It’s essential for service-based small businesses to offer their customers multiple online payment options.

In addition to credit cards and e-wallets, two of the most common forms of cashless payment are ACH credit and ACH debit.

In 2021 over $72.6 trillion was transferred through the ACH network.

That’s a year-over-year increase of 17.4 percent. Businesses, especially subscription-based ones, are prioritizing them because they’re fast, secure, and require low processing fees.

Although similar, ACH credit and ACH debit have their differences. In this article, we’ll reveal the most significant of those differences, and also define each type of payment.

We’ll also help you choose which one is right for your specific business.

- What Is ACH Credit

- What Is ACH Debit

- ACH Credit vs. ACH Debit: Key Differences

- ACH Credit vs. ACH Debit: Which Should You Choose

- Conclusion

What Is ACH Credit

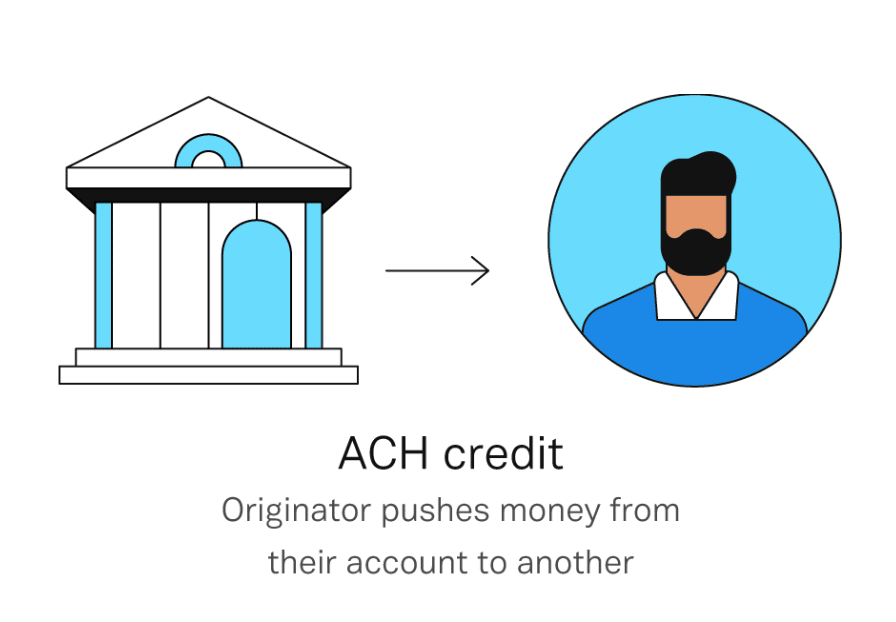

ACH credit is an online payment method where the payer requests that the Automated Clearing House (ACH) network transfer funds from their bank account to the seller’s bank account.

It’s like the payer is sending the recipient a digital check.

Digital is a keyword here. The payment process takes place entirely online, so there’s no need for the payer or the payee to visit a bank or fill out any paperwork.

While it is electronic, the payment is still not immediate.

These payments usually take 1-2 days to process completely because the bank has to send the ACH request, verify there’s money in the payer’s account, and wait for the receiving bank to approve the request.

ACH credit is sometimes referred to as a push transaction. That’s because the payer has the ability to push funds into the payee’s account at the payee’s discretion.

Source: Plaid

There are many examples of ACH credit payments, from customers paying businesses to companies paying their vendors.

If you’ve ever had an employer pay you through direct deposit, it’s likely that it was done with an ACH credit transfer.

If you received a stimulus check from the government, it is likely that it happened through ACH credit as well.

Payers usually do so through a secure website or payments app, where you input the required bank account details.

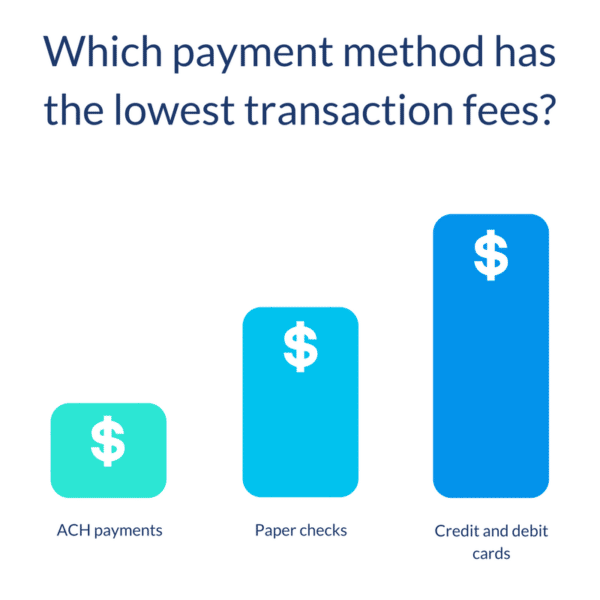

The benefits of using ACH credit to receive payments include quick payments, low human error, high security, and low fees when compared to processing fees associated with credit and debit card payments.

