Building a business from the ground up sometimes gets overwhelming since you have to consider each aspect of the company and ensure they all work well together.

One of the essential parts of setting up a business is budgeting. This might sound like a pitch for something, but it’s not.

Here’s why: running out of cash is the main reason why small businesses fail, and it’s preventable with good planning and a little effort.

Staying on top of your finances means knowing what you have, how you’re spending your money, and whether you can afford any unexpected expenses in the following year.

While this may sound complicated, it doesn’t necessarily have to be—it’s all about putting things down on paper and having a good overview of your past and future cash flow.

To make things easier for you, we bring you six tips on creating a budget for your small business.

Jump to section:

Examine Your Income Sources

Estimate Your Future Revenue

Determine Monthly Fixed Costs

Include Variable Expenses

Set Aside a Contingency Fund for Unexpected Costs

Put It All Together in a P&L Statement

Examine Your Income Sources

The first step to creating a bulletproof budgeting plan is having the correct understanding of your income.

Guesses won’t get you far and are not something you can rely on when it comes to your budget since you can come up with an amount that’s a far cry from the actual one.

If you overestimate your income, you’ll land in hot water in no time as your funds will dry out.

To understand exactly how much you’ve earned, look at all forms of income, i.e., sales and other forms of revenue.

Even though it will take a while to gather this data, it will pay off.

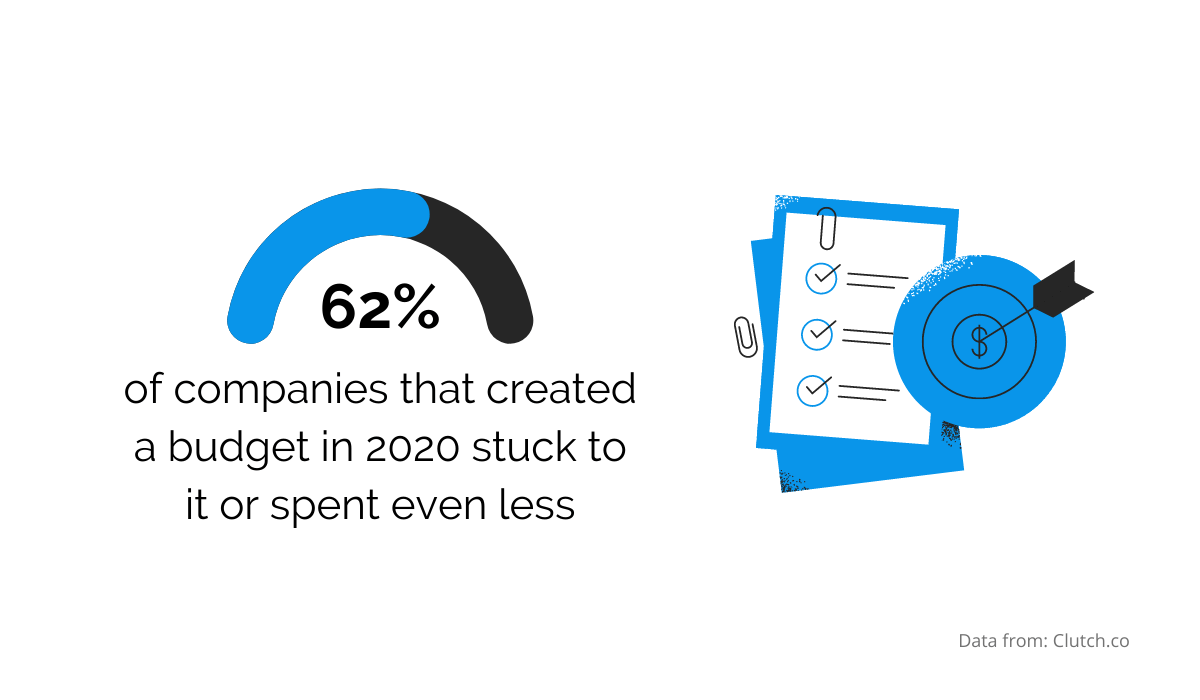

Research shows that most businesses that create a budget usually stick to it. However, half of all small companies failed to make one in 2020, which might have caused problems for many.

