Optimizing accounts receivable management will have a beneficial effect on many other aspects of your business.

Accounts receivable that are organized ensure that you can predict and plan revenue for your business. In other words, you can count on a stable core of your business that is ready for whatever the market throws at it.

In this article, we’ll examine what goals you should accomplish when optimizing your accounts receivable. Keep them in mind, and your finances will be in top shape.

Automating Your Billing Process

Implementing automation in your billing process is considered one of the best practices for businesses of any scale.

Even the most basic forms of automation can immensely improve your billing process. You can avoid errors and save time and money by automating a recurring billing system, payment reminder emails, creating and sending invoices, and payment processing.

All of these factors have a great impact on tracking your accounts receivable because payments are made quickly and without a hitch, continually reducing the amount of money tied up in unpaid invoices.

In addition to various others, you can find these features in automatic billing solutions. For example, with software like Regpack, you can automate your billing process and still maintain the necessary control over it and keep it personalized.

Source: Regpack

Automating your billing process is a simple way to optimize your accounts receivable, but the benefits are far from negligible; they can improve the whole business, let alone one department.

Sending Invoices Promptly

There are many reasons to send invoices promptly, but one of the most significant for your business is getting paid faster. The math is simple—the sooner you send an invoice, the sooner the client will pay.

Of course, it isn’t always that straightforward; some clients have their payment cycles and pay their invoices in batches. Regardless, if you prolong invoicing, you may miss a cycle, which can result in cash flow issues.

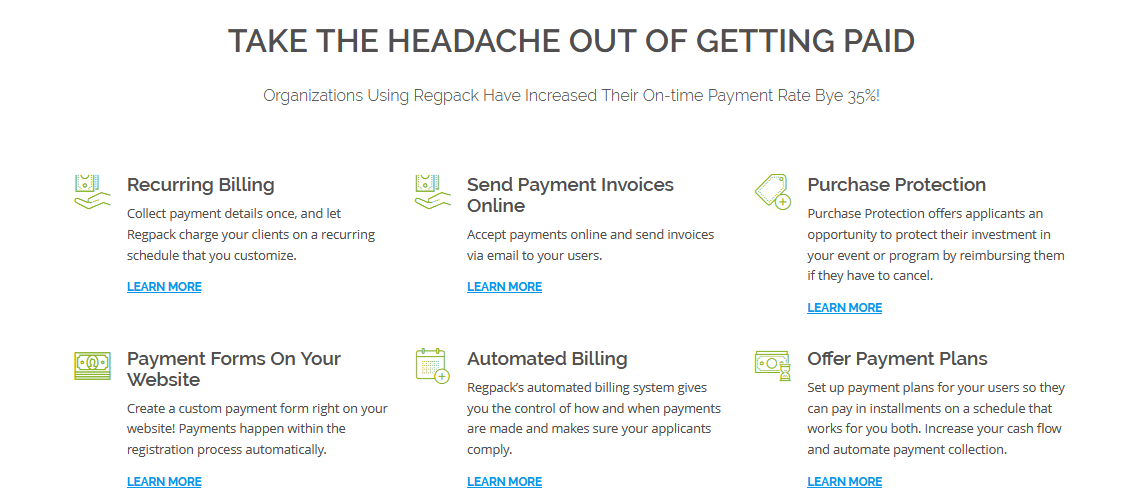

The issue of late payments isn’t something to be disregarded; according to an analysis by Brodmin, almost a third of businesses have encountered problems because of it.

Source: Regpack

Promptly invoicing your clients is an efficient and professional way to ensure a steady stream of revenue. Therefore, it should be one of the vital goals to achieve with your accounts receivable optimization.

Setting Earlier Due Dates

Some clients may need a longer period than others to make their payments in a timely manner, and that’s understandable.

For example, customers with smaller debts may not need 60 days to pay an invoice, yet without a deadline, they can unnecessarily procrastinate on making payments, thus hurting your revenue.

