Whether you are starting a subscription-based business or planning on switching to one, it’s essential to carefully select the payment model you’re going to implement.

After all, you are not selling a product that requires a one-time transaction. Rather, you expect your users to repeatedly pay for your service for weeks, months, or even years on end.

Therefore, payment processing is not peripheral to your product, serving only as a means to an end. Instead, it is an integral part of your service.

To make it as effortless as possible for both you and your customers, you should consider implementing recurring payments in your business.

To help you make an informed decision, we highlighted some pros and cons of this system below.

The Pros

There are several benefits to choosing a recurring payment model for your business.

Let’s take a look at how this model can help you manage your subscription businesses and improve customer experience.

More Predictable Cash Flow

To start, businesses with a recurring payment model can predict cash flow with greater accuracy than those relying on different models.

The reason for this is twofold.

First, recurring payments are made at regular intervals.

Whether it be on a weekly, monthly, or yearly basis, users have to pay a set amount at the start of each period to continue using the service.

This way, the business avoids major fluctuations in income typical for products only popular during certain seasons or those meant to be bought only once.

And second, recurring payments are automatic.

Having to manually pay each installment can become burdensome for some users, especially if they subscribe to multiple different services.

On the other hand, recurring billing requires users to input their information only during the initial transaction.

From then on, the system will automatically charge their credit card, removing the human element from the equation.

Therefore, companies can confidently estimate how much money will be coming in each month based on the number of users and the price of the service.

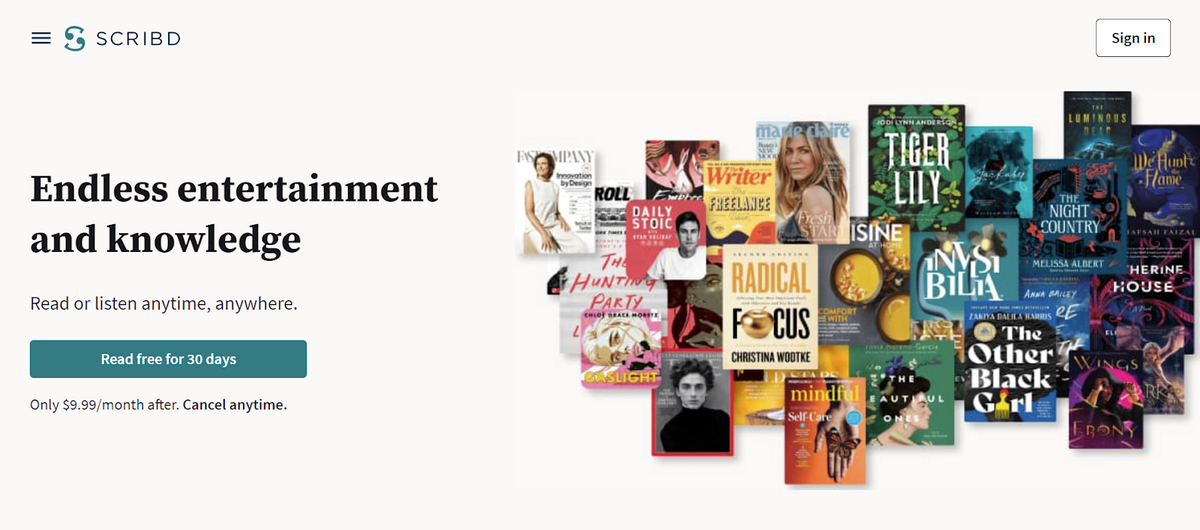

Take Scribd, for example. It is an online platform offering a digital library of ebooks, audiobooks, podcasts, etc., and charges users $9.99 per month for unlimited access.

Source: Scribd

According to its About page, Scribd has a user base of around 1.8 million people.

Consequently, unless something radically changes with how the users perceive the site, it is guaranteed a monthly revenue of $18 million, which helps with business planning.

