It probably goes without saying: if you’re running a business, you need to make money.

That’s why accounts receivable management—or the process of making sure you receive customer payments correctly and on time—is crucial. It can mean the difference between a booming business and one that crashes and burns.

Effective accounts receivable (AR) management is crucial for maintaining a healthy cash flow and ensuring the financial stability of your business. By optimizing your AR processes, you can minimize outstanding invoices, reduce late payments, and improve overall cash flow.

- What Is Accounts Receivable Management?

- Accounts Receivable Management Process

- Accounts Receivable Management Best Practices

- Your Business Needs Proper Accounts Receivable Management

What Is Accounts Receivable Management?

Accounts receivable are one of the most important elements of a company’s balance sheet. So, effective management of this measurement is critical.

Accounts receivable management involves monitoring and controlling the money owed to your business by customers for goods or services purchased on credit.

If your company sells goods or services on credit, you need a reliable process for managing your accounts receivable; otherwise, you’ll have no way to:

- Keep track of the money you’re owed

- Avoid cash flow issues

- Calculate future revenue

- Outline your predicted profits to potential investors

Accounts receivable directly impact future cash flow. Without providing credit to customers, transactions would stall, and you’d lose important customer relationships.

A properly managed accounts receivable process ensures your company receives timely payments, which is essential for maintaining a healthy cash flow and financial stability.

Accounts Receivable Management Process

Accounts receivable management is about more than just sending payment reminders. It also involves discovering the reasons for late or missing payments, monitoring customers for credit risks, and fixing gaps in your payment process.

The process changes slightly depending on the industry and the company in question, but there are a few factors that remain constant in successful AR management.

Establishing a Customer’s Credit Rating

Before extending credit, assess the creditworthiness of your customers. This involves checking their credit history and financial stability to minimize the risk of bad debt.

Based on the applicant’s creditworthiness, you can then decide whether to do business with the customer on credit.

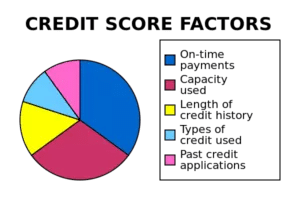

The factors involved in considering a potential customer’s creditworthiness include:

Source: Business Factors

These data points help determine how trustworthy and financially viable a customer is before you start doing business with them.

Invoicing the Customer

An invoice is a document that outlines the products or services provided, the costs, and the date the payment should be made.

In order to be paid on time and reduce the chance of unpaid invoices, you’ll need to send invoices promptly. Promptly sending invoices to your customers does more than giving them the information they need to make a payment. It also facilitates transparency and a positive working relationship between you and your customer.

Ensure that invoices are clear, and detailed, and include all necessary information such as payment terms, due dates, and contact information.

Tracking and Managing Payments

Your accounts receivable management system is only as good as your monitoring skills. Make it a point to review your receivable accounts as often as possible to stay aware of all the payments due and received.

An automated billing solution assists with the entire payment process, from invoicing to collecting and tracking payments.

Such an automated system makes AR tracking easier by reducing your team’s workload and making more time for following up on delinquent accounts.

It also automates many procedures, such as invoicing and payment reminders, to make sure important processes never fall through the cracks.

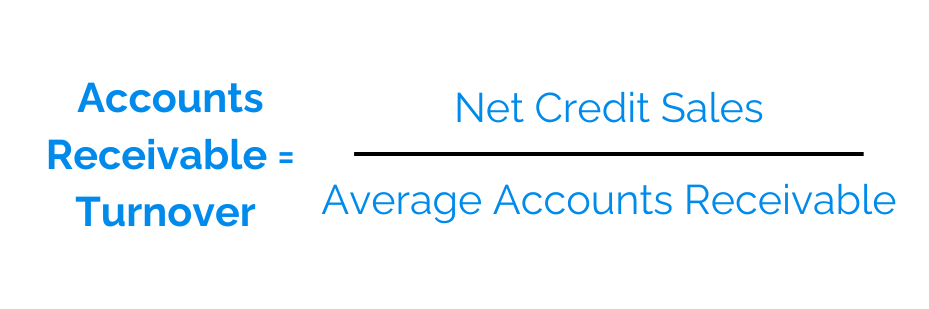

Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio is a key metric that measures how efficiently a company collects payments from customers. It calculates the number of times accounts receivable are collected and replaced within a specific period, usually one year. The formula to calculate the accounts receivable turnover ratio is:

