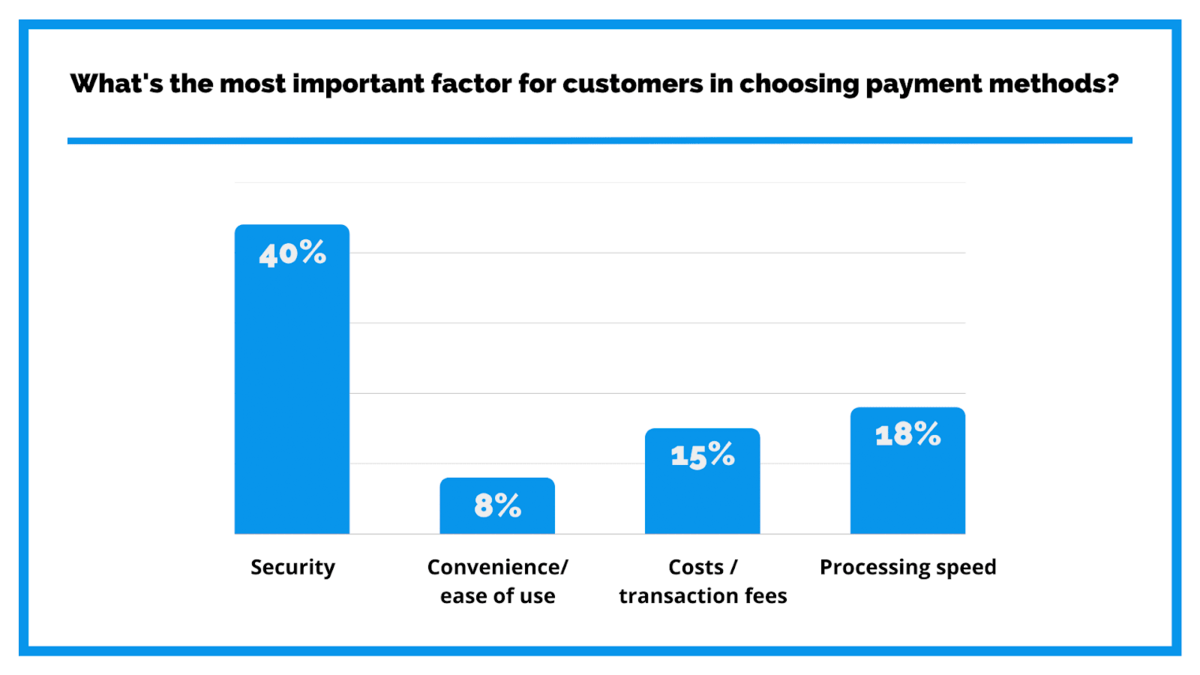

But research has shown that for most people, security still tops the charts as the decision-making factor in choosing their payment method:

Source: PaySafe / Illustration: Regpack

To top it off, 70% of those surveyed prefer not to share financial details online.

Automated billing software can help you alleviate some of their worries.

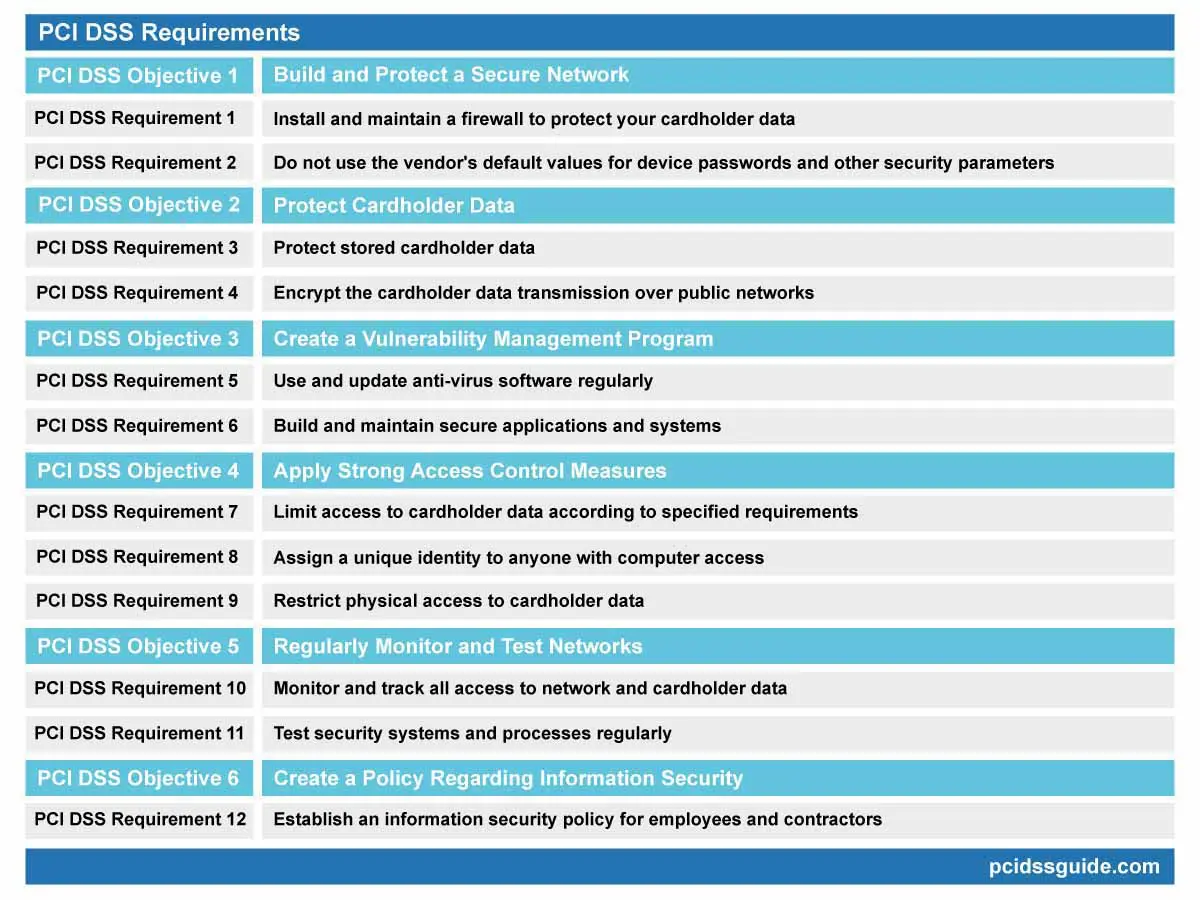

Payment processing platforms require at least one protection layer—PCI compliance.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of standards for all organizations handling credit card information.

These are the requirements for compliance:

Source: PCI DSS GUIDE

Having this information available on your business website will assure visitors that they are dealing with a professional service instead of a shady online vendor.

You could implement additional security methods, such as encryption and data access controls, if your software supports it.

With the former, users’ data is encrypted and thus impossible to read if it leaks.

Data access control allows you to limit sensitive personal data exposure only to qualified and verified individuals. This serves as protection from internal breaches.

Implementing all three systems to work in unison will give you virtual immunity over cyberattacks and their potentially devastating consequences to your business and its customers.

Conclusion

One thing’s certain—automation is here to stay.

When compared to old-school tactics, it is faster, more consistent, more convenient, and more precise, improving upon every important element in ensuring an excellent experience for your customers.

As a growing number of companies start to use automation for their business practices, automated billing will quickly become a requirement, rather than a special feature.

For that reason, it’s best to get ahead of the curve and implement automated billing software as soon as you get a chance.