Knowing the approximate amount of money they will receive each month goes a long way in helping companies set actionable goals and objectives, plan for expenses, and generally develop their long-term business strategy.

Ultimately, having an automatic process for regular payments allows businesses to have a consistent influx of funds, helping them to plan for the future more effectively.

Reduced Customer Acquisition Costs

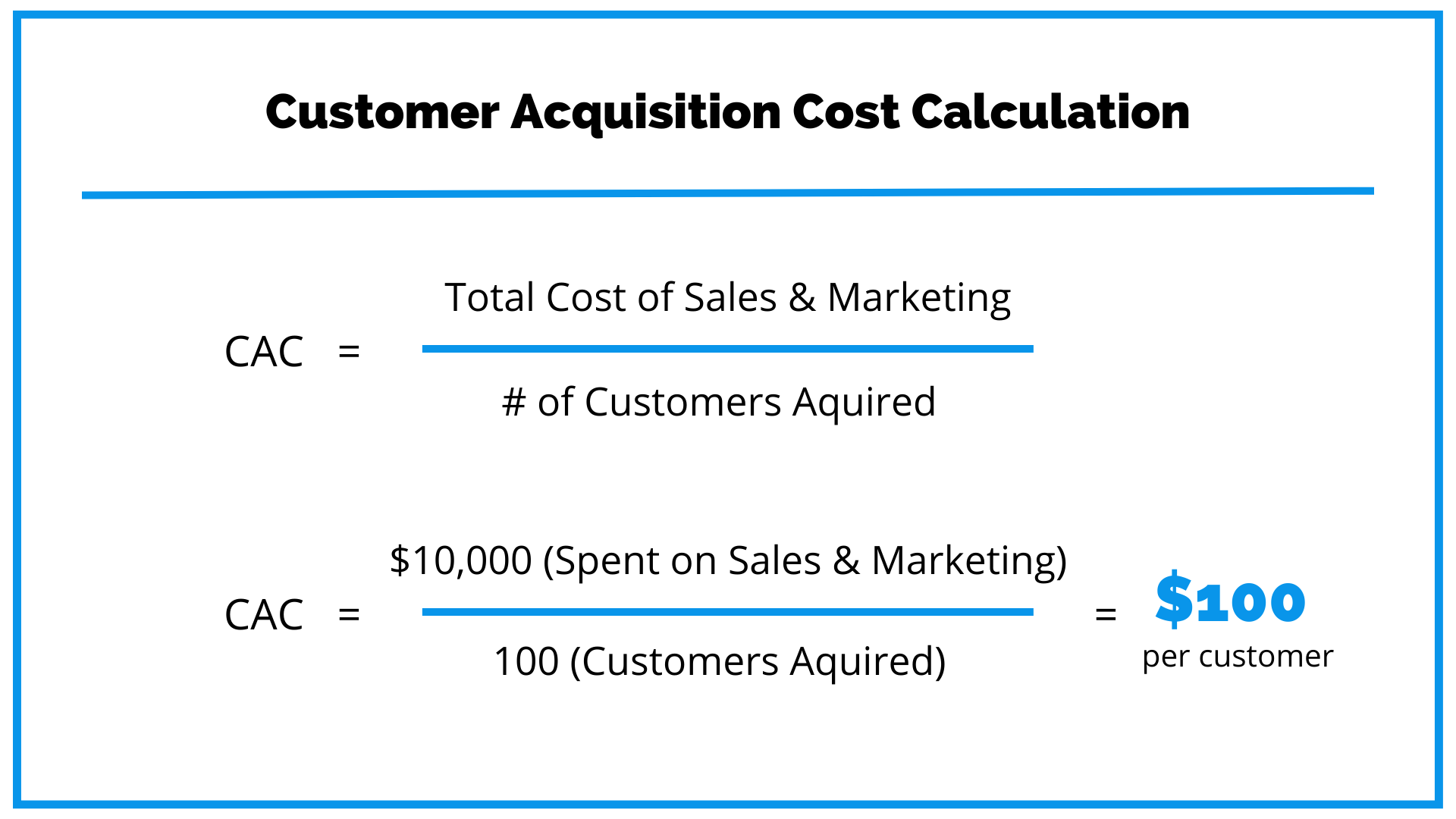

In business, customer acquisition cost (CAC) is the amount of money you spend to bring on a new user to buy your product or subscribe to your service.