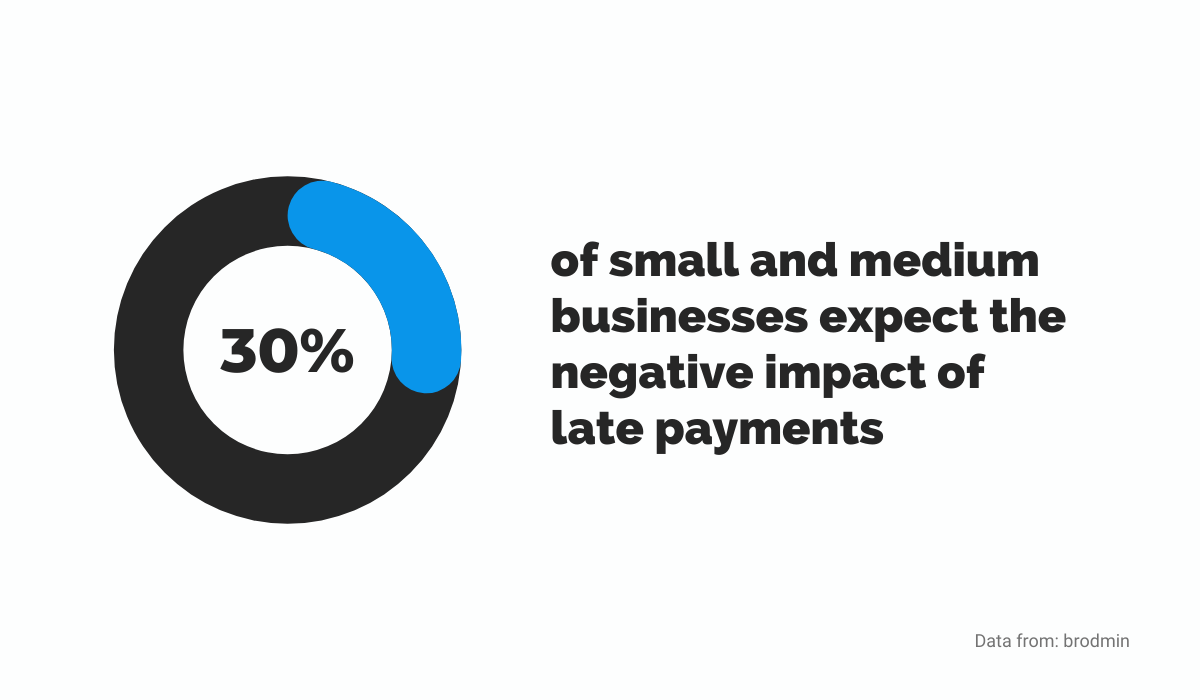

You can try incentivizing your clients to pay earlier by offering them discounts for fast payments. In the example below, you can see that the client can receive a 2% discount if they pay within ten days; otherwise, the due date is 30 days, and it doesn’t come with a discount.

Source: fitsmallbusiness

You can experiment with different due dates on your invoices and find a balance between an earlier due date and still giving your clients a reasonable amount of time to pay.

Billing Customers Online

Online billing is a standard in today’s business world, and if you’re not practicing it, that should be one of your goals for accounts receivable optimization.

There’s no comparison between online billing and sending paper invoices by mail regarding speed and simplicity.

The former is instant, while snail mail is called that for a reason. Likewise, it’s much more convenient and simple to bill customers online. There’s less hassle with creating and sending invoices, not to mention the ease of keeping records of payments when you have everything in one place.

An automated billing solution like Regpack is a natural fit for online billing. You can accept payments on any device, and it keeps track of every client and their payment status.

There’s no reason to stick to the outdated, slow, and unreliable process of billing your customers offline when there’s a better alternative at your fingertips.

Decrease Non-Payment By 75%

With Flexible Payment Plans!

Extending More Payment Options to Customers

The more payment options you offer to customers, the more convenient it is for them to pay.

If you’re billing your customers online, there’s no point in offering them only checks or cash as payment options, as they’re not the most suitable for online billing.

