Although disappointing, seeing customers end your working relationship is a natural part of running a subscription business.

Nevertheless, you shouldn’t just accept your churn rate and reconcile yourself with it.

There are many actions you can take to reduce both voluntary and involuntary churn, many of which we’ll cover in this article.

First, however, it’s crucial to understand the difference between these two types of churn.

Otherwise, you may end up adopting solutions that don’t get to the root of the problem, and thus do very little to improve customer retention.

Let’s get into it!

- What Is Voluntary Churn

- What Is Involuntary Churn

- How to Calculate the Churn Rate

- How to Reduce Voluntary Churn

- How to Reduce Involuntary Churn

- Conclusion

What Is Voluntary Churn?

Voluntary churn occurs when a customer decides to cancel a subscription. It’s an active type of churn—the customer initiates it. Unlike involuntary churn, it doesn’t happen against their will.

An example of voluntary churn is when a customer sends you an email asking to cancel their subscription because they’re unhappy with your service.

Because it occurs when a customer wants to cancel, voluntary churn indicates an underlying problem with your business. Customer churn happens when they are unhappy with something.

It could be poor customer feedback, ineffective onboarding, a confusing user interface, payment processing issues, or something else that’s causing people to leave the relationship.

One of the most common causes of voluntary churn is unmet expectations. When customers are promised some positive result and then feel that you didn’t deliver on it, they are likely to leave.

If you’re experiencing high voluntary customer churn rates, it’s important to ask your customer base why they’re leaving and then take action to fix whatever is wrong.

What Is Involuntary Churn?

Involuntary churn happens when a customer’s subscription is canceled without the customer intending to cancel it.

The most common cause of involuntary churn is a failed payment. These can occur for a variety of reasons:

- Insufficient funds in the customer’s account

- Incorrect billing address

- The wrong card expiration date

Involuntary churn says nothing about your customer experience. However, it can indicate that something is wrong with your payment processor.

For example, a business might be losing a lot of its customers to involuntary churn because they cancel the subscription after one payment failure attempt.

This is a mistake, and the business should implement something like automatic payment retries that will retry the customer’s payment method multiple times.

This will reduce involuntary churn caused by soft declines.

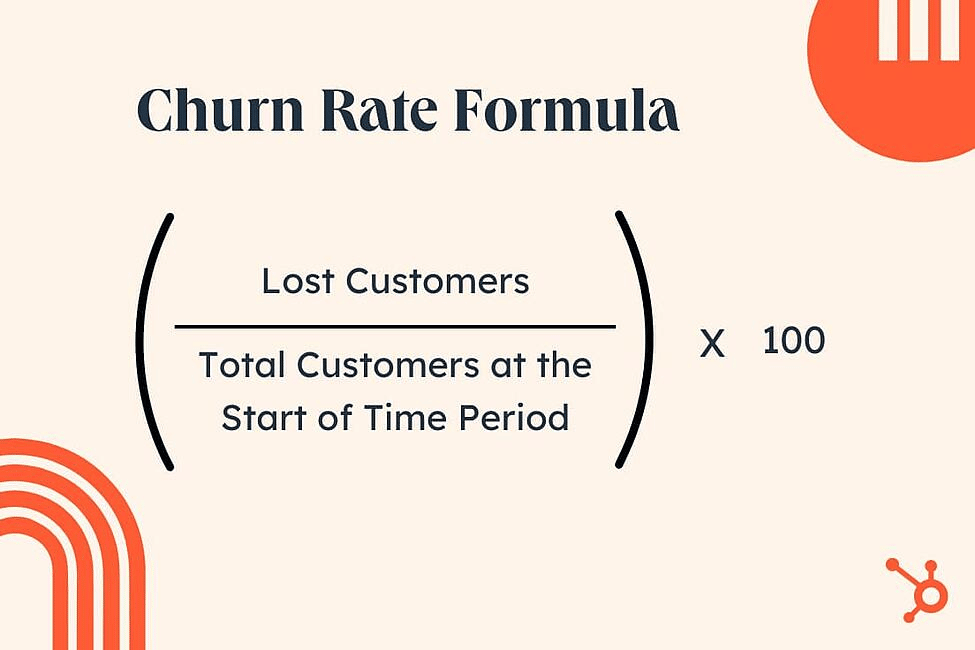

How to Calculate the Churn Rate

The churn rate measures the percentage of customers who have voluntarily or involuntarily churned over a given period of time. Most companies calculate the average churn rate monthly.