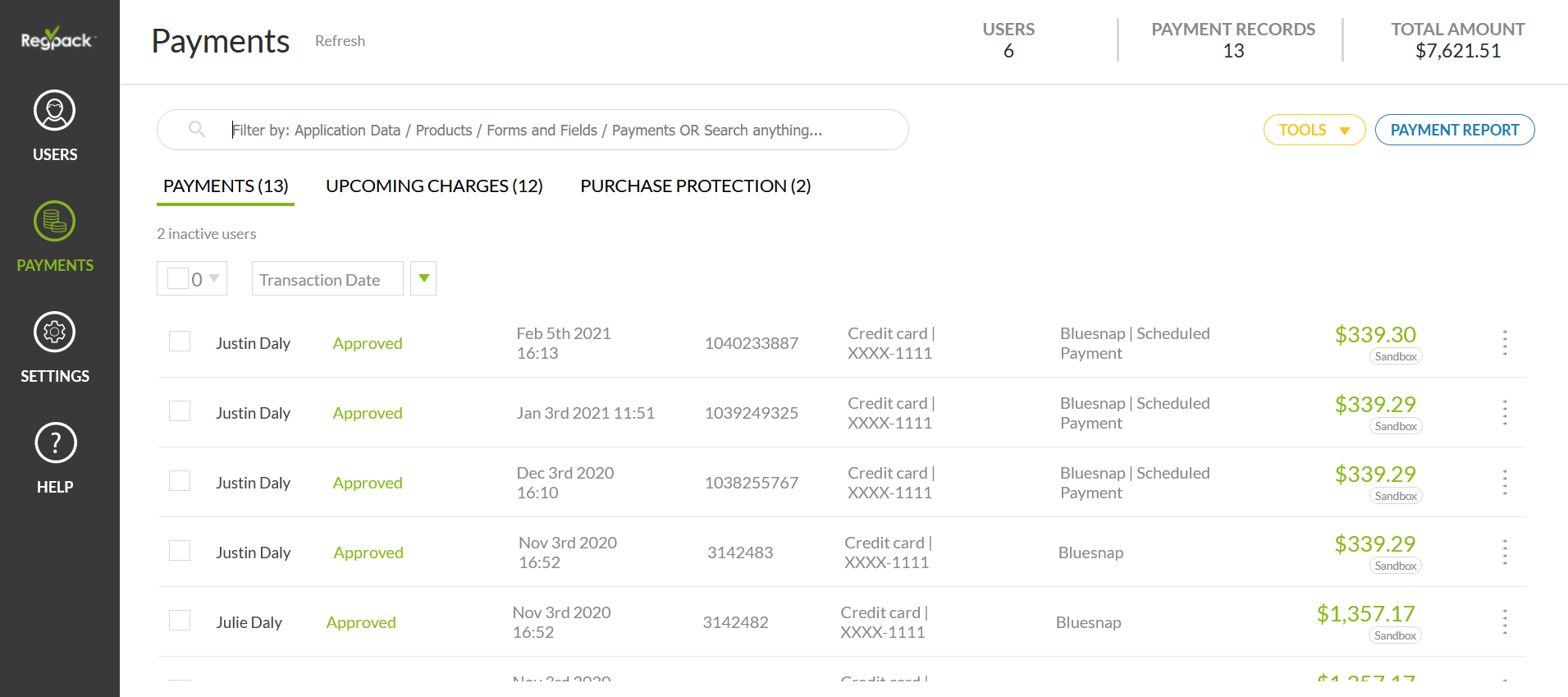

Source: Regpack

Clearly, you need a budgeting plan to ensure you don’t overspend, and the first step is to make a note of your income.

For starters, you need to go through your sales statements to see how much money you earn from sales each month or year.

If you’re doing business online or have a lot of customers, it might be a good idea to look into software, like Regpack, that lets you invoice and collect payments online.

By implementing this, you will be automating the management of your finances, while the information about payments will be readily available.