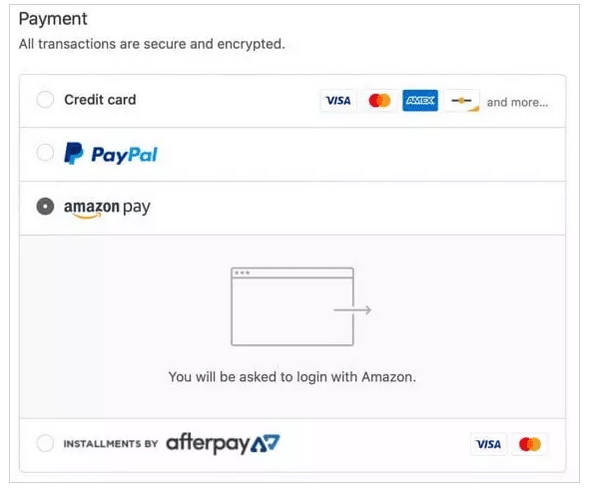

For example, big companies offer at least a few popular payment options to their customers.

Source: practicalecommerce

As you can see, Amazon accommodates a wide range of payment options, including multiple credit cards, debit cards, PayPal, Amazon Pay, and installment payments through Afterpay, thereby meeting the needs of the vast majority of their customers.

Offering multiple payment options to your customers can make doing business easier for them and you. Consider that one of the crucial goals to accomplish in accounts receivable optimization.

Sending Reminder Emails

When the payment is due or already late, you should remind your customers to settle their debt with a well-composed email.

That’s equally important for maintaining a good revenue stream and customer relationships.

Optimizing your payment reminder emails is easier with an automated payment solution.

For instance, with Regpack, you can compose your reminder emails, personalize them according to the customer you’re sending them to, and set up a trigger to send them automatically.

Source: Regpack

That way, if the customer is late on their payments, they’ll receive your reminder email without you manually sending it to them.

Sending reminder emails on a regular basis is important, but it can be tedious and time-consuming. Optimizing the process as described above makes a world of difference.

Maintaining Accurate Customer Information

Failing to give proper attention to the accuracy of your customer information is a grave mistake.

Even the simple thing as one client who starts to use a new email address without you knowing about it can set back your revenue. Invoices wouldn’t get delivered, payments would be late, and your accounts receivable team would need to spend precious time uncovering the problem.

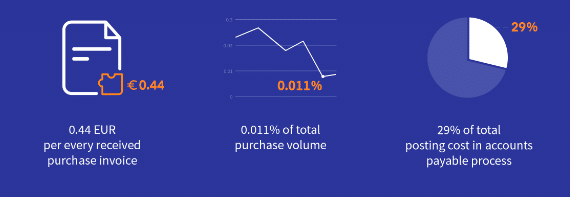

Besides time, inaccurate customer information can cost money. According to research done by Qvalia on Nordic companies, payment errors cost them 0.44 EUR on average for every processed invoice.

Source: Qvalia

In other words, because of wrong customer information, those companies lost 0.44 EUR on every invoice.

Regularly checking and updating customer information is one of the most important accounts receivable goals you can accomplish during optimization. By having that under control, you lay a foundation for the financial stability of your business.

Establishing a Credit Approval System

Having clear and concise policies for issuing credit can be very effective for your business.

When to approve credit, when to override limits or put outstanding accounts on hold, and how to enforce these policies are all vital issues to consider if your goal is to establish an efficient credit approval system.

Furthermore, you should determine the criteria for deciding if the customer is suitable for credit and to what amount. For example, you can ask them for their financial documentation or credit score.

Every business should be careful with their assets if they want to survive and improve—that also applies to approving credit terms to customers. A good credit approval system can significantly reduce financial risks.

Don’t Limit Your Customer Pool!

Offer Multiple Payment Options Seamlessly

Reviewing Customer Credit Lines

Most businesses deal with responsible customers who pay their invoices on time and those who regularly show that they can’t be trusted to respect due dates and settle their debts.

Their credit lines should reflect that.

By reviewing customer credit lines, you ensure that your regular customers who make timely payments reap the benefits. On the other hand, you can lower the credit limit for unreliable customers. That way, you maximize the chances of having higher and steadier revenue.