The formula for the churn rate is simple:

Source: HubSpot.

So, if you were calculating your monthly churn rate, you’d take the number of lost customers during that month and divide it by the total number of customers you had at the start of the month. Then you’d multiply it by 100 to get a percentage.

How to Reduce Voluntary Churn

Let’s go over some strategies you can deploy to reduce voluntary churn and maintain your company revenue.

Offer Flexible Subscription Plans

One of the biggest reasons customers decide to cancel their subscriptions is that they can no longer afford the payments.

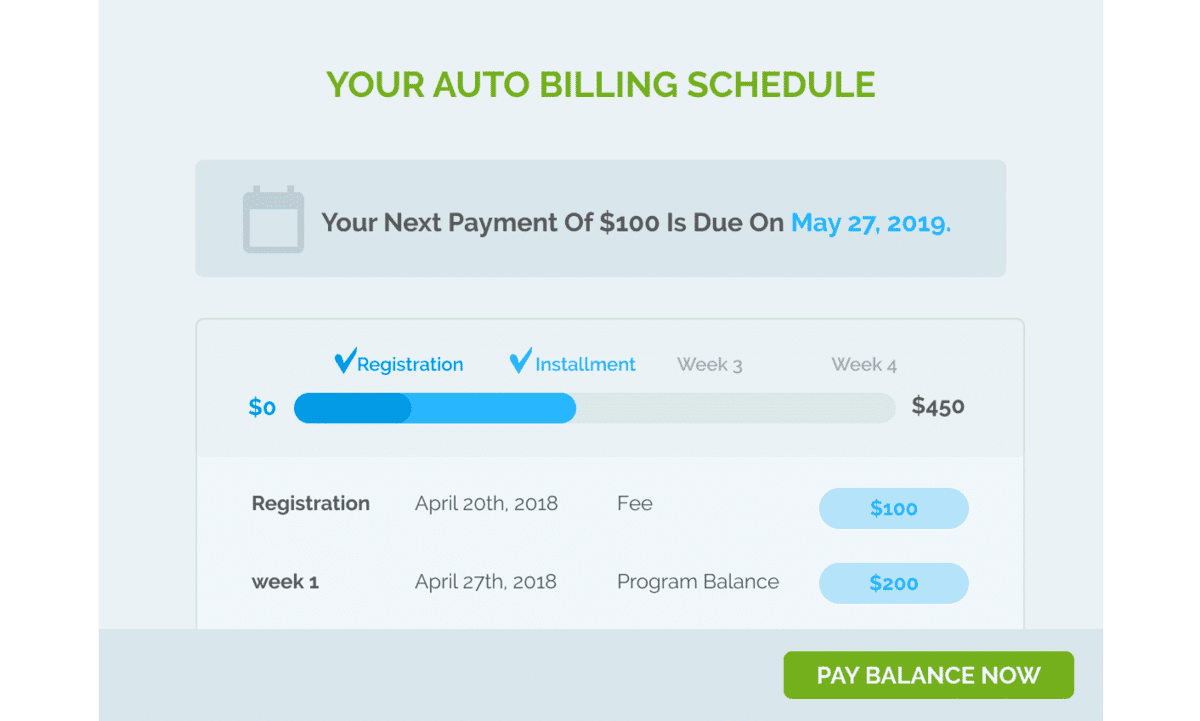

If you offer flexible subscription plans that allow customers to select payment plans that work for their budget, you can minimize this subscription churn.

Providing options prevents excited customers from signing up for a subscription that they won’t be able to afford down the line.

Although tiers are the most common form of flexible subscription plans, Regpack’s online payment system takes it a step further and enables its users to create personalized payment plans for each specific customer:

Source: Regpack

This not only reduces the likelihood that the customer will churn but also greatly enhances customer satisfaction.

