B2B Billing Software

Subscription management software designed to simplify the payment process: invoice automation, secure payments, and accounting software integration for improved cash flow helping to scale your business.

Subscription Management Software Features

Invoice Automation

With Regpack, businesses can automate their invoicing operations to save time and avoid the risk of costly human error that comes with manual processing. Our automated invoicing tools control how and when invoice payments are made to avoid delayed payments and keep payment terms circulating.

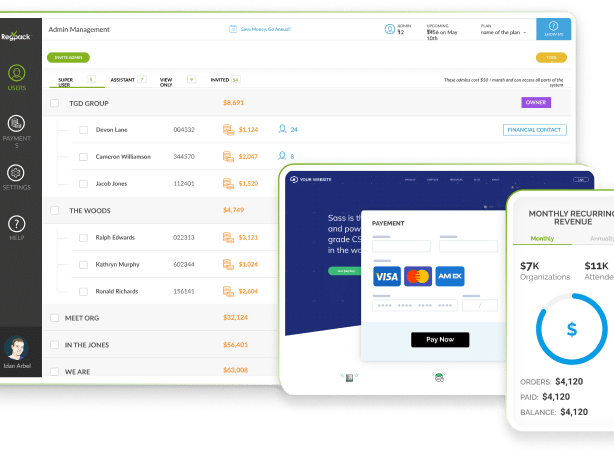

Recurring Billing

The billing process can be time-consuming, especially when manual processes are involved in payment processing. Regpack gives businesses the tools they need to collect and store payment information, charge clients on customizable recurring schedules, and manage automatic payment plans.

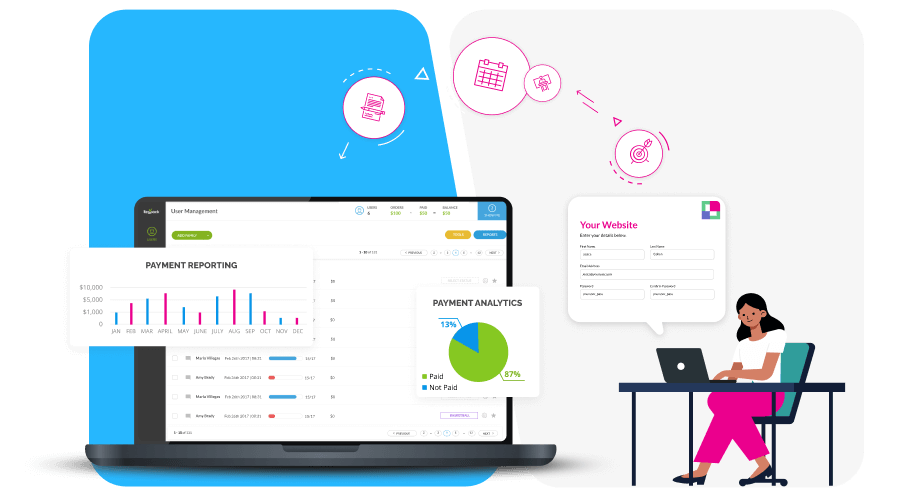

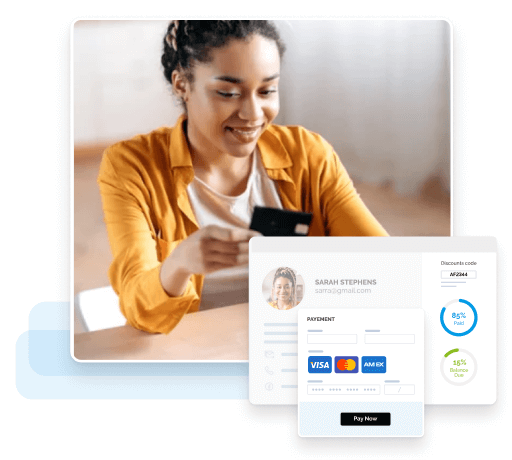

Online Payments

At Regpack, our subscription billing software offers a variety of features to better manage online payments. Our online platform offers customizable payment forms, the ability to accept payments on any device, and ACH payments and credit card processing. With improved payment solutions, businesses can achieve faster payment via wire transfers and other electronic payments.

Accounting Software Integration

Subscription-based businesses often utilize other software to ensure smooth operations. Regpack’s subscription management software easily integrates with accounting software to make managing your SaaS business a breeze. It’s the ultimate accounting solution to fit your unique needs.