Source: EBizCharge

To keep ACH credit separate from ACH debit in your mind, remember that with ACH credit, the payer initiates the transaction.

For ACH debit, it’s the payment’s recipient who kicks off the payment process.

Now, let’s go over the definition of ACH debit so you can better understand how they differ.

Don’t Limit Your Customer Pool!

Offer Multiple Payment Options Seamlessly

What Is ACH Debit

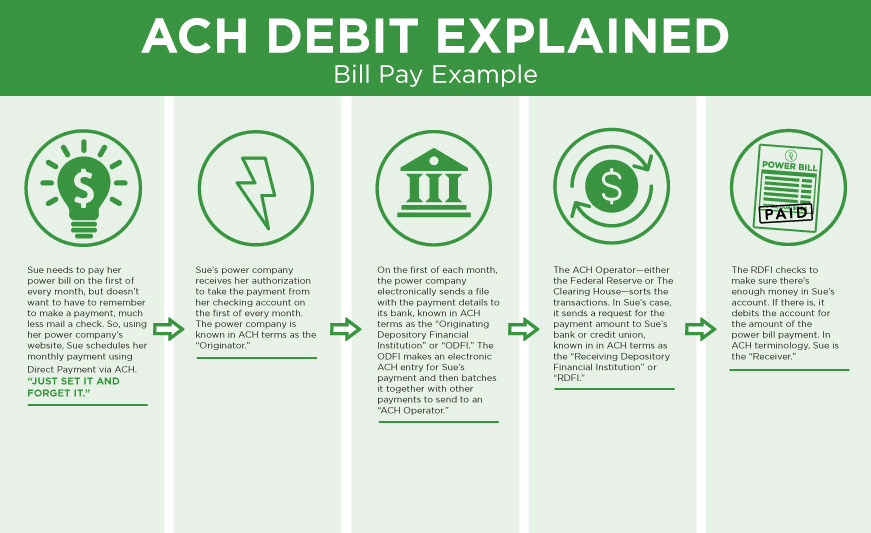

ACH debit is an online payment method where the recipient requests to withdraw funds from the payer’s bank account into their own bank account.

While ACH credit is a push transaction, ACH debit is a pull, since the payee is initiating the transaction and asking to pull money out of the payer’s account.

Like ACH credit, this all takes place online. No paperwork or trips to the bank are necessary, so you end up saving time and reducing costs.

How it works is pretty simple. During ACH debit transactions, the recipient, the person owed the money, sends a payment request to their bank, which is routed through the ACH network to the payer’s bank.

The payer’s bank then deducts the required amount of funds from the payer’s account and sends it to the receiver’s bank.

This is quite popular among utility companies, as discussed in the example below:

Source: Eagle Business Software

In order for this transaction to occur, the receiver has to send the payee their account and routing numbers beforehand.

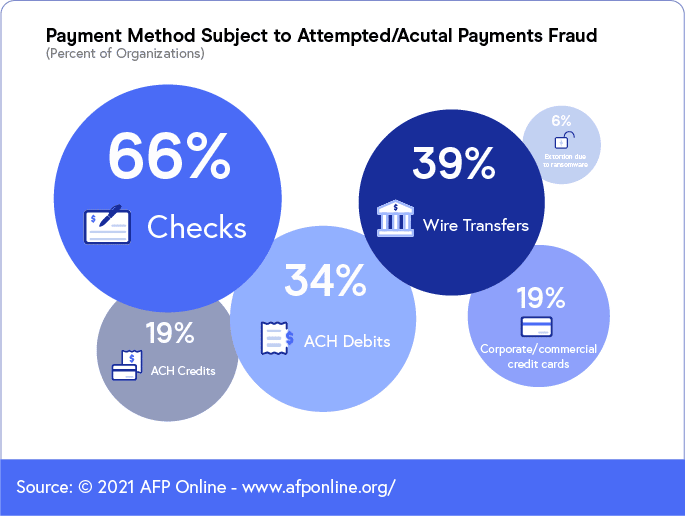

This makes ACH debit transactions a bit less secure than ACH credit transactions, but both ACH payment types are still more secure than most other payment methods in terms of their defense against fraud, as long as you’re following best practices.