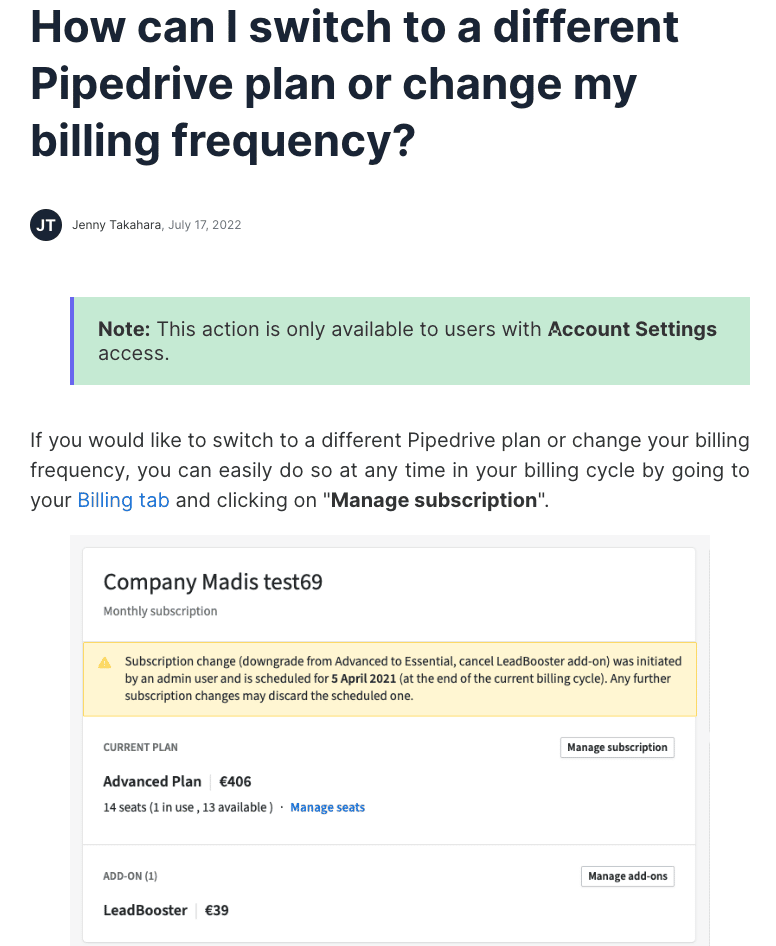

Further, you should make it easy and free for customers to switch between pricing plans, upgrading or downgrading product tiers or service packages at their convenience.

Then, dedicate a page in your Knowledge Center to clearly instruct customers on different ways to make this switch, as Pipedrive does:

Source: Pipedrive

That way, instead of canceling a subscription to the golden package because they took a hit to their income, customers can simply switch to the silver or bronze package and stay with your company.