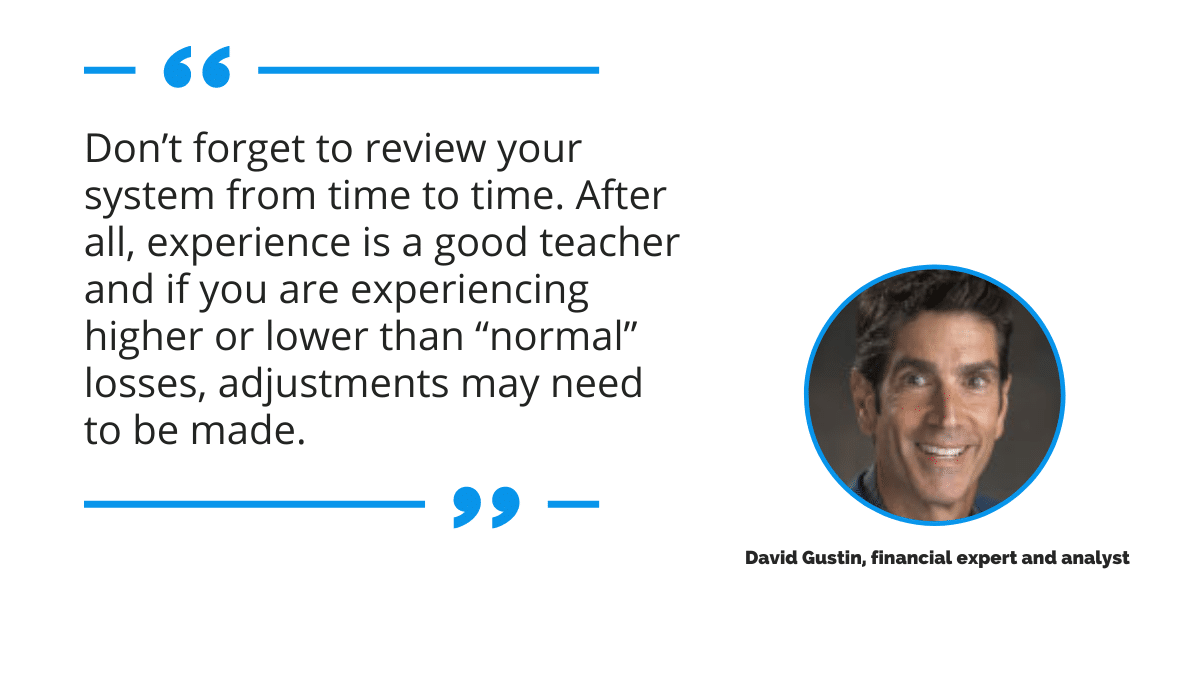

David Gustin, a financial expert and analyst, summed up the importance of reviewing customer credit lines.

Source: Regpack

Reviewing your customers’ credit lines is a sign of optimized accounts receivable, which doesn’t let your customers’ good or bad payment practices go unnoticed.

Updating Current Credit Policies

Credit policies shouldn’t be set in stone. Regularly updating them saves you a lot of financial trouble.

Updating your credit policies is needed because every business aspect tied to them is prone to change—companies grow, customers and industries change, as well as government regulations.

For example, if you have clients in high-growth industries like tourism, you may want to update your credit policies from time to time to reflect the state of that industry. You may even consider paying attention to updating the specific aspects of your credit policy like credit evaluation or the collection process.

By updating your credit policies, you can ensure that the payment terms you offer to your customers are realistic and in line with the current state of the market.

Staying On Top of Errors

Errors can happen even in the most smoothly run accounts receivable departments. The goal of optimization isn’t to eliminate the errors but to find a way to deal with them effectively.

That’s important because errors can be costly, and it can take a long time to notice and fix them. According to data from Qvalia, in the 26 million analyzed invoices, one in four invoice errors passed undetected.

Source: Regpack

Whether there are errors within the invoice-sending process, you receive complaints from the customers, or you suffer from another issue from a vast catalog of possible ones, a good way to stay on top of them is to record them.

That way, you can be aware of them and optimize the process accordingly.

Establishing a System for Resolving Billing Disputes

The majority of small businesses sooner or later encounter a customer who’s disputing their bill; it isn’t a question of if, but when it happens.

And when it does, an optimized finance department should have a system to resolve it.

Whatever the reason for the potential dispute, a system of keeping records of correspondence with your customers, proofs of delivery, and financial documentation can help you get to a resolution effectively.