A higher accounts receivable turnover ratio indicates that a company is collecting payments more quickly, suggesting efficient management of credit and collection policies.

It is important to monitor this metric to see how effective your company is at collecting payments from customers.

Accounts Receivable Management Best Practices

Now that you know the basic process of AR management, let’s look at a few best practices to help you save time and resources, get paid faster, and improve your customer relationships.

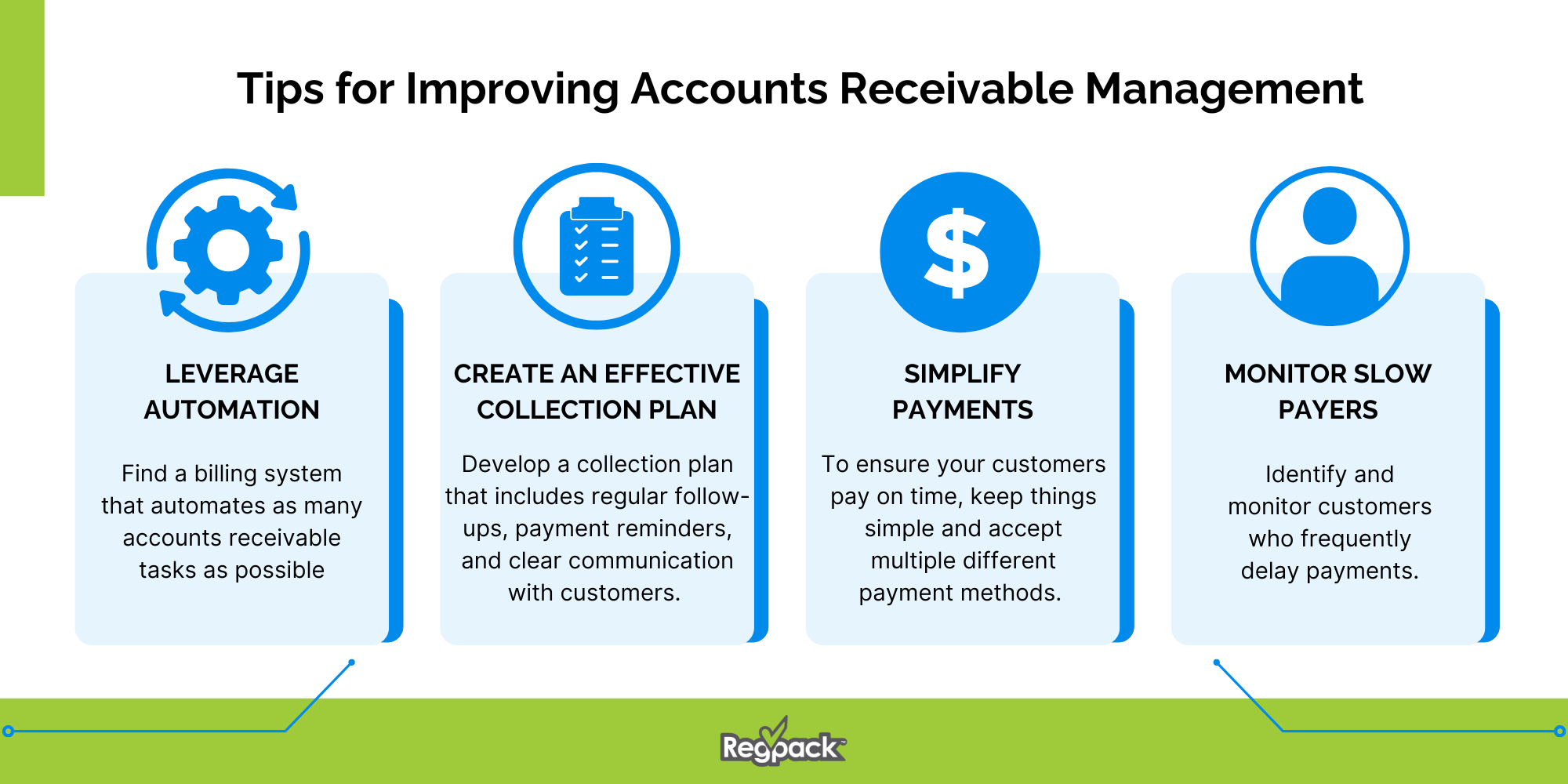

Leverage Automation

Using accounts receivable automation software makes sure all the repetitive tasks—like invoicing, accepting, tracking, and payment collection —get done promptly and accurately.

AR management is crucial, but it can easily become a full-time job. That’s why it’s important to find a billing system that automates as many accounts receivable tasks as possible, such as:

- Invoicing and bookkeeping

- Dunning management (i.e., late payment reminders and other related communications)

- Tracking customer payment and financial data

With the right software solution, you’ll eliminate human error and improve the efficiency of your team.

Source: Regpack

Create an Effective Collection Plan

Develop a structured collection plan that includes regular follow-ups, payment reminders, and clear communication with customers. This helps in maintaining a healthy cash flow and reduces outstanding balances.

You’ll need to come up with a system for dealing with payments, such as:

- How much interest will you charge for late payments?

- How many days past the due date will you charge a late fee?

- How will you get in touch with customers regarding late or missing payments?

- How frequently will customers receive communications (due date, one week overdue, three weeks overdue, etc.)?

- Do you have a template for payment reminder emails?

- How and where will the AR team record payment communications for your records?

Develop a set of policies that works for you, and then stick to it. Once an account becomes overdue, your AR team should be able to act on your established collection policy quickly and without hesitation.

Simplify Payments

To maximize the chances of your customers paying on time, keep things as simple as possible.