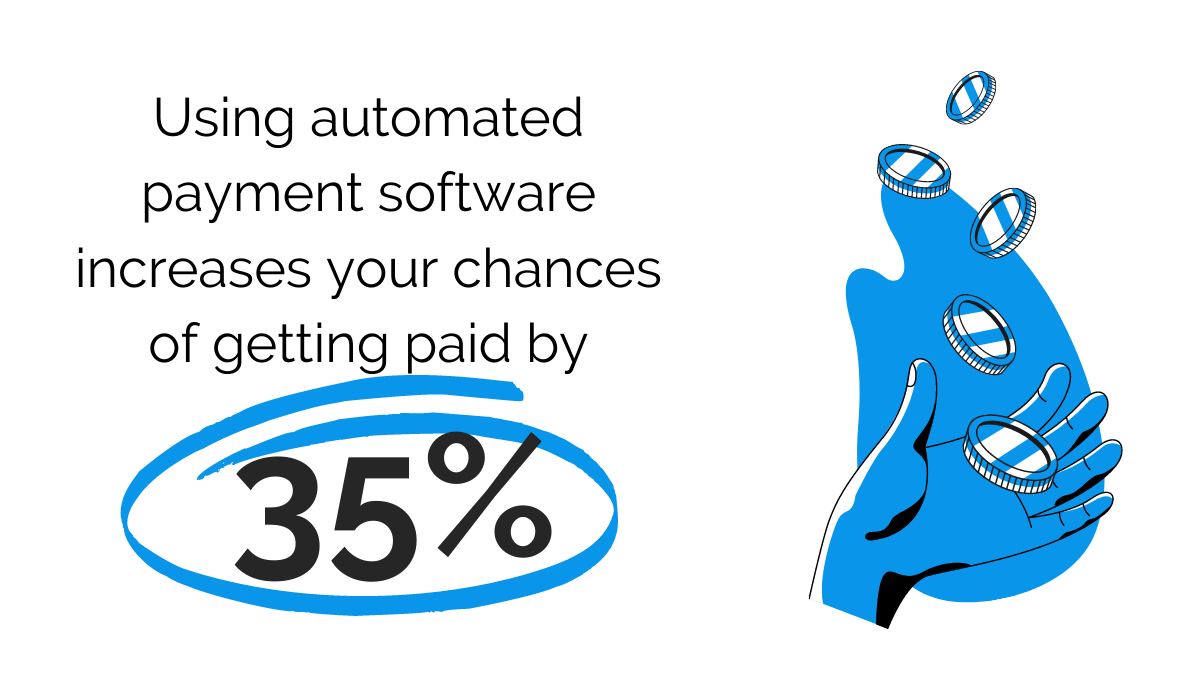

An automated system can also increase the chance of you getting paid by 35%, which can mean a lot for your business.

Source: Regpack

As already mentioned, your sales are most likely not your only source of income. So, don’t forget to add any other source of business revenue to your estimation in case you offer a variety of products and services.

Every cent you earn should be listed under your income for clarity.

For example, if you decide to sell a piece of the equipment you use for production, the money you earn from the sale will be listed as income, but not from your regular sales as it’s not a product or service you’ve sold to your target customers.

Estimate Your Future Revenue

Making projections about your future revenue is crucial for a reasonable business budget.

Without these predictions, you can’t know for sure if you’ll earn enough to cover all your monthly fixed and variable expenses. So, sit down and try to figure out how much you can expect to make in the following months.

However, don’t be too optimistic and base your projections on your best-performing month, as this will set you up for failure.

Instead, factor in the seasonal trends and the trends in your industry overall. For example, if you’re in the business of organizing outdoor trips, your profit will be bigger in the spring or summer, and likely plummet in winter due to the weather.

That’s why you should try to factor in these changes before coming up with the expected revenue for the next few months.

Once you have this number, you will know whether you need more money to stay afloat or whether you might even be able to save up.

In an interview for Business News Daily, Paul Cho, COO at Above Lending, talks about sales cycles and how companies have slower and busier periods.

He suggests using the quieter ones to invest in your marketing. This move will ensure you have some form of income even if business is slow.

Source: Regpack

In other words, while sales aren’t going great, try focusing on marketing to attract more customers.

You can regularly review and adapt this part of your budget plan based on the current circumstances. You can’t foresee everything, which became apparent during the pandemic.

So, instead of calculating your revenue once and counting it as a one-and-done deal, regularly revisit the future revenue section of your budget to note any changes on time.

Determine Monthly Fixed Costs

The basis of your business budget is your monthly spending. You have to know this value to set enough money aside to be sure it will cover your expenses.