Of course, it’s better to avoid disputes than to try to resolve them. Informing your customers beforehand on all of the terms can prevent their complaints. Also, including all the necessary information on your invoices is beneficial as well.

That way, you can always refer to the information on your invoice if it comes to a dispute.

A good system for dispute resolution is vital in maintaining customer satisfaction and keeping a professional attitude when disputes arise.

Getting to the Bottom of Common Problems

There’s nothing wrong with dealing with problems in the accounts receivable process as they show up. However, you should strive to resolve problems at their root.

You can track the origin of most problems by investing time in identifying processes that lead to them. For example, even if you have an automated billing solution that sends invoices to customers, one wrong letter in their email address can cause payment delays.

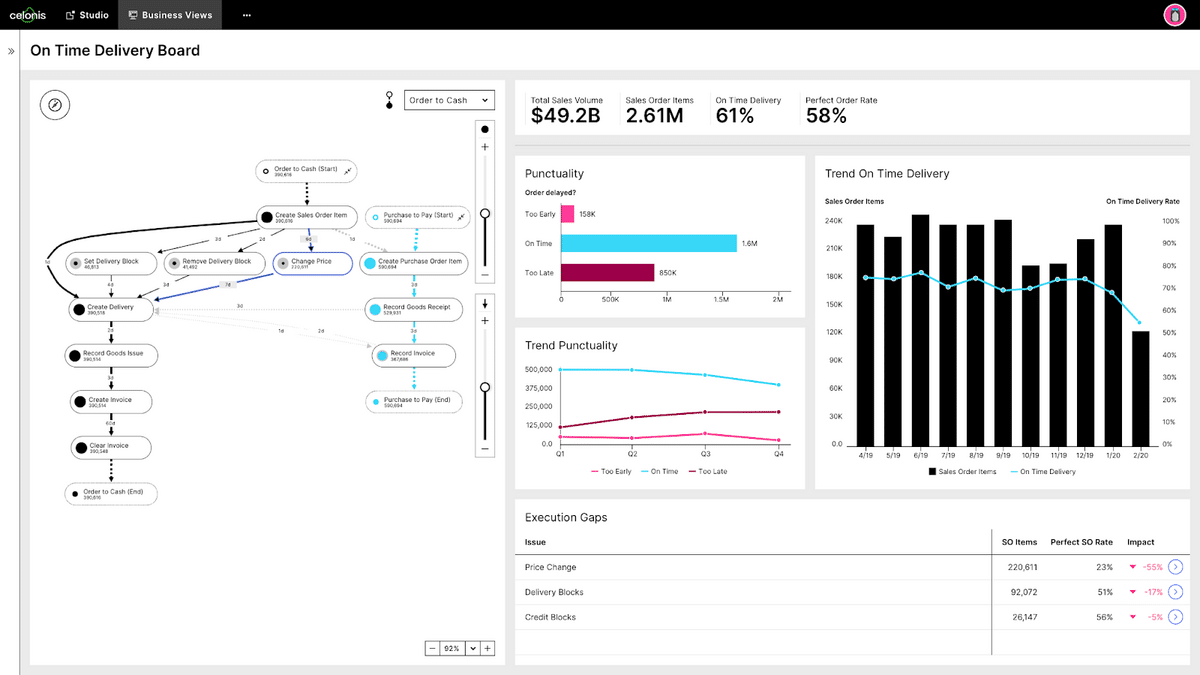

However, you can use more advanced solutions like process mining to analyze your business processes and extract information from them.

Source: celonis

Process mining software, like Celonis above, can find problem areas in processes and highlight them, leading to the root cause.

Whether you opt for a more hands-on approach to getting to the bottom of problems or a highly advanced software solution, the crucial thing for your accounts receivable is to efficiently prevent those problems from constantly occurring.

Resolving issues before they arise not only addresses immediate concerns but also contributes to a culture of continuous improvement.

Providing Legal Training to Personnel

Accounts receivable personnel have to be aware of current laws, even if it’s just for providing credit to the customer. Because of that, it’s crucial to provide them with legal training as one of your accounts receivable department goals.

For example, if your business is in the US, your accounts receivable personnel should be familiar with the Fair Debt Collection Practices Act and both your and your customers’ rights under it.