The less you make your customers work to complete the payment, the more likely they are to do it in a timely manner.

One way to simplify the payment process is to accept different payment methods, such as:

- ACH payments

- eChecks

- Debit and Credit Cards

- Electronic Payments

- Online Payment Portals

Offering a variety of payment methods is an easy and practical way to improve your customer experience. If they see their preferred method is available, they’re much more likely to make the payment right away.

Monitor Slow Payers

Identify and monitor customers who frequently delay payments.

The occasional late payment or processing glitch can happen to anyone—but some people regularly struggle with meeting their financial obligations.

For those customers who miss due dates frequently, the risk of future payment issues may outweigh the benefits of continuing that customer relationship.

Implement strategies to prevent slow payers, such as:

- Offer early payment discounts

- Adjust credit terms

- Reduce credit limits

- Ask for future payments upfront

Your Business Needs Proper Accounts Receivable Management

Saying that it’s important for a business to bring in money is an understatement. If you want reliable cash flow, improved revenue, and a positive customer experience, you need to track your accounts receivable properly.

The AR management process is about more than just keeping a spreadsheet of upcoming payments. It involves vetting prospective customers for credit risks, using effective invoicing strategies, and tracking and managing payments correctly.

And for the best results, you’ll need to monitor slow payers, simplify the payment process, and establish a consistent and effective collections policy.

How Regpack Can Help

Regpack offers receivable management services and a quality billing solution that leverages advanced automation tools to reduce manual processes.

Our solutions include automated invoicing, payment schedules and tracking, and collection management, ensuring that you receive payments in a timely manner.

Also, gain valuable insights into the exact transactions you want to see, based on date, company, and more.

By partnering with Regpack, you can focus on growing your business while we simplify your accounts receivable management.