Benefits of B2B Billing Software

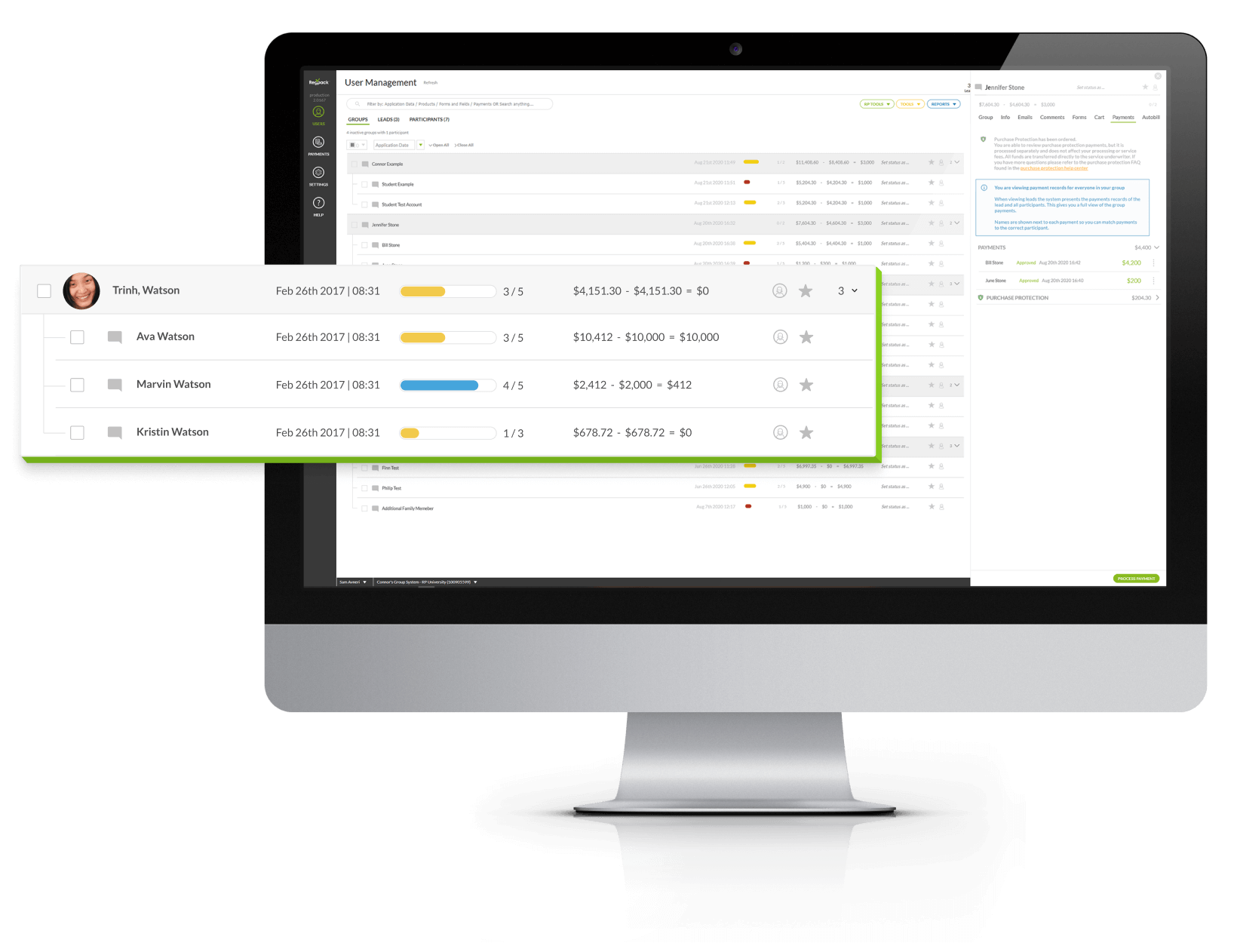

Increased Efficiency

Handling B2B billing through a single digital payment system makes it easier for businesses to manage and record their financial data. Businesses that use automated systems are also less likely to encounter problems stemming from human error. Regardless of your payment method, all payments are processed and recorded reliably on an intuitive platform.

Improved Accuracy

With the help of a B2B billing system, businesses can ensure that clients are billed accurately for any goods or services rendered. With an efficient billing solution, businesses can accurately track billable time, compile quotes, and create invoices for clients.