Monthly fixed costs include all the obligatory expenses your business has each month, i.e., the payments that are due regardless of how much you sell.

In case you own a physical store, these expenses include, among other things, rent, utilities, the internet, cleaning, or payroll. They stay roughly the same each month.

When it comes to payroll, it’s important not to underpay yourself. This will not save you as much as you think and will affect your personal finances.

Business News Daily also interviewed Doug Keller, a financial planner who notes that some business owners feel guilty when paying themselves, so they often decide to skip this step.

However, Keller warns that this is not the way to go since you’re still an employee of your company. Instead of cutting corners on the well-deserved paycheck for yourself, find other ways to save that money.

Source: Regpack

Even if you’re just starting your business and don’t have any data to base your predictions on, you’ll have to create a budget plan.

In this case, estimate your spending based on the expenses you already know you will have to pay monthly, like rent. If you already have employees, including yourself, add their payroll expenses to your monthly costs.

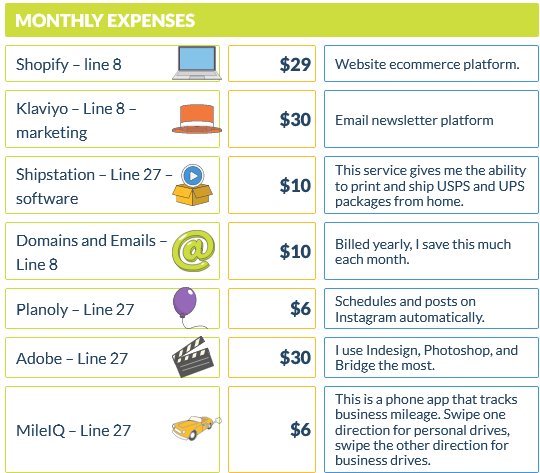

Izzie, a successful small business owner, shared her budget plan online. Other than the payroll and credit card expenses, here’s the “monthly expenses” section of her business plan:

Source: YNAB

Izzie explained that she is basing her business online, so she invests in different apps and software to help her generate more sales, market better, and save time.

If that is what you’re doing too, your monthly expenses section will probably look similar to hers. Of course, your payments might significantly differ from Izzie’s, depending on the kind of business you run.

Include Variable Expenses

No business budget is complete without an estimate of variable expenses, i.e., the costs that vary from month to month.

Such spending is usually related to production, sales, or the tools you use. The more you sell and produce, the more you’ll spend.

For example, if you use equipment for production, you will surely have to invest in replacement parts when something goes wrong, and this is an expense to include in your budget.

One month, you may not spend a single dollar on your equipment, and the next, you may need hundreds to cover the bills due to a machine breakdown.

So, if you account for it in the variable expenses section every month, you will be prepared for the worst when it happens.

Source: Regpack

In this section, it is okay to overestimate a bit. Think of it like this: the funds set aside are not wasted since you will not spend them unless absolutely necessary.

So, you’re saving this money for a rainy day. This benefits you in the long run, as something unexpected can happen down the line.

If you’ve been smart with your savings and saved a certain amount for variable expenses monthly, you can rely on this money in case of emergency and avoid hurting your bottom line.

Of course, don’t get too crazy with the amounts you put away. After all, the money you set aside is money you’re not tapping into for, let’s say, marketing that could significantly increase your sales.

So, make sure to save more than strictly necessary, but not too much.

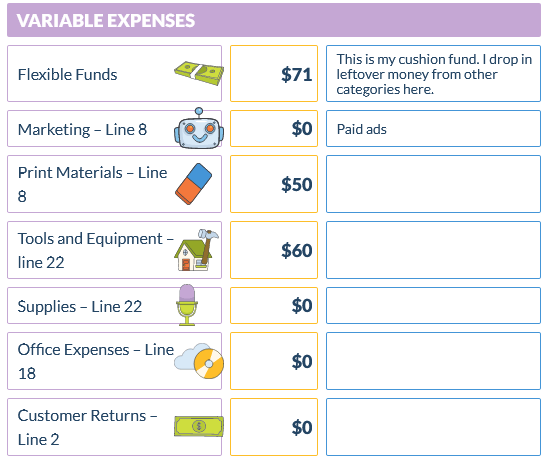

Here’s what Izzie’s “variable expenses” plan section looks like:

Source: YNAB

Once again, all of the expenses listed vary from month to month, depending on whether Izzie actually needs to invest in any of the categories.