CAC is fairly easy to calculate. You simply add up all costs of acquiring customers in a certain period with the number of new customers in that period. Here is how that looks:

Source: Regpack

As shown in the example above, if you spend 10,000$ a week on sales and marketing, during which you gain 100 new subscribers, your CAC would be 100$.

So, how can recurring payments help in reducing CAC?

It’s simple.

If a customer is in any way put off by your payment system, it will take more resources to convince them to buy into your business. After all, you have competitors.

They are equally eager to attract customers and may go into battle mode to win over potential users.

This could push you to spend more on marketing or developing unique features to create a competitive edge.

An effortless, convenient payment system removes a layer of uncertainty about your service, making it easier for the potential customer to decide to try it out.

Therefore, you won’t have to invest as much in customer acquisition as you would with a less suitable billing model.

This is especially true if the competitors themselves still rely on manual payments.

All in all, an integrated hands-off system for handling transactions can become one of the selling points for your service, making it more competitive and less costly to promote.

Increased Customer Lifetime Value

Once you acquire customers, you still have to develop a strategy to maintain your relationship with them.

This falls under customer retention, and is an important factor in increasing customer lifetime value (CLV).

CLV is a metric measuring the earnings you receive from a single customer for the duration of your relationship.

It takes into account all expenditures related to customer acquisition and retention and relates them to the total revenue they bring in.

The longer an account is actively paying, the higher the earnings and CLV.

Luckily, here is where subscription models especially shine compared to product-oriented ones.

Businesses often work under the Pareto principle, also known as the 80/20 rule, which Investopedia defines as:

Source: Investopedia

Applied to business economics, It basically states that 20% of existing customers make up 80% of future earnings. Meaning that only a fifth of customers buying a product will continue to do so.

With recurring payments, you can turn the odds in your favor. Why? Because you don’t have to spend as much money convincing the customers to buy from you again.

After all, they only have to pay once. Therefore, you just have to ensure they do not cancel their subscription and they will keep buying from you indefinitely.

Furthermore, recurring payments enhance the overall customer experience.

Users appreciate convenience, and not having to deal with outdated billing practices will make them like your service more.

This will, in turn, prolong their subscriptions and make for a higher CLV.

In summary, offering recurring payments helps your business thrive by providing a more user-friendly service, which strengthens your relationships with paying customers, and earns you more money in the long run.

The Cons

Having listed the benefits of recurring payments, it is important to also note some negatives. For serious businesses, these are hardly deal-breakers.

Nonetheless, you need to be aware they exist so you can properly respond if they adversely affect your company.

Having to Manage Involuntary Churn

Churn is a term used to describe the loss of customers or, in this case, subscribers.

There are many potential causes for users deciding not to renew their subscriptions.

It could be they are unsatisfied with the service, discover a competitor they prefer, or simply decide to cut expenses.

However, recurring payment also opens up the possibility of involuntary churn.

For businesses, one of the benefits of an automated system is that they can put payments on a back burner. While this is generally true, you still need to look out for potential issues.

Card expiring, users switching banks or running out of money, or even a server error, can lead to unwanted subscription cancellations due to payment failure.