Cash Flow Management

SaaS billing software is ideal for any small business in need of improved cash flow management. Large enterprises can also benefit from business-to-business payment automation which allows your business to collect payments automatically the moment they are due.

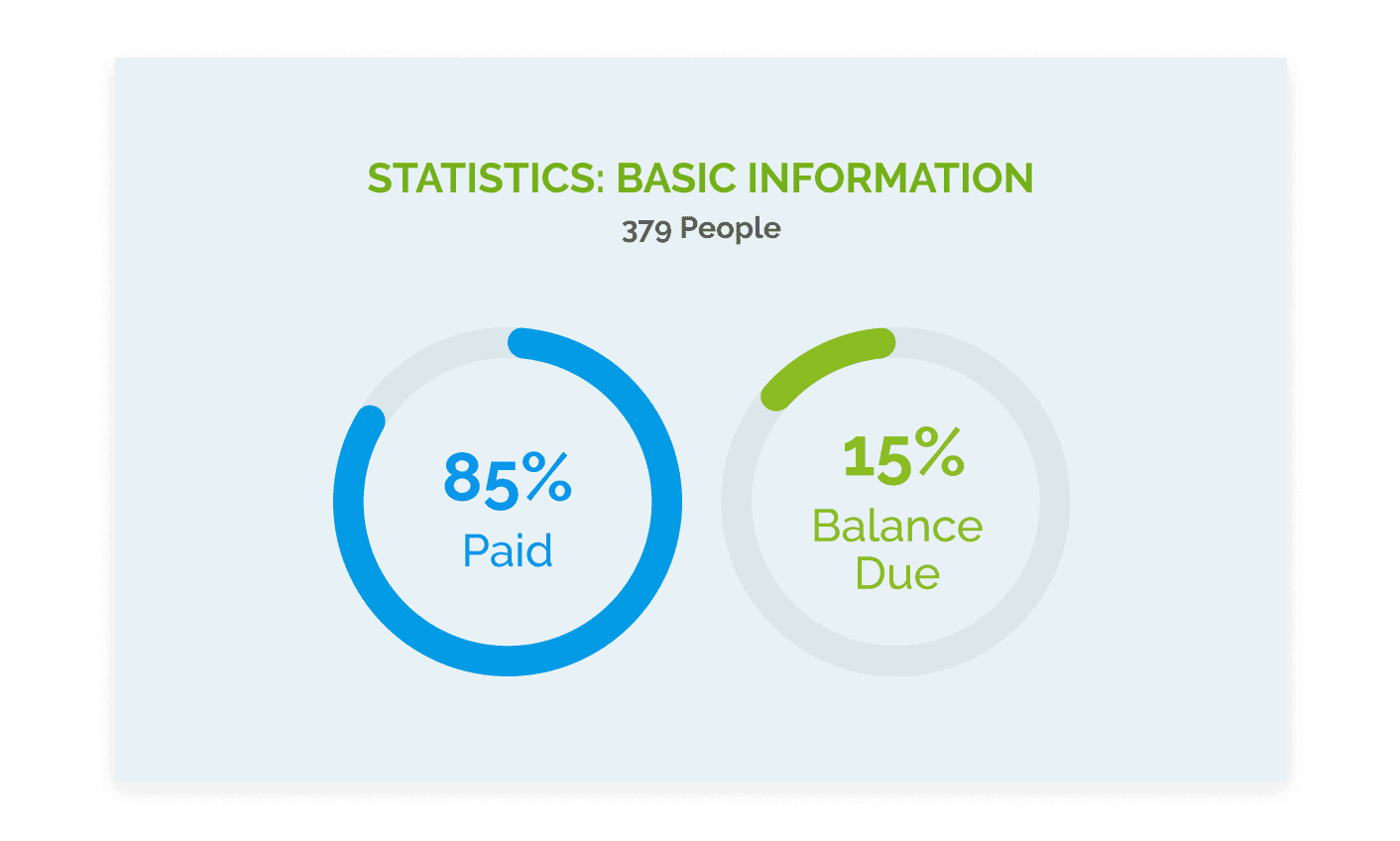

Better Visibility

Switching to an automated billing business model can give businesses better visibility and greater flexibility. At Regpack, our automated B2B billing solutions allow you to easily manage payments from both new and traditional methods, whether it’s paper checks, debit card or credit card payments, ACH transactions, cross-border payments, or other payment methods.