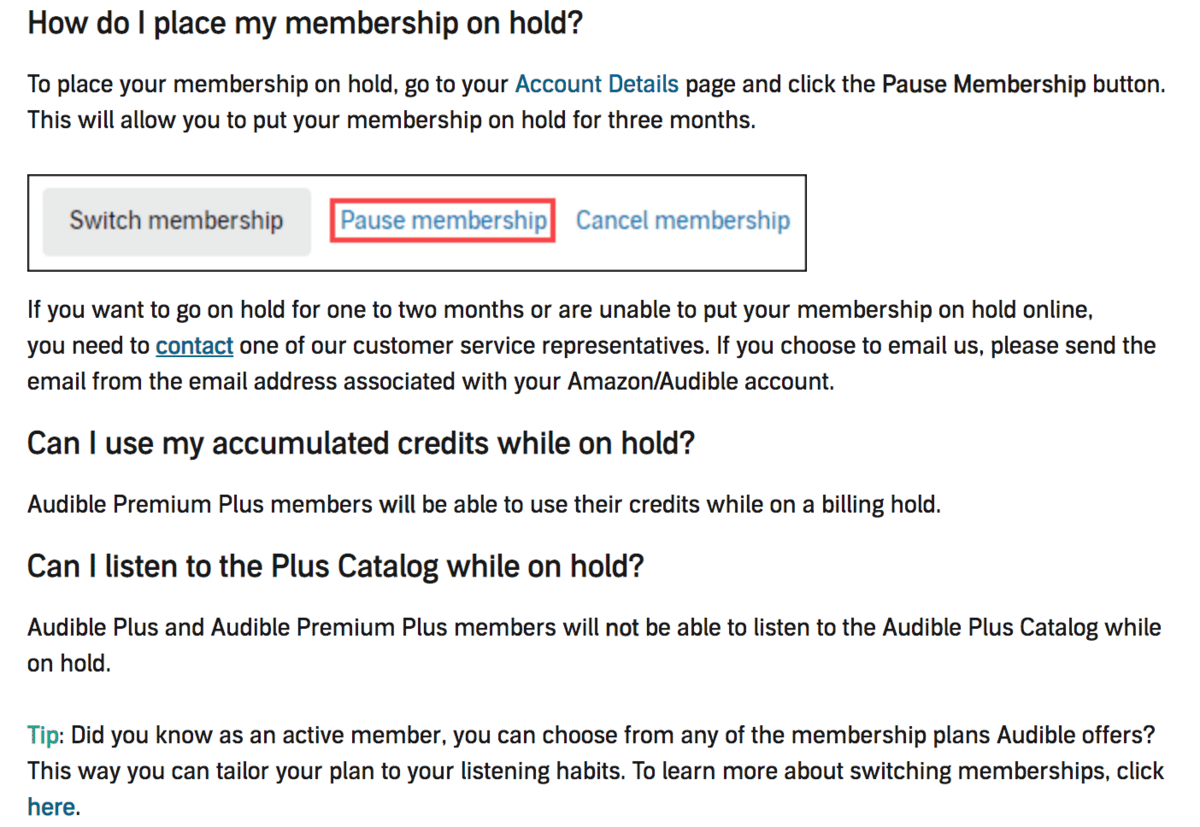

Let Customers Pause the Subscription

Another great way to reduce churn is to give your customers the option to pause their subscriptions as an alternative to canceling them.

If money troubles are the cause of their cancellation, and the customer is still a fan of your brand, they are likely to choose to pause it over ending the relationship completely.

Offering them this grace period as an option can help them reconsider their decision to cancel, especially if it’s an impulse reaction to a single bad experience with the service.

Be sure to fully explain to the customers the implications of putting their account on hold. What will they be able to access? When, if ever, will the pause turn into a cancellation?

Audible does a good job of clarifying the process and the effects of pausing a membership:

Source: Audible

When you provide the pause option, you might be surprised at the number of people who pause an annual subscription and then return to using it like the break never happened.

Offer Great Customer Support

Customer support is often your best and final line of defense against the voluntary churn of your subscription company. A well-trained agent can persuade even the angriest of customers to keep their subscriptions.

But customer support doesn’t only come into play at the deciding moment of voluntary churn.

If you offer great customer service throughout the customer journey, an issue with billing or the product won’t be enough to make a customer cancel.

For example, a customer might be fed up with issues they’re having configuring automation in their software and decide in a fit of rage that cancelation might be appropriate.

Remembering, however, how helpful the support team was during onboarding, they might instead decide to see if they’ll be able to help.

By offering the customer quick guidance on how to set up automation in the software, the customer service team can save the relationship and turn the negative experience into a positive one.