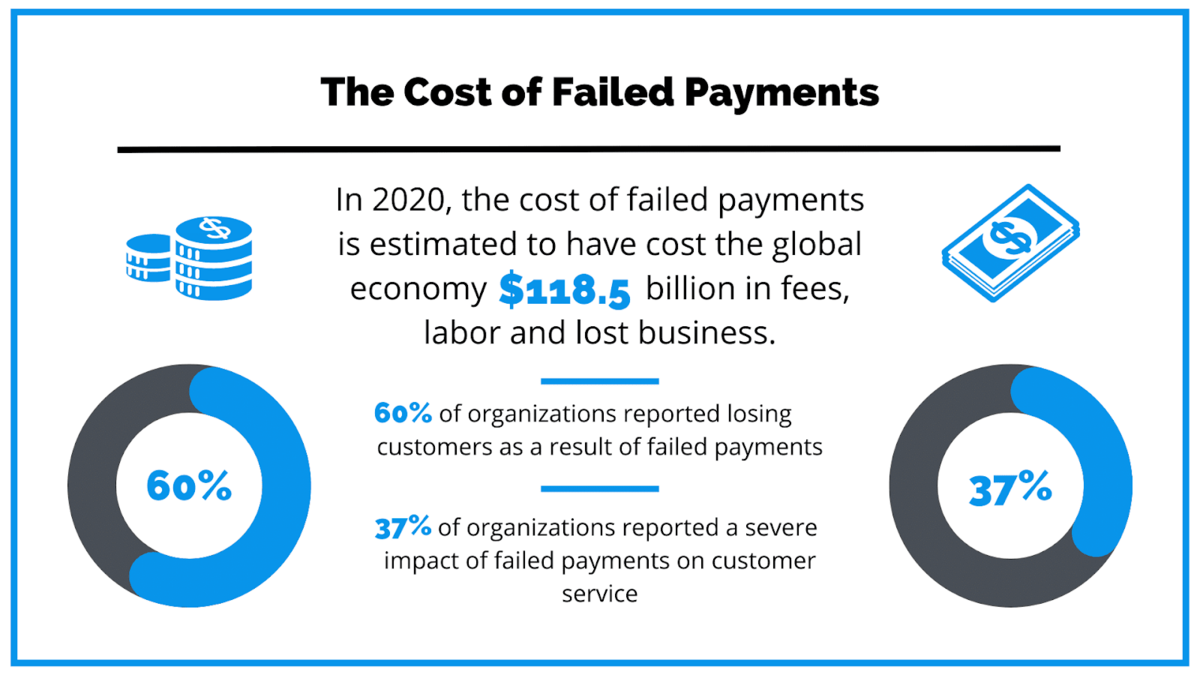

If left unchecked, over time, these can add up to have a significant impact on your bottom line. Just look at the numbers provided by LexisNexis, a company specializing in data analytics:

Data: LexisNexis / Illustration: Regpack

Your income depends on maintaining a steady positive relationship with customers. Let us say they, for example, get locked out of their accounts because of a payment error.

If they don’t have a readily available solution, the procedure of getting the account back may prove to be too much hassle.

In that case, they can easily give up and take their business elsewhere.

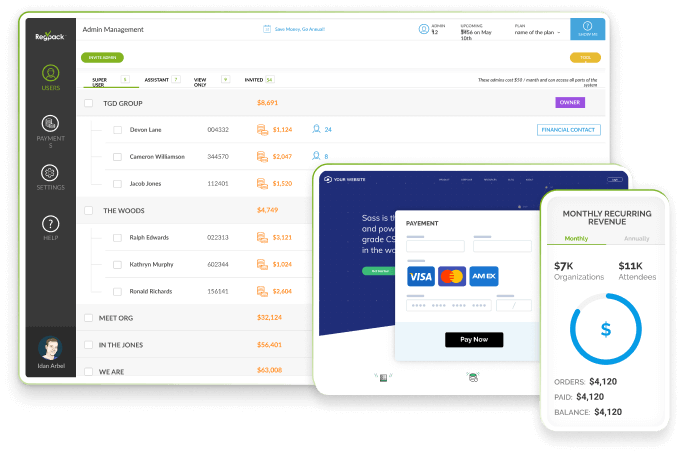

The good news is, you can avoid involuntary churn. All you need is a responsive team and a quality subscription service provider, such as Regpack.