In this case, the target amount for most categories is 0$ because she doesn’t expect to spend money on each option every month.

At the end of a month, you should check the details of variable funds and note how much you’ve spent.

That way, in a couple of months or a year, you’ll have a clearer picture of how reasonable your estimates were and whether your spending is always higher in certain months and lower in others.

Set Aside a Contingency Fund for Unexpected Costs

This advice is pretty self-explanatory: you need to think about the future and prepare for the worst by creating a contingency budget. This money will serve as a safety net of sorts when problems arise.

If you are faced with unexpectedly high costs without this type of savings, it can set you back significantly. Most small businesses can’t afford such setbacks, and chances are that you can’t either.

So, here’s some advice from experts collected by Forbes to help you create a fund.

Jody Grunden from the Summit CPA Group thinks small businesses should keep anywhere from 10% to 30% of annual revenue on the side.

In his opinion, this “equates to having three to six months of expenses saved up in case of an emergency.” So, if you run into an unexpected problem, you’ll have enough money ready to cover all the costs without going into debt or risking bankruptcy.

If you can’t afford to set that much aside at once, which is probably the case for most smaller businesses, do it in monthly installments instead. This won’t hurt your profit that much but will still ensure you have an emergency fund for rainy days.

For instance, Aaron Spool, a CFO at Eventus Advisory Group, suggests taking a certain amount from every sale you make and putting it in the bank.

Source: Regpack

Setting aside a dollar or two from every transaction won’t hurt your business if you can’t afford to deposit large amounts of money each month, but will add up to a good amount over time.

Of course, this doesn’t mean you should rely solely on this type of savings for your contingency funding, as it will take a while to collect a noticeable amount.

Put It All Together in a P&L Statement

Finally, when you have a good idea of how much money you can expect to earn and spend in a month, you should make a profit and loss statement (P&L).

This statement does exactly what its name suggests: it lists your expected income and losses, leaving you with a total net monthly income.

Investopedia explains that P&L statements help you determine whether you can profit by increasing your sales or decreasing your spending.

In other words, P&L statements help you understand where you stand and what you can change to maximize your revenue.

Sometimes, you’ll notice that you can cut on some spendings or increase them by investing back into the business. For example, investing in good marketing will cost you, but it could also bring in new customers and sales, benefitting you in the long run.

If you’re unsure about where to start, think about investing in software that will help you automate certain processes, thus minimizing human error and saving you time and money.

For instance, think about automating your billing process. That way, you get paid on time each month, and you can count on that monthly revenue.

Source: Regpack

Even if you’re a small business, budgeting by hand might prove to be more complicated than you think, especially if the numbers are constantly changing.

Don’t forget that even the tiniest error with payroll can lead to an IRS fine of at least $845, which is often something small businesses can’t afford.

Source: Regpack

Human data entry errors happen more often than you realize, and some are incredibly costly.

Just take Citigroup, whose credit department sent $893 million to its lenders instead of a $7.8 million payment, costing the company a whopping $885 million!

Of course, the chances of something this big happening in your company are slim, but why take the risk and lose the money you don’t have? All it takes is an extra number here or a left-out number there for you to run into trouble down the line.

However, if you’re still more inclined to do this by hand or simply want to see how other professionals do it, we recommend checking out these budget templates for small businesses.

Nevertheless, because of all the risks, you might want to look into software that helps you charge customers and allows you to generate financial reports.

Such solutions assist you in creating your budget efficiently and much faster than if you did it by hand. Plus, the mistakes will be minimal, especially compared to the ones humans make.

Conclusion

Budgeting is one of the most important aspects of running a small business since it helps you prepare for the worst and spot potential financial problems on time.

If you want to budget effectively, gather your financial statements to know exactly how much you spend and earn each month, which will then help you make predictions about the following months.

All of this will take time, which is why you might benefit from automating a part of the process, like billing your customers to ensure you get paid correctly and on time.

With a good budget plan, you’re more likely to keep your business afloat. What’s stopping you from making one?