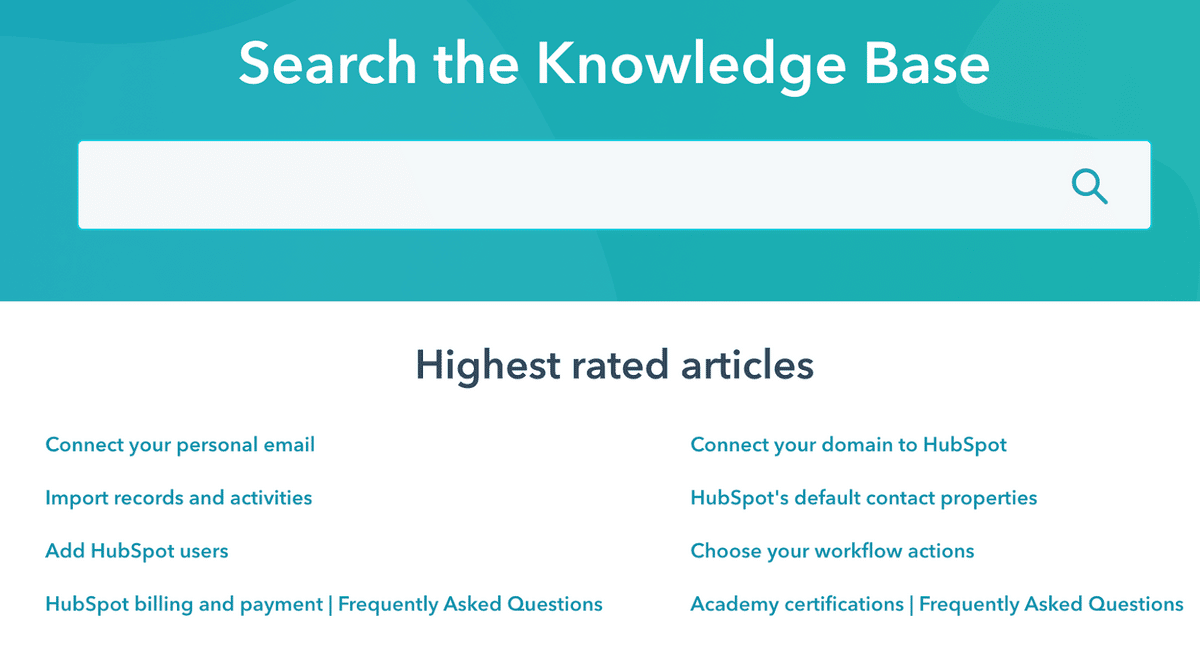

Remember that customer support isn’t only your team of agents. It’s also your self-service options like video tutorials and how-to blog posts.

HubSpot has a fabulous searchable knowledge center with answers to almost every billing and product question customers might have, allowing them to easily solve whatever is bothering them:

Source: HubSpot

These self-service options ensure that your customers can get the help they need without having to contact a member of your team, something some of your customers won’t want to do, regardless of your support team’s charm and charisma.

How to Reduce Involuntary Churn

Subscription-based businesses can reduce involuntary churn by using account updaters, automatically retrying failed payments, and following up on failed payments. Let’s take a closer look at each strategy!

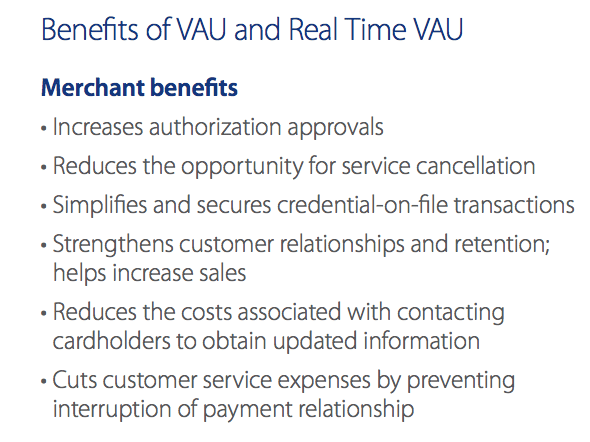

Take Advantage of Account Updaters

An account updater is a program that sends automatic notification updates for a customer’s card information in your system whenever it changes or expires.

The four major credit card issuers (Visa, Mastercard, Discover, American Express) all offer these programs, as do many payment gateway providers.

Taking advantage of account updaters is an excellent way to reduce the involuntary churn rate caused by incorrect card information.

Here’s how Visa describes the benefits of using its account updater:

Source: Visa

When you have an updater, if a customer were to get a new security code on their credit card, that alteration will be reflected in your system automatically.

The same goes for updates in addresses, card numbers, expiration dates, and other payment details.

If you didn’t have an account updater, the payment would hard decline and you’d then have to reach out to the customer to figure out what went wrong.

If the customer doesn’t answer, or if you had no staff to reach out in the first place, the subscription would be canceled after some time, and you’d lose a customer to something easily preventable.

In sum, when you get an account updater, you can rest easy knowing that your customer’s card information is accurate and ready for transactions.