Besides that, they should know the Consumer Protection Act, understand what legally constitutes the harassment of a debtor, as well as which information to always have in writing for legal purposes, etc.

Maintaining an AR team that stays informed about updates on laws and regulations can protect you from legal issues and prevent you from having to pay unnecessary fines.

Incentivizing the Staff in Charge of Accounts Receivable

Working in accounts receivable isn’t always a walk in the park; it can be a taxing job with many responsibilities. That’s why you should have incentives for the staff. Taking steps to make your workforce happier is always a step towards optimization of any work process, including accounts receivable.

Effective accounts receivable staff handles the responsibility of managing the revenue of your business. This is why it is essential to keep them motivated and satisfied. Incentives can go a long way in showing them that their work is appreciated.

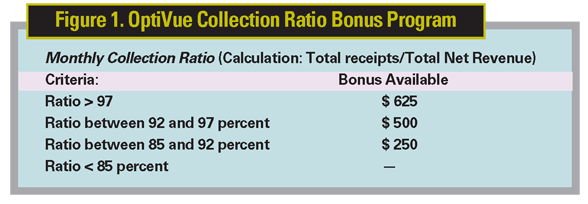

Incentives can come in many forms, and one of them is financial.

Source: reviewofophthalmology

In the example above, the accounts receivable staff members receive a monthly bonus depending on their efficiency in collecting payments from clients. The more they collect, the bigger the bonus is.

That’s just one example of a possible incentive. Every business owner should know what motivates their staff the most and try to form that into an incentive for reaching performance goals.

Minimizing Collection Agency Involvement

Despite all your efforts to collect payments on time, some of your customers may still fail to pay before the due date. For those cases, your accounting department should have a goal to minimize collection agencies’ involvement.

Those agencies can help recover debts, but they require compensation for their services, so you lose money one way or the other.