Regpack offers an all-encompassing system for managing subscriptions, including recurring payments. Their billing solution has a 95% client satisfaction rate and reduces churn by 26%.

Source: Regpack

Regpack provides several tools to help you deal with churn issues.

If you ever encounter a problem with payment failures, they offer unlimited customer support, made up of experts who solve similar issues on a daily basis.

To sum up, implementing recurring payments into your business requires you to pay attention to potential payment issues so you can respond in time and keep your customers happy.

Higher Risk of Chargebacks

We discussed what happens if businesses lose sight of payments, but it can pose an even greater problem for you if users do the same.

Let us say you offer a 14-day free trial period for your service, but unlocking access requires customers to input their card information.

They end up browsing through your site but decide to defer their final decision to a later date.

A few payment cycles later, they notice you have been charging them for a service they have not used past the first day.

Perhaps they forgot they even signed up in the first place. Frustrated by perceived unfair treatment, they decide to contact the bank to request their money back.

Now, chargebacks differ from regular refunds in one fundamental way.

If a dissatisfied user approaches you asking for their money back, you can review their complaint and decide whether or not to return the money.

While it is generally a good idea to do so, fraud attempts exist and you should be careful not to become a victim of one.

On the other hand, chargebacks put the bank in charge of solving the issue.

Seeing as they are managing your account, they also have the power to terminate it if they deem you to be too risky to be in business with.

And with a high enough chargeback ratio, even if you win the disputes, that is precisely what will happen.

Still, do not worry. There are solutions that can help you lessen the risk of chargebacks.

As they point out at the dispute management service Chargeback Gurus:

The best way to stop recurring billing chargebacks is to take action ahead of time to prevent them.

They continue to elaborate:

Source: Chargeback Gurus / Illustration: Regpack

You can visit their website for a more in-depth exploration of chargeback prevention.

However, keep in mind that subscription services by nature have a higher chargeback rate than regular businesses.

For this reason, banks usually offer them the possibility of opening a high-risk merchant account.

Needing a High-Risk Merchant Account

High-risk merchant accounts are reserved for businesses belonging to industries with reputations for being controversial or unstable.

These are the ones with an unusually high percentage of chargeback, defaults, or fraud.

In fact, most online businesses with recurring billing can expect to be labeled as high-risk because they accept card-not-present transactions—or rather payments where the seller does not see the card in person.

As Robyn Newmark, founder and CEO of Newmark Beauty, pointed out:

Source: Lightspeed

So, what can you expect if your business is deemed to be high-risk?

Typically, this means you will pay a 0.5% to 1% higher credit card processing rate, as well as higher chargeback rates.

In addition, you will be charged a monthly fee of $10 to $50. Other than that, you will probably need a reserve account.

It will be used to temporarily withhold a percentage of your sales to insure the account provider from potential damages.

Nevertheless, it’s not all bad news.

Businesses with high-risk merchant accounts are not considered “worse” by any means.

In fact, having one means you can accept more currencies and payment types, it can help you expand your customer base and increase profits, and usually comes with higher chargeback protection.

You only need to make sure that you are upfront with your business model and history so as not to raise unnecessary suspicion.

Ultimately, recurring billing will probably necessitate you to open a high-risk merchant account. While this does have some drawbacks, embracing it can lead to positive outcomes.

Conclusion

For subscription businesses, payment processing is vital to customer satisfaction.

No matter the quality of service, users can be put off by having to hassle with invoice reminders and manual transactions over and over again.

Recurring payments automate this process, allowing you to offer a more streamlined experience for your customers.

Having read about the good and the bad of the system, you are in a better position to decide whether or not to make it a part of your service.