Check out this guide to make sure you’re taking the right precautions to ensure safe ACH transfers.

As for the speed of payment, ACH debit payments aren’t instant. It typically takes about 3-4 days for the funds to appear in the recipient’s bank account.

Banks also process ACH debit payment requests in batches, typically about three times per day, so when you initiate the payment does matter. The earlier in the day, the better.

Sometimes, ACH debits can fail, prolonging the payment. This is rare, but when it occurs, it’s usually because of one of the following reasons:

| The ACH file was submitted in an incorrect format. |

| The payer doesn’t have enough money in their account to cover the payment. |

| The payer provided the wrong routing and/or account number. |

Overall though, ACH debit payments are secure, cashless, and cost-effective, as they have lower processing fees than most credit card, debit card, or wire payment transactions.

They can be a great way to collect money from your customers through recurring billing.

ACH Credit vs. ACH Debit: Key Differences

The fundamental difference between ACH credit and ACH debit is that they are initiated by different parties.

ACH credit payments are initiated by the payer (the sender of the funds) and ACH debit payments are initiated by the payee (the recipient of the funds).

That’s why people often call ACH credit payments push transactions and ACH debit payments pull transactions.

In addition to this major difference, there are some others to keep in mind. Here’s a graph outlining the key differences between ACH debit and ACH credit:

| ACH Credit | ACH Debit | |

| Initiator | Payer, or customer | Payee, or business |

| Push vs. Pull | Push transaction | Pull transaction |

| Transfer Duration | 1-2 days | 3-4 days |

| Security | Slightly more secure | Slightly less secure |

First, ACH debit transfers tend to take a bit longer (3-4 days) than ACH credit transfers (1-2 days).

Second, ACH credit is slightly more secure than ACH debit because fewer bank account details need to be shared.

With ACH debit, the recipient has to provide their bank’s account and routing numbers to the payer.

Source: EBizCharge

Keep in mind that duration and security differences are minor in consequence.

What you really need to know is that ACH credit puts the burden of transfer initiation on the customer, and ACH debit puts it on the recipient, allowing them to pull funds from the customer’s account as long as the customer has consented.

Which works better for your business depends primarily on whether a push or a pull transaction will fit more neatly into your payments process.

Decrease Non-Payment By 75%

With Flexible Payment Plans!

ACH Credit vs. ACH Debit: Which Should You Choose

Businesses can benefit from both ACH debit and ACH credit payments. Some companies even choose to use both, picking the right one for specific situations.

Your optimal choice depends on your specific needs. Does your payment process work better when you initiate the payments or when the customer does it?

If it’s the former, you’re probably better off using ACH debit, since it’s the recipient who initiates the request for a funds transfer from your customer’s bank to yours.

If the answer is your customers, then ACH credit is likely the better option, since ACH credit requires initiation by the payer rather than the payee.

Many subscription-based businesses love using ACH debit because it allows them to draw money from the bank accounts of their customers every month, provided that the customer has accepted these terms.

That means the customer doesn’t have to initiate the payment, and the chances of forgotten or late payments decrease, as long as your accounting team has its act together, of course.

Not to mention, customers will likely appreciate this method because it takes work off their plates.

They don’t have to devote mental energy to remembering to pay their monthly bill, and they don’t have to spend time doing it.

Here’s a video outlining some of the benefits of using ACH debit for recurring payments:

Source: Nacha

These businesses might still send invoices to their customers to remind them that the payment is occurring, so as not to leave a customer surprised about missing funds in their account.

There are, however, other factors to take into account when deciding between ACH debit and ACH credit.

Your level of aversion to security risks like payment fraud will also determine which you should choose since ACH credit payments have a slightly lower risk of security issues than ACH debit.

And keep in mind that ACH credit transfers often complete a few days faster than ACH debit transfers. So if you want your money quickly, ACH credit might be the way to go.

In sum, some businesses will use both ACH debit and credit. Some might choose just one.

When deciding, think about whether you want it to be you or the customer who initiates each payment, and also think about how much you value security and transfer speed.

Conclusion

Accepting ACH payments, debit or credit, can provide your business with numerous benefits, from increased payment security to lower transaction costs.

As a reminder, ACH payments come in two forms: debit and credit. ACH debit is a pull transaction initiated by the payer, while ACH credit is a push transaction initiated by the payee.

Subscription-based businesses should include one or both into their bouquet of payment methods in order to delight customers with their flexibility.

If you want to start using ACH for payments, check out our article on things to know before setting up ACH billing in your business.

Accept Payments Online, Right On Your Website!

Streamline your checkout process, offer payment plans, and more!