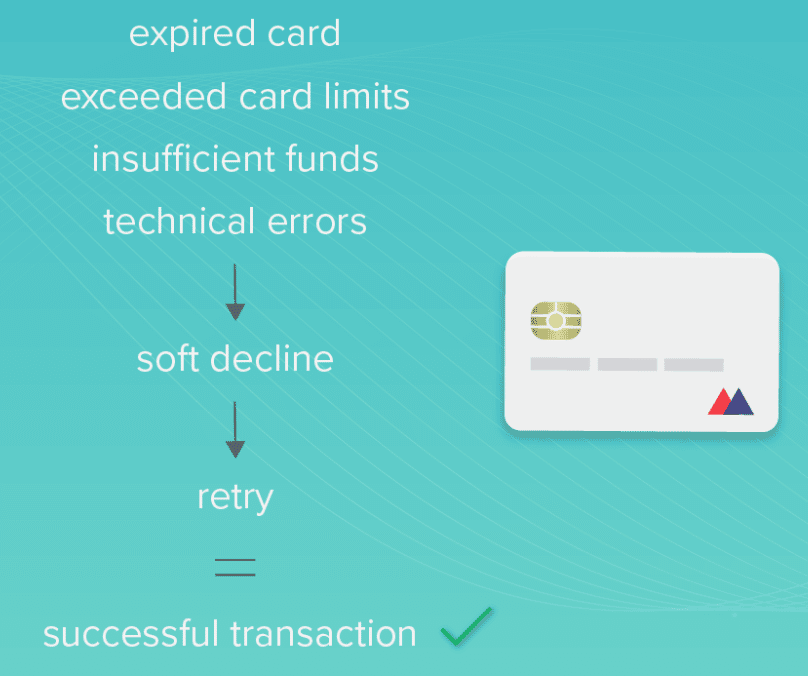

Automatically Retry Failed Payments

Another safeguard against involuntary churn caused by failed payments is to institute automatic payment retries.

With this approach, every time a customer’s payment fails, your system will automatically retry the payment method after some defined interval, without getting the customer involved.

Retries work well because a lot of the time customer card payments fail due to some reason they can easily fix.

Source: Straal

For example, there might’ve been a temporary technical network error that resolved itself in an hour.

Some other reasons might be that the customer has insufficient funds in their debit account, exceeded credit card limits, or an expired card, all of which a customer can fix almost instantly.

Churnbuster says that around 21% of failed payments will be resolved in the first couple of days by retrying the same card.

As a rule of thumb, set up your retries in your billing system to occur at least three times over the time span of five days. That should solve the majority of your customers’ soft declines.

Follow Up on Failed Payments

Sometimes, even with automatic retries and an account updater, you’ll still encounter card declines that can lead to involuntary churn if they aren’t handled.

So always follow up on failed payments. Get in touch with the person over email or phone to figure out and resolve the payment issue.

Often, you’ll find that your customers just need a reminder email to update their credit card information in their payment portal with your business.

To ensure you reach your customers, consider expanding your outreach methods to include text messages or in-app notifications.

Regardless of which channel you’re using, it’s important to keep your message straightforward and friendly.

Ask them politely to check their payment information, and provide a link to their account to do so.

A failed payment can be embarrassing and stressful, so make the experience as pleasant as possible for your customers by being understanding.

If you do automatic retries, tell the customer not to worry and that you’ll retry the payment over the next couple of days, as Spotify does in their emails:

Source: Customer.io

Also, tell the reader how long you’ll keep their account open before they lose access. And, suggest that it might be an error on your end, as Stitch Fix has done below:

Source: Customer.io

When you always remind your customers to update their billing information after a failed payment, you increase protection against involuntary churn.

Conclusion

Taking the time to understand the nuanced differences between voluntary and involuntary churn, as well as the available strategies counteracting them, will help you increase retention rates for your subscription-based business.

As a reminder, voluntary churn is when a customer, of their own accord, cancels their subscription, while involuntary churn is when a customer’s subscription is canceled without their approval.

In the case of voluntary churn, the solutions for preventing it include offering your customers more flexibility and doing your best to improve your service and the relationship you have with them.

When it comes to the latter, you can leverage various forms of automation to ensure that your customers remember to prolong their subscriptions.

For more ways to reduce churn in your small business, check out our article on the best churn management strategies, where you’ll find easy-to-implement methods like transparency in the sales process and customer segmentation.