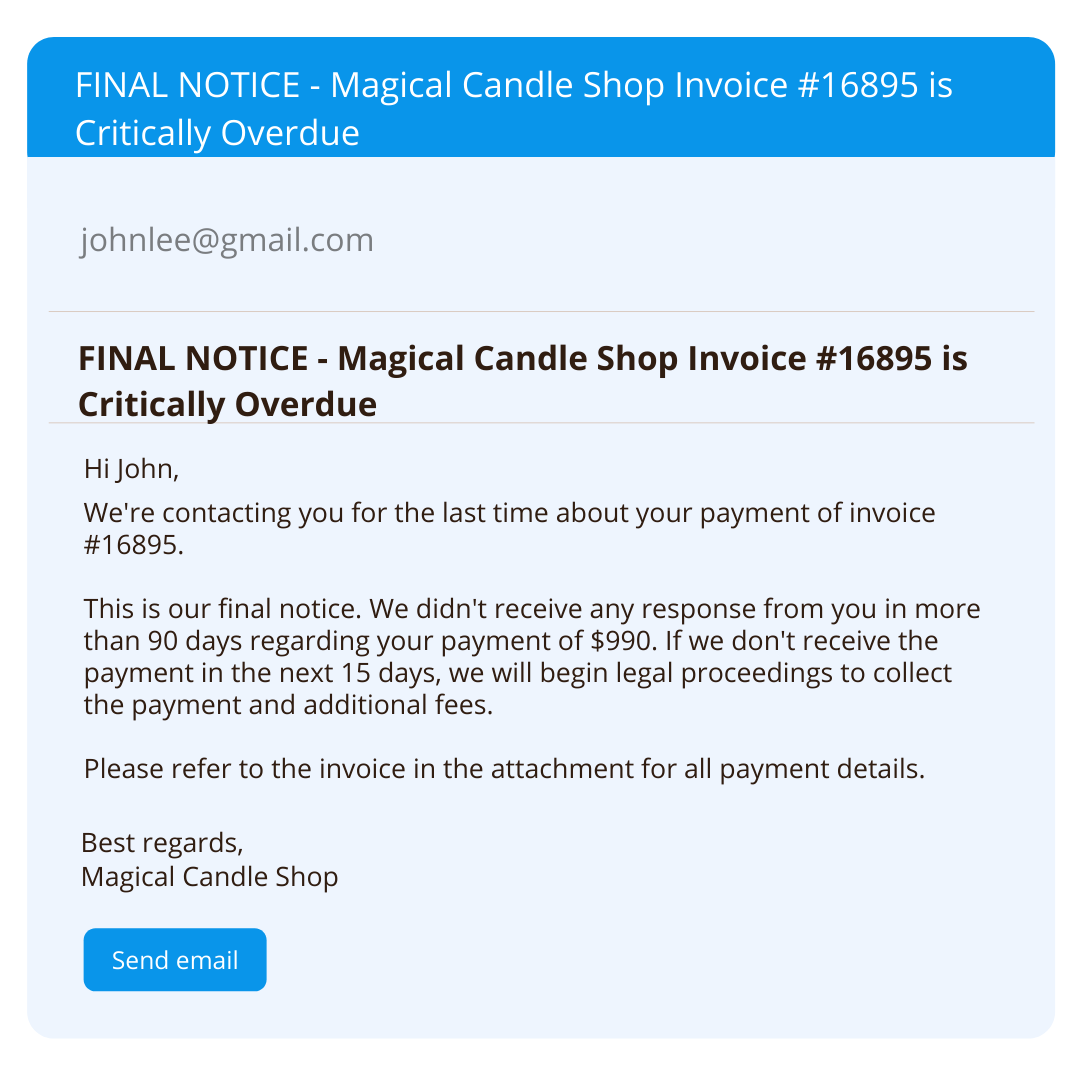

That’s why the optimized accounts receivable should have a system of dunning emails that warn customers multiple times of their late payments, like the one below.

Source: Regpack

As you can see, this is an example of the last warning email. All details about the late payment are included, and the consequences are clearly stated. An email like this can be effective, especially if the client wants to avoid legal action.

Having a system of multiple warning emails for different stages of late payment is one of the ways to minimize the involvement of collection agencies.

Adjusting Your Bad Debt Reserve

Many businesses have a bad debt reserve—a certain amount of receivable balance they don’t expect to collect. That gives them the buffer that helps to mitigate the effects of actual unpaid invoices.

One of the ways to calculate how much to put in a bad debt reserve is to use a percentage of revenue. Therefore, accounts receivable staff should adjust your bad debt reserve according to the situation and maintain a good balance between too low and too high bad debt reserve.

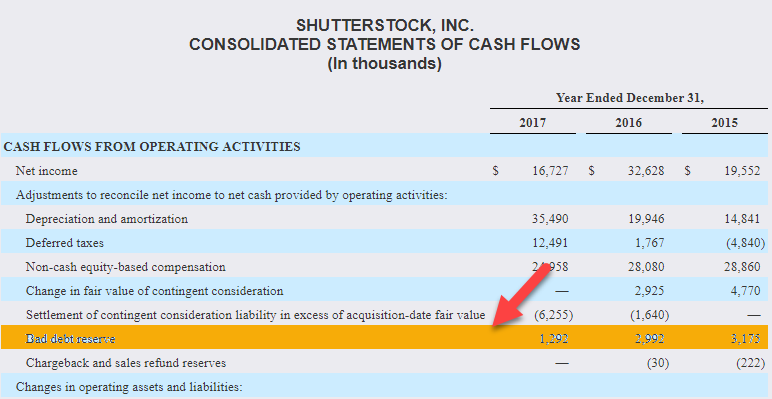

Here’s an example of a bad debt reserve stated on a cash flow statement from Shutterstock.

Source: wallstreetmojo

As you can see, they adjusted their bad debt reserve; it’s different for every year listed on the statement.

Adjusting bad debt reserves according to business performance can be helpful to avoid losing profit; that’s why it’s a goal accounts receivable optimization should accomplish.

Conclusion

The state of accounts receivable can reflect on the whole business. If they’re well-organized, the finances are healthy, the customer relations are thriving, and the employees are happy.

On the other hand, if they’re a mess, the opposite is true.

A good question is how you can know where you stand with your accounts receivable; one of the ways to see that you’re on the right track is by accomplishing the goals we discussed in this article.

Reach all of them, and you can be sure that you have optimized